A Layman’s Guide to the Union Budget

What really is a Union Budget? How is it prepared? What is its scope? Here are some basics to provide a perspective. This article was originally authored by Shruti Jain, CSO of Arihant Capital on First Post and is being republished with permission.

Sure, you have heard the hype around the Union Budget 2023 which will be presented by the Finance Minister, Mrs Nirmala Seetharaman on Feb 1, 2023. But what is the Union Budget really?

Just like we plan the budget for our homes and businesses- the government also plans how it will manage its money for an entire year this is called the Union Budget. It will outline where the government will spend its money (expenditures) and where the money will come from (revenue) for the fiscal year starting from 1st Apr 2023.

By showing the planned expenditure, the budget shows the priorities of the government and outlines the policies which the government will keep in place for the next fiscal year. Not only is the budget day important for setting up the macro-economic theme for the next year, but it is also important for every individual to understand what the budget is and how it impacts them.

With the Union Budget right around the corner, you can read what Mrs Anita Gandhi, Head Institutional Business, Arihant Capital believes are the FM’s priorities of 2023 Union Budget .

Understanding the Budget

Just like in our homes and business, the budget is an estimate of the expenses and the revenue.

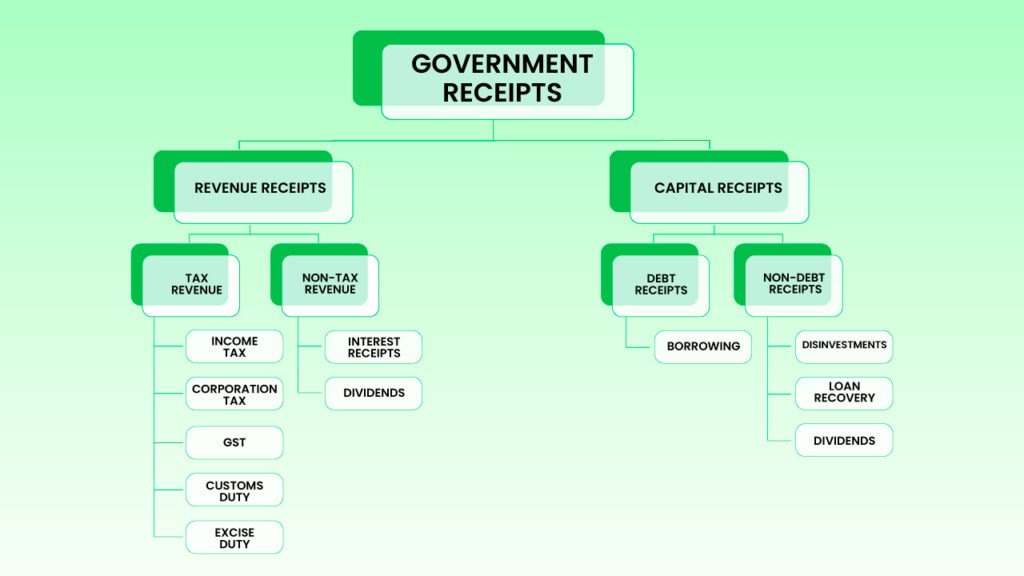

The revenue or Government Receipts come primarily from tax revenues, including income tax, corporate tax, goods and services tax (GST) and dividends & profits. It is broadly divided into two categories – “revenue receipts” and “capital receipts”.

- Capital receipts include loans from the public or from the Reserve Bank of India (RBI). Whenever the government disinvestment route to sell its shares in PSUs to private entities, this also is counted as a capital receipt.

- Revenue receipts include tax revenue which includes income tax, corporate tax, and goods and services tax (GST). Apart from this it also includes the dividends & profits it earns from the entities it runs (PSUs) and RBI. It also collects interest in the return for loans provided to states and union territories.

The Indian union budget has two categories of spending – charged and voted. A major part of government spending is fixed, known as “charged” expenditure. The actual planning goes into the “voted” expenditure, where the government decides how much and where it wants to spend.

