Unravelling Budget 2023

The much-awaited event for the economy – the Union Budget announcement started on 1st Feb 2023 at 11:00 am. Finance Minister Nirmala Sitharaman stated that this is the first budget in Amritkaal and has 7 major priority areas called the Saptarishi. While the honourable FM’s speech lasted for more than one hour, we will try our best to summarise the budget in just a few minutes.

The Health of the Indian Economy

India has been doing extremely well despite the impact of Covid-19 and the Russia-Ukraine war. India is now the 5th largest economy in the world and has assumed the G-20 presidency. Its expected economic growth rate of 7% is the highest among all the major economies.

The cherry on top is that the average amount of money an individual earns has more than doubled to ₹1.97 lacks in around nine years.

As we explained in our pre-budget feature, “Layman’s guide to Budget”, fiscal deficit is the amount by which the goverment spends more than it earns or the amount that it needs to borrow. In FY23, the government is targeting to close the fiscal deficit at 6.4% of the GDP, and reduce this further to 5.9% by FY24. We truly hope that the FM is able to meet her ambition of bringing the fiscal deficit below 4.5% of GDP by 2025-26 as it will surely speak volumes to the economic development of the country

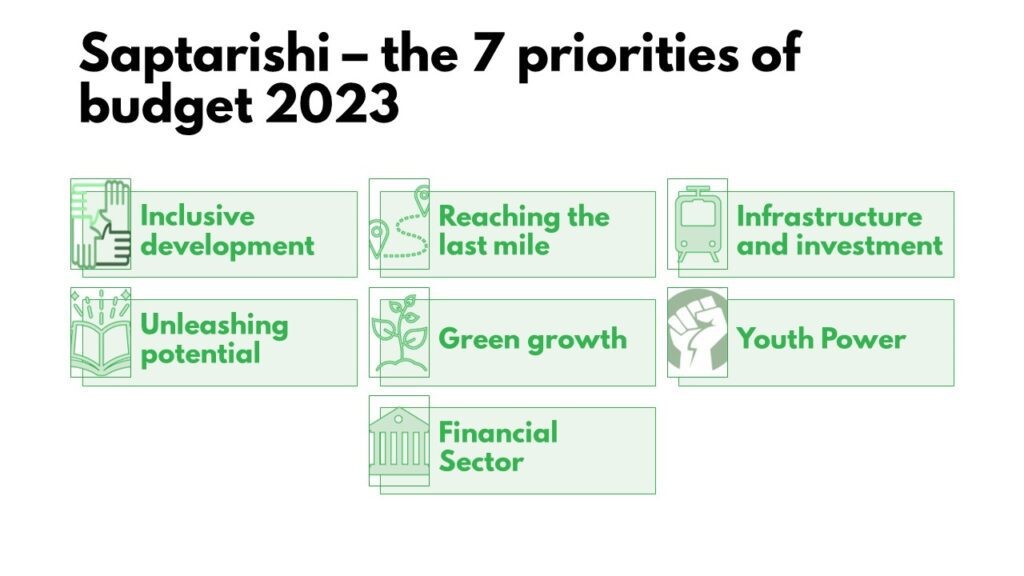

Saptarishi- the 7 Priorities of the Budget 2023

This is the 75th year of Indian independence, so the budget introduced the theme of Amritkaal – a period leading up to India@100.

“We envision a prosperous and inclusive India, in which the fruits of development reach all regions and citizens, especially our youth, women, farmers, OBCs, Scheduled Castes and Scheduled Tribes.”

Finance Minister Mrs Nirmala Sitharaman

What is great about this framework is that with one glance, you can see that the government has not taken a myopic view in the face of the elections next year. But has instead made long-term sustainable growth their true objective to build India@100. Focusing on inclusive development and ensuring that the benefits of the policies reach the last mile has always been one of the key priorities of our democracy. Investment in infrastructure and education is always helpful in the long-run growth of the economy. And truthfully, building a green economy is the need of the hour to reduce our carbon footprint and build a world we can thrive.

