Landmark Cars Limited IPO is live. Should you invest?

Landmark Cars Limited IPO is live. Should you apply? Find out here.

In this article

📃About Landmark Cars Limited IPO

Incorporated in 1998, Landmark Cars Limited is the leading premium automotive retail business in India with dealerships for Mercedes-Benz, Honda, Jeep, Volkswagen and Renault. The company also caters to the commercial vehicle retail business of Ashok Leyland in India.

Landmark Cars offers services such as sales of new vehicles, after-sales service and repairs (including sales of spare parts, lubricants and accessories), sales of pre-owned passenger vehicles and facilitation of the sales of third-party finance and insurance products.

The company has expanded the network to include 112 outlets in 8 Indian states, comprised of 61 sales showrooms and outlets and 51 after-sales services and spare outlets, as of September 30, 2021.

Landmark Cars Limited vehicle dealership network is spread across 31 cities in eight states and union territories including Maharashtra, Uttar Pradesh, Gujarat, Haryana, Madhya Pradesh, Punjab, West Bengal and the National Capital Territory of Delhi.

The company operates as an authorized service centre for Mercedes-Benz, Honda, Volkswagen, Jeep, Renault and Ashok Leyland. Landmark Cars also provides after-sales service and repairs through 51 after-sales services and spare outlets, as of September 30, 2021.

The company’s business model captures the entire customer value chain including retailing new vehicles, servicing and repairing vehicles, selling spare parts, lubricants and other products, selling pre-owned passenger vehicles and distribution of third-party finance and insurance products.

💰Issue Details of Landmark Cars Limited IPO

- IPO open from 13 Dec – 15 Dec 2022

- Face value: ₹5 per equity share

- Price band: ₹481 to ₹506 per share

- Market lot: 29 shares

- Minimum investment: ₹14,674

- Listing on: BSE and NSE

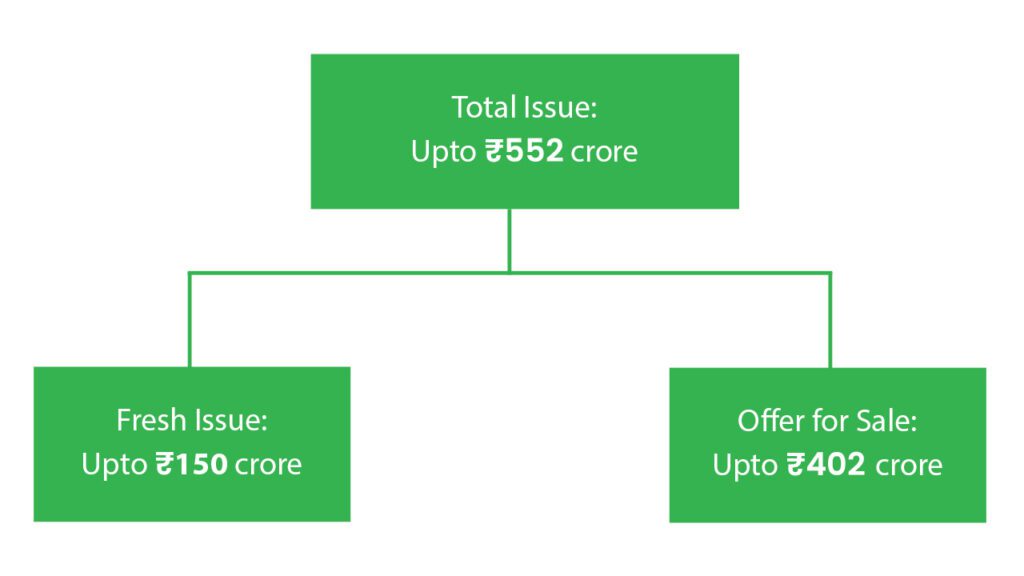

- Offer for sale: ₹552 Cr (OFS of ₹402 Cr. + Fresh Issue ₹150 Cr.)

- Registrar: Link Intime India Private Ltd

- Promoters:

- SANJAY KARSANDAS THAKKE

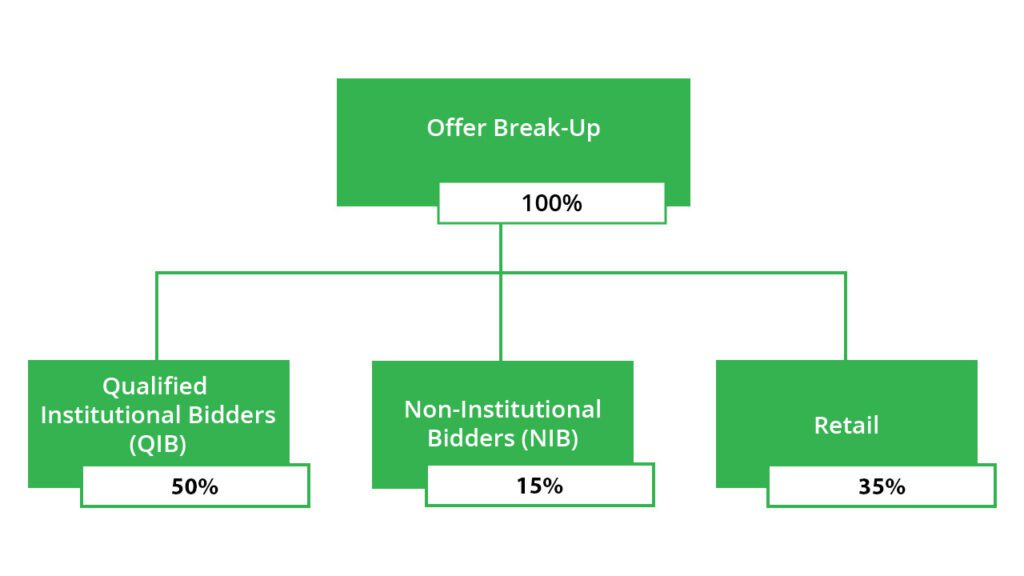

🪚Offer Breakup

🔭IPO Object

The net proceeds of the fresh issue, are proposed to be utilized in the following manner:

- Repayment/pre-payment, in full or in part, of certain borrowings availed by the company and subsidiaries.

- General corporate purposes.

⛓️IPO Strength

Some of the qualitative factors and strengths that form the basis for computing the offer price are:

- A leader in automotive dealerships for major OEMs focused on high-growth markets

- Growing presence in the after-sales segment leading to predictable growth in revenues and superior margins

- Leveraging technological innovation and digitalization to build robust business processes

- Customer-centric business model capturing the entire value chain

🧨IPO Risk

- It is subjected to the significant influence of, and restrictions imposed by OEMs pursuant to the terms of its dealership or agency agreements that may adversely impact the business

- Success depends on the value, perception, marketing and overall competitiveness of the OEMs’ vehicle brands in India

- The decision by any of the OEMs not to renew, terminate or require adverse material modifications to any of its dealership or agency agreements entered into with them could have a material effect.

- Increasing competition among automotive dealerships through online and offline marketing and competition from unauthorized service centres may have an adverse impact on the business.

⚖️Peer Companies

- There are no listed companies in India that engage in a similar business.

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-20 | ₹831.77 | ₹2228.93 | ₹-28.94 |

| 31-Mar-21 | ₹887.9 | ₹1966.34 | ₹11.15 |

| 31-Mar-22 | ₹1085.38 | ₹2989.12 | ₹66.18 |

📬Also Read: Sustainable Investing in India: ESG Investments

A Piece of Cake | Weekly Stock Market Updates 11 Dec