SAMHI Hotels IPO is live. Should you Invest?

In this article

📃About SAMHI Hotels

Incorporated in 2010, SAMHI Hotels Limited is a branded hotel ownership and asset management platform in India.

SAMHI Hotels has a portfolio of 4,801 keys across 31 operating hotels in 14 of India’s critical urban consumption centres, including Bengaluru, Karnataka; Hyderabad, Telangana; National Capital Region (NCR); Pune, Maharashtra; Chennai, Tamil Nadu; and Ahmedabad, Gujarat as of March 31, 2023. The company also has 2 hotels under development with 461 keys in Kolkata and Navi Mumbai.

On August 10, 2023, the company acquired Asiya Capital and the ACIC SPVs (the ACIC SSPA), which gained the company an additional 962 keys across six operating hotels and land for the development of a hotel in Navi Mumbai, Maharashtra.

SAMHI’s hotels operate under well-recognized hotel operators such as Courtyard by Marriott, Sheraton, Hyatt Regency, Hyatt Place, Fairfield by Marriott, Four Points by Sheraton, and Holiday Inn Express, which provide its hotels’ access to the operator’s loyalty programs, management and operational expertise, industry best practices, online reservation systems, and marketing strategies.

💰Issue Details of SAMHI Hotels

- IPO open from 14th Sep 2023 – 18th Sep 2023

- Face value: ₹1 per equity share

- Price band: ₹119 to ₹126 per share

- Market lot: 119 shares

- Minimum Investment: ₹14,994

- Listing on: BSE and NSE

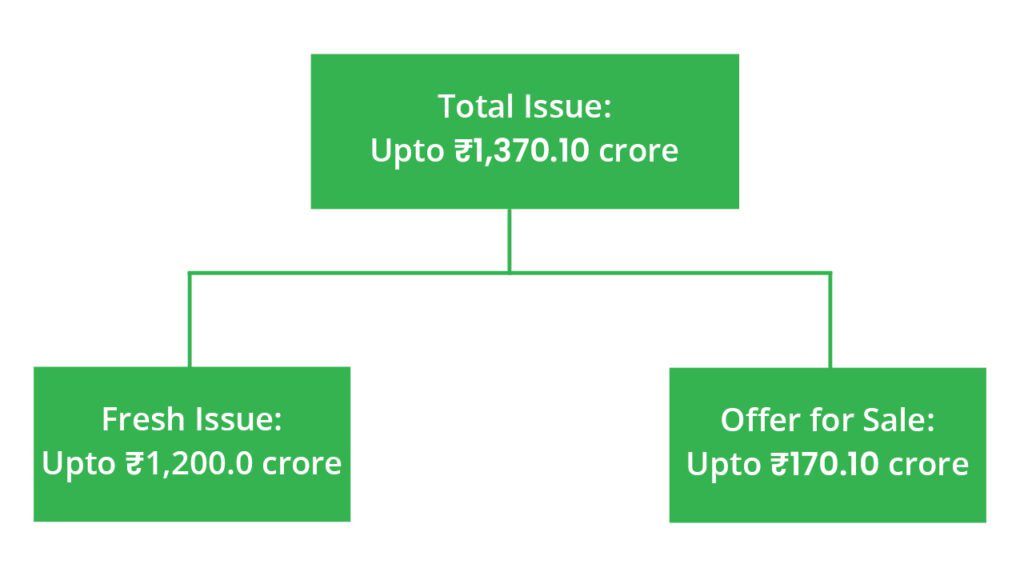

- Offer for sale: Approx ₹1370.10 Cr (Fresh Issue: ₹1200 Cr + OFS ₹170.10 Cr)

