Radiant Cash Management Services Limited IPO is live. Should you invest?

Radiant Cash Management Services Limited IPO is live. Should you apply? Find out here.

In this article

- IPO details

- Issue details

- Offer Breakup

- IPO Strengths

- Key Risks

- Radiant Cash Management Services Financials

📃About Radiant Cash Management Services IPO

Incorporated in 2005, Radiant Cash Management Services Limited is the market leader in retail cash management services for banks, financial institutions, and organized retail and e-commerce companies in India. The company offers a range of services under this segment consisting of collection and delivery of cash on behalf of our clients from the end user.

The company’s management is supported by a qualified and motivated pool of about 2,012 employees (as of July 31, 2022).

The main objectives of the company are:

To carry on the business of providing to banks, individuals, commercials, and government establishments, cash/cheques/DDs pickup and delivery services, cash processing such as sorting for goods and soiled currencies, notes, coins of various denominations, overnight vaulting services for bulk cash and ATM cards, cassettes & important documents, ATM Services, handling of PIN mailers/drafts/cheque book delivery, providing strong rooms installed as per RBI guidelines.

To carry on the business of management of electronic online and mobile financial and cash transactions and product management and development of intellectual property in the area of cash management.

To carry on any business regarding cash management under business process outsourcing.

The company is one of the largest players in the RCM segment in terms of network locations or touch points served as of March 31, 2022.

Radiant Cash Management Services provide services across 13,044 pin codes in India covering all districts (other than Lakshadweep) with about 55,513 touchpoints serving more than 5,388 locations as of July 31, 2022.

The company’s key clients are Axis Bank Limited, Citibank, Deutsche Bank Limited, HDFC Bank Limited, ICICI Bank Limited, Kotak Mahindra Bank, Standard Chartered Bank, State Bank of India, The Hongkong and Shanghai Banking Corporation Limited, and Yes Bank Limited.

💰Issue Details of Radiant Cash Management Services IPO

- IPO open from 23 Dec – 27 Dec 2022

- Face value: ₹1 per equity share

- Price band: ₹94 to ₹99 per share

- Market lot: 150 shares

- Minimum investment: ₹14,850

- Listing on: BSE and NSE

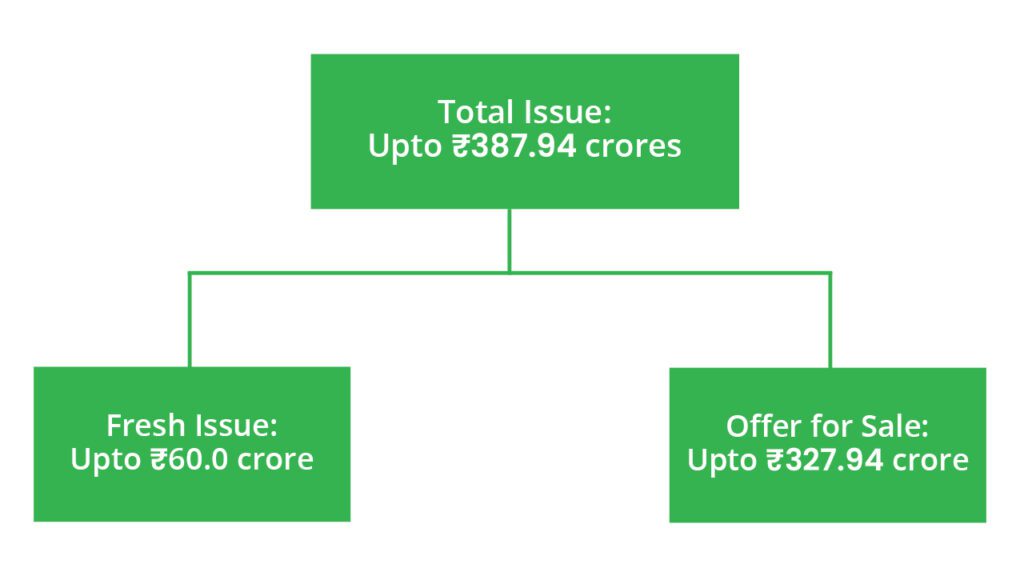

- Offer for sale: Issue size ₹387.94 cr. (fresh Issue ₹60 cr. + OFS ₹327.94cr.)

