Abans Holdings Limited IPO is live. Should you invest?

Abans Holdings Limited IPO is Being live. Should you apply? Find out here.

In this article

📃About Abans Holdings Limited IPO

Incorporated in 2009, Abans Holdings Limited is engaged in financial services, gold refining, jewellery, commodities trading, agricultural trading and warehousing, software development and real estate. The company represents the financial services arm of the Abans Group.

Abans Holdings Limited provides NBFC services, global institutional trading in equities, commodities and foreign exchange, private client stock broking, depositary services, asset management services, investment advisory services and wealth management services to corporates, institutional and high-net-worth clients.

The company’s business is divided into:

Finance Business: The company operates an RBI registered NBFC (non-deposit taking).

Agency Business: The company is SEBI registered stock and commodity exchange brokers with memberships across all the major stock exchanges in India, including BSE, NSE, MSEI, MCX, NCDEX and ICEX.

Capital and other business: The capital business includes the internal treasury operations which manage the excess capital funds.

The company is primarily a holding company and it operates all its businesses through its seventeen (17) subsidiaries (including three (3) direct subsidiaries and fourteen (14) indirect/step-down subsidiaries). The company has active businesses in six (6) countries across the Eastern Continents, including Hongkong, the UK, UAE, China, Mauritius and India.

On a consolidated basis, the company has employed 100 employees as of August 31, 2022.

💰Issue Details of Abans Holdings Limited IPO

- IPO open from 12 Dec – 15 Dec 2022

- Face value: ₹2 per equity share

- Price band: ₹256 to ₹270 Per Share

- Market lot: 55 shares

- Minimum investment: ₹14,850

- Listing on: BSE and NSE

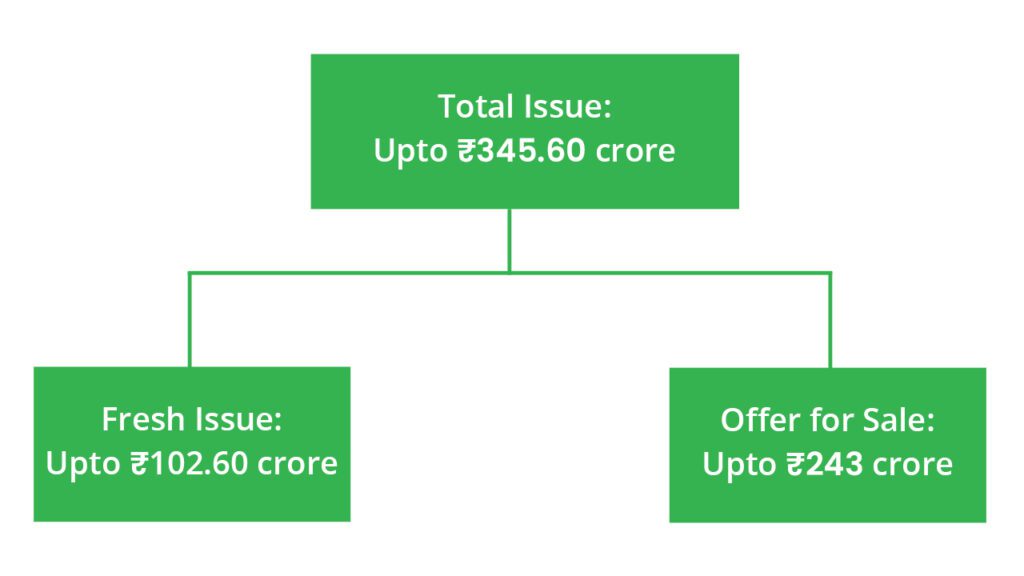

- Offer for sale: ₹345.60 Cr (OFS of ₹243 Cr. + Fresh Issue ₹102.60 Cr.)

