See-Saw in the Markets | Weekly Stock Market Update 12 Feb

Grab your morning cuppa and let’s check out what happened during the week in the weekly stock market update on 12 Feb 2023

Have you ever had a test where getting one question wrong could wipe out the marks for all the other questions? No, right? Unfortunately, Google’s newly introduced chatbot, BART (rival to the famed chatGPT) got this unique problem. Right after its launch, BART got bad publicity for getting a question wrong in the tech demo. A mistake which cost the company billions of dollars in market cap.

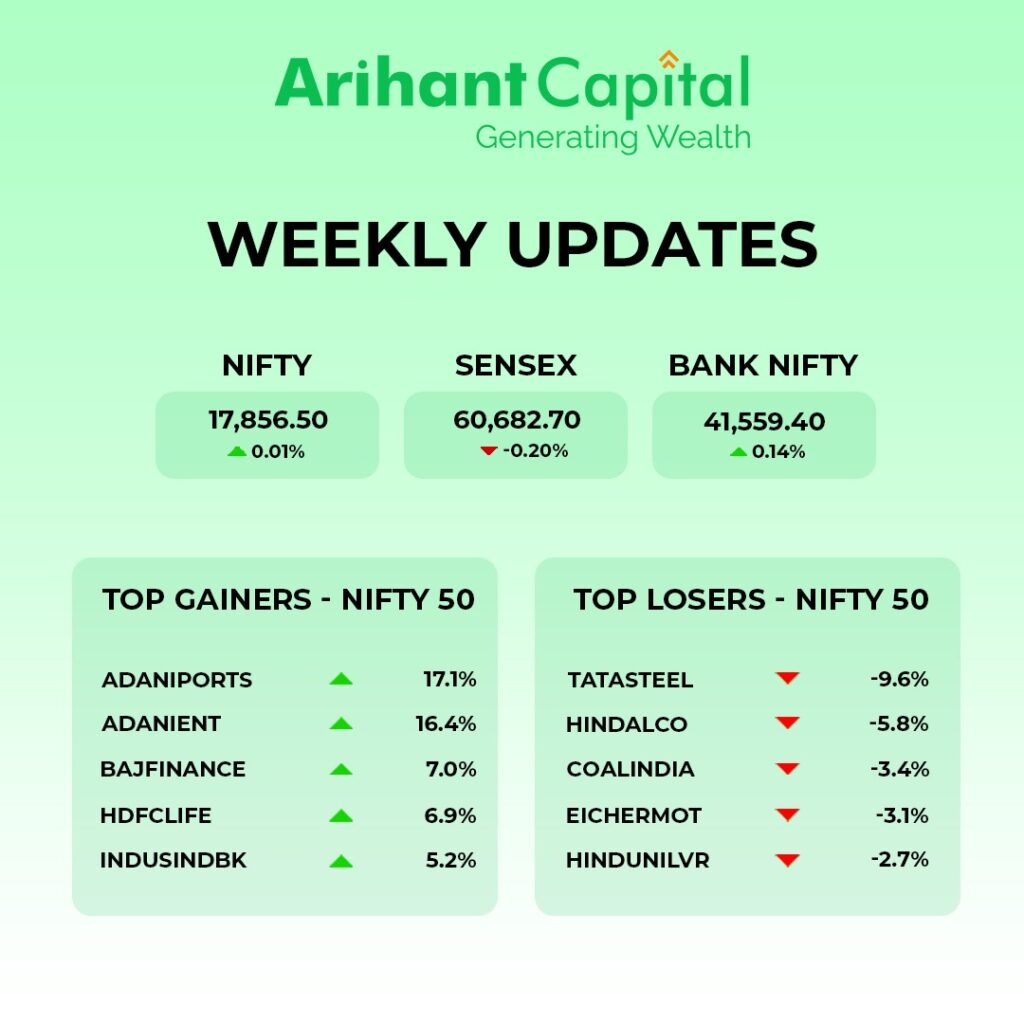

Just like its rise and fall, the markets specially Adani stocks were in see-saw mode. Adani stocks saw some movements due to some major news. Adani Enterprises and Adani Ports, rebounded off their recent lows to gain 18-20% during the week. In view of the heavy volatility observed during the week, the markets ended the week, with Nifty up 0.01% and Sensex down 0.20%.

