Divgi TorqTransfer Systems Ltd IPO is live. Should you Invest?

Divgi TorqTransfer Systems Ltd IPO is live. Should you Invest? Find out here.

In this article

- IPO details

- Issue details

- Offer Breakup

- IPO Strengths

- Key Risks

- Divgi TorqTransfer Systems Financials

📃About Divgi TorqTransfer Systems IPO

Incorporated in 1964, Divgi TorqTransfer Systems Limited is engaged in the business as an automotive component entity. They are among the very few automotive component entities in India with the capability to develop and provide system-level transfer cases, torque couplers, and dual-clutch automatic transmission solutions.

Divgi TorqTransfer is one of the leading players supplying transfer case systems to automotive OEMs in India and the largest supplier of transfer case systems to passenger vehicle manufacturers in India. Not only this they are also the only player manufacturing and exporting transfer cases to global OEMs from India, and the only manufacturer of torque couplers in India.

Divgi TorqTransfer Systems Limited manufactures and supplies its products under a wide range which includes:

- Torque transfer systems (which include four-wheel-drive (“4WD”) and all-wheel-drive (“AWD”) products).

- Synchronizer systems for manual transmissions and DCT.

- Components for the above-mentioned product categories for torque transfer systems and synchronizer systems in manual transmission, DCT, and EVs.

- Alongside, they have also developed transmission systems for EVs, DCT systems, and Rear wheel drive manual transmissions.

Divgi TorqTransfer Systems Limited also takes pride in being among the few companies that serve as both systems-level solution providers and component kit suppliers to global OEMs and Tier I transmission systems suppliers.

💰Issue Details of Divgi TorqTransfer Systems IPO

- IPO open from 01 March 2023 – 03 March 2023

- Face value: ₹5 per equity share

- Price band: ₹560 to ₹590 per share

- Market lot: 25 shares

- Minimum Investment: ₹14,750

- Listing on: BSE and NSE

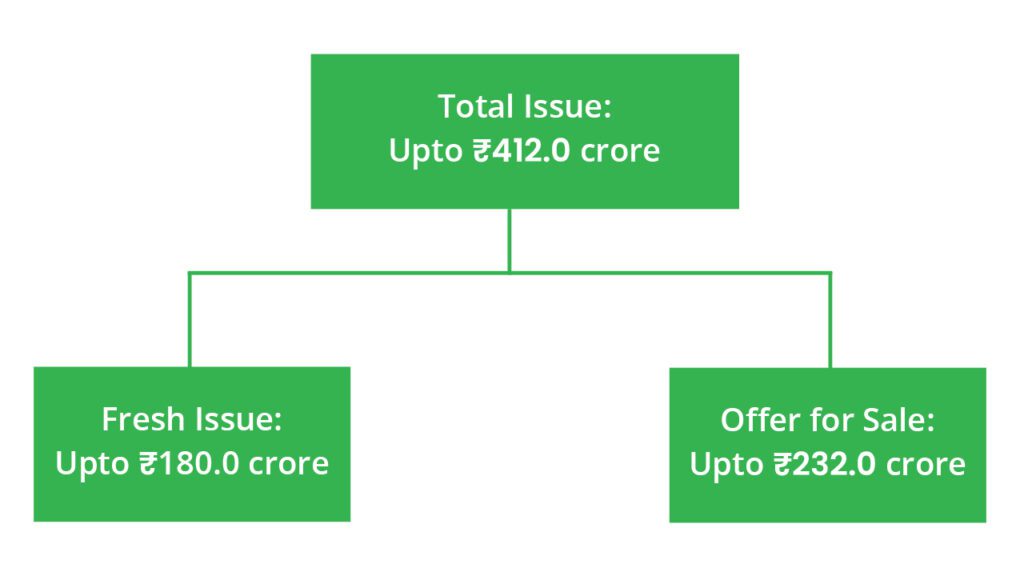

- Offer for sale: Issue size ₹412 cr. (fresh Issue ₹180 cr. + OFS ₹232 cr.)

