A Piece of Cake | Weekly Stock Market Updates 11 Dec

Stock Market Weekly Updates. Catch up on all that’s trending in the last week and get ready for the Monday markets with insights from our expert research team.

In this article

Hi, how was your week? We had a blast because Arihant Capital just won the Asiamoney best retail brokerage (India) award of 2022 and our head of research Mr Abhishek Jain was also awarded Best Analyst/ Commentator (India) by Asiamoney.

While we were busy celebrating these milestones, Modi was out celebrating too having secured a landslide victory in Gujarat with 156 seats out of 182. Even AAP found a reason to celebrate because it is now recognized as a national party. The Congress suffered its worst-ever defeat in Gujarat but wrested power from the BJP in Himachal Pradesh. Considering that the BJP has not lost a single election in Gujarat since 1995 this historic win was nothing but a piece of cake.

RBI increased repo rate for the fifth time in the year. But, this time at 35 bps the hike was substantially dialled down. Several Indian banks raised their base interest rates after the RBI hiked the rate at which it lends money to them. Does this signal that inflation is in the rear view mirror? Our eyes are glued on next week’s Fed rate meeting and November inflation numbers.

Talking about another global phenomenon, the FIFA World Cup Qatar 2022 has reached the business end after two weeks of absolute madness and the upcoming finals on Dec 18 will decide the fate of the final 4.

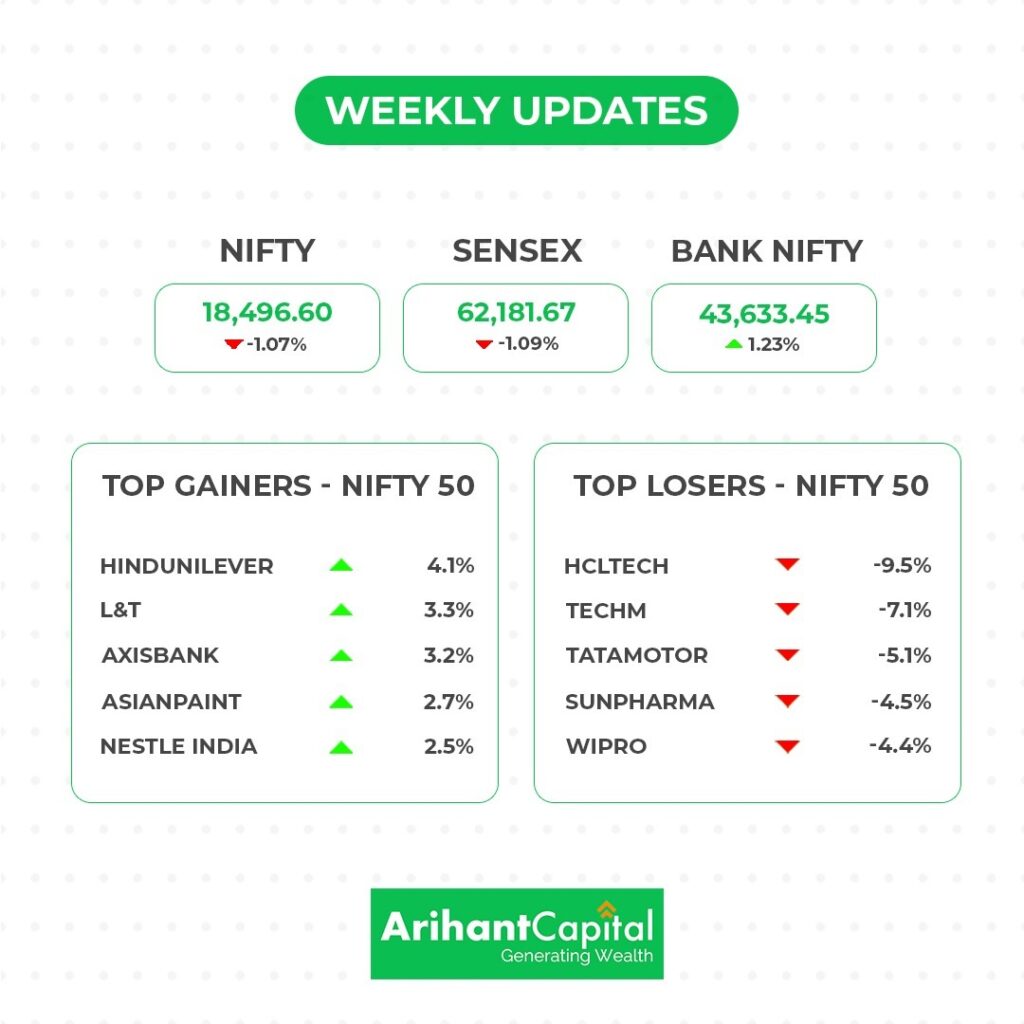

The fate of the D- street on the other hand was pretty grim this week. Nifty ended the week 1.06% down at 18,496. Sensex was also down 1.09% ending the week at 62,181. Bank Nifty, unsurprisingly was up at 43,633 in the aftermath of the rate hike.

