Should you Invest in Harsha Engineers International Ltd IPO?

Harsha Engineers International Ltd IPO is live now. Should you apply? Find out here.

In this article

- IPO details

- Issue details

- Offer Breakup

- IPO Strengths

- Key Risks

- Harsha Engineers International Financials

About Harsha Engineers International

Incorporated in 2010, Harsha Engineers International Limited is the largest manufacturer of precision bearing cages, in terms of revenue in the organised sector in India. The company is a part of the Harsha Group. The company supplies its products to customers in over 25 countries covering five continents i.e., North America, Europe, Asia, South America and Africa.

The business comprises two segments:

- Engineering business, under which the company manufactures bearing cages (in brass, steel and polyamide materials), complex and specialised precision stamped components, welded assemblies and brass castings and cages & bronze bushings.

- Solar EPC business, under which the company provide complete comprehensive turnkey solutions to all solar photovoltaic requirements and provides operations and maintenance services in the solar sector.

As of September 30, 2021, Harsha Engineers International has been able to manufacture more than 7,205 bearing cages and more than 295 other products for customers in the automotive, railways, aviation & aerospace, construction, mining, agriculture, electrical and electronics and renewables sectors. In addition, over the past three years company’s product development and innovation centre has developed more than 1,200 products in different bearing types.

The company has five manufacturing facilities for the engineering business with two manufacturing facilities at Changodar and one at Moraiya, near Ahmedabad in Gujarat, India and one manufacturing unit each in Changshu, China and Ghimbav Brasov in Romania.

Harsha Engineers International Limited has three wholly owned subsidiaries, one in China –Harsha Precision Bearing Components (China) Co. Ltd, one in the United States of America –HASPL Americas Corporation and one in the Netherlands-Harsha Engineers B.V., and a stepdown subsidiary in Romania –Harsha Engineers Europe SRL.

Product Portfolio

(i) Engineering business: under which the company manufactures bearing cages (in brass, steel and polyamide materials), complex and specialized precision stamped components, welded assemblies and brass castings and cages & bronze bushings; and

(ii) Solar EPC business: under which the company provide complete comprehensive turnkey solutions to all solar photovoltaic requirements.

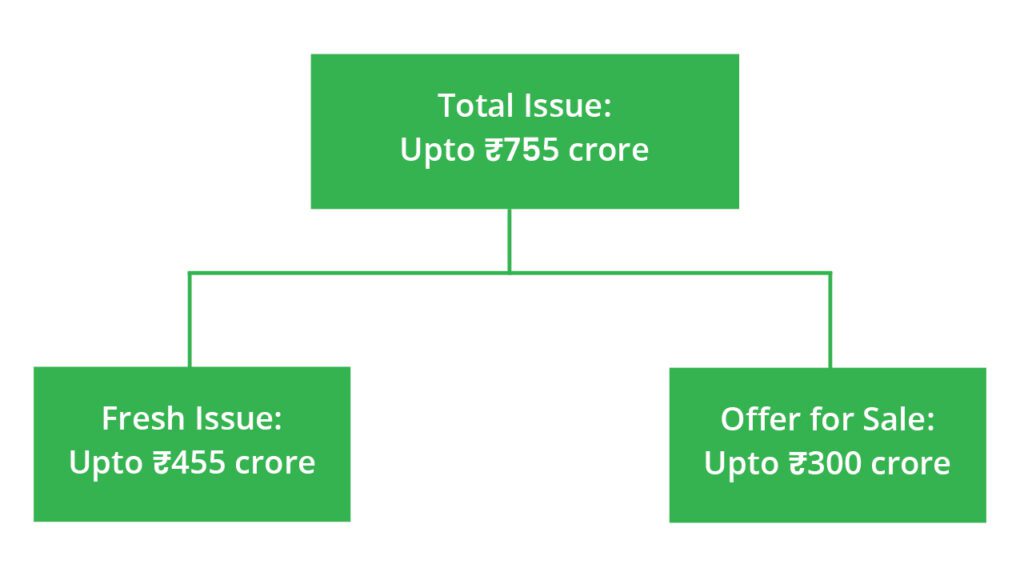

💰Issue Details of Harsha Engineers IPO

- IPO open from Sep 14th – Sep 16th 2022

- Face value: ₹10

- Price band: ₹314-₹330

- Market lot: 45 shares

- Minimum investment: ₹14,850

- Listing on: BSE and NSE

- Offer for sale: up to ₹300 crores

- Registrar: Link Intime India Private Ltd

What is an IPO and should you invest in them?

