Maharajah is spreading smiles | Weekly Stock Market Update 18 Feb

Grab your morning cuppa and let’s check out what happened during the week in the weekly stock market update on 18 Feb 2023

If you were a frequent flier in India in the 90s, (and even if not) it would be hard to miss the omnipresent Maharajah – a turbaned, red-cloaked man smiling graciously. The Maharajah – symbolic of India’s first airline carrier – Air India reunited with its founding father the Tata Group in Jan 2022. In a bid to restore the Maharajah to its former glory, the Tata Group is pulling all stops in reviving the airlines. In the latest move, Air India placed a massive order of 250 planes from Airbus and 220 planes from Boeing, adding up to a staggering 470 aircraft. This is the largest order by any airline so far, surpassing a 460-plane global record (American Airlines 2011) and a 300-aeroplane Indian record (Indigo, 2019). The contract also includes an option to acquire 370 additional aeroplanes, bringing the possible total to 840!

Spreading smiles to the world

This is where it gets even more interesting, this deal has been lauded not just by PM Narendra Modi but also by the US and the UK premiers. Why? It may just be the first time an Indian company will create massive job opportunities in both these major economies. Significantly, it comes at a time when US and UK are both struggling with recessionary headwinds and massive tech layoffs. This deal may create over 1 million jobs in the US and create thousands of high-paying jobs in the UK. Truly, the Maharaja is spreading smiles globally.

More airmiles for India

Reports say that other Indian airlines, have also lined up an order book with Indigo leading the pack at 500. Akasa and Go First will both acquire 72 planes while Tata’s own Vistara is getting 17 new ones. With a total of 1,100+ new planes added to the fleet, it looks like the skies are going to be pretty busy in the coming years. So, planning a trip with your loved ones next valentines may just be easier.

Speaking of, did you check out this article where Ms Shruti Jain, CSO Arihant Capital explains the “Love economy” trending in India.

Inflation remains stubborn

Meanwhile, inflation numbers came in and showed a three-month high of 6.52% in January. With inflation remaining a major concern, do check out this article in which Mr Arpit Jain, Jt MD, Arihant Capital, explains how one can invest in the inflationary scenario. Did you know that you can hedge against inflation by investing in gold? Check out this article where Ms Shruti Jain, CSO Arihant Capital gives her outlook on investing in gold in the current scenario.