Infrastructure Development

The government will be spending a whopping ₹10 lakh crores on infrastructure development. This is the highest-ever capital outlay by the government and a 33% increase over the last year. While this means better connectivity for us, it also means more jobs and more disposable income. In fact, infrastructure development projects have a large multiplier impact on the growth of the economy. So even though, the capital expenditure looks huge, it is expected to have a big long-term impact on the economy.

Apart from the central government’s outlay, the government plans to support state infra projects by continuing to give them 50-year interest-free loans. These outlays will go into sanitation, building sustainable cities of tomorrow, development of airports, helipads etc.

Railways have also been given a massive ₹2.4 crores outlay, which will be used for electrification, the building of railway tracks and increasing the number of Vande Bharath trains.

Education and Skill Development

Utilizing youth power is critical in ensuring the current growth trajectory of the India story. For this, the government has proposed to:

- Establish centres of excellence for artificial intelligence and 5G-powered labs for developing the next generation of apps.

- Increase the number of nursing colleges to meet the dearth of good medical professionals

- Establish National Digital Library for children and adolescents to compensate for the learning gaps created due to the pandemic or accessibility of a good learning ecosystem.

- Use Pradhan Mantri Kaushal Vikas Yojana 4.0 and National Apprenticeship Promotion Scheme which to upskill youth with industry exposure and training in relevant courses. Skill India International Centres will be set up across different states to skill the youth for international opportunities.

Green Energy and Sustainability

The government is planning on tackling the environmental challenges head-on. It has introduced several programmes for green fuel, green energy, green farming, green mobility, green buildings, and green equipment, and policies for the efficient use of energy. They are targeting to meet the goal of ‘Net Zero Carbon Emission’ by 2070 to create a green industrial and economic transition. Some key initiatives under this banner:

- National Green Hydrogen Mission will reduce dependence on fossil fuel imports, & reach a target annual production of 5 MMT by 2030.

- Battery Energy Storage Systems with a capacity of 4,000 MWH will be supported along with the development of an inter-state transmission system for renewable energy from Ladakh.

- The government will also introduce a Green Credit Program which we (both individuals and companies) can use to reduce our carbon footprint.

- In a push for green mobility, the government will help electrify the railways fleet, scrap many of its polluting vehicles and incentivise capital goods and machinery required for the manufacture of batteries of EVs.

New Tax Regime Made Simpler

There is no change to the old tax regime and the exemptions under 80C, HRA loans etc are all still applicable as per last fiscal year.