- Registrar: Link Intime India Private Ltd

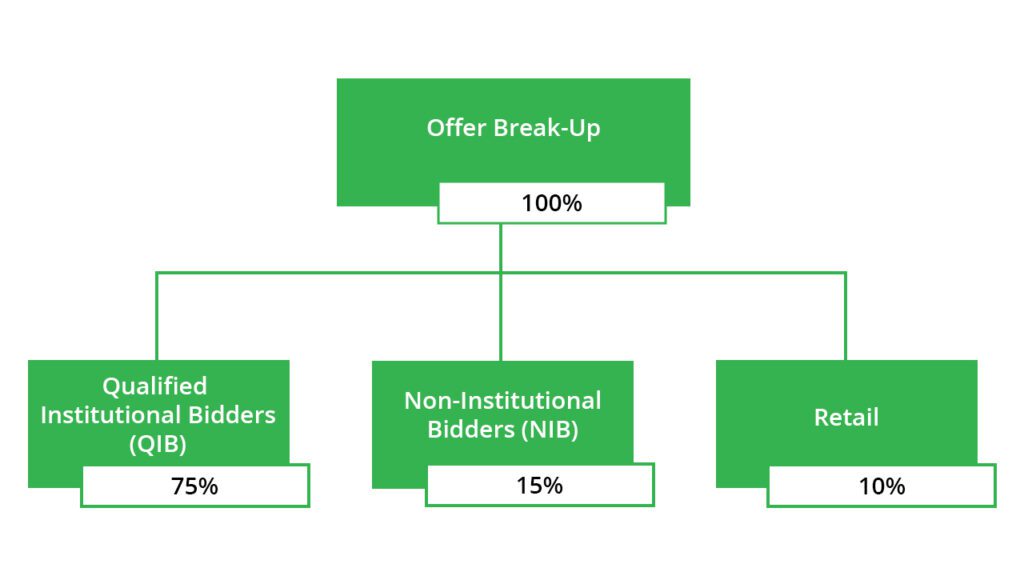

🪚Offer Breakup

🔭IPO Object

The Company proposes to utilize the net proceeds from the fresh issue towards the following objects:

- Funding capital expenditure requirements for the purchase of equipment/machinery of its manufacturing facilities.

- General corporate purposes

⛓️IPO Strength

Some of the qualitative factors and strengths which form the basis for computing the offer price are:

- It is one of the very few suppliers in India who have the capability to develop and provide a system level transfer case, torque coupler, DCT solutions and transmission systems for EVs across a wide array of automotive vehicles and geographies, with leadership across select product categories.

- Strategically located manufacturing facilities capable of producing high precision components meeting system-level design intent.

- Long-term relationships with marquee domestic and global customers

- Company has experienced board of directors and senior management team supported by skilled and qualified workforce

- Consistent financial performance with focus on innovation and R&D capabilities

🧨IPO Risk

- Business largely depends upon its top five customers, and the loss of such customers will have a adverse impact on its business

- Fluctuations in transportation and logistics costs could have a negative impact on the cash flow and revenue of the company.

- Their business is exposed to foreign currency exchange rate fluctuations, which may adversely affect its results of operations and cause its quarterly results to fluctuate significantly.

- The company depends on some third-party suppliers for certain key components and raw materials used for manufacturing its systems and components.

- Business could be adversely affected by volatility in the price or availability of raw materials and components.

⚖️Peer Companies

- Sona BLW Precision Forgings Limited

- Bosch Limited

- ZF Commercial Vehicle Control Systems India Limited

- Sundram Fasteners Limited

- Endurance Technologies Limited

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-20 | ₹303.70 | ₹170.74 | ₹28.04 |

| 31-Mar-21 | ₹362.88 | ₹195.03 | ₹38.04 |

| 31-Mar-22 | ₹405.37 | ₹241.87 | ₹46.15 |

📬Also Read: Sustainable Investing in India: ESG Investments

A tale of two circuits| Indian Stock Market Weekly Update 04 March