Elin Electronics Limited IPO is Going to live. Should you invest?

Elin Electronics Limited IPO is live. Should you apply? Find out here.

In this article

📃About Elin Electronics Limited IPO

Incorporated in 1969, Elin Electronics Limited is a leading electronics manufacturing services (“EMS”) provider. The company is a manufacturer of end-to-end product solutions for major brands of lighting, fans, and small/ kitchen appliances in India, and is one of the largest fractional horsepower motors manufacturers in India.

Elin Electronics Limited manufactures and assembles various products and provides end-to-end product solutions. The company serves under both original equipment manufacturer (“OEM”) and original design manufacturer (“ODM”) business models.

The company’s diversified product portfolio in EMS includes:

- LED lighting, fans, switches, lighting products, ceiling, fresh air, TPW fans, and modular sockets.

- Small appliances such as dry and steam irons, toasters, hand blenders, mixer grinders, hair dryers, and hair straighteners.

- Fractional horsepower motors are used in mixer grinders, hand blenders, wet grinders, chimneys, air conditioners, heat convectors, TPW fans, etc.

The company has three manufacturing facilities which are strategically located in Ghaziabad (Uttar Pradesh), Baddi (Himachal Pradesh), and Verna (Goa).

The company also has a centralized R&D center in Ghaziabad (Uttar Pradesh), focusing on the research and development of all aspects of OEM and ODM models including concept sketching, design refinement, generating optional features, and testing.

In fiscals 2020, 2021, and 2022 and the seven months ended October 31, 2022, the company catered to 327, 387, 342, and 297 customers, respectively.

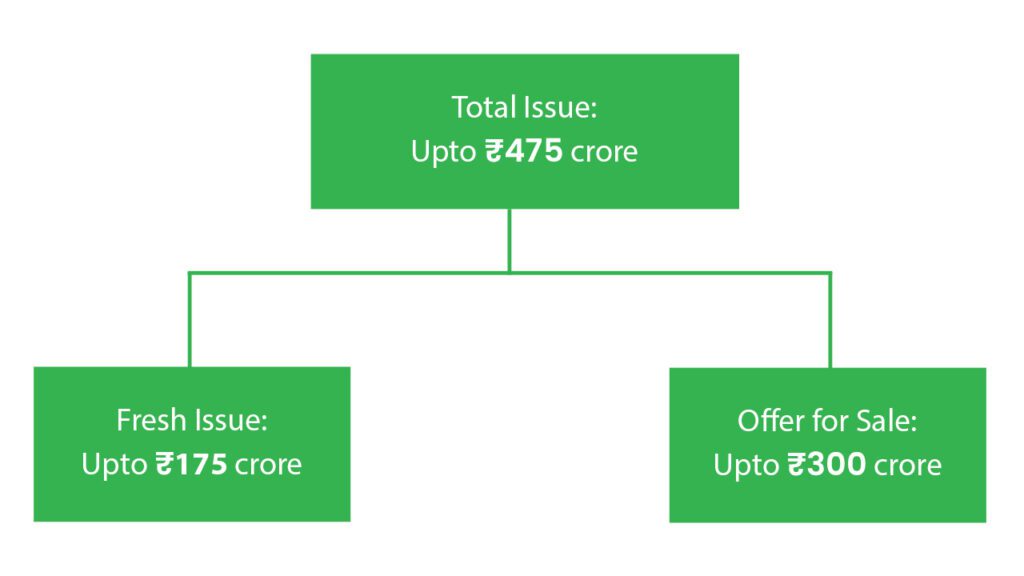

💰Issue Details of Elin Electronics Limited IPO

- IPO open from 20 Dec – 22 Dec 2022

- Face value: ₹5 per equity share

- Price band: ₹234 to ₹247 per share

- Market lot: 60 shares

- Minimum investment: ₹14,820

- Listing on: BSE and NSE

- Offer for sale: Issue size ₹475 cr. (fresh Issue ₹175 cr. + OFS ₹300cr.)