CHARGED EXPENDITURE (mandatory)

It is the part of the expenditure that mandatorily needs to be paid by the government as it is considered the liability of the government. It includes all the charges, spending, or expenditures that are set without any voting like salaries of various government bodies like judges of Supreme and High courts and chairman & members of the Union Public Service Commission, and interest on the money borrowed by the government of India.

VOTED EXPENDITURE (discretionary):

The part of expenditure where the government determines how much it wants to spend for each fiscal year. It includes expenditure on areas like education, health, sanitation, infrastructure, etc. All the “voted expenditures” in India need to be approved by the Lok Sabha by way of voting.

The budget also outlines the details of the actual receipts and expenditures of the closing financial year and the reasons for any deficit or surplus in that year. It lays down the economic and financial policy of the next year. This includes taxation proposals, revenue prospects and how will it be spent and the introduction of new schemes and projects.

Largest line items of the Union Budget

Talking of expenses, a major share, nearly 50%, of the GOI’s expenses goes towards interest, defense, subsidies, health and education. Among these, interest payment accounts for nearly one-fourth of the government’s expenditure.

You must be wondering, what is this interest cost?

Ideally, none of us wants to spend beyond our means. This means we try to keep our expenses limited to, or under, our income. But if we have some important expenses lined up, we breach this limit and resort to external borrowing. That’s the same case with the government. They are spending substantially more than what they are earning. So, they have to take out loans and pay interest on these loans, which account for a huge part of their yearly expenses.

The difference between the total revenue and total expenditure of the government is called fiscal deficit.

Among the discretionary spending, the government spends a big chunk on reducing poverty by reducing income disparities and focusing on priority areas. Let’s understand ‘focus on priority areas with an example. If the government wants to incentivize manufacturing in the electric vehicle (EV) sector, it will subsidize EV manufacturing units by reducing their import duties or reducing their tax burden.

Suppose the budget wanted to incentivise women-owned businesses, they can incentivise them by providing SOPs.

On the revenue side, debt receipts, GST, corporation tax and income tax accounts are the biggest sources of income, coming to ~86% share of total revenues.

The Planning of the Union Budget

Since this budget affects billions of Indians and decides the health of the Indian economy, the entire process is fairly lengthy. It takes about six months of planning and involves the ministry of finance, NITI Aayog, and different spending ministries.

As the first step, the government asks all the ministries, states, union territories, and autonomous bodies to provide details of both revenue and expenses:

- how much do they expect to spend next year

- their actual expenditure in the previous year, and

- revised figures according to the actual rate of spending in the ongoing period.

The finance ministry holds pre-Budget meetings with key stakeholders like economists, state representatives, bankers, trade unions, and agriculturists, to understand their views on how best to allocate resources to their specific sectors.

The revenue secretary and the Department of Expenditures then analyse this data. This involves a lot of discussions with relevant parties and number crunching. The budget department consolidates these figures and prepares the final “budget” document.

Finally, the Finance Minister presents the Union Budget in the Lok Sabha on February 1 each year. But, this is just the start – not everything that’s proposed in the budget is accepted.

How the Union Budget affects you?

Individuals are most directly affected by the declaration of income tax slabs for the year. This affects almost all salaried and non-salaried professionals. The next major announcement includes a change in capital gains tax. Capital gains tax is applicable to both long-term and short-term sales of assets such as properties, shares, etc.

The discretionary spending in the budget allows the government to incentivize certain sectors where it needs progress by providing subsidies or by reducing taxation. It also allows the government to change the taxes on corporates and import duties. These changes impact an individual directly by affecting the prices of goods and services we buy. It also impacts companies by affecting their profitability.

You can catch up on what are India Inc’s expectations from the Union Budget 2023.

