Busy Week at the Bombay House| 🤑Results Season| Weekly Stock Markets Updates | Jan 15, 2023

Hey Investor

It’s time to tune in to “Naatu Naatu“, from the Telugu film RRR, which made history at the 80th Golden Globes and became the first Indian song to win the Best Original Song award, and brace yourself with all the financial news and events you need to start your week.

In this article

It’s been quite a busy week at the Tata office {aka Bombay House} considering numerous activities within the organization like Tata Motors’ acquisition of Ford India’s manufacturing plant and decisions for acquiring a major plant in southern India, creating the country’s first homegrown iPhone manufacturer.

Tata Consultancy Services (TCS) kicked off earnings season with the release of their FY23-Q3 results on Monday. Meanwhile , IT giant Infosys outperformed the street expectations by reporting a consolidated net profit of ₹6,586 in Q3FY23, up 13.4% YoY and 9.4% QoQ.

Speaking of losses, Elon Musk now holds the world record for the largest loss of personal fortune in history. He has lost over $182 billion in 2022, according to the Guinness World Record.

Monday, January 16th, is National Startup Day; click here to see what’s in store for Indian startups in 2023 and their roadmap for the year, including comments from our CSO, Ms. Shruti Jain.

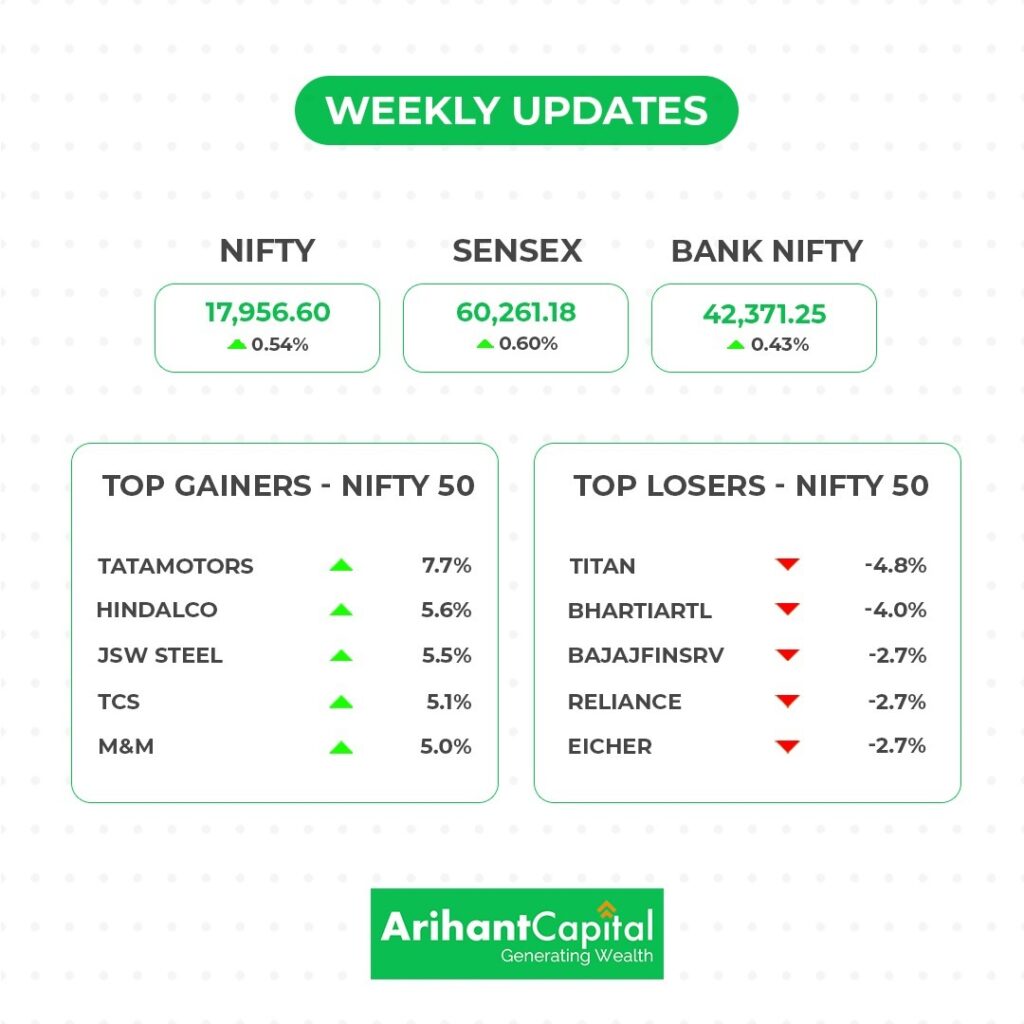

The benchmark indices ended the week with gains. Nifty closed the week at 17,859, up 0.54%, and the Sensex closed the week 360 points higher at 59,900 points. The Bank Nifty was up 182 points, ending the week at 42,188.

Most sectoral indices ended in the green, with Nifty IT (3.50%) and Metals (2.58%) leading the pack. Only consumer durables (-2.47%) and FMCG (-1.03%) were walking over the parade.

Coming Soon!

