Ticking clock | Weekly Stock Market Update 25 Feb

Grab your morning cuppa and let’s check out what happened during the week in the weekly stock market update on 25 Feb 2023

In this article

The race against time

Inflation remains sticky, and the government and the Monetary Policy Committee (MPC) are both racing to tame inflation so that the country can focus on growth. RBI raised the policy repo rate by 25 basis points to 6.50% whereas, the government is looking at open market sales to bring down the retail prices of wheat flour. Even the Fed meeting minutes released recently didn’t show any signs towards slowing down the pace of hikes.

Time Bomb : Geopolitical turbulence

Russian President Vladimir Putin has suspended participation in the nuclear arms reduction treaty with the United States. Now this treaty was the only thing stopping the two superpowers from expanding their nuclear arsenal. This event made the famed ‘Doomsday Clock’ to clock 90 seconds to midnight. The doomsday clock analyses the global threats present at any time and warns the public about how close we are to destroying our world with midnight being the metaphorical doomsday. The clock last stood at 100 seconds to midnight with the Covid outbreak in 2020 and has now touched 90 seconds to midnight for the first time ever. It may just happen that both the countries resolve their differences to avoid a nuclear catastrophe. One thing that we do know is that there are turbulent times ahead for the markets as geopolitical uncertainities loom.

More time to trade

NSE has extended the market trade timing for interest rate derivatives to 5 pm. The change will be effective from February 23. This move comes after the RBI increased the timings of the bond market to 5 pm earier in Dec 2022.

The exchanges are also considering increased time of equity F&O segment. Currently, trading in both segments was limited from 9 – 3:30 pm, and now the exchanges are contemplating extension to 5 pm. This move may increase but may increse stress and overtrading in retail clients. Should the exchanges go ahead and increase the timing of F&O trading? What do you think? Let us know in the poll here.

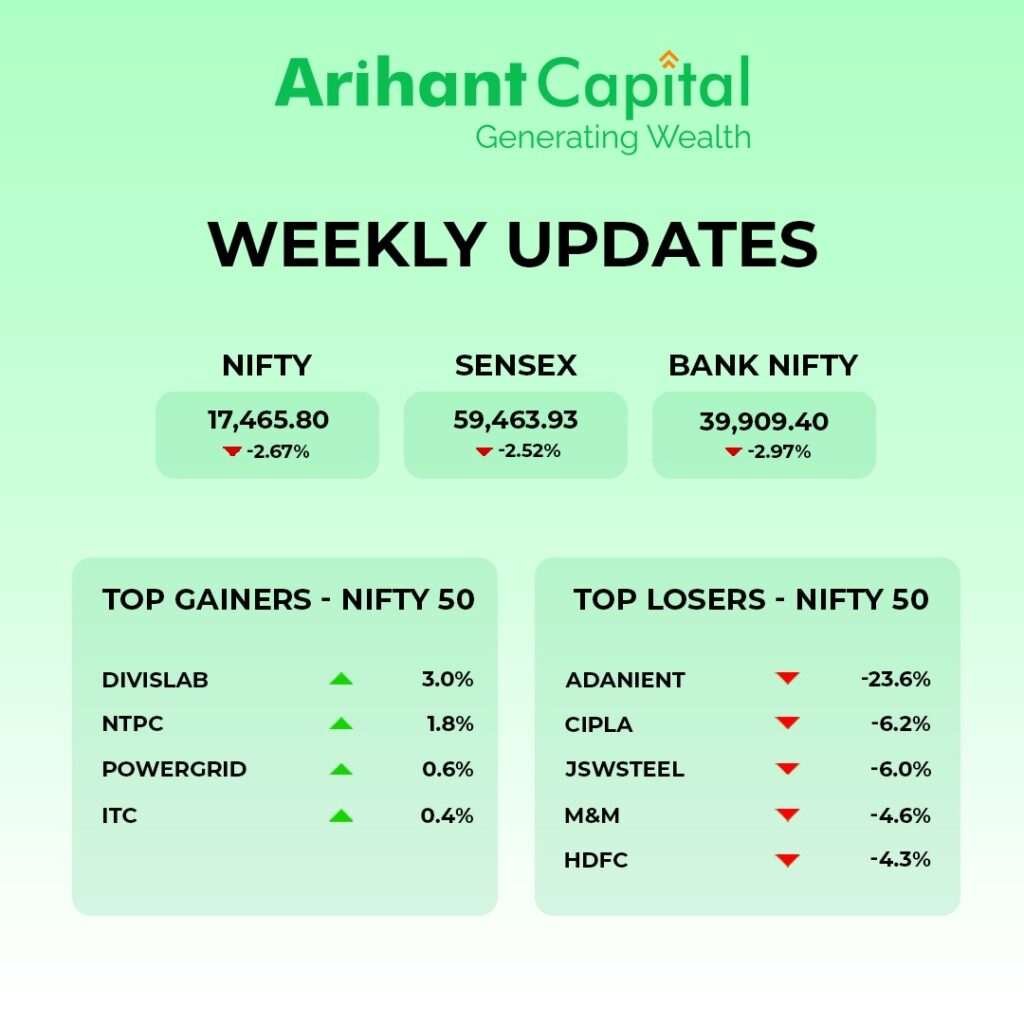

In what was probably the worst week for the markets in 2023, both the 30-share Sensex and 50-script Nifty ended the last five days in the red. Sensex closed 2.52% down at 59,464 and Nifty ended at 17,466 2.67% down from previous week.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

On the daily chart of Nifty, it is trading near the support level of the 200 SMA, and on the weekly chart, it is taking support from the lower channel. This indicates the market is still in the consolidation phase, and we can see supply from higher levels. In the coming trading session, if Nifty trades above the 17,600 level then it can touch the 17,850-18,050 levels. While, on the downside support is 17,420 if it starts to trade below then it can test the level of 17,300 and 17,100.