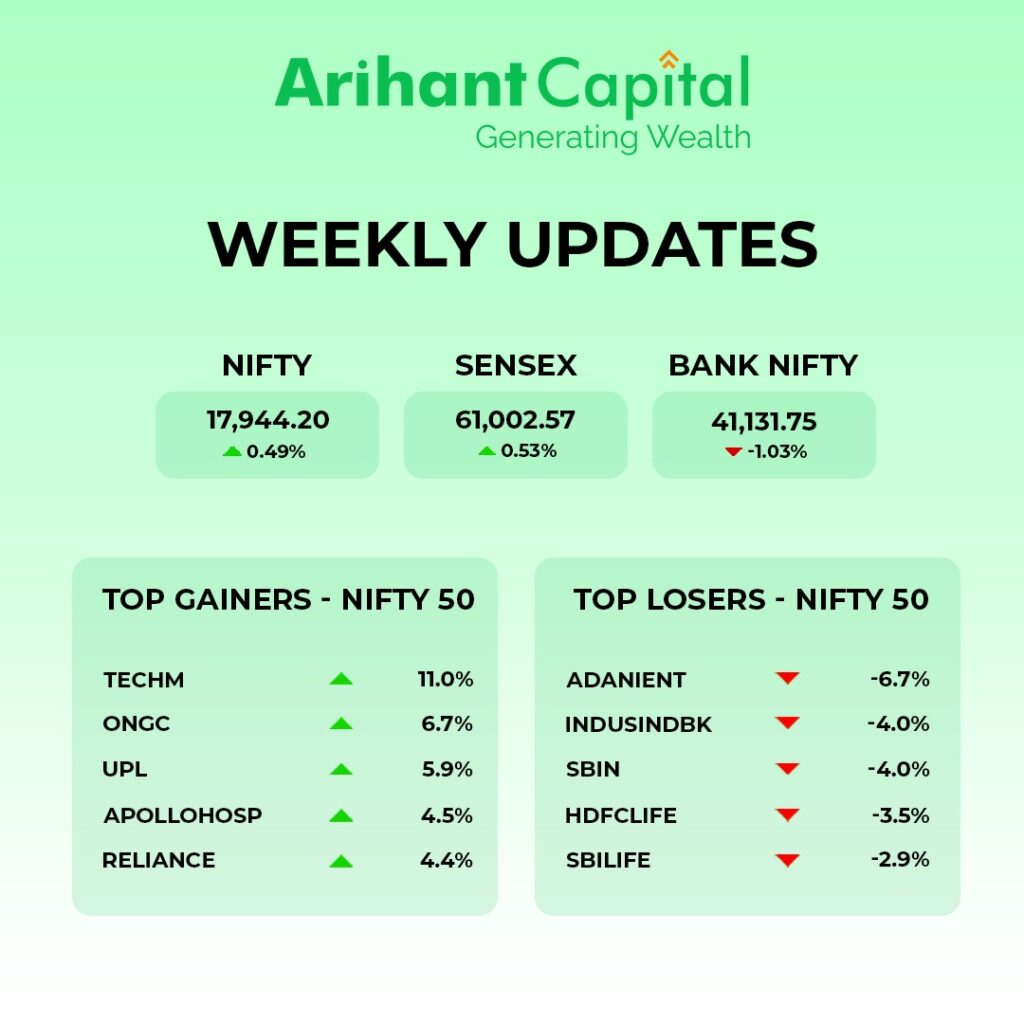

The Indian benchmark snapped a three-day winning streak to close lower on Friday, with the Nifty slipping below the 18,000 level. Sensex was flat by 0.53% and stood at 61,002 and Nifty was also flat and stood at 17,944 this week. The broader market indices declined and underperformed their larger peers. At market close, the S&P BSE MidCap fell 0.75% and the S&P BSE SmallCap declined 0.24%.

In this article

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

On the daily chart of Nifty we are observe that it is facing resistance from its 50-day SMA. On the weekly chart, we observe two consecutive narrow range body formations, indicating that the market is still in the consolidation phase and we can see supply from the higher levels. In the coming trading session, if Nifty touches the 18,050 level, it may trade above to touch the 18,200-18,350 levels. While, on the downside, the support is 17,800. Below this, it can test17,650 and 17,400 levels.

Bank Nifty

Bank Nifty is also facing resistance from its 50-day SMA level and we also observe a Narrow range body formation. It indicates that the market is still in the consolidation phase and we can see supply from the higher levels in the coming trading session. If it trades above 41,350 then it can touch 41,500 and 41,750 levels. However, the downside support comes at 40,900 below that we can see 40,650-40,500 levels.

Quick Bites

Global

- Retail inflation in the UK stood at 10.1% in Jan vs 10.5% in Dec.

Economy

- India’s foreign exchange reserves declined by $8.31 billion to $566.94 billion in the week that ended on Feb 10 – the biggest decline in over 11 months.

- The government reduced windfall tax on crude petroleum and cuts special additional excise duty on ATF.

- India’s wholesale inflation (WPI) stood at 4.73% in Jan vs 4.95% in Dec.

IT and Telecommunications

- Jio gained 17 lakh subscribers in Dec. Airtel added 15 lakh users, and Vi lost around 25 lakh subscribers.

Banking and Finance

- HDFC Bank customers can now link HDFC Rupay credit cards to UPI.

- CAMSPay has received in-principal approval from the RBI to operate as a payment aggregator.

- Indian Overseas Bank launched electronic bank guarantee scheme.

- Paytm Payments Bank: launched UPI LITE feature.

Energy and Infrastructure

- Bharat Electronics will form Joint Venture (JV) with Israel Aerospace Industries.

- DLF will launch a project for 1,100 luxury condos in Gurgaon.

- PTC Industries’ subsidiary received an order from Safran Aircraft Engines (SAE) to develop and supply titanium cast components for aircraft engines.

- HAL will supply spares and provide engine repair services to Argentinian Air Force’s two-tonne class helicopters.

Other

- Ambuja Cements has been declared as the ‘preferred bidder’ for the Uskalvagu limestone block in Odisha.

- Uno Minda will invest ₹175 cr to increase production at its Rajasthan plant.

🔌Sustainability Corner

- Indian Railways is planning to launch India’s first hydrogen-powered train by Dec 2023.

- India’s first solid waste-to-hydrogen plant will reportedly be set up in Pune at a cost of over Rs 430 cr.

- Ather Energy installed 1,000 fast-charging EV stations in 80 cities across India currently offered free of charge until March 2023. This is part of its aggressive expansion plan to set up over 2,500 Ather Grids by end-2023.

- TVS Motor Co is targeting sale of 100,000 e-scooters in FY2023.

- Tamil Nadu’s new EV Policy targets ₹50,000 crore investment in manufacturing & creation of a robust EV ecosystem.

- Automotive Research Association of India certifies Cummins Group in India for Bharat Stage-VI OBD II emission compliance.

- Karnataka government earmarks ₹500 crore to procure 1,200 electric buses for state transport undertakings to accelerate the transition to electrification.

- Greaves Electric Mobility launches new Ampere Primus e-scooter, and an updated Zeal EX.

- Minda Corporation acquires 15.70% of Pricol Ltd (Pricol) in an open-market transaction for ₹400 crore, raises questions about a hostile takeover.

- Sona Comstar chairman Sunjay Kapur invests in EV charging startup Sunfuel Electric, which creates battery charging infrastructure for luxury EVs in India.

- Bengaluru-based FreshBus secures ₹26 crore seed funding for proposed intra-city EV bus market foray; company plans to introduce 24 e-buses from April 2023 with a range of 375km on a single charge.

- Fyn Mobility rolls out 15-minute full charge EV fleet. Exponent Energy has installed 20 e^pumps in Bengaluru and plans 80 more.

- Mahindra Last Mile Mobility (LMM) and SLA Mobility sign distribution agreement of electric 3-wheelers in Sri Lanka to export Treo range and Zor Grand EVs to Sri Lanka.

- Piaggio to sell Apé Electrik 3-wheelers, equipped with Sun Mobility’s battery-swapping tech, in the Philippines.

- Ola Electric plans aggressive network expansion to 500 showrooms across India by March 2023.