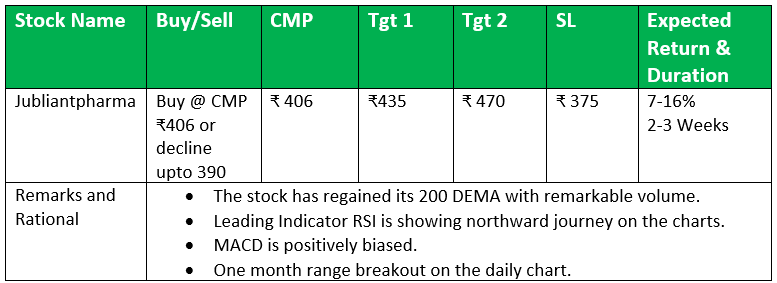

💰Stock Picks

From the Technical Desk

-Ms. Kavita Jain, Sr Research Analyst and Learning Head, Arihant Capital

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital

Nifty

On the daily chart of Nifty we observe the price trying to reach its previous upward gap area. On the weekly chart, Nifty forms “narrow body” candlestick patterns. It seems the markets may remain in consolidation after the massive rally and we may witness some selling pressure from upward resistance levels. It can face resistance around 18,550 level. If it starts trading above then it can touch 18,750-18,850 levels. While on the downside, the support is 18,300 if it starts trading below then it can hit the levels of 18,150 and 18,050.

Bank Nifty

On the daily and weekly chart of Bank Nifty we observe Doji candlestick pattern formation. Analyzing both charts, it appears that Bank Nifty may continue to consolidate but it has outperformed Nifty. In the coming trading sessions if it trades above 43,800 then it can touch 44,200 and 44,500 levels, however downside support comes at 43,400 below that we can see it falling to 43,100-42,800 levels.

🔎Quick Bites

Global

- The IMF says the world will lose economic output equal to the German economy between now and 2026.

- EU at odds over gas price cap as 12 countries criticise latest proposal.

- China reopening to curb growth: Goldman President.

- Taiwan may take China to the World Trade Organization after the country effectively banned the import of more Taiwanese food and drink products.

Automobile

- Tata Motors may hike passenger vehicle prices next month to make its models compliant with stricter emission norms kicking in from Apr 1, 2023.

- Maruti Suzuki announced the recall of around 9,000 vehicles due to possible defects in seat belts.

Industry

- L&T has bagged an order in the proposed Mumbai-Ahmedabad bullet train project.

Banking and Finance

- Indian govt clarified that it will allow a consortium of foreign funds and investment firms to own more than 51% stake in IDBI Bank.

- SBI raised ₹10,000 cr through non-convertible bonds.

- RBI has extended trading hours for various markets. The money, commercial paper, and certificate of deposit markets will now close at 5 pm.

Energy and Infrastructure

- India’s thermal power generation rose by 16% to 87,687 MU in November.

- GMR Airports partnered with National Investment and Infrastructure Fund for investment in 3 airports.

- The Indian govt has approved five new sites for nuclear power plants and given the financial go-ahead to build 10 700-MW pressurized heavy water reactors.

- ADB has approved a $780 million loan for the development of the Chennai metro rail system.

- Reliance and Ashok Leyland in talks for development and hydrogen-powered engines.

- RIL, PATH India bid to develop ₹18,000 cr Bengaluru logistics park.

Other

- IndiGo announced 32 new connecting flights to Europe through its partnership with Turkish Airlines.

- Alembic Pharma received approval from USFDA for marketing a skin treatment cream.

- Marico will buy Vietnam-based personal care firm Beauty X Corporation for ₹172 cr.

- Bajaj Consumer Care announced a buyback of shares at ₹240 per share.

- Air India will lease 12 more aircraft comprising A320 neo and Boeing 777 which will be deployed on Air India’s short, medium, and long-haul international routes.

- Dabur forayed into the women’s personal hygiene market with the launch of Fem Ultra Care sanitary napkins.

- Hindustan Unilever has acquired a 51% equity stake in plant-based supplement brand Oziva.

- USFDA has placed Sun Pharma’s Halol plant under ‘import alert’. All future shipments from this plant can be refused entry into the American markets till the plant adheres to the required standards.

- HCL Tech announced a collaboration with Intel and Mavenir to provide 5G enterprise tech solutions.

- Glenmark gets warning letter from USFDA for lapses at Goa plant

- Air India will invest $400 million to refurbish cabin interiors.

🚀IPO Corner

- Sula Vineyards will go for an IPO on December 12. The price band has been set as ₹340 – 357 per share.

- Landmark Cars IPO will open for subscription on Dec 13. The price band has been set as ₹481 – 506 per share.

- Abans Holdings Limited IPO will be open for subscription from Dec 12, 2022

🔌Sustainability Corner

- Jindal Stainless signed a contract with ReNew Power to develop a renewable energy project for power supply to its facility in Jaipur and Odisha.

- JSW Energy commissioned a wind project in Tamil Nadu.

- EU has reached a deal to ban the import of products which contribute to deforestation around the world.

- India has achieved 165.94 GW of renewable energy capacity till Oct. The target for 2022 is to have 175 GW capacity.

- The govt announced a ₹2.44 lakh cr ($29.6 billion) plan to build transmission lines. These will be used to boost the inter-regional connectivity of renewable energy.

- Greenko Group emerges as the lowest bidder in NTPC’s 3,000 megawatt energy storage tender.

- HEID & BMRCL announce operation of battery swap service at BMRCL metro stations.

- West Bengal to install 1000 EV charging stations in the next 2 years.

- The next budget could see some import duty cuts and custom duty exemptions for EV manufacturers and energy storage solutions.

- Altigreen opens its eleventh dealership and brand centre in Bhopal.

- Micelio Mobility signs MoU with JETRO for clean mobility.

- eBikeGo to launch a new business model ‘Float by eBikeGo’ to transform tourism.

- Amara Raja Batteries to set up Lithium-Ion battery facility in Telangana.

- Zen Mobility unveils its first range of light EVs.

- BGauss partners with GoZap to offer EVs to food and vegetable delivery agents

- BEST to launch 50 double-decker E-buses starting January 14, 2023.

- Perpetuity Capital teams up with 3ev Industries & 3eco Systems to finance electric cargo vehicles.

- Maharashtra allows individual EV owners to install charging points within building premises.

Also read: ESG Investing & Its Emergence in India