TVS Supply Chain Solutions IPO is live. Should you Invest?

TVS Supply Chain Solutions IPO is live.

In this article

- IPO details

- Issue details

- Offer Breakup

- IPO Strengths

- Key Risks

- TVS Supply Chain Solutions Financials

📃About TVS Supply Chain Solutions

TVS Supply Chain Solutions provides supply chain management services for international organisations, government departments, and large and medium-sized businesses.

TVS SCS offers its Services in Two Segments:

- Integrated supply chain solutions (ISCS); and

- Network Solutions (N.S.)

The ISCS Segment Includes:

- Sourcing and procurement.

- Integrated transportation.

- Logistics operation centres.

- In-plant logistics operations.

- Finished goods.

- Aftermarket fulfilment.

- Supply chain consulting.

And the N.S. segment includes global forwarding solutions (“GFS”), which involves managing end-to-end freight forwarding and distribution across ocean, air, and land, warehousing and at port storage and value-added services, and time-critical final mile solutions (“TCFMS”) which involves closed-loop logistics and support including spares logistics, break-fix, refurbishment and engineering support, and courier and consignment management.

TVS SCS’ provided supply chain solutions to over 10,531 and 8,115 customers during Fiscal 2022 and the nine months ended December 31, 2022, globally. And to over 1,044 and 733 customers, respectively, in the same periods, in India. In December 2022, the company’s global customers included 72 ‘Fortune Global 500 2022’ companies, while its Indian customers included 25 ‘Fortune Global 500 2022’ companies.

The company’s client list includes companies in the Automotive, Defence, Engineering, FMCG, Rail, FMCG, Utilities, E-commerce, and Healthcare industry, namely Sony India Private Limited, Hyundai Motor India Limited, Johnson Controls-Hitachi Air Conditioning India Limited, Ashok Leyland Limited, TVS Motor Company Limited, Diebold Nixdorf, TVS Srichakra Limited, Lexmark International Technology Sarl, VARTA Microbattery Pte Ltd, Daimler India Commercial Vehicles Private Limited, Hero MotoCorp Limited, Modicare Limited, Panasonic Life Solutions India Private Limited, Dennis Eagle Limited, Electricity North West Limited, Yamaha Motor India Private Limited, and Torrot Electric Europa, S.A., and so on.

TVS Supply Chain Solutions registered a total income of ₹92,999.36 million in Fiscal 2022.

💰Issue Details of TVS Supply Chain Solutions IPO

- IPO open from 10th Aug 2023 – 14th Aug 2023

- Face value: ₹1 per equity share

- Price band: ₹187 to ₹197 per share

- Market lot: 76 shares

- Minimum Investment: ₹14,972

- Listing on: BSE and NSE

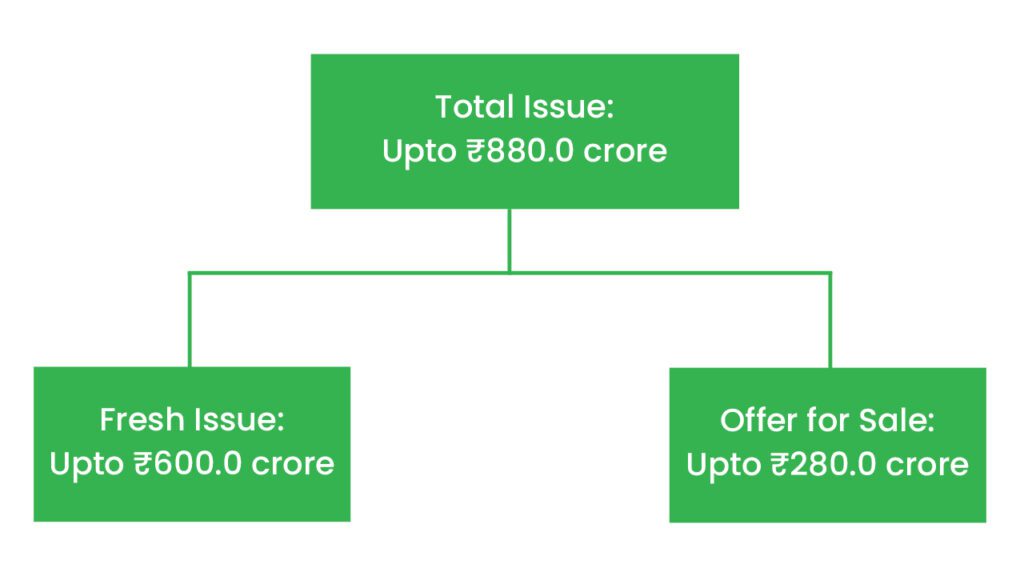

- Offer for sale: Approx ₹880 Cr (Fresh Issue: ₹600 Cr + OFS ₹280 Cr)