You asked, we listened, and we have upgraded your Arihant Plus trading experience. The power-packed upgrade has all the features we know you will love💚

There is a good news for our NRI users- Now you can also use our Arihant Plus app to trade in securities in India.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

On the daily chart of the Nifty, we observe that it has taken support from the 100 SMA price level, while on the weekly chart, we observe a Doji candlestick formation. Overall, it implies that we could expect some support from this level in addition to some stock-specific movements in the market. Nifty may encounter resistance around 18,050 in the coming trading session if it begins trading beyond that level, then it could test the levels of 18,250-18,400, whereas on the downside, support is at 17,780 if it begins trading below that level, then it might test the levels of 17,600 and 17,450.

Bank Nifty

On the daily chart of Bank-Nifty, we see a Hammer candlestick formation, while on the weekly chart, we see a Doji candlestick formation. Upon examining both charts, we can see some support from the downside levels. Whereas if Bank Nifty trades above 42,450 in the coming trading session, it can reach 42,750 and 42,900 levels; but even so, downside support comes at 42,100 and below that, we can see 41,500-41,200 levels.

US markets will be closed on Monday to honor the legacy and dream of Dr. Martin Luther King Jr.

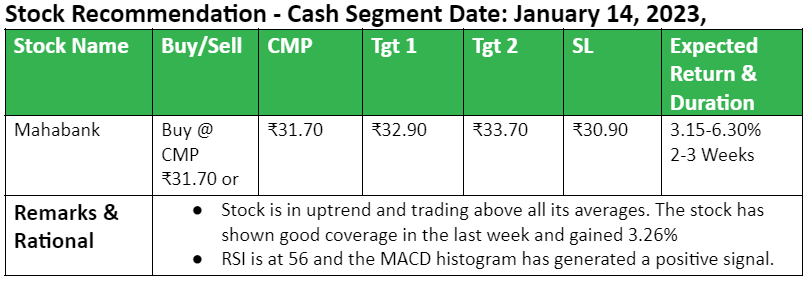

💰Stock Picks

From the Technical Desk

-Ms. Kavita Jain, Sr Research Analyst and Learning Head, Arihant Capital

📊Key Results: 3QFY23

- TCS reported 10.98% YoY growth in net profit at ₹10,883 crore. Its consolidated revenue jumped 19.11% at ₹58,229 cr. The company declared an interim dividend of ₹8 and a special dividend of ₹67 per share.

- HCL reported 19% YoY growth in net profit to ₹4,096 crore and the attrition rate reported at 21.7% vs 23.8% in the previous quarter.

- Infosys reported a 13.4% YoY growth in net profit, while the revenue saw a rise of 20.2% at ₹38,318 crore and the attrition rate reported at 24.3% vs 27.1% in the previous quarter.

- HDFC Bank Q3 reports PAT rises 18.5% YoY to ₹12,259 cr.

- Wipro reported 2.8% YoY growth in net profit of to ₹3,053 crore and attrition rate of 21.2%.

- Just Dial has reported net profit at ₹75.32 crore and revenue rose 39.32% to ₹221.37 crore, total expenses were at ₹204.92 crore, up 25.67% during the quarter.

- Key earning announcement this week:

- 16 Jan – Bank of Mah, Federal Bank, Kesoram.

- 17 Jan – Delta Corp, ICICI Lombard, ICICI Prudential, Network 18, Mastek.

- 18 Jan – Central Bank, IndusInd, Rallis India, Oracle Finserv.

- 19 Jan – AnantRaj, Asian Paints, AU Small Finance Bank, Can Fin Homes, Havells India, Hind Zinc, Happiest Minds, L&T Technology, Mphasis, PVR, Sterling Wilson.

- 20 Jan – Bandhan Bank, HDFC Life, JSW Energy, JSW Steel, Petronet LNG, Shakti Pumps.

⏩Quick Bites

Economy

- India’s factory output (IIP) grew 7.1% YoY in Nov while it had contracted by 4% in Oct.

- India’s fuel consumption rose 3.1% year-on-year in Dec to 1.96 cr tonnes.

- Indian spot gold prices on Friday fell by ₹153 to ₹55,650 per 10 grams.

- Govt will soon launch a new PLI scheme for IT hardware.

- Remittances from overseas Indians increased by 12% to $100 bn in 2022.

- India’s gross direct tax collection has risen 24.58% YoY to ₹14.71 lakh cr so far in this financial year.

- Retail inflation was down to 5% by March.

- India’s palm oil imports in Dec rose 96% Y-o-Y to 11 lakh tonnes.

- India’s December gold imports plunge 79%.

- FSSAI specified the identity standards for basmati rice exports.

- 🏛️Parliament’s budget session will begin from Jan 31, 2023.

Budget outlook: Which sectors will be the focus of government and what to expect from Budget 2023 by Mrs. Anita Gandhi, Institutional Equities Head ⬇️.

Industry

- Coal India subsidiary NCL will start production of manufactured sand.

- The defense ministry has cleared projects worth ₹4,276 cr including the procurement of indigenous anti-tank missiles and a new short-range air defense missile.