- Registrar: KFin Technologies Limited

- Promoters:

- Mangi Lall Sethia, Kamal Sethia, Kishore Sethia, Gaurav Sethia, Sanjeev Sethia, Sumit Sethia, Suman Sethia, Vasudha Sethia, and Vinay Kumar Sethia are the company promoters

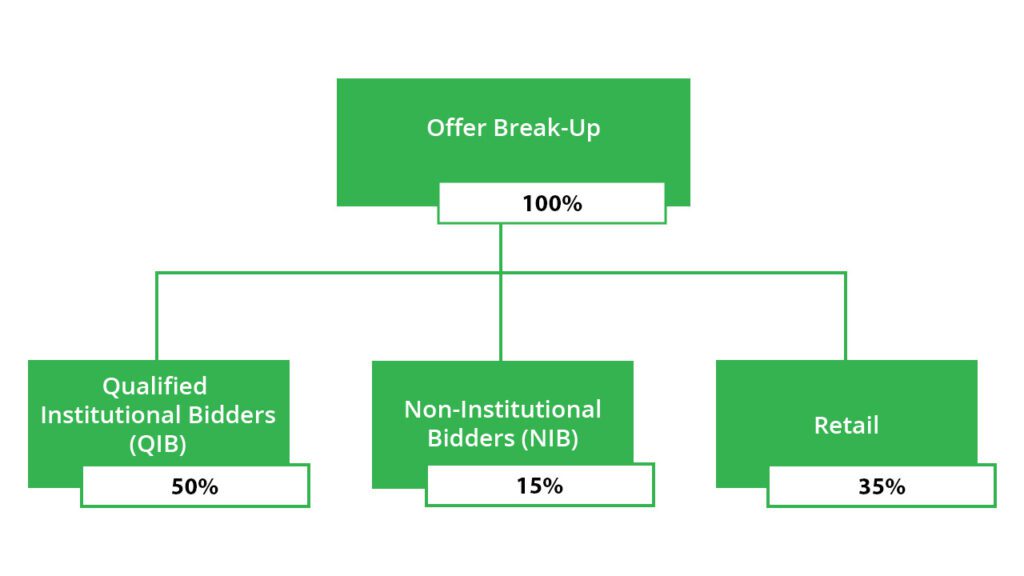

🪚Offer Breakup

🔭IPO Object

The net proceeds of the fresh issue, are proposed to be utilized in the following manner:

- Repayment/ prepayment, in full or part, of certain borrowings availed by the company.

- Funding capital expenditure towards upgrading and expanding its existing facilities at

- Ghaziabad, Uttar Pradesh

- Verna, Goa

- General corporate purposes

⛓️IPO Strength

Some of the qualitative factors and strengths that form the basis for computing the offer price are:

- Established market position in key verticals including leadership in fractional horsepower motors

- Diversified products resulting in a de-risked business model

- Entrenched relationships with a marquee customer base

- Consistent and strong track record of financial performance

- Augmenting R&D capabilities

- Expanding operations in medical diagnostics cartridges

🧨IPO Risk

- There is no guarantee that the firm can retain the business with its (new or existing) customers after completing contracts, adversely affecting the profitability and results of operations.

- The manufacturing facilities are critical to the business. Thus, any disruption in their continuous operations of them would have a material adverse effect on the business, and profitability.

- If the firm fails to optimally utilize its well-versed backward integration to enhance and support the business, then reliance on third-party suppliers may cause delays in timelines and an increase in input cost (on short notice).

- . The EMS industry is rapidly changing and evolving. The company may fail to keep up with the latest trends and fail in adopting new ODM capabilities and technology.

- Technical knowledge may not be adequately protected by intellectual property, but only by secrecy, which cannot keep things confidential for long and may lead to the firm losing out on its competitive edge.

- . The firm relies on third-party transportation providers to supply most of the raw materials and deliver products to its customers, hence, there may be failures in these continuous supply or delivery processes in an efficient and reliable manner.

⚖️Peer Companies

- Dixon Technologies Ltd. (India)

- Amber Enterprises India Limited

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-20 | ₹387.63 | ₹786.37 | ₹27.49 |

| 31-Mar-21 | ₹508.31 | ₹864.9 | ₹34.86 |

| 31-Mar-22 | ₹532.61 | ₹1094.67 | ₹39.15 |

📬Also Read: Sustainable Investing in India: ESG Investments