Personal Finance in Budget 2023. Is the new Tax Regime good for you?

The modified new tax regime will be effective from Apr 1. Find taxation confusing? Don’t worry, we will decode it for you in this blog. Read it before you decide which tax regime is good for you.

The most awaited part of the Finance Minister’s budget speech is the Personal Income tax segment, as it affects everyone directly. So it came as no surprise that When Mrs Nirmala Sitharaman announced that “There will be no tax for an income under 7 lakhs”, she was met with a deafening applause. She then clarified that this was only in the new tax regime. What is this new tax regime? What all changes were introduced in personal income tax in Union Budget 2023? Lets find out.

Let us start with the basics- Finance Minister Mrs Nirmala Sitharaman announced changes in the new tax regime on Feb 1. This new tax regime along with all other changes in personal taxation will be effective from the next financial year – 1st April 2023. Let us first deal with the elephant in the room: what really is the new tax regime.

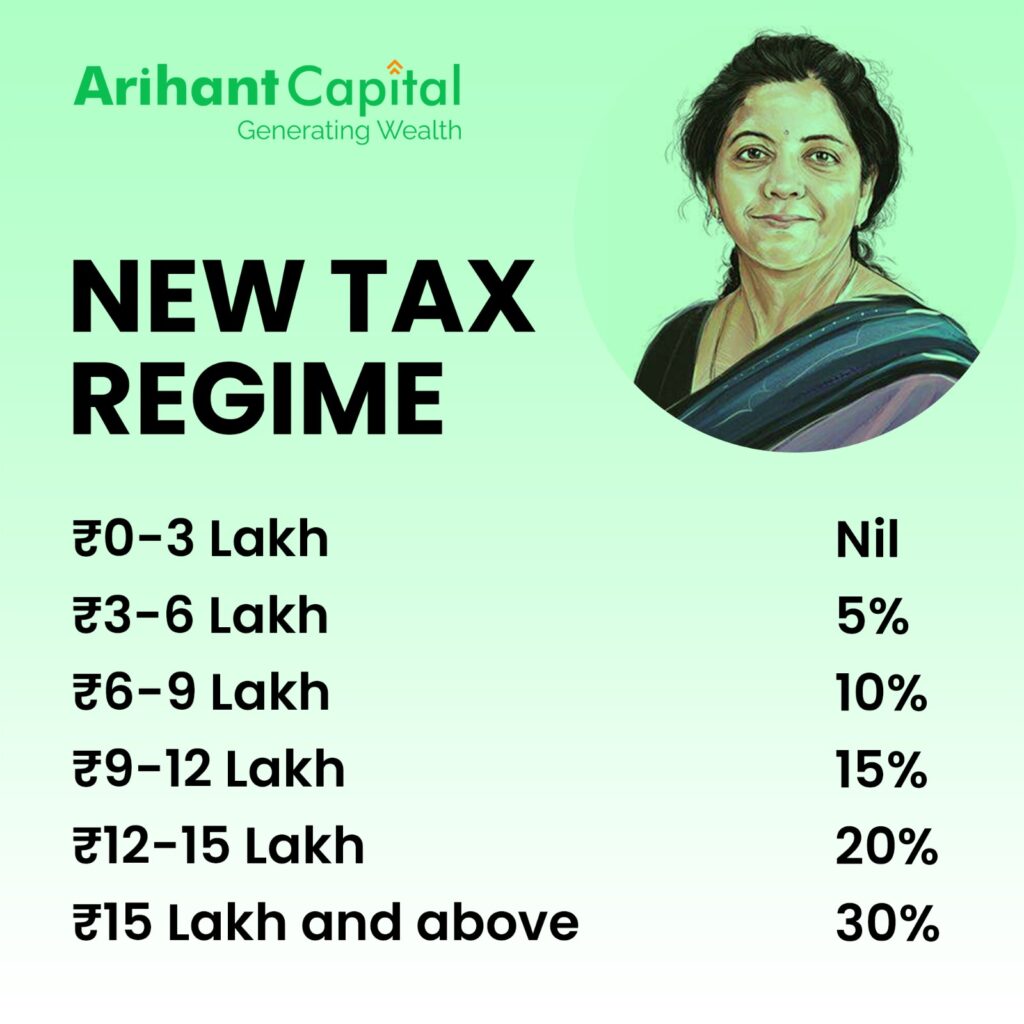

New Tax Regime

We are all too familiar with the old tax regime- the one which gave us tax exemptions for making good long term decisions with our money. It encouraged investments under section 80C (investments), 80D (health insurance), 80G (donations) and so forth. But so many different rules, exemptions and submission of proofs made income tax filing pretty cumbersome.

To encourage more taxpayers to file their income tax returns and to make this process hassle-free, the FM had announced a new tax regime way back in 2020-21. This new tax regime said goodbye to all the familiar deductions and simplified tax brackets. At that time, it was introduced as an optional tax regime and one could opt for it to make their tax-filing simple.

This year, FM has announced changes to the new tax regime and made it a little more lucrative (I repeat: “No tax under 7 lakhs”). It has now been made the default tax regime while we can still opt for the old regime if we think it is more lucrative. The purpose is simple: to reduce the taxation on the middle class and make the tax-filling process easier so that more and more people are encouraged to take the new route.

Here are the key features of the new tax regime

- The minimum income for paying tax has been increased from ₹5 lakhs to ₹7 lakhs, which means that if your annual income is below ₹7 lakhs, you don’t need to pay any tax.

- The rebate under section 87A has been increased to ₹25,000.

- Standard deduction(₹50,000) and deduction for family pension(₹15,000) has now been introduced of to the new tax regime.

