Global Recession Ahead | Indian Stock Market Weekly Updates 18 Dec

Stock Market Weekly Updates. Catch up on all that’s trending in the last week and get ready for the Monday markets with insights from our expert research team.

In this article

While the colours of Christmas have fallen over the markets, investors are hoping that Santa will bring a rally with him. India’s stock market fell for the second straight week. Nifty closed the week on a negative note of 1.23% at 18,269 with a 228 pts loss and BSE Sensex ended the week at 61,338. On a week-on-week basis, Sensex is negative by 1.36%. Bank Nifty also closed on a negative note by 0.95% during the week, ending at 43,219.5.

In our last week’s newsletter, we covered that the RBI increased the repo rate by 35 bps. Within this week several global central banks viz Fed, the ECB, and the Bank of England increased their rates by a half percentage point. While all countries struggle to battle skyrocketing inflation, these rate hikes are causing their growth to slow down further possibly leading some major economies into a recession.

💰Stock Picks

From the Technical Desk

-Ms. Kavita Jain, Sr Research Analyst and Learning Head, Arihant Capital

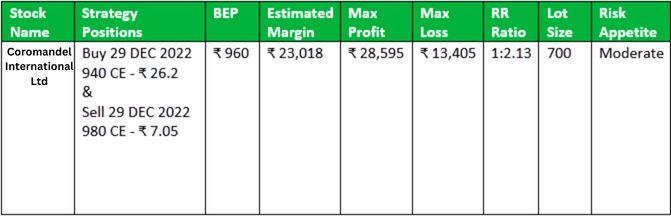

✨Option Hub

From the Technical Desk

-Ms. Kavita Jain, Sr Research Analyst and Learning Head, Arihant Capital

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital

Nifty

If we look at the daily chart of Nifty, we observe that it is now trading below its short-term moving averages. On the weekly chart, the Nifty breaks through its lower trendline support levels. After combining and analyzing both of the data, it seems the market may remain in consolidation and it may face some selling pressure from upward resistance levels. It can face resistance around the 18,380 level if it starts trading above then it can touch 18,480-18,550 levels, while on the downside support is 18,250 if it starts trading below then it can hit the levels of 18,150 and 18,050.

Bank Nifty

If we look at the daily chart of BankNifty, we may observe that it has reached its short-term moving averages and on the weekly chart we see the formation of a “Spinning Top” candlestick pattern. Analyzing both charts, it appears that BankNifty is still in consolidation and may be subject to some selling pressure from upward resistance levels. In the coming trading session if it trades below the support level of 43,100 then it can touch 42,800 and 42,500 levels, however, upside resistance comes at 43,350 above that we can see 43,550-43,700 levels.

🔎Quick Bites

Economy

- Global funds sell a net ₹ 1.58B of Indian stocks on 9th December.

- India November consumer price inflation y/y; est. 6.36%, prior 6.77%

- Forex reserves rose $11b to $561.2b in a week to Nov. 25

Industry

- Vedanta has partnered with 30 Japanese tech companies to develop semiconductors and glass displays.

Banking and Finance

- ICICI Bank raised ₹ 5,000 crores through long-term bonds at a coupon of 7.63% p.a. payable annually.

- Lenders of Reliance Capital finalize the e-auction process for bidders

- RBI gives the final nod to Yes Bank’s capital expansion plan.

- Bandhan Bank received ₹ 916.6 crores as the first tranche under the credit guarantee scheme.

- Axis Bank received the board’s approval for the allotment of 12,000 non-convertible Basel-III compliant Tier-2 bonds of the face value of ₹ 1 crore each.

- Paytm board approved ₹ 850 cr buyback

- PTC India Financial Services said the board of directors has sanctioned additional loans of ₹800 crores to various borrowers.

- HDFC Bank acquired a 7.75% stake in fintech start-up Mintoak

Energy and Infrastructure

- Kalpataru Power raises ₹990M via bonds in a private placement

- Macrotech Developers Ltd has raised approximately ₹ 3,547 crores by selling 7.2% of the equity share capital of the company through QIP.

- Ultratech Cement commissioned 1.9 metric tonnes per annum (mtpa) greenfield clinker-backed grinding capacity at Pali Cement Works, Rajasthan.

- Jaypee Group is to sell its cement business to Dalmia Cement (Bharat) Ltd at an enterprise value of ₹5,666 crores.

- NTPC will raise ₹ 500 cr via debentures.

