Global Surfaces Limited IPO is live. Should you Invest?

Global Surfaces Limited IPO is live. Should you Invest? Find out here.

In this article

📃About Global Surfaces Limited IPO

Incorporated in 1991, Global Surfaces Limited is engaged in processing natural stones and manufacturing engineered quartz.

Natural stones are produced through complex geological processes and form various products like granite, limestone, marble, slate, quartzite, onyx, sandstone, travertine, and others that are quarried from the earth. The company has two units, one located at RIICO Industrial Area, Bagru Extn, Bagru, Jaipur, Rajasthan, and the other at Mahindra World City SEZ, Jaipur, and Rajasthan. Both units engage in the processing and manufacturing of the products. The products of Global Surfaces Limited have applications in flooring, wall cladding, countertops, cut-to-size, and other items. The products are widely used for commercial and residential industries and are sold within and outside India.

💰Issue Details of Global Surfaces IPO

- IPO open from 13 March 2023 – 15 March 2023

- Face value: ₹10 per equity share

- Price band: ₹133 to ₹140 per share

- Market lot: 100 shares

- Minimum Investment: ₹14,000

- Listing on: BSE and NSE

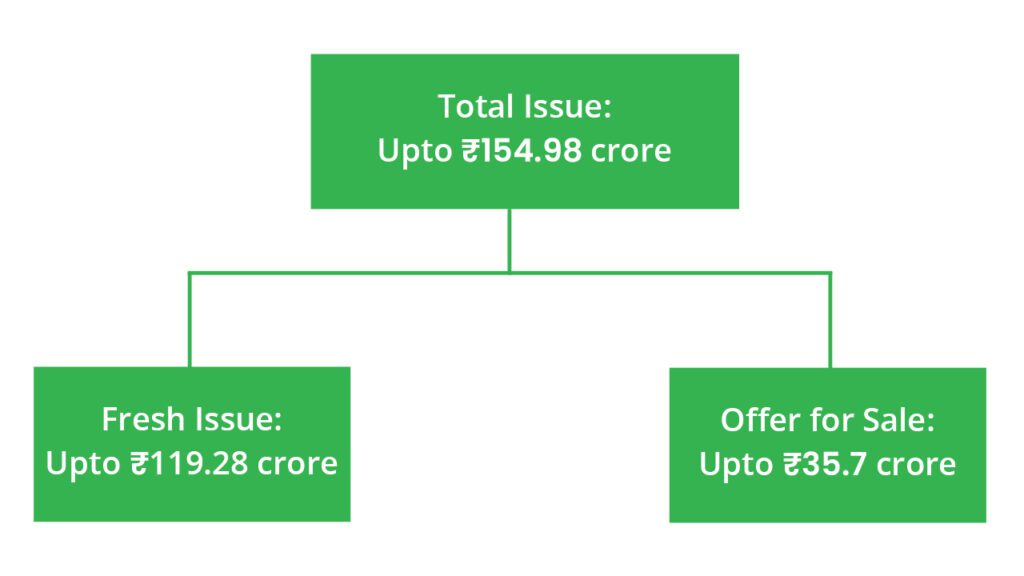

- Offer for sale: Issue size ₹154.98 cr. (fresh Issue ₹119.28Cr cr.+OFS ₹35.7 cr.)

- Registrar: Bigshare Services Pvt Ltd

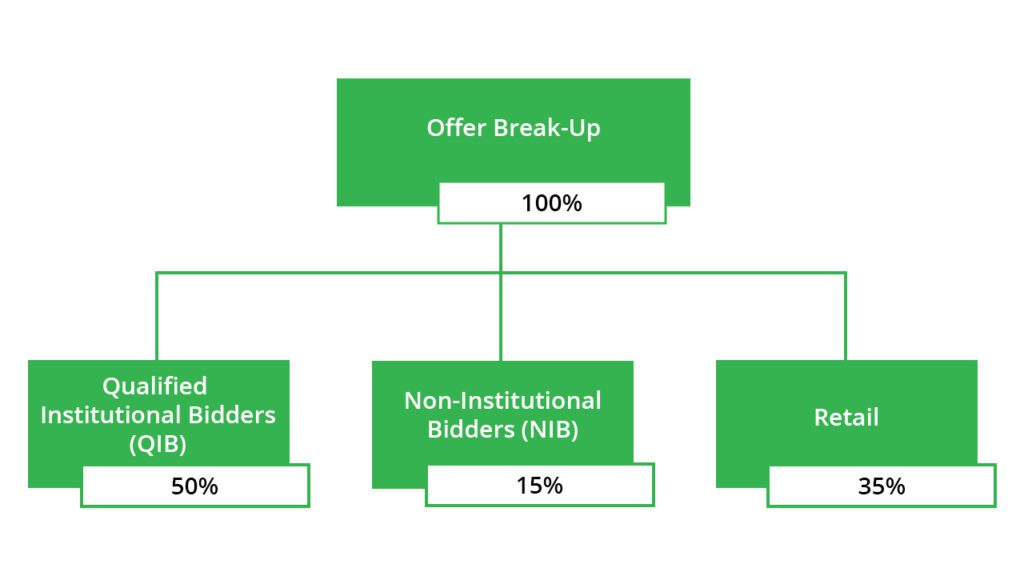

🪚Offer Breakup

🔭IPO Object

The Company proposes to utilize the net proceeds from the fresh issue towards the following objects:

- Investment in the wholly owned subsidiary, Global Surfaces FZE for part-financing its capital expenditure requirements in relation to the setting up of a manufacturing facility for engineered quartz at The Jebel Ali Free Zone, Dubai, United Arab Emirates (UAE).

- General corporate purpose.

⛓️IPO Strength

Some of the qualitative factors and strengths which form the basis for computing the offer price are:

- They offer a wide product portfolio and multiple designs.

- Consistent Growth.

- International presence.

- The synergy of a young and experienced management team.

- Experienced and result-oriented Promoter.

🧨IPO Risk

- The Company is dependent on a few customers for a major part of its revenues.

- They do not have long-term agreements with their suppliers for raw materials and an inability to procure the desired quality, and quantity of raw materials in a timely manner.

- The major portion of their revenues are derived from exports to the USA and any adverse developments in this market or restrained economic or political relations of India with the USA could adversely affect their business.

- Restrictions on the import of raw materials may adversely impact their business and the results of operations.

- Their Units and office premises are located on a leasehold basis. If these leasehold agreements are terminated or not renewed on terms acceptable to them, could have a material adverse effect on their business, financial condition, results of operations and cash flows.

⚖️Peer Companies

- Pokarna Limited

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-20 | ₹128.73 | ₹165.78 | ₹20.96 |

| 31-Mar-21 | ₹159.00 | ₹179.00 | ₹33.93 |

| 31-Mar-22 | ₹236.48 | ₹198.36 | ₹35.63 |

📬Also Read: Sustainable Investing in India: ESG Investments

A tale of two circuits| Indian Stock Market Weekly Update 04 March