Adani hits back at Hindenburg |Weekly Stock Markets Updates | Jan 29, 2023

Phew, what an eventful week. In our last week’s newsletter, we covered what happens when giants go public. But we did not foresee that a 100+ page document could have the power to throw the much-awaited Adani Enterprises FPO into the doldrums.

Suckerpunch

ICYMI (only if you were living under a rock this past week) – Hindenburg Research posted a detailed report on Adani Enterprises claiming that the world’s richest Indian -Gautam Adani is committing corporate fraud. The report raised concerns about debt levels and the use of tax havens and challenged Adani to answer 88 questions and come to the US court for a standoff.

The shock

What’s crucial here is the timing. This report came only days before the start of Adani’s ₹20,000 crores FPO. Adani Enterprises had allotted shares worth ₹5,985 crores to institutional investors. Whereas the sharp selloff following this report made Adani Enterprises trade well below the FPO price band. This resulted in a muted retail subscription at 1% on day 1.

Adani group is crucial to building and maintaining India’s infrastructure and a drop in its share price not only affected all Adani stocks but also several big financial institutions leading to a complete rout in the stock markets.

Adani hits back

But Adani did not become the tycoon that he is by sitting back. He claims the Hindenburg Research report is a malicious attempt at misinformation designed to harm the upcoming FPO and enable the U.S.-based short seller to book gains, without citing evidence. In a 413-page response, Adani says they have made all the regulatory disclaimers and has responded to all 88 questions raised by the US-based agency. Adani may even take legal action against Hindenburg.

He stood by the FPO and said that there will be no change in the price band of the schedule of the FPO.