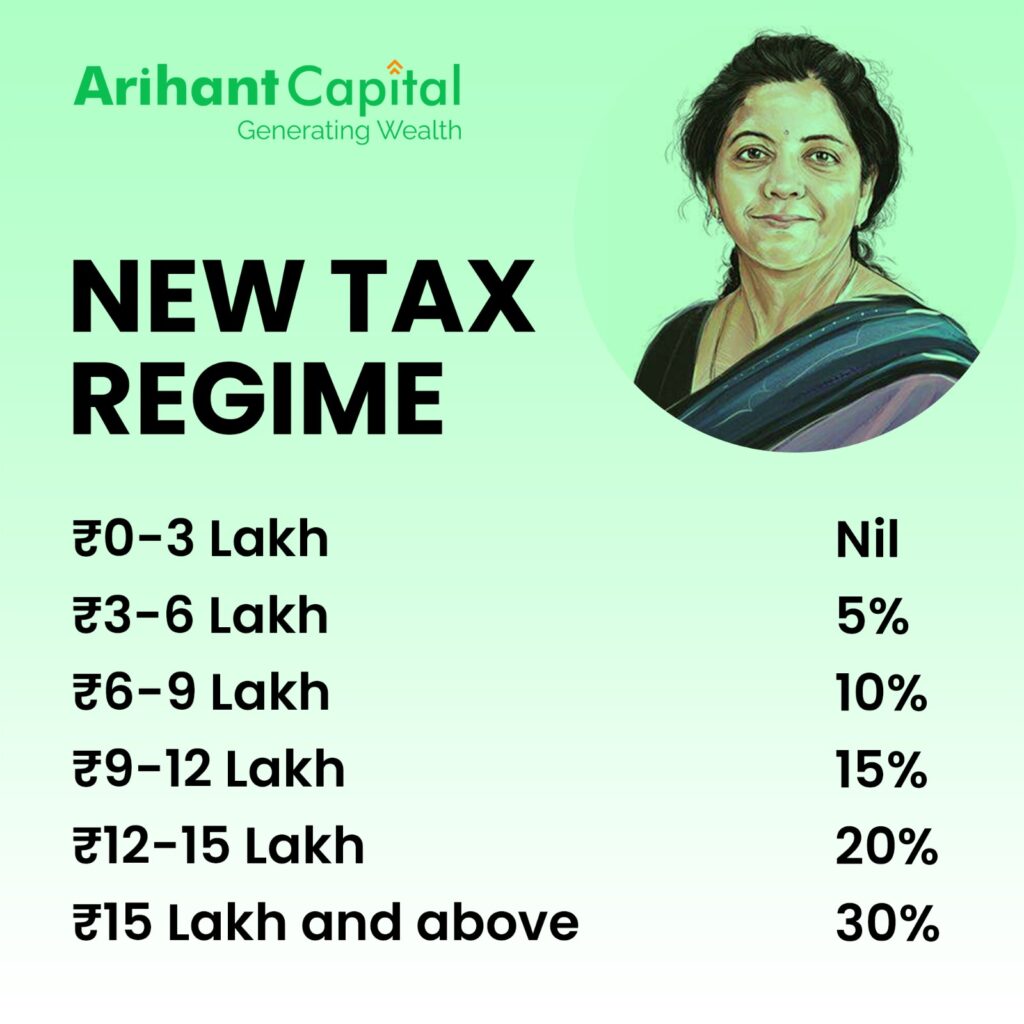

However, the new tax regime has been rejigged to make the process even more hassle-free. Another good news is that it does not charge any tax till ₹7 lakh income. The FM has also reduced the tax slabs from 6 slabs to 5 slabs as shown below:

However, this new tax regime is available by default and it does not include any exemptions. You can choose to opt for the old tax regime if that seems more profitable to you with your current financial situation and exemptions. To make the tax-filing process even easier, the ITR processing time has also been reduced from 93 days to 60 days. Having trouble understanding which regime is better for you or what are the other changes for taxation and savings for retail investors, check out this blog.

Ease of Doing Business

The government has reduced nearly 39,000 compliances and 3,400 legal provisions to make running a business easier. This comes at a time when an allegation of corporate fraud by Adani, has led to a massive rout in the stock markets. So, let’s hope this “ease” does not come hand in hand with lenient corporate governance.

The government agencies will use a unified filing process to reduce repeat submissions of sane information. PAN will now be universally accepted as a common business identifier. More and more documents will be brought under Digilocker and enhance the digital public infrastructure consisting of Aadhaar, PM Jan Dhan Yojana, Video KYC, India Stack and UPI. The government will give more SOPs to MSMEs by providing expanded credit access. It will also give relief for MSMEs that failed to execute contracts during COVID by forfeiting 95% of bids/performance securities.

Inclusivity

The gender budget has always been an important point in giving a level playing field for women, but this year the government has increased the scope of inclusivity to include far-off regions like northeast and Ladakh. Yet again, there are several provisions for farming including improved credit access, plant quality and setting up of an agriculture accelerator fund. There will also be targeted funding of ₹20 lakh cr toward Animal Husbandry, Dairy, and Fisheries.

The government has also passed several initiatives under education and skill development of the youth to increase the reach of quality education to villages and tribals as well.

What Gets Cheaper and What Gets More Expensive?

We knew diamonds are forever, but now they may also get cheaper! The government has pushed to reduce the custom duty on seeds for lab-grown diamonds. To help the battery makers reduce their costs, specified goods/machinery for the manufacture of Li-ion batteries of electrically operated vehicles (EVs) have been made exempt from customs duty. Here’s a summary you can check out:

Overall it is a good budget and has focused on key sectors important for the long-term, sustainable development of the economy.