IT and Telecommunications

- FPIs dump IT stocks worth ₹ 72,000 cr in 2022.

- Reliance Jio has become the first telecom company to launch a 5G-specific recharge plan while expanding 5G coverage to 101 cities.

- Cyient reported a 37% jump in quarterly revenue on the back of a slew of acquisitions.

Energy and Infrastructure

- Adani keen to acquire stake in PTC India Ltd.

- Jindal Steel to invest ₹1,500 crores to make Monnet Power operational.

- JK Cement subsidiary has acquired paint manufacturer and construction chemicals company Acro Paints Limited.

- Housing sales across India’s 8 major cities stood at a 9-year high of 3.13 lakh units in 2022.

- Private equity investment in the Indian real estate market reached $4.9 bn in 2022.

- RailTel received new orders worth ₹170.11 cr from the Puducherry Govt.

- Rail Vikas Nigam bagged Chennai Metro Rail project worth ₹1,134 cr.

- Piramal Capital and Housing Finance to grow its retail loan book to more than ₹1 lakh crore over the next three years from around ₹25,000 crore now.

Banking and Finance

- The LIC and the government together looking to sell 60.7% stake in IDBI Bank. Meanwhile, shares of the bank soared 8.5% last week.

- HDFC Capital raised $376 mn for its affordable housing fund.

- SBI raises home loan, other loan interest rates by 10 bps w.e.f Jan 15.

- Punjab & Sind Bank in a partnership with Bajaj Allianz Life Insurance for the distribution of insurance products. In other news, Punjab and Sind Bank to cross 2 lakh cr business milestone soon.

- Paytm recorded a 330% jump in loan distribution business to ₹3,665 cr in Dec 2022.

- Net inflow into equity funds stood at ₹7,303.39 cr in Dec 2022, while net outflow out of debt mutual funds stood at ₹21,946.73 cr.

- The AUM of the mutual fund industry rose by 5.7% (₹2.2 lakh cr) to ₹39.88 lakh cr in 2022.

- Alibaba sold a 3.1% stake in Paytm for ₹1,031 crore through a block deal.

- RELIGARE FINVEST (RFL) expects to start anew after settling its dues to lenders through a one- time settlement (OTS) later this month.

- IIFL Wealth board will consider a stock split and bonus issue on 19 Jan.

- PB Fintech received in-principle approval from RBI to run account aggregator business.

Automobile

- Tata Motors retail sales of Jaguar-Land Rover rose 5.9% to 84,827 in the Oct-Dec quarter.

- TVS Motor to invest ₹1,000 cr to expand in Madhya Pradesh

- Maruti Suzuki launched 2 new SUVs, Jimny and Fronx in India.

Other

- PVR opened new multiplexes in Jaipur, Bengaluru, and Gurugram.

- Titan reports 12% business growth in Q3.

- Tata Group nears deal that would give India its first homegrown iPhone maker.

- Hindalco planning to raise ₹700 cr via a bond sale.

- Sun Pharma launched a breast cancer medicine in India.

- HUL acquired 51% stake in Zywie Ventures for ₹264.28 crore.

- Lupin gets US FDA nod for a generic medicine to treat heart ailments.

- Kalyan Jewelers revenue rose by 13% on a year-on-year basis.

- Drug firm Gland Pharma inked a pact with FPCI Sino French Midcap Fund to acquire a 100% stake in Europe-based Cenexi Group.

- PVR-Inox merger has been approved by NCLT.

- BCL Industries approved raising ₹201 cr via issue of warrants.

Global

- UK GDP rose by 0.1% in Nov vs 0.5% in Oct.

- Inflation in US stood at 6.5% , the lowest in an year.

- Japan’s Nikkei rallies to 2-week high.

🚀IPO Corner

- Sah Polymers listed on BSE and NSE at ₹85 – a premium of 30.77%.

- Cyient DLM Ltd., a subsidiary of Cyient, has filed draft papers for an IPO.

- Furniture retailer Stanley Lifestyle plans ₹700 crore IPO.

🔌Sustainability Corner

- L&T signed a pact with Norway-based H2Carrier (H2C) to develop floating green ammonia projects.

- Tata started deliveries of its new Ace EV.

- Global cos plan to rally into India’s luxury EV market.

- Adani Green, Torrent Power, Shell and Actis, are looking to acquire Virescent Renewable Energy Trust for enterprise value of ₹4,500 crore.

- Jindal Worldwide has set up an electric vehicle plant in Ahmedabad.

- Sterling Generators plans to enter manufacturing of hydrogen engine gensets, electrolysers and EV charging equipment.

- Atul Auto forayed into the electric vehicle space by launching two electric 3-wheelers.

- Tata Group will set up 25,000 electric vehicle charging points across India.

- China’s BYD announced that it will launch its third electric car in India this year.

- Eicher Motors subsidiary VECV has launched a new intercity electric bus.

Do you not have an Arihant Capital account yet?

Loving our newsletter? Share with friends and give us a shoutout in the comment section.

“Injustice anywhere is a threat to justice everywhere. We are caught in an inescapable network of mutuality, tied in a single garment of destiny. Whatever affects one directly, affects all indirectly.”

Martin Luther King