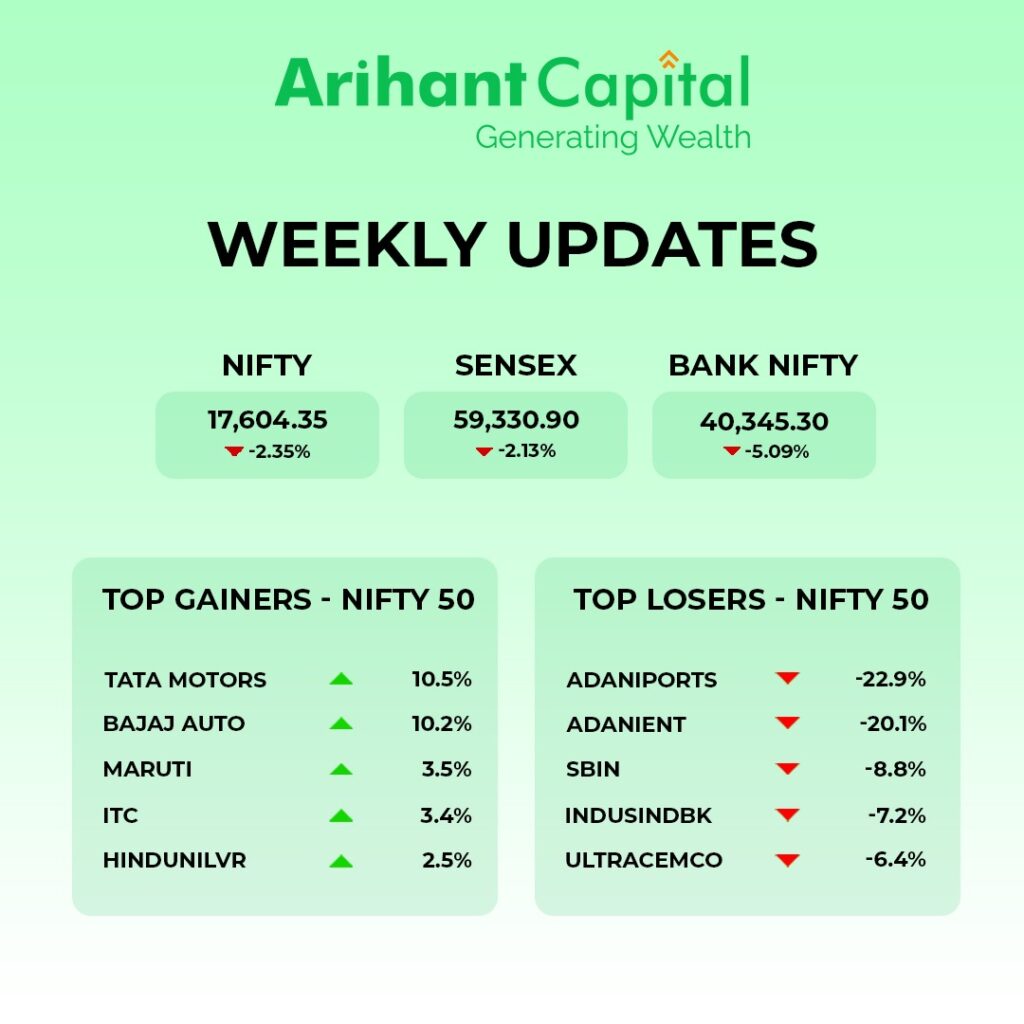

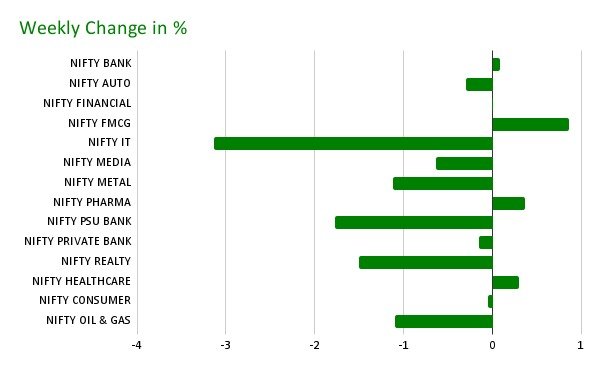

Let’s hope this brings back confidence in Adani stocks and the markets that were well covered in red last week. Sensex ended the week 2.13% down at 59,331 whereas Nifty slid further (by 2.35%) to end the week at 17,604. Bank Nifty was worst-hit dropping 5.09% to end at 40,345.

While talking about colours and kings, it appears that PVR and INOX will be grooving to ‘Besharam Rang🎶’ as the king of Bollywood- SRK is back with a bang with Pathaan. While the fans are out dancing in the theatres in full swing, the movie is making opening records despite several protests.

Let’s hope D-street investors also get a chance to celebrate this next week as markets respond to Adani’s statement, the outcomes of FOMC and the Union Budget.

In this article

Live now!

You asked we listened, and we have upgraded your Arihant Plus trading experience. The power-packed upgrade has all the features we know you will love 💚!

There is good news for our NRI users- Now you can also use our Arihant Plus app to trade in securities in India.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

The market will be volatile in the coming week as a result of the Union budget. On the Nifty daily chart, we observe the triangle pattern breaking down, and on the weekly chart, we see the lower trendline formation breaking down. It implies that higher market levels may exert some pressure on us. Nifty may encounter resistance at 17,720; if it trades above this level, it may test the levels of 17,850 and 17,050; if it trades below, it may test the levels of 17,350 and 17,100.

Bank Nifty

The moving average on Bank Nifty’s daily chart has a negative divergence, and there is a bearish candlestick formation on the Bank Nifty’s weekly chart. Looking at both charts, the higher level appears to be exerting some pressure in the upcoming trading session. If it trades above 40,500, it has the potential to reach levels of 40,800 and 41,200. However, the downside support level is at 40,100, and levels of 39,700 and 39,500 are available below that.

📊Key Results: Q3FY23

- Axis Bank Q3 net income jumps 62% YoY to ₹58.5 billion.

- Poonawalla Fincorp‘s Q3 profits were up 89% YoY to ₹1.82 billion.

- Bajaj Auto‘s net profit rose 23% to ₹1,491 cr. Revenue grew 3.3% in Q3 at ₹9,318 crores YoY, an increase from ₹29,021 cr in the last fiscal year.

- Cipla Ltd.’s net profit rose 10% to ₹801 cr. Its revenue jumped 6% to ₹5,810 cr up from ₹5,476 cr in the last quarter.

- Patanjali Foods Q3 PAT stood at ₹269 cr vs ₹234 crore YoY.

- Tata Motors Q3 PAT stood at ₹3.043 cr compared to loss of ₹1,451 cr YoY. Its revenue jumped 22.5% to ₹88,489 cr.

- Dr Reddy’s Net profit jumped 77% YoY to ₹1,247 cr. Its revenue jumped 27% to ₹6,770 cr.