- Registrar: Bigshare Services Pvt Ltd

- Promoters:

- Mr Abhishek Bansal

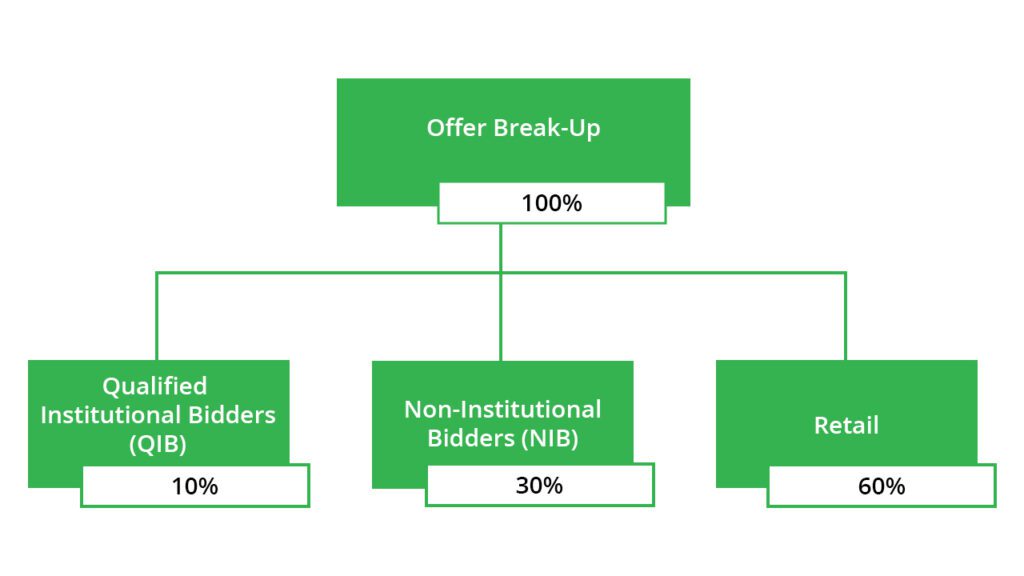

🪚Offer Breakup

🔭IPO Object

The net proceeds of the fresh issue, are proposed to be utilized in the following manner:

- Further Investment in the NBFC Subsidiary (Abans Finance Pvt. Ltd.) for financing the augmentation of its capital base to meet its future capital requirements.

- General corporate purpose.

⛓️IPO Strength

Some of the qualitative factors and strengths that form the basis for computing the offer price are:

- An integrated financial services platform.

- Strong human capital and organizational culture.

- Global exposure providing innovative financial products.

- Strong relationships with clients and market participants.

- Standardized operating procedures and efficient use of technology.

🧨IPO Risk

- Abans Commodities (I) Private Limited, one of the subsidiaries, is involved in a proceeding before SEBI regarding allegations of participation/facilitation by it of pair contracts as a trading member/clearing member.

- Failure to obtain, retain and renew certain approvals and licenses in a timely manner or comply with rules and regulations.

- Subject to extensive statutory and regulatory requirements and supervision, which have a material influence on, and consequence.

- Dependent on a few sets of market participants or counterparties w.r.t the physical commodities trading activities which support online exchange-based trading operations.

- Any downward revision in its credit ratings could adversely affect its ability to service debts as well as raise funds.

- Vulnerable to the volatility in interest rates and may face interest rate and maturity mismatches between assets and liabilities in the future which may cause liquidity issues.

⚖️Peer Companies

- Edelweiss Financial Services Ltd.

- Geojit Financial Services Ltd.

- Choice International Ltd.

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-20 | ₹1,212.98 | ₹2,771.88 | ₹39.22 |

| 31-Mar-21 | ₹1,181.51 | ₹1,331.37 | ₹45.8 |

| 31-Mar-22 | ₹1,168.69 | ₹646.23 | ₹61.97 |

📬Also Read: Sustainable Investing in India: ESG Investments

A Piece of Cake | Weekly Stock Market Updates 11 Dec