Bank Nifty

If we look at the daily chart of Bank Nifty, we observe that Bank Nifty is also taking support from its 200 SMA level, and on the weekly chart, we observe that Bank Nifty is trading below its short-term moving average. This indicates that Bank Nifty will underperform Nifty and we can see supply from the higher levels in the coming trading session. If it trades above 40,500, then it can touch 40,900 and 41,300 levels, However, downside support comes at 39,850, and below that we can see 39,650-39,400 levels.

Quick Bites

Global

- UN votes for Russia to leave Ukraine, India abstains from vote.

- China to overtake US as world’s largest economy.

Economy

- India’s forex reserves declined by $5.68 billion to $561.27 billion in the week that ended on Feb 17.

- India is estimated to contribute over 15% of global GDP growth this year: IMF.

- GST revenue in Jan stood at Rs 1.59 lakh cr – the 2nd highest monthly collections.

Automobile

- Maruti Suzuki: company’s Eeco car model has crossed 10 lakh sales in India.

- Samvardhana Motherson (+2.7%) has entered into an agreement to acquire 100% stake in SAS Autosystemtechnik at an enterprise value of €540 million

IT and Telecommunications

- Sonata Software’s wholly-owned subsidiary has signed an agreement to acquire Quant Systems.

- Cyient partners with UK-based technology firm Thingtrax.

- Capacite Infraprojects has secured a contract worth ₹181 crore from the government-owned Indian Oil Corporation.

- Reliance Jio’s 5G services are now available in 277 cities.

- Vedanta and Foxconn JV will set up semiconductor and display manufacturing facility in the Dholera Special Investment Region.

Banking and Finance

- Paytm launched UPI lite.

- HDFC Bank raises $750 million in dollar bond sale

- SBI raised ₹4,544 cr from bonds.

- Telecom tycoon Sunil Mittal is seeking a stake in Paytm

Energy and Infrastructure

- Adani Ports is reportedly planning to prepay ₹1,000 cr debt in March.

- Adani Power to supply electricity to Bangladesh at a reduced price.

- Adani Power has called off plans to acquire DB Power.

- DLF’s ₹7 crore luxury flats in Gurugram sold out in 3 days.

- IRB Infra emerges as the preferred bidder for a 6-lane highway in Gujarat.

- ONGC plans to invest $2 billion to drill wells in the Arabian Sea over the next three years

- RVNL bags ₹197 crore order from the power department of Madhya Pradesh

Other

- Lemon Tree signed a deal for a new hotel in Bhopal.

- Lupin launched a generic antipsychotic medicine in the US.

- Wockhardt to restructure US business result in annual savings worth $12 million

- Cipla received 8 observations from the USFDA for its Pithampur-based manufacturing facility.

- Gland Pharma will invest ₹400 cr to expand its Telangana plant.

- Indigo promoter Shobha Gangwal sold a 3.7% stake via block deals for ₹2,944 crore.

- Air India and Vistara have reportedly started their merger process.

- Zomato launched ‘Zomato Everyday’ for ordering home-style food.

- Oyo plans to double the number of premium hotels in India in 2023.

- Triveni Engineering aims to increase its ethanol output to 31 crore litres by 2025,

- KFin Tech acquired a 25.6% stake in Fintech Products and Solutions India

🚀IPO Corner

- Divgi Torqtransfer Systems IPO will open between March 1 and March 3.

- Indian jewelry company Joyalukkas has withdrawn its ₹2,300 cr IPO.

🔌Sustainability Corner

- Solar capacity installations in India increased by 27% to 13 gigawatts (GW) in 2022 from 2021: Mercom.

- Tata Motors is planning to raise up to $1 billion via a stake sale in its electric vehicle business, as per media reports.

- Hero MotoCorp: has installed over 300 charging points at 50 locations in Bengaluru, Delhi, and Jaipur.

- Sri Lanka’s Board of Investment has approved 2 wind projects by Adani Green.

- Tata Motors will supply 25,000 electric sedans to Uber.

- Olectra has launched a hydrogen bus in partnership with Reliance.

- Mahindra Last Mile Mobility Installs EV Charging Stations In Mumbai For Electric Three-Wheelers

- River, An EV Start-Up Launches Electric Scooter ‘Indie’ In India

- International Finance Corporation proposes an equity investment of $25 Million in Ather Energy

- Ola Electric to invest ₹7,614 Crore in Tamil Nadu for electric vehicle Production

- VIDA sets up public charging infrastructure in Bengaluru, Delhi, and Jaipur

- Okaya EV launches Faast F2F electric scooter in India

- VoltUp and BPCL to install 650 battery swapping stations and 7,800 charging points across 50 cities In India.