Authorise your trades using DDPI: Secure & Seamless

Authorizing your trades just got a whole lot simpler and more secure. Arihant Capital has now introduced online DDPI facilities to make your transactions smooth, secure, and seamless.

Traditionally, every time that you sell shares, there were three ways you could authorize your sell transactions:

- Through physical DIS slip (too much hassle and cumbersome)

- Using CDSL TPIN and OTP (digital but pre-authorisation needed for every transaction)

- Through one time POA (liable to misuse)

SEBI recently introduced DDPI, a secured POA-alternative) to safeguard the interests of investors. Demat Debit and Pledge Instruction (DDPI) is going to replace POA (Power of Attorney) and is in effect from 01-Sep-22.

What is DDPI and how does it help?

DDPI is a document that permits your broker and depository participant to access your demat account only with the goal of meeting pay-in obligations for settlement of the trades executed by you on your trading platform.

It came into effect on 01 Sep 2022, and will be used for pay-in of securities and margin pledge instructions, among others.

While DDPI serves the same purpose as a POA, because of its limited usage, it gives you more control over your debit transactions. That means more peace of mind for you!

What actions can be authorized by DDPI?

You can use DDPI for:

- Transferring shares from your account to broker’s account only for trades executed by you in the secondary market to meet pay-in obligations. In simple words, if you sell stocks on Arihant’s trading platform, Arihant will be authorised to debit only those shares from your account for meeting settlement obligation towards stock exchange.

- Pledging/re-pledging of securities in favour of the broker to meet margin calls.

- Mutual fund redemption order, rights entitlement sell transactions.

- Corporate actions including buy back, offer for sale, takeover, and delisting.

However, DDPI cannot be used for:

- Margin funding (POA only)

What changes for you?

Effective immediately, any new account or non-POA account with Arihant Capital will not accept POA as a form of authorization of trades. Instead of POA, you can now use DDPI. Existing POAs will remain valid until revoked by you. So, if your POA is already registered with Arihant Capital (before 31st August), you can continue to use POA as a mode of authorization. To use DDPI you will need to revoke your POA and register for DDPI.

How to activate DDPI?

Good news is, you can easily activate DDPI online. New account holders will be able to subscribe to the DDPI facility using eKYC and through a digital signature.

For existing customers, you can choose the DDPI facility by authorising DDPI via rekyc.

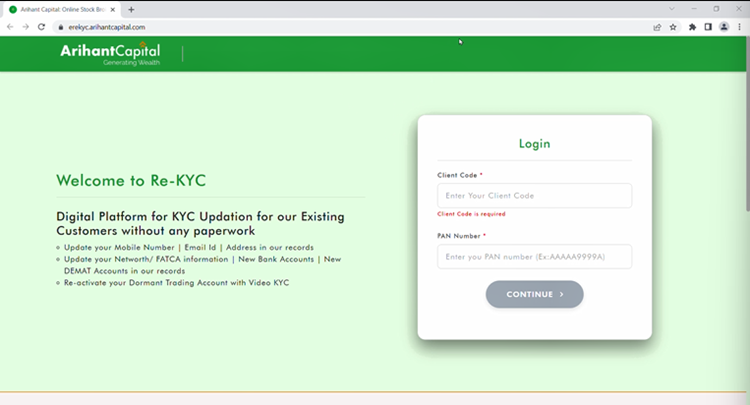

Step 1: Login to Arihant Re-KYC using your client code and PAN number.

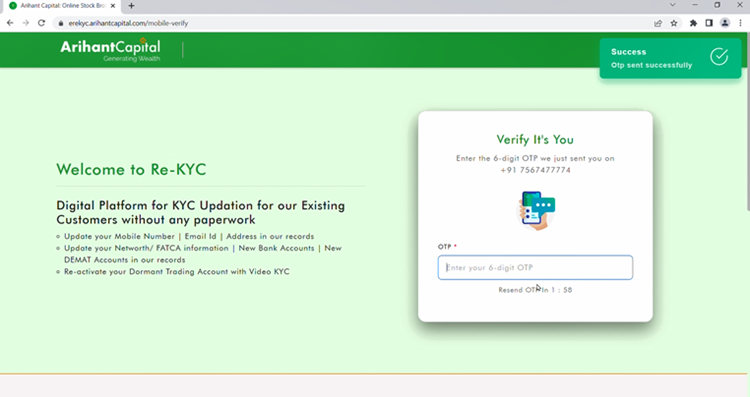

Step 2: Enter the 6 digit OTP received on your registered mobile number and email id to verify its you.

