A tale of two circuits| Indian Stock Market Weekly Update 04 March

Grab your morning cuppa and let’s check out what happened during the week in the weekly stock market update on 04 Mar 2023.

Youtube in SEBI Scanner

Arshad Warsi the “circuit” of Munnabhai fame has been in the news, this time for his involvement in a Youtube “Pump and Dump” scheme. Warsi and his wife Maria Goretti had uploaded misleading videos on YouTube channels and recommended investors buy the shares of Sadhna Broadcast Ltd and Sharpline Broadcast Ltd. We certainly hope someone could warn Mr Warsi, “Mamu Teri watt Lagne Wali Hai“.

FYI: A pump-and-dump is an age-old scheme where the value of a worthless asset is made to rise quickly and then those who helped increase the price, sell off the asset and make a profit from the price increase.

SEBI has banned 45 entities from the stock market in the last week, but why are we focussing on Warsi? As you must be aware, Warsi being a public figure or an “influencer” holds a lot of (uhm… ) influence on public opinion- something which ethically should be utilised for good. In this time of “influencers” and information overload on the internet, for you investors, this tale holds a cautionary message. Get investment advice from SEBI-registered market participants and perform your own analysis for making investment decisions.

Adani Stocks Climb

The Adani saga continues, but it seems now Adani has managed to keep his companies on the good side of the news. First off, US-based PE firm GQG Partners has invested ₹15,446 crores ($1.8 billion) in Adani Group companies through a secondary block deal. Secondly, the Supreme Court ordered a six-member probe panel to investigate regulatory aspects behind the rout in Adani Group companies’ shares. Adani has welcomed this move saying that “the truth shall prevail”. Another good news came from Adani Ports which saw a 10% increase in cargo.

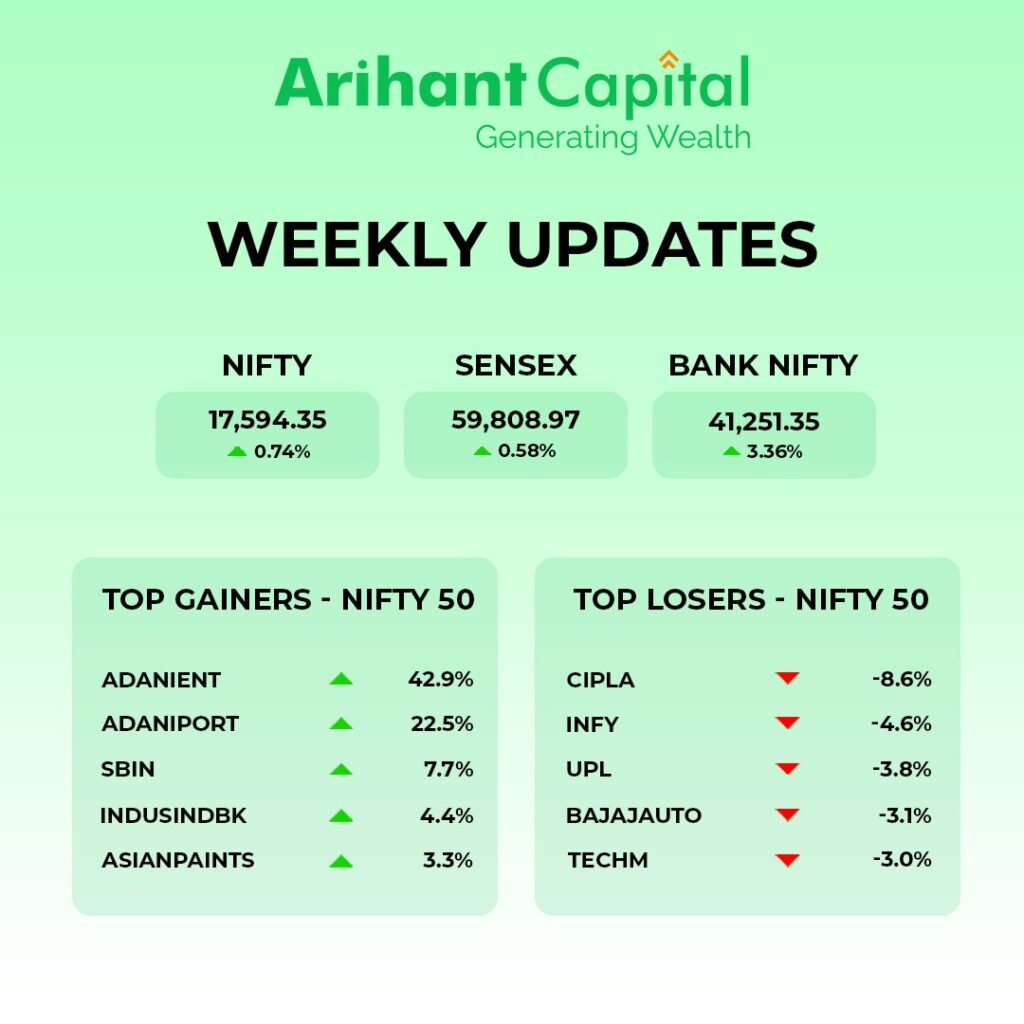

With this stream of news coming in, Adani stocks gave wary investors a good chance to exit, as the stocks touched the upper circuit. The flagship Adani Enterprises became the top performer of the week with a 40% rise in its stock prices, and Adani Ports also surged by 22%.

