KFin Technologies Limited IPO is live. Should you invest?

KFin Technologies Limited IPO is live. Should you apply? Find out here.

In this article

- IPO details

- Issue details

- Offer Breakup

- IPO Strengths

- Key Risks

- KFin Technologies Limited Financials

📃About KFin Technologies Limited IPO

Incorporated in 2017, KFin Technologies Limited is a leading technology-driven financial services platform. The company provides services and solutions to asset managers and corporate issuers across asset classes in India and provides several investor solutions including transaction origination and processing for mutual funds and private retirement schemes in Malaysia, the Philippines and Hong Kong.

As on September 30, 2022, the company is India’s largest investor solutions provider to Indian mutual funds, based on several AMC clients serviced. The company is also servicing 301 funds of 192 asset managers in India as on September 30, 2022.

As on September 30, 2022, KFin Technologies Limited is the only investor and issuer solutions provider in India that offers services to asset managers such as mutual funds, alternative investment funds (“AIFs”), wealth managers and pension as well as corporate issuers in India.

KFin Technologies Limited is one of the two operating central record-keeping agencies (CRAs) for the National Pension System (NPS) in India as on September 30, 2022.

KFin Technologies Limited is India’s largest issuer solutions provider based on several clients serviced, as of September 30, 2022.

The company has classified its products and services in the following manner:

- Investor Solutions – Account setup, transaction origination, redemption, Brokerage Calculations, Compliance / Regulatory Reporting Recordkeeping). Domestic mutual funds, International, Pension services, Alternatives and wealth management.

- Issuer solutions (Folio Creation and Maintenance, Transaction Processing for IPO, FPO, etc. Corporate Action Processing, Compliance / Regulatory Reporting Recordkeeping MIS, Virtual Voting e-AGM, e-Vault).

- Global business Domestic mutual services (Mortgage Services Legal Services Transfer Agency Finance and Accounting).

- The company’s revenue from operations for Fiscal 2022 and the six months ended September 30, 2022, was Rs 6,395.07 million and Rs 3,487.68 million, respectively.

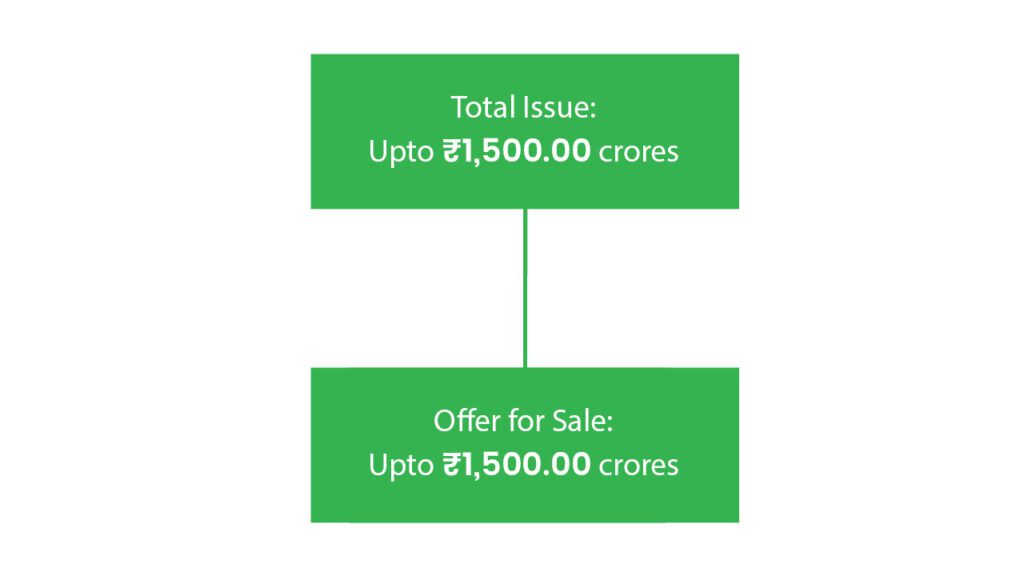

💰Issue Details of KFin Technologies Limited IPO

- IPO open from 19 Dec – 21 Dec 2022

- Face value: ₹10 per equity share

- Price band: ₹347 to ₹366 per share

- Market lot: 40 shares

- Minimum investment: ₹14,640

- Listing on: BSE and NSE

- Offer for sale: ₹1,500.00 Cr.

