TCS Q3 Results: India’s top IT Company

India’s top IT company, Tata Consultancy Services Ltd (TCS), kicked off the earnings season for the third quarter of the current fiscal year (Q3 FY23) on Monday, reporting a profit of ₹10,846 crore.

Why do TCS results matter?

As we explained in our weekly newsletter, whenever there are recessionary talks, earnings reports have a higher impact on the market. Apart from this, the IT sector is among the first sectors to be impacted by recessionary headwinds in the US and Europe. So the commentary emerging from TCS, India’s leading IT company and their deal volume expectations sets the tone for the impact on the industry. Not only that, TCS is one of the biggest employers in India and has a large market cap, so its results impact the markets significantly.

Key highlights of the TCS Q3 Results

Hits:

- 😄Tata Consultancy Services (TCS) reported better-than-expected revenue growth in a seasonally weak quarter.

- 😊5.3% sequentially rise in consolidated revenue to ₹58,229 crore above estimates of ₹57,684 Cr.

- The net profit rises nearly 4% on quarter to ₹10,486 crores.

- 😲The hiring target for FY24 is benchmarked at 125,000 to 150,000 employees.

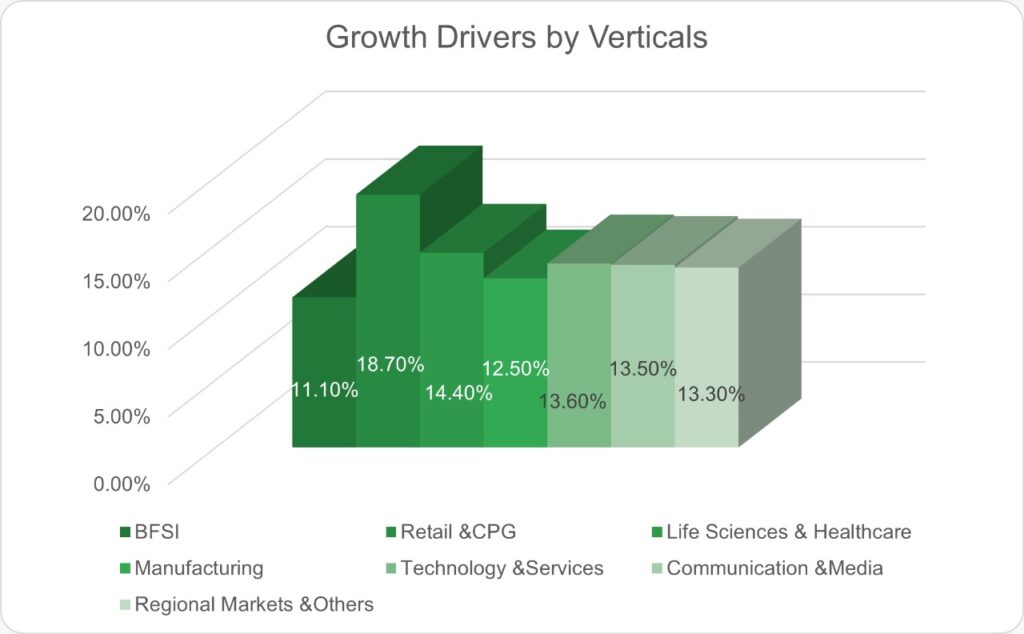

- Product and platform continue to perform well Ignio or Cognitive automation software signed 10 new customers and 7 new clients live during the Q3FY23.

- 🎉TCS announced a social dividend of ₹67 per share and an interim dividend of ₹8 per share.

- 😊The revenue grew 13.5% Y-o-Y in constant currency terms.

- Softening in attrition led to margin improvement, and annualized attrition was lower than prev quarter at 21.3%.

- 😄Operational margin expanded by 0.5% sequentially to 24.5% on the back of improved productivity, currency support, and abating supply-side challenges.

- Strong demand in Cloud Space was demonstrated by the company. It won several cloud transformational deals in Q3FY23.

Misses:

- 😥TCS posted deals worth 7.5 billion in this quarter which is slightly less than the preceding two quarters.

- 📉Gross margin fell by 61 bps Y-o-Y, Whereas Net margin fell by 36 bps Y-o-Y at 20%.

TCS Q3 Results Reflect Robust Growth Momentum

Looking ahead and beyond current uncertainties, our longer term growth outlook remains robust.

-Rajesh Gopinathan, Chief Executive Officer and Managing Director, TCS.

Sustainability

- Recognized as National Leader in Community Engagement by Points of Light for 5th Consecutive Year.

- BridgeIT won the ASSOCHAM award in the category of “Excellence in providing Livelihood to Local Community” at the CSR & Sustainability Summit.

- Won the Global CSR Excellence & Leadership Awards for “Innovation in CSR Practices” for its innovative global community initiatives.

- TCS has shown its commitment to sustainability by working on climate change, human capital & workforce, circularity, social capital & community, impact

Innovation, compliance, reporting & governance with its programs like adult literacy programs, BridgeIT Youth Employment Program, Jal Jeevan Mission, goIT, and Ignite My Future.

Outlook & Valuation: should you buy or hold TCS?

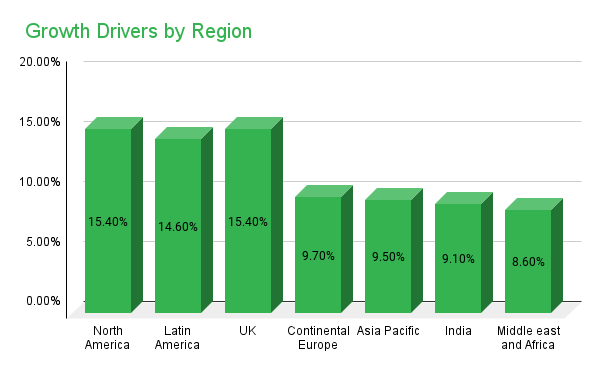

TCS’s USD revenue was above our estimate in Q3 FY23. The company’s deal booking of $7.8bn was weak due to the impact of geopolitics in Europe. We believe, the demand environment to be steady over the long term, and overall demand has not changed significantly, but to be fair, it would take a couple months to actually know the decision-making. However, we remain constructive on TCS from the medium to long term with its ability to engage with large clients. We have factored in USD revenue CAGR growth of 9% over FY22–FY25E and a margin of 24.5%/24.7%/24.8% each for FY23E, FY24E, and FY25E. We value TCS at a PE of 24x its FY25E EPS of ₹155 and increased the target price to ₹3,725 per share (earlier TP: ₹ 3,609 per share).

We maintain our Accumulate rating on the stock.

Also read: ESG Investing & Its Emergence in India