Markets ended the week firmly in green with Nifty ending 0.7% higher at 17,594 whereas Sensex ended 0.6% up at 59,809.

In this article

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

On the daily chart of Nifty, it is trading near the support level of 200 SMA, and on the weekly chart, it is taking support from the lower channel. This indicates that the market is now taking support from its lower level, and we can see some stock-specific action. In the coming trading session, if Nifty trades above the 17,650 level, if it starts to trade above, then it can touch the 17,850-18,050 levels. On the downside, the support is 17,500, and if it starts to trade below then it can test 17,350 and 17,100 levels.

Bank Nifty

On the daily chart of Bank Nifty, it is trading near its 50-day SMA level. On the weekly chart, we observe a bullish candlestick formation. This indicates that Bank Nifty can outperform Nifty. In the coming trading sessions, if it trades above 41,350, then it can touch 41,600 and 41,800 levels. However, the downside support comes at 40,900, and below that, we can see 40,700–40,400 levels.

Want to know which stocks Mr Goyal will focus on in the week? Check out this article.

Quick Bites

Global

- China’s factory activity stood at 52.6 in February – the highest since April 2012.

Economy

- India’s service sector growth (PMI) rose to a 12-year high of 59.4 in Feb 2023.

- Feb GST collection stood at ₹1.50 lakh cr, up 12% year-on-year.

- Petrol sales in India rose 12% year-on-year in Feb. Diesel sales increased 13%. Electricity usage rose 9% year-on-year in Feb 2023.

- India’s GDP rose 4.4% in the Oct-Dec 2022 quarter as compared to the same quarter in 2021. From July to Sep 2022, GDP grew by 6.5%.

- The fiscal deficit for the first 10 months stood at ₹11.91 lakh cr or 67.8% of the annual estimates.

Automobile

- Hero MotoCorp reported a 10% year-on-year increase in sales at 3.94 lakh units in Feb. Maruti Suzuki sold 1.72 lakh units in Feb 2023 — 5.04% more than in Feb 2022. Ashok Leyland sales rose 26.70% to 18,571 units in Feb 2023. TVS Motors sales fell around 2% to 2.76 lakh units.

- Tata Motors launched its first vehicle scrapping facility in Jaipur.

IT and Telecommunications

- Ramco Systems partners with Etihad Airways Engineering to implement its aviation suites.

- Foxconn is planning to invest about $700 million in a new plant in India to increase the production of iPhones.

- Happiest Minds will raise ₹125 cr via debentures.

- Airtel crosses 10 lacks 5G subscribers in Mumbai.

Banking and Finance

- Axis Bank completed the acquisition of Citi’s India consumer business in a ₹11,603 cr deal.

- IRDAI has asked insurance companies to offer specific products for people with disabilities, mental illness, and people with HIV/AIDS.

Energy and Infrastructure

- HAL gets new aircraft orders from Indian Airforce for ₹6,828 crores.

- Reliance Industries sets up a subsidiary to develop properties for commercial use

- Shriram Properties is planning to develop 53 million square feet of real estate across Bengaluru, Chennai, and Kolkata over the next 2-3 years.

- Coal India posted a 14.3% year-on-year increase in production at 619.7 million tonnes.

- GR Infra received an order for ₹758 cr logistics park in Madhya Pradesh.

- Shree Cement was the highest bidder for Datima Coal Mine Block.

Other

- PVR-Inox is planning to add 200 screens every year.

- Hinduja Global completed the acquisition of TekLink International for $58.8 million.

- MRF raised ₹150 cr through non-convertible debentures.

- HPL Electric bagged a new order worth ₹409 cr.

🚀IPO Corner

- Divgi TorqTransfer IPO was subscribed 5.44 times. Retail investors subscribed to the issue 4.31 times.

- IRM Energy and Lohia Corp have received approval from SEBI for their IPO.

🔌Sustainability Corner

- The Olectra Greentech India’s first e-tipper receives a roadworthiness nod.

- Tata Power Renewable Energy has received an investment of ₹2,000 crores from GreenForest

- WPIL bagged a ₹1,225 cr order from Madhya Pradesh Jal Nigam

- India has approved its largest-ever hydropower project, Dibang Multipurpose Project, worth $3.9 billion in Arunachal Pradesh. It is estimated to take 9 years to build.

- SBI raised a $1 billion ESG loan.

- Bajaj Auto launches the 2023 Chetak electric scooter in India.

- IIIT-Delhi installs EV charging points on its campus.

- Three Wheels United plans to bring affordable EV financing to 27 cities by April 2023 in India.

- Ather Energy join forces with Jana Small Finance Bank to provide EV financing options

📬Also Read: Sustainable Investing in India: ESG Investments