- Registrar: Link Intime India Private Ltd

- Promoters:

- Col. David Devasahayam

- Dr Renuka David

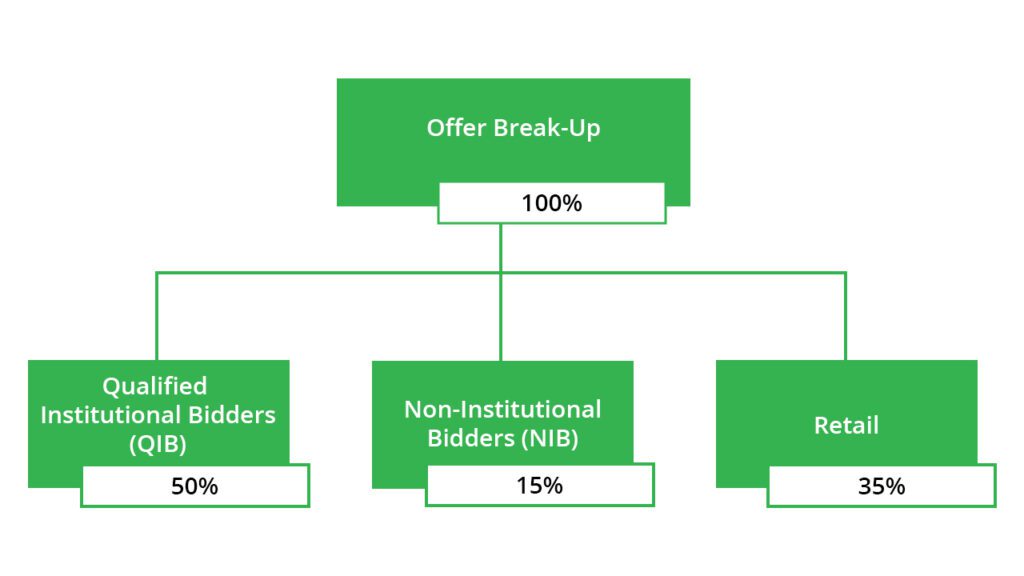

🪚Offer Breakup

🔭IPO Object

The net proceeds of the fresh issue, are proposed to be utilized in the following manner:

- Funding working capital requirements

- Funding of capital expenditure requirements for the purchase of specially fabricated armoured vans

- General corporate purposes

⛓️IPO Strength

Some of the qualitative factors and strengths that form the basis for computing the offer price are:

- Leading integrated cash logistics player in a consolidating industry present across the value chain of retail cash management.

- Pan India’s presence with a strong network in Tier 2 and Tier 3+ locations and fast-growing end-user segments.

- Diversified client base with long-standing relationships and the ability to cross-sell value-added services.

- Robust Operational Risk Management.

- Significantly built-up technology to optimize operational profitability.

🧨IPO Risk

- The business is highly dependent on the banking sector in India to generate revenues, and any changes within Indian banks that affect their utilization of and demand for cash management services could affect the business and its operations.

- If one or more of the key customers were to suffer deterioration in their business, cease doing business or substantially reduce its dealings with them, the revenues could decline.

- A decrease in the availability or use of cash as the predominant mode of payment in India could have an adverse effect on the business as the cashless payments system gains traction.

- The currency demonetization measures had a significant impact on cash circulation in India and there is uncertainty about whether similar unanticipated measures could be adopted, hence the future remains unpredictable.

- Given the large volumes of cash handled, the firm is exposed to various operational risks, including armed robbery, end customer or third-party fraud, theft or embezzlement by employees, or, reporting errors, both deliberate and inadvertent, and failure to meet specific requirements under applicable service agreements for which we may incur penalty charges.

⚖️Peer Companies

- None of the listed companies in India is exclusively engaged in a portfolio of business similar to Radiant Cash Management Services Limited.

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-20 | ₹157.62 | ₹251.78 | ₹36.5 |

| 31-Mar-21 | ₹162.14 | ₹224.16 | ₹32.43 |

| 31-Mar-22 | ₹190.57 | ₹286.97 | ₹38.21 |

📬Also Read: Sustainable Investing in India: ESG Investments