- Dixon Tech Q3 income at ₹2,405 cr compared to ₹3,073 cr YoY.

- Maruti Suzuki‘s net profit rose 130% to ₹2,391 cr. Revenue grew 26.9% to ₹29,918 cr.

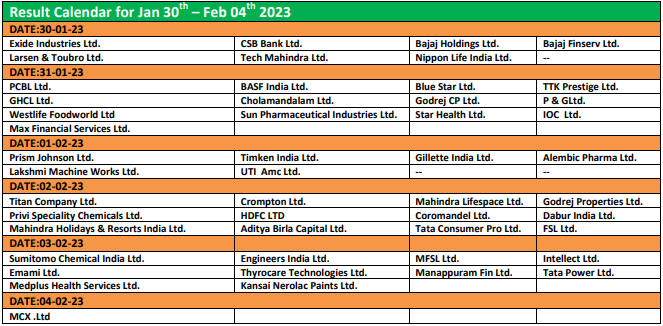

Upcoming Results

⏩Quick Bites

Economy

- India’s foreign exchange reserves increased by $1.727 billion to $573.727 billion.

- India’s sovereign green bond auction for 10-year and 5-year maturity bonds closed at yields of 7.1% and 7.29%.

- Indian stock markets to shift to T+1 settlement cycle from Jan 27.

Industry

- JSW Steel will acquire a 31% stake in the startup Ayena Innovation.

- British govt offered 300 million pound sterling to Tata Steel’s UK business, to decarbonise its operations.

- Vedanta Holdco eyes upto $2b in bridge loans

IT and Telecommunications

- Made in India 4G and 5G technology to be launched this year says Telecom minister Ashwini Vaishnaw.

- Jio and Airtel gained 14.2 lakh and 10.5 lakh mobile users respectively in Nov, while Vi lost 18.2 lakh subscribers.

- Indus Towers made a debt provision of ₹722 98 b against receivables from Vi.

Energy and Infrastructure

- Toll collections at national and state highways through FASTag touched ₹50,855 cr in 2022, the highest ever.

- Oil India (OINL) is to shut the oil refinery for 40 days from March.

- DLF recorded a 45% rise in sales to ₹6,599 cr in the Apr-Dec quarter.

- Indigrid to buy Khargone transmission for ₹1,497 crores.

- Sterlite Power bagged orders worth ₹3,800 cr in the April-Dec period.

Banking and Finance

- SBI acquired a 40% stake in Commercial Indo Bank LLC (CIBL), Moscow.

Automobile

- Tata Motors confirms its delisting from the NYSE and termination of its ADS program

- Maruti Suzuki (MSIL) recalls 11,177 Grand Vitara vehicles manufactured between Aug. 8-Nov. 15

- Samvardhana Motherson will buy a 51% stake in Saddles International for ₹207 cr.

Other

- Tata Vistara reported its first-ever quarterly profit in the third quarter.

- Zomato brings back gold subscription but is reportedly planning to shut its 10-minute food delivery business.

- Vikas Lifecare to invest up to ₹250 crores in Kohinoor Foods Ltd.

Global

- The US economy slowed but still grew at a 2.9% rate in the last quarter.

- EU panel to vote on tighter crypto rules for banks

🔌Sustainability Corner

- Electric Honda Activa is to roll in by early 2024.

- Adani Green posted a 9% increase in sales of solar energy in the Dec quarter.

- Tata Motors (TTMT) partners with ICICI Bank for the financing EV dealers.

- Battery start-up Log9 Material raised $40 million in Series B funding led by Amara Raja Batteries.

- BPCL to set up 1 gigawatt (GW) of renewable energy capacity in Rajasthan.

- Mumbai Airport is planning to use more than 100 electric vehicles by 2024 to reduce its carbon footprint.

- Hero MotoCorp has started deliveries of its electric scooter Vida in Delhi and Jaipur.

- Suzuki Motors plans 6 battery electric vehicles for launch in India by 2030. They will also introduce carbon-neutral internal combustion engine vehicles powered by CNG, biogas and ethanol.

- Citroen set to launch EV version of C3 in Feb.

- Tube Investments subsidiary IT Clean Mobility will acquire a 30% stake in Celestial E-Mobility.

Do you not have an Arihant Capital account yet?

Loving our newsletter? Share with friends and give us a shoutout in the comment section.