- Registrar: Bigshare Services Pvt Ltd

- Promoters:

- General Atlantic Singapore Fund Pte. Ltd.

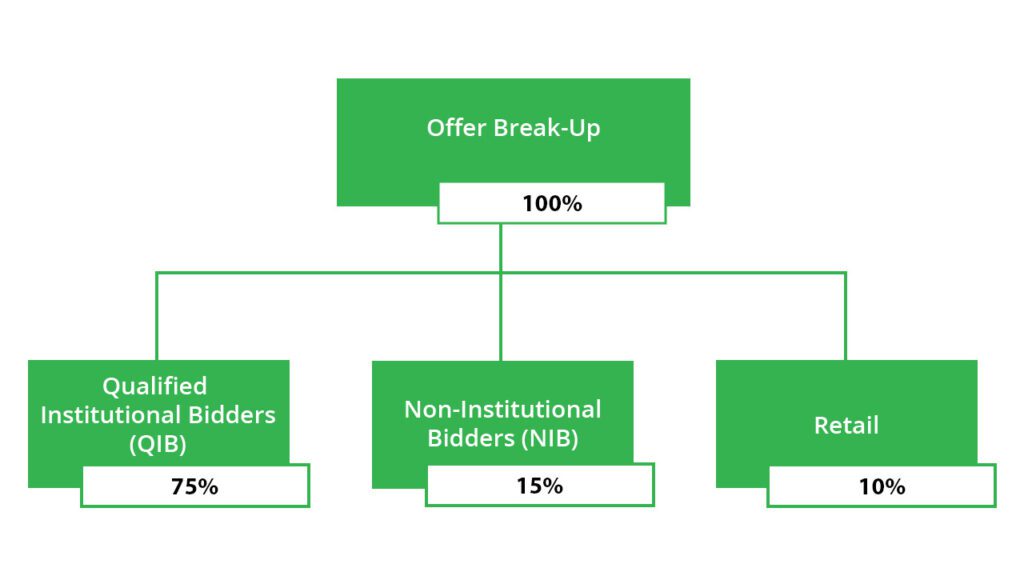

🪚Offer Breakup

🔭IPO Object

The net proceeds of the fresh issue, are proposed to be utilized in the following manner:

- To carry out the Offer for Sale of up to Equity Shares aggregating to Rs. 2,400 crores by the Promoter Selling Shareholder

- Achieve the benefits of listing Equity Shares on the Stock Exchanges

⛓️IPO Strength

Some of the qualitative factors and strengths that form the basis for computing the offer price are:

- Scaled platform with a strong track record of growth and market leadership

- A diversified multi-asset servicing platform is well-positioned to benefit from strong growth across large markets in India and South East Asia

- Unique “platform-as-a-service” business model providing comprehensive end-to-end solutions enabled by technology solutions developed in-house

- Deeply entrenched, long-standing client relationships with a diversified and expanding client base

- The asset-light business model with a recurring revenue model, high operating leverage, profitability and cash generation

🧨IPO Risk

- Significant disruptions in the information technology systems or breaches of data security could adversely affect its business and reputation

- It derives a significant portion of its revenues from a few customers and the loss of one or more such clients could adversely affect the business and prospects

- There are outstanding legal proceedings involving the firm

- The issuer solutions business is affected by seasonality, which could result in fluctuations in its operating results

- Failure to obtain, maintain or renew its statutory and regulatory licenses, permits and approvals required to operate business

⚖️Peer Companies

- Computer Age Management Services Limited (CAMS)

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-20 | ₹868.38 | ₹455.26 | ₹4.52 |

| 31-Mar-21 | ₹922.61 | ₹486.2 | ₹-64.51 |

| 31-Mar-22 | ₹1026.41 | ₹645.56 | ₹148.55 |

📬Also Read: Sustainable Investing in India: ESG Investments