- Its not all good news for middle class. The higher income brackets have also been benefitted. For income above ₹5 crores, the surcharge rate has reduced from 37% to 25% in the new tax regime. Thus all individuals with an income of more than ₹2 crores will be paying a 25% surcharge.

- The limit on tax exemption for leave encashment is increased from ₹3,00,000 to ₹25,00,000.

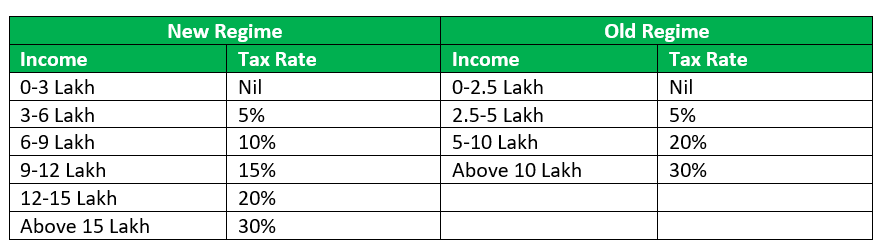

- The new brackets for taxation are given below:

The new debate: Old regime vs New tax regime

With the new tax regime becoming more lucrative, the debate has started again: which tax regime should you opt for? Let us compare the two options which will be available to you in the next financial year.

To decide which regime is better for you, you will need to see the amount of deductions you can take advantage of.

Let us take a few examples:

- If your gross income is ₹7.5 lakh and you do not avail of any deductions:

- In the old regime, you will get a benefit of ₹50,000 standard deduction and will be paying ₹52,500 as tax.

- In the new regime, a standard deduction of ₹50,000 will bring your taxable salary to ₹7 lakhs. and remember “No tax under 7 lakhs” so your tax liability is zero.

- If your gross income is ₹7.5 lakh and you use the deductions available in the old regime to an extent of ₹2.5 lakhs.

- In the new regime, you still have zero tax liability.

- In the old regime, your taxable income now becomes ₹5 lakh (₹7.5-2.5), and you will now have a zero tax liability in the old regime.

- The essential concept which comes out of this example is that this ₹2.5 lakh deductions brings you to a break-even point: a point where both the tax regimes have the same tax liability.

The takeaway

The choice between the old tax regime and the new tax regime is dependent on the amount of deductions that you are taking advantage of.

The old tax regime is beneficial at higher deductions, whereas the new tax regime is beneficial at lower deductions.

We will define break even point (BEP) as the amount of deductions you use for both the tax regimes to have the same tax liability for your gross income.

- At the break even point(BEP), you can use either of the tax regimes as your tax liability will be the same in both cases.

- If you can claim more deductions depending on your financial situation, you should opt for the old tax regime.

- If your current/planned finances do not allow you to claim more deductions than the BEP, you should opt for the new tax regime to take advantage of the lower tax bill.

We have calculated a few break even points for your reference. The table below should help you understand the approximate deductions you need to claim to break even between the two regimes.

| Gross income | Maximum deductions (₹) one must claim in the old tax regime | Tax payable in both tax regimes (₹) |

| ₹7.5 lakh | 2,50,000 | – |

| ₹10 lakh | 3,00,000 | 54,600 |

| ₹12.5 lakh | 3,62,500 | 93,600 |

| ₹15 lakh | 4,08,332 | 1,45,600 |

| ₹20 lakh | 4,25,000 | 2,96,400 |

Remember, the decision to choose the best regime for you has to be done with careful consideration of your finances and deductions available. For further understanding of the deductions you can use and the best way to plan your taxes, you should always consult your tax planner.

Insurance and its taxability

If you purchase any new life insurance policies after the 1st April 2023, with more than ₹5 lakhs’ aggregate premium, the proceeds from those policies are now taxable. For ULIPs, this limit was already at ₹2.5 lakhs. So if you plan to buy any large insurance policies, it is becoming unfavourable from 1st April. So, hurry up and insure yourself!

Purchasing equity abroad

If you have been investing in the international markets through LRS (Liberalised Remittance), currently you were being charged a TDS of only 5% if the amount was higher than ₹7 lakhs. After Apr 1, you will now have to pay a higher TDS of 20% irrespective of the amount.

Reinvestment of Long-Term Capital Gains

If you sell your assets like property or a stake in a company, you can re-invest the proceeds and claim benefits of long-term capital gains under section 54F of Income tax. From Apr 1, if your LTCG exceeds ₹10 cr, you will not get the complete benefit of Sec 54F. You can only get benefits under the section to the extent of ₹10 Cr. Simply put, if you sell a house/ stake in a company, and your gains are more than ₹10 cr, then the maximum tax benefit is up to ₹10 cr when you invest in another property etc.

Other changes in personal finance

- The maximum deposit limit for Monthly Income Account Scheme will be enhanced from ₹4.5 lakhs to ₹9 lakhs for a single account and from ₹9 lakhs to ₹15 lakhs for joint accounts.

- The maximum deposit limit for Senior Citizen Saving Scheme ( SCSS) has been enhanced from ₹15 lakhs to ₹30 lakhs and the rate of interest has increased from 7.4% to 8%.

- The threshold for TDS for online gaming of ₹10,000/- has now been removed.

- Market Linked Debentures (MLDs) / Structured Products will now be fully taxed as short-term capital gains. Earlier, they were taxed at 10% and treated as Long term gains.

- To make the IT filing smoother, the processing time for ITR has now been reduced from 93 days to 60 days.

We hope this article could help you understand the new tax regime and the changes in personal finance brought about in Budget 2023. If you have any questions, please ask them in the comments section, we will be happy to help.

Know someone who needs this article? Don’t forget to share this link with them.