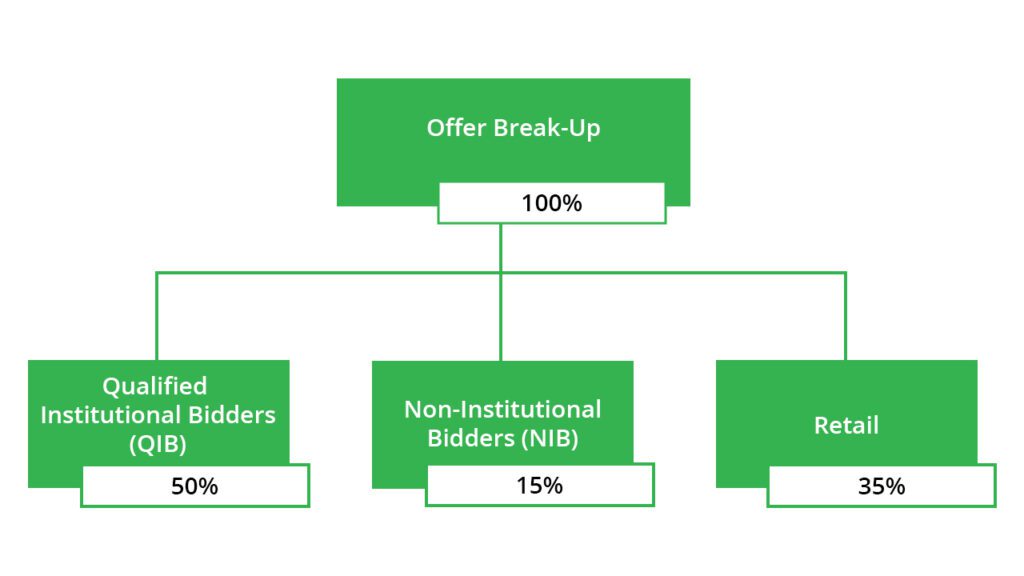

✂️Offer Breakup

The offer is broken up into the following investor classes:

🏷️IPO Object

The company proposes to utilize the net proceeds of the fresh issue for the funding of the following objects:

(a) Pre-payment or scheduled repayment of a portion of the existing borrowing.

(b) Funding capital expenditure requirements towards the purchase of machinery.

(c) Infrastructure repairs and renovation of our existing production facilities.

(d) General corporate purposes.

📊IPO Timeline

| IPO open date | Sep 14th 22 | Initiation of refunds | Sep 22nd 22 |

| IPO close date | Sep 16th 22 | The credit of shares to the Demat account | Sep 23rd 22 |

| Basis of allotment date | Sep 21st 22 | IPO listing date | Sep 26th 22 |

🔭IPO Strengths

- Comprehensive solution provider offering a diversified suite of precision engineering products across geographies and end-user industries.

- Long-standing relationships with leading clientele.

- Strategically located domestic and international production facilities and warehouses.

- Expertise in tooling, design development and automation.

- Consistent track record of growth and financial performance.

- Strong, experienced and dedicated senior management team and qualified workforce.

⚡PEER COMPANIES

- Timken India Limited

- SKF India Limited

- Rolex Rings Limited

- Sundaram Fasteners

- Limited

🔎IPO Risks

- The company depends on a limited number of customer groups for a significant portion of its revenue from the engineering business. The loss of any of its major customer groups due to any adverse development can cause a significant reduction in business.

- The company and certain of its subsidiaries have unsecured loans that may be recalled by the lenders at any time.

- The company has certain contingent liabilities, which, if they materialize, may adversely affect its financial condition.

- There are outstanding litigations involving the company and its directors. Any adverse outcome in any of these proceedings may adversely affect our reputation, results of operations and financial condition.

- The company depends on suppliers from China for certain key components used in our solar power projects. A disruption in the supply of these key components or failure of our suppliers to meet their obligations could impact our ability to set up solar power projects.

🧾Valuation and View

HEIL has delivered strong revenue growth (22% CAGR) in FY20-FY22, being a leader in the bearings market and having a domestic market share of around 50% to 60% and a global market share of around 6.5%. Its strategically located manufacturing facilities with warehouses, presence in 25 countries over 5 continents, comprehensive solutions to customers backed by strong R&D and strong relationships with customers will drive the business going forward. At the upper band of INR 330, the issue is valued at an EV/EBITDA of 17x based on FY22 EBITDA. We are recommending “Subscribe for Long Term” for this issue.

🚀Financial Data

| Particulars | For the year (₹ in Cr) | ||

| 2021 | 2020 | 2019 | |

| Total Revenue | 876.73 | 899.5 | 117.9 |

| Total Assets | 981.07 | 973.24 | 195 |

| Profit After Tax | 45.44 | 21.91 | -27.41 |