Other

- India’s Neo Aims to Raise Up to ₹20b for private credit

- Tata’s Air India nears deal for 150 Boeing 737 Max Jets.

- Infosys slumps as much as 6% in US Trading After HCL Technologies Warning

- Mahindra Holidays to invest up to ₹1,500 crores in the next three years in expansion.

- Lupin is set to enter the digital healthcare space in India with the launch of cardio-vascular therapeutics in 10 cities by February.

- Marico South-East Asia Corporation has inked a pact to acquire 100% of Beauty X

- India’s passenger vehicle wholesales jumped 28% year-on-year in November: SIAM.

- KEC International: won new orders worth ₹1,349 crore

- BSE has crossed the milestone of 12 cr registered users. Around 40% of these users fall in the 30-40 age bracket. 10% of users are below 20 years of age.

🚀IPO Corner

- Sula Vineyards IPO was subscribed 0.59 times till day 2. Retail investors subscribed to the issue 0.99 times.

- Abans Holdings IPO was subscribed 0.28 times till day 2. Retail investors subscribed to the issue 0.23 times.

- Landmark Cars IPO was subscribed 0.17 times on Day 1. Retail investors subscribed to the issue 0.17 times.

- Tata Motors board has given in-principal approval for partial disinvestment in its subsidiary Tata Technologies via the IPO route.

🔌Sustainability Corner

- Adani Total Gas (ATGL) wins mandate for EV charge station in 8 cities

- Mahindra & Mahindra: will invest $1.21 bn to set up an electric vehicle manufacturing plant.

- Emami (HMN) increases stake in Brillare Science to 80.59% from 77.53

- The iQube, TVS Motor Co’s sole electric two-wheeler, recorded its best-ever sales in November: 10,058 units. The eco-friendly product, which is seeing growing demand, has also crossed the cumulative 50,000-unit milestone.

- Greaves Electric Mobility to reveal 5 new EVs at Auto Expo 2023 (Greater Noida, Jan 13-18) they include an electric scooter with a new brand identity and premium design, & an aerodynamic 3-wheeler cargo concept; all 5 have a high level of localization.

- Battery Electric Vehicle sales in Europe exceed a million units – 1,103,055 units – in the first 10 months of CY2022

- In October, EVs (BEV: 119,600 & PHEV: 88,200) made up 23% of the total volume. Volkswagen ID.3 & ID.4 lead the BEV ranking.

- Tata Motors to supply and operate 921 electric buses (12-metre low-floor Starbus) for Bengaluru Metropolitan Transport Corporation as part of a larger CESL tender to date, the company has supplied over 730 electric buses across multiple cities in India.

- India’s growing EV market sees component suppliers make speedy moves – 1)Uno Minda JV with Buehler for traction motors 2) Shriram Pistons to acquire motor specialist EMFI. 3) Ramkrishna Forgings to acquire Tsuyo.

- Electric car & SUV retail sales in India are on a speedy run – charge past 25,750 units in April-Nov; already 45% more than FY2022’s 17,800 units & driving towards 40,000 units in FY2023; November’s 3,884 units highest monthly sales; 2023 to see new-model rush.

- Bajaj Auto, Piaggio & Mahindra power 3-wheeler sales in April-November; company despatches soar 98% in the first 8 months of FY2023 to 296,430 units; top three OEMs command 90% of the market. electric 3Ws grow their market share to 6%.

- Mahindra & Mahindra has announced that its investment of ₹ 10,000 crores for electric vehicles has been approved under the Maharashtra Government’s industrial promotion scheme for Electric Vehicles.

- Mahindra & Mahindra’s Chakan plant has become India’s first 5G-enabled automobile facility; Airtel India & Tech Mahindra to deploy captive private network; ‘5G for Business’ enhances network connectivity, delivers improved speeds for software flashing

- Shriram Pistons & Rings to enter the EV components industry; set to acquire a majority stake in the Singapore-based EMF Innovations, which designs and manufactures BLDC hub and inner rotor motors, and also motor controllers.

- Electric car & SUV retail sales in India charge past 25,500 units in April-November, headed for 40,000 in FY2023; Nov’s 3,884 units high monthly sales yet; Tata Motors rules with 84% share while MG Motor India increases EV share to 10%.

- Tata Motors is to supply 5,000 Xpres-T EVs to fleet company Everest Fleet which is keen on making a shift from CNG to electric mobility; the first batch of 100 cars was delivered on 14th Dec 2022.

Also read: ESG Investing & Its Emergence in India