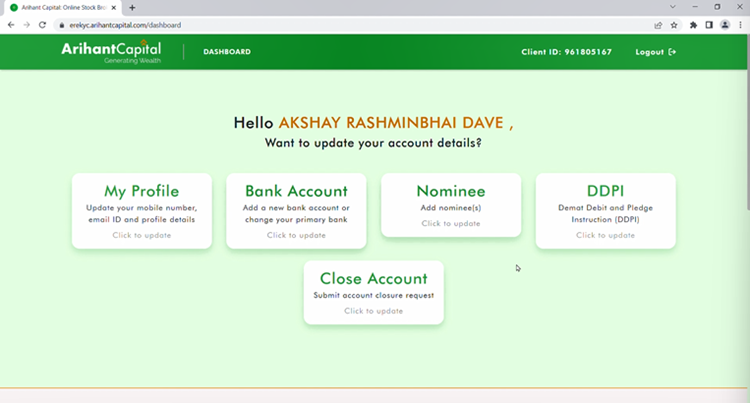

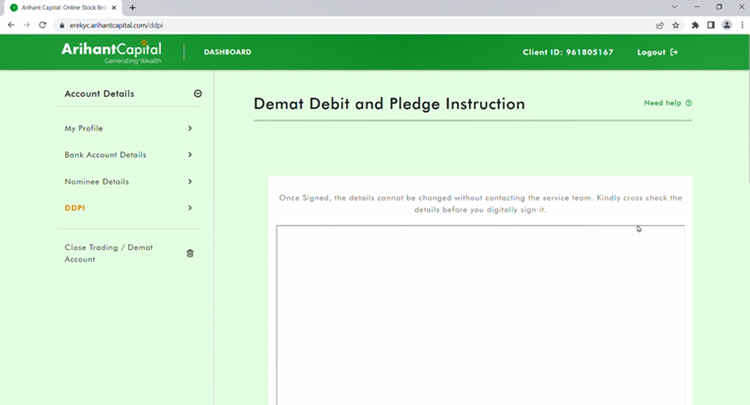

Step 3: Select DDPI on your dashboard

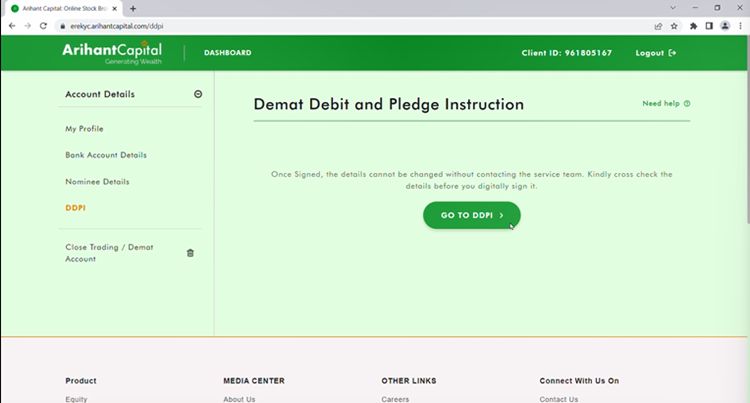

Step 4: Click on “Go to DDPI” button.

Please note: once signed, the details cannot be changed without contacting the service team. Please read all terms & conditions before digitally signing.

Step 5: Upload your digital signature and proceed

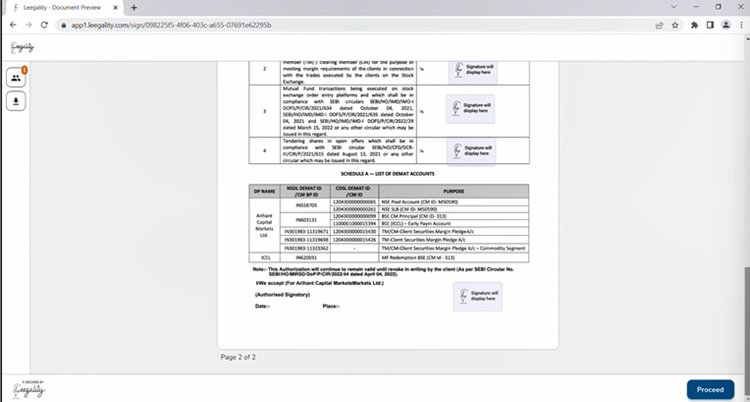

Step 6: After reading the circular, click on “Proceed” at the bottom right of your page