- Registrar: Kfin Technologies Limited

🪙Total Issue Price

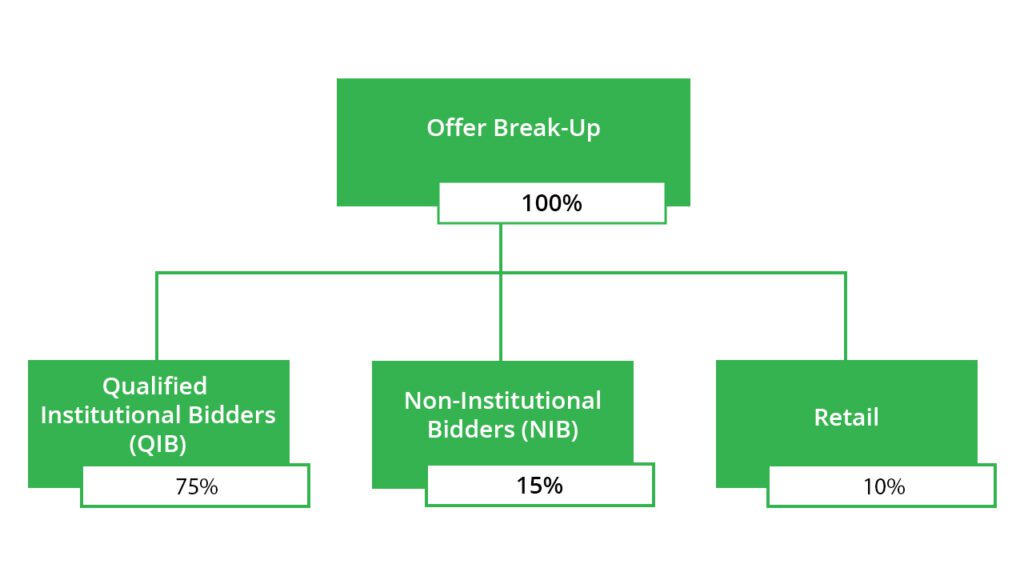

🪚Offer Breakup

🔭IPO Object

The company intends to utilise the net proceeds from the issue towards the funding of the following objects:

- Repayment/ prepayment/ redemption, in whole or in part, of certain borrowings the company and the subsidiaries availed of, including payment of the interest accrued thereon.

- General corporate purposes.

⛓️IPO Strength

Some of the qualitative factors and strengths that form the basis for computing the Offer Price are:

- Ability to acquire dislocated hotels and demonstrate a track record to re-rate hotel performance through renovation and/or rebranding.

- Track record of managing hotels efficiently.

- Possess the ability to create operating efficiencies and long-term performance using analytics tools.

- Strong governance and seasoned management team.

- Sector tailwinds further enhance the portfolio’s scale and diversification.

🧨IPO Risk

- They were not in compliance with certain covenants under certain of their financing agreements in the past, and in case of any breach of covenants in the future, such non-compliance, if not waived, could adversely affect their business, results of operations and financial condition.

- A significant portion of their revenues are derived from a few hotels and hotels concentrated in a few geographical regions, and any adverse developments affecting such hotels or areas could hurt their business, results of operation and financial condition.

- Their business is subject to seasonal and cyclical variations that could result in fluctuations in their operations.

- If they fail to obtain, maintain or renew their statutory and regulatory licenses, permits and approvals required to operate their business, their business and results of operations may be adversely affected.

- They rely on third parties for the quality of services at their hotels, which are managed under third-party operators’ brands. Any adverse impact on the reputation of their hotels and the brands under which they operate, or a failure of quality control systems at their hotels, could adversely affect their business, operations, and financial condition results.

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-21 | ₹2488.00 | ₹179.25 | ₹-477.73 |

| 31-Mar-22 | ₹2386.58 | ₹333.10 | ₹-443.25 |

| 31-Mar-23 | ₹2263.00 | ₹761.42 | ₹-338.59 |

PEER COMPANIES

- Chalet Hotels

- Lemon Tree

- Indian Hotels

- EIH

📬Also Read: Ensuring Financial Safety: Embracing the Raksha of Returns