Sah Polymers Limited IPO is live. Should you Invest?

Sah Polymers Limited IPO is live. Should you apply? Find out here.

In this article

📃About Sah Polymers IPO

Incorporated in 1992, Sah Polymers Limited is primarily engaged in manufacturing and selling Polypropylene (PP)/High-Density Polyethylene (HDPE) FIBC Bags, Woven Sacks, HDPE/PP woven fabrics and woven polymers.

The company offer customised bulk packaging solutions to business-to-business (” B2B”) manufacturers catering to different industries such as Agro Pesticides Industry, Basic Drug Industry, Cement Industry, Chemical Industry, Fertilizer Industry, Food Products Industry, Textile Industry Ceramic Industry Steel Industry.

Sah Polymers Limited have two business divisions (i) domestic sales; and (ii) exports. The company has a presence in 6 states and 1 union territory for the domestic market and 6 regions internationally in 6 regions such as Africa, the Middle East, Europe, the USA, Australia and the Caribbean.

As of March 31, 2022, the company is supported by 97 committed staff based on the payroll. The company has one manufacturing facility with an installed production capacity of 3960 m.t. p.a. located at Udaipur, Rajasthan

💰Issue Details of Sah Polymers Limited IPO

- IPO open from 30 Dec 2022 – 04 Jan 2023

- Face value: ₹10 per equity share

- Price band: ₹61 to ₹65 per share

- Market lot: 230 shares

- Minimum Investment: ₹14,950

- Listing on: BSE and NSE

- Offer for sale: Issue size ₹66.30 cr. (fresh Issue ₹66.30 cr. + OFS ₹00.00 cr.)

- Registrar: Link Intime India Private Ltd

- Promoters:

- Sat Industries Limited is the company promoter

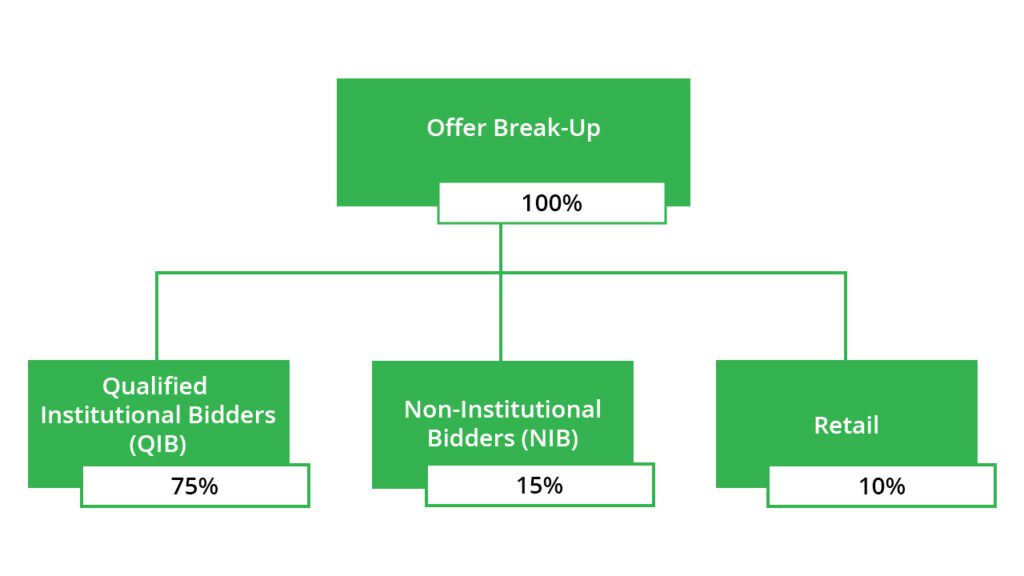

🪚Offer Breakup

🔭IPO Object

The net proceeds of the fresh issue, are proposed to be utilized in the following manner:

- Setting up a new manufacturing facility to manufacture a new variant of Flexible Intermediate Bulk Containers (FIBC)

- Repayment/ Prepayment of certain secured and unsecured borrowings in full or part availed by the Company and the Subsidiary Company

- Funding the working capital requirements of the Company

- General corporate purposes

⛓️IPO Strength

Some of the qualitative factors and strengths that form the basis for computing the offer price are:

- Product portfolio

- Customer base across geographies and industries

- Management Team

🧨IPO Risk

- Inadequate or interrupted supply and price fluctuation of raw materials and packaging materials could adversely affect business.

- Company, Group Company, Corporate promoter, Directors and Subsidiary are involved in certain litigations viz criminal, civil and tax proceedings currently pending at various stages.

- The company generated a major portion of sales from operations in certain geographical regions both domestically and in exports, Any adverse developments affecting operations in these regions could have an adverse impact on revenue and results of operations.

- The company derives a portion of our revenue from certain customers, and the loss of one or more such customers adversely affects our business.

- company require a number of approvals, NOCs, licences, registrations and permits for setting up a new manufacturing unit as well as in the ordinary course for existing business and any failure to obtain the same will adversely affect our operations.

- The company depends on third parties for its suppliers, logistics and transportation needs. Any disruptions in the same may adversely affect the financial condition.

⚖️Peer Companies

- Rishi Techtex Limited

- Jumbo Bag Limited

- SMVD Poly Pack Limited

- EMMBI Industries Limited

- Commercial Syn Bags Limited

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-20 | ₹35.93 | ₹49.91 | ₹0.3 |

| 31-Mar-21 | ₹40.58 | ₹55.34 | ₹1.27 |

| 31-Mar-22 | ₹68.67 | ₹81.23 | ₹4.38 |

📬Also Read: Sustainable Investing in India: ESG Investments