- Registrar: Link Intime India Private Ltd

🪙Total Issue Price

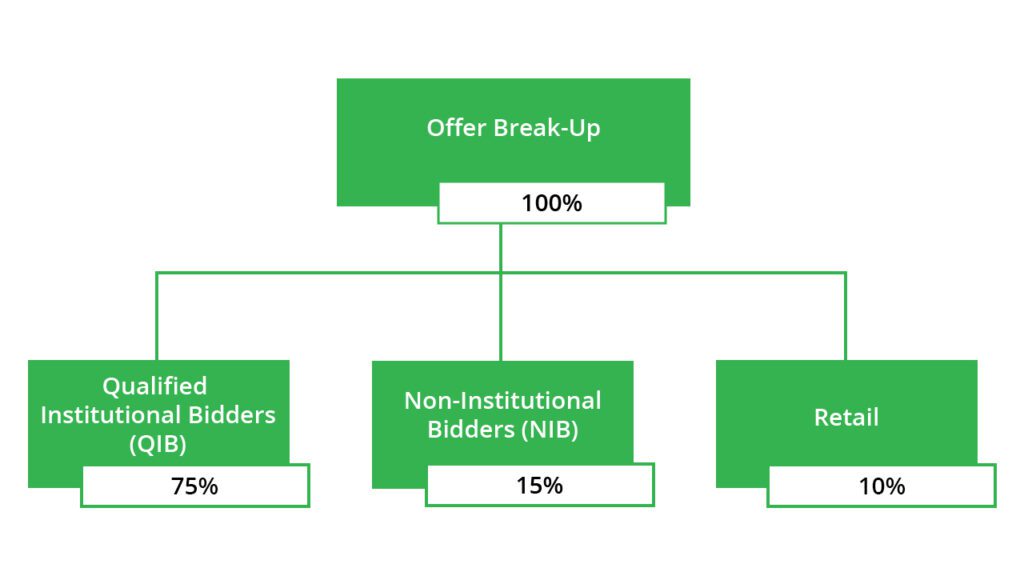

🪚Offer Breakup

🔭IPO Object

The company intends to utilise the net proceeds from the issue towards the funding of the following objects:

- Prepayment or repayment of all or a portion of certain outstanding borrowings availed by the company and subsidiaries, TVS LI UK and TVS SCS Singapore; and

- General corporate purposes.

⛓️IPO Strength

Some of the qualitative factors and strengths which form the basis for computing the Offer Price are:

- Leader in end-to-end solutions enabled by domain expertise, global network and knowledge base.

- Prolonged and consistent track record of successful acquisitions integration to support capabilities and customer acquisition.

- Robust in-house technology differentiation.

- Long-term customer relationships in diversified and attractive industries through encirclement.

- The resilient business model with multiple drivers of profitable growth and a management team with cross-industry experience.

🧨IPO Risk

- They depend on network partners and other third parties in certain aspects of their operations, and unreliable or unsatisfactory services or failure to maintain relationships with them could disrupt their operations, harming business, financial condition, results of operations and cash flows.

- They rely highly on technology infrastructure and software suites in their business operations. Any disruption or failure of their technology infrastructure could materially and adversely affect growth prospectus, reputation, business, results of operations, financial condition and cash flows.

- Their diverse and complex global operations subject them to many risks and uncertainties.

- They are exposed to foreign currency exchange rate fluctuations, and their results of operations have and will impact by such changes in the future.

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-21 | ₹4990.06 | ₹6999.69 | –₹76.34 |

| 31-Mar-22 | ₹5789.73 | ₹9299.94 | –₹45.80 |

| 31-Mar-23 | ₹6210.92 | ₹10311.01 | ₹41.76 |

PEER COMPANIES

- TCI Express Limited

- Mahindra Logistics Limited

- Blue Dart Express Limited

- Delhivery Limited

📬Also Read: Sustainable Investing in India: ESG Investments