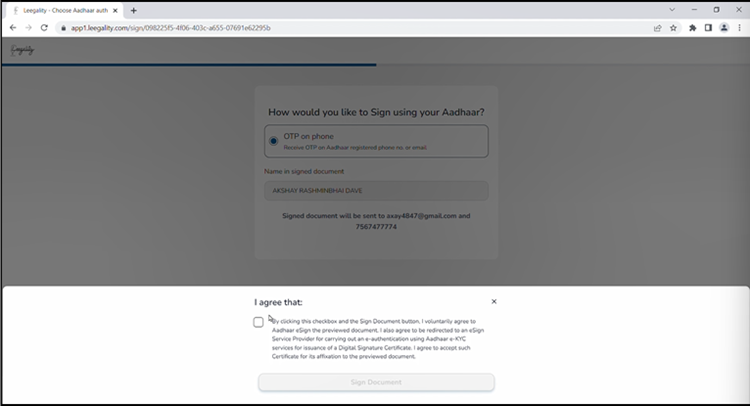

Step 7: Click on the checkbox to agree terms before signing the document

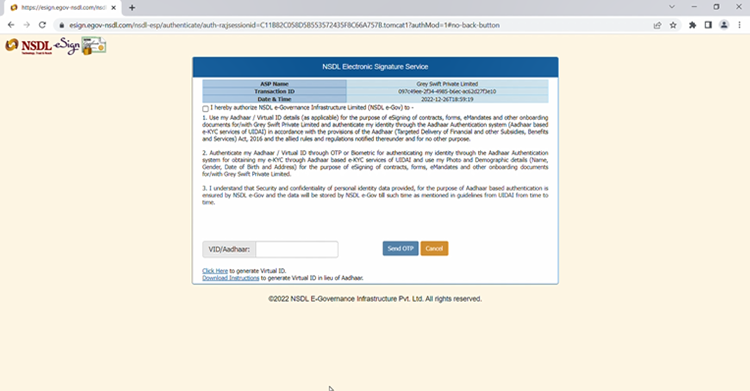

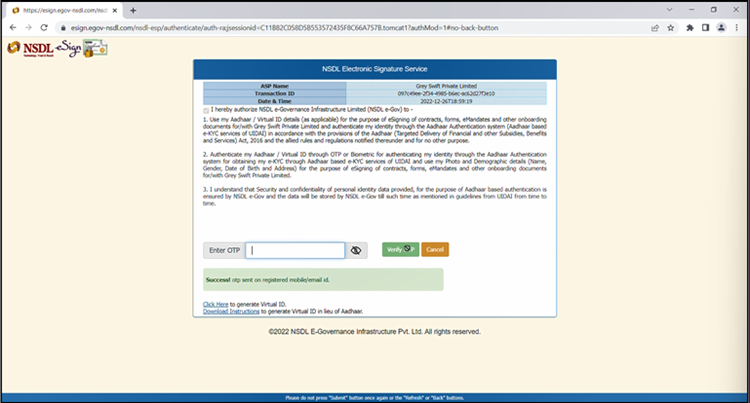

Step 8: You will be redirected to NSDL E-SIGN page, to e-sign your DDPI request. Here you will need to enter your AADHAR card number, after which you will receive OTP on your mobile number and email ID for authorisation.

Step 9: Enter valid OTP, and click on” verify”.

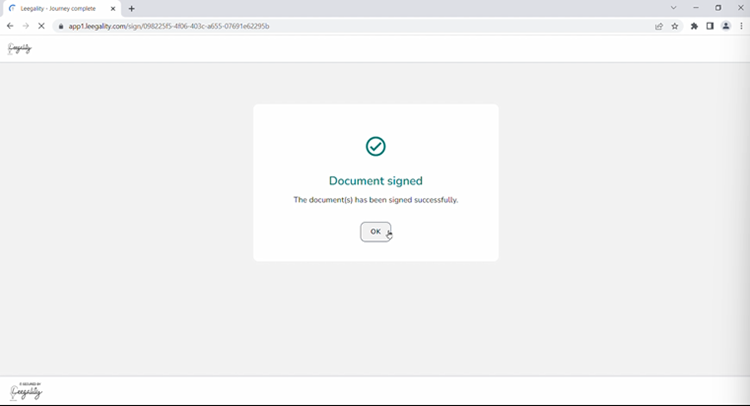

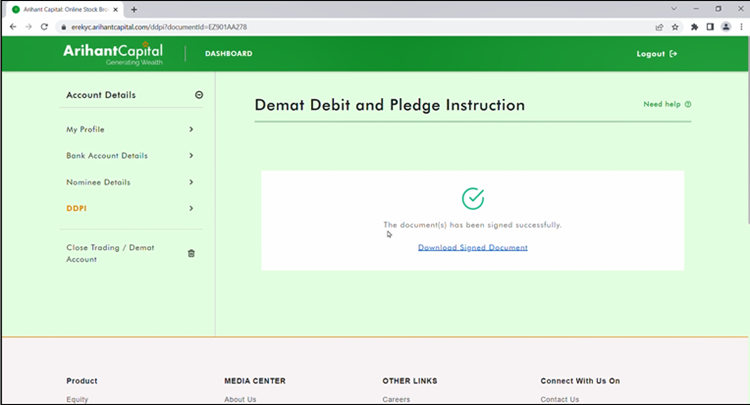

Step 10: Voila, your document has been signed successfully. Clicking on Ok, will redirect you to the Arihant reKYC portal.

You’re all set to make your trading experience better and secured with DDPI!

Namaskar sir ji I am Sudarshan Dongare I want start trading but re-open my account and send my client code and password