RBI announced a 25 bps hike in repo rate this week. This is the sixth consecutive rate hike by the central bank. Even though inflation moderated to 5.72%, the core inflation has not yet been controlled. To tame this, RBI announced this rate hike, albeit lesser than previous hikes. The markets celebrated the slow pace of the increase and the expectation to bring down retail inflation to 5.3% in the next financial year. The RBI also estimates that India’s economy will grow at 6.4% in FY24 supported by factors like increasing rural and urban consumption, strong demand for loans and government spending more on capital expansion.

In this article

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

On the daily chart of Nifty, we observe that Nifty is trading in a channel and facing resistance from the higher level of 50 SMA, and on the weekly chart, we are observing a Doji candlestick formation. We may see some limited upside movement in the market. Nifty can face resistance around the 18,080 level if it starts to trade above this, then it can touch 18,250-18,400 levels. On the downside, support is 17,800 if it starts to trade below, then it can test 17,600 and 17,450 levels.

Bank Nifty

On both the daily and the weekly chart of Bank Nifty, we are observing a series of narrow-range body formations. On analysing both charts, it seems that we can see some consolidation from the higher level. In the coming trading sessions, if its trades above 42,620 then it can touch 42,850 and 43,100 levels. However, the downside support comes at 42,300 below that we can see 41,800-41,500 levels.

💰Stock Picks

From the Technical Desk

-Ms. Kavita Jain, Sr Research Analyst and Learning Head, Arihant Capital

Quick Bites

Global

- Credit Suisse posted its biggest annual loss since the 2008 financial crisis – $7.9 billion.

Economy

- India’s factory output (IIP) grew 4.3% year-on-year in Dec vs 7.1% in Nov.

- The government has set a target of Rs 6,700 cr from asset monetization in the port and shipping sector for the financial year 2024.

- India’s steel exports fell 52.2% to 53.3 lakh tonnes between April and Jan.

IT and Telecommunications

- Airtel has partnered with Vultr to offer cloud solutions to companies in India.

- The government has asked Vi to convert its debt to equity. Govt will own ~33% stake in Vi.

- TCS got a £600 million order from UK-based Phoenix Group.

- Reliance: Jio 5G will be launched in UP by Dec 2023.

- Disney+Hotstar posted a 6% drop in its paid user base in the Oct-Dec period – its biggest decline so far. Its paid subscriber base now stands at 5.75 cr.

Banking and Finance

- Kotak Bank may be considering a majority stake in IDBI Bank

- China’s Alibaba Group sold its entire remaining 3.4% stake in Paytm.

Energy

- Reliance Jio-bp announced the initial launch of E20 petrol – 20% ethanol and 80% petrol.

- GAIL to sign a gas deal with Russia.

- India’s non-fossil fuel-based power generation capacity stood at 174.53 gigawatts (GW) at the end of Dec 31. Solar power accounted for 63.30 GW, large hydro contributed 46.85 GW and 41.93 GW was contributed by wind power. 10.73 GW,4.94 GW and 6.78 GW came from biopower, small hydropower and nuclear power respectively.

- Indian Energy Exchange clocked a total trade volume of 8,639 million units in Jan 2023 vs 8,652 million units in Jan 2022.

Other

- Engineering firm Greaves Cotton (-0.5%) will acquire a 100% stake in motion control systems company Excel Controlinkage for ₹385 crores.

- Tata Motors hiked the price of Tata Tiago by up to ₹20,000.

- Symphony: announced ₹200 cr buyback.

- PVR and Inox have fixed Feb 17 as the record date for their merger. Investors will get 3 shares of PVR for 10 shares of Inox.

- Motilal Oswal’s subsidiary will invest ₹400 cr in Pan Healthcare for a minority stake.

🚀Key Results

- Hindalco reported a sharp 63% YoY drop in consolidated net profit to ₹1,362 crore during the December quarter.

- M&M’s net profit rose 14% YoY to ₹1,528 crore; its revenue also rose 41% YoY to ₹21,654 crore.

- Adani Total Gas posted a 17% YoY rise in net profit to ₹150 crores during Q3 FY23

🔌Sustainability Corner

- Good news for battery makers: Lithium reserves have been found in J&K.

- Ola is planning to launch an electric car in 2024.

- Techno Electric & Engineering has sold off 37.5 MW of its wind power assets in Tamil Nadu for ₹158 crore and may sell another 71.40 MW.

- Indian Oil will recycle 10 cr plastic bottles each year to make uniforms for its staff.

- Reliance, Ashok Leyland launched India’s first Hydrogen Internal Combustion Engine (H2-ICE) powered heavy-duty truck.