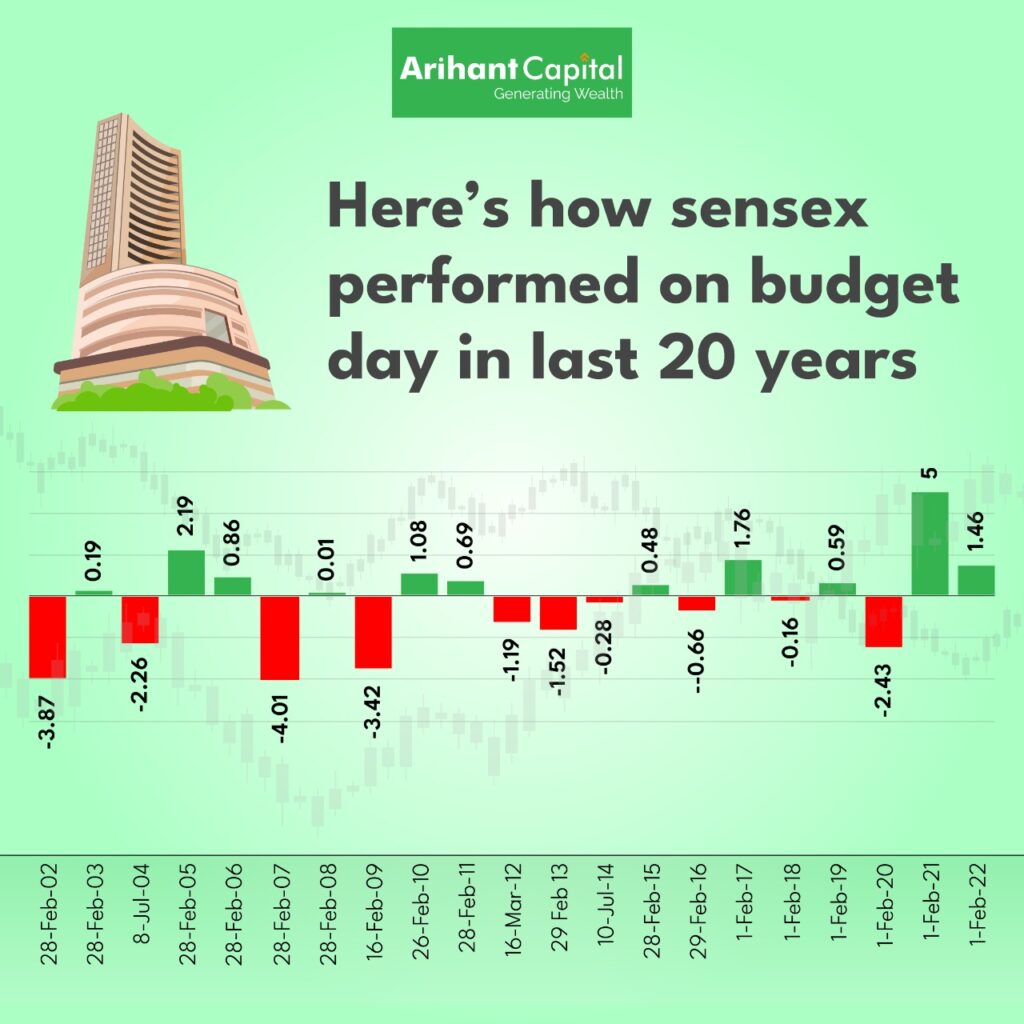

If you regularly follow the stock markets you will note that budget day and the days leading up to the budget are usually very volatile in the stock markets. So as an investor, the budgets impact your portfolio’s performance during this period.

This infographic will show the fluctuations in the market on the budget day.

If you need any guidance for your trades you can follow Arihant Capital’s analysts live on CNBC Awaaz Tech Panchayat and follow award-winning analysts on Twitter for the latest updates.

From 2021, the budget has been presented in paperless form. Everyone can access the presented budget on the “Union Budget” Mobile App. The app was launched by FM Nirmala Sitharaman on 23 January 2021.

Shruti Jain is Chief Strategy Officer (CSO) at Arihant Capital Markets Limited. She is passionate about investor education and sustainability.