All eyes on the budget | Weekly Stock Market Updates | Jan 15, 2023

Pick up your morning cuppa and get ready to catch up on all that happened last week, and be ready for the Monday markets with insights from our expert team.

In this article

The Union Budget 2023-24 is just around the corner, and experts are busy analysing every piece of information they receive. This upcoming budget is not just important from the economic point of view, but also has a political significance as well as it is the last full budget before the Lok Sabha elections in 2024.

Everyone else is glued to their favourite news channels for expectations and anticipations. The house is divided, some experts believe it will be a populist one, while some believe it will focus on reducing the fiscal deficit, both of which are diametrically opposite stances.

To read what Mrs Anita Gandhi, Whole Time Director and Head of Institutional Business feel about the FM’s priorities in the budget, check out the article below.

Cheers for the Women in Blue

The women’s IPL is coming soon, and Viacom18 recently bought its broadcasting rights from 2023 to 2027. Women’s IPL is good news for our women in blue, who only recently got equal pay from BCCI as this IPL will open up several opportunities for them. Over 30-plus companies have taken the invitation to tender (ITT) to buy a Women’s IPL franchise including Haldiram, Infosys, APL Apollo, Shriram Group, and JK Cement.

While we are talking about girl power, New Zealand PM Jacinda Ardern will bid an early goodbye to her position in Feb. Chris Hipkins will step up to be the next Kiwi PM.

When giants go public

Adani Enterprises will soon launch India’s largest follow-on public offer. The FPO will be open on January 27 at ₹3,112 -₹3,276 per share. Adani Enterprises will invest a part of the FPO proceeds (₹10,869 crores) to fund the green hydrogen projects. It will also be used for improving existing airports and funding the construction of expressways. The FPO will also help cut down Adani’s debt.

Tata Tech has also started work on its IPO to raise up to ₹4,000 crores. The company is an engineering design and technology services company that caters to the automotive, aerospace and others. The company also believes in the convergence of digital technology and traditional engineering to develop products.

No good news for tech

The season of layoffs is continuing, with around 3,000 tech employees being fired every day in January. The latest to join the layoff bandwagon is Google’s parent Alphabet Inc, cutting about 12,000 jobs, and Microsoft, laying off 10,000 employees. Even food delivery application, Swiggy has laid off 380 employees recently.

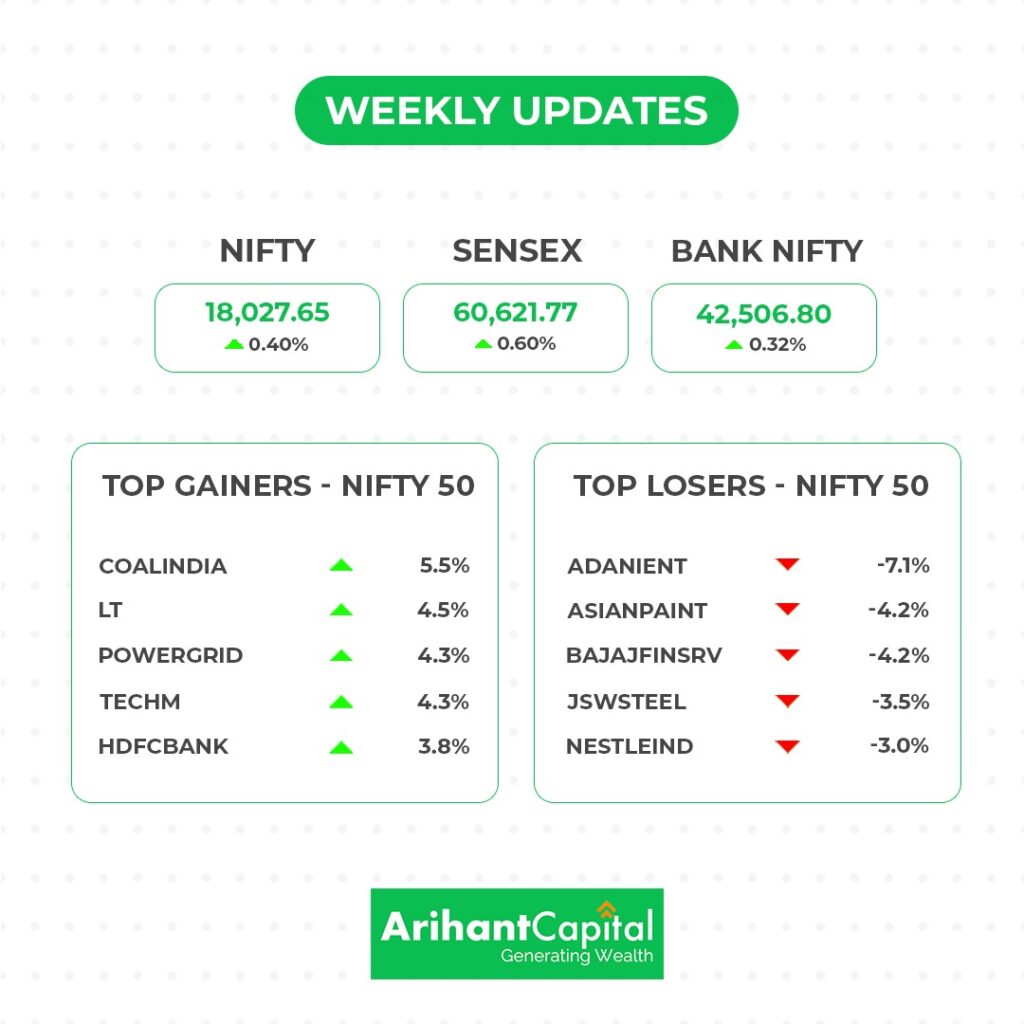

The Indian benchmark indices ended lower during the final minutes of trade after largely remaining rangebound through the day on Friday. Over the course of this week, both the indices were firmly in the green, Sensex was up 0.60% and Nifty was up by 0.40%.

Coming Soon!

You asked we listened, and we have upgraded your Arihant Plus trading experience. The power-packed upgrade has all the features we know you will love

There is good news for our NRI users- Now you can also use our Arihant Plus app to trade in securities in India.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

On the daily chart of Nifty, we observe that Nifty is trading in a channel and facing resistance from the higher level of 50 SMA and on the weekly chart we observe a Doji candlestick formation. It indicates that we may see some limited upside movement in the market. Nifty can face resistance around 18,080 levels. If it starts to trade above this level, then it can touch 18,250-18,400 levels. On the downside, the support is 17,800. If it starts to trade below this, then it can test the 17,600 and 17,450 levels.

Bank Nifty

On the daily and weekly chart of Bank Nifty, we observe a series of narrow-range body formations. It seems that we can see some consolidation from higher levels in the coming trading sessions. If it trades above 42,620 then it can touch 42,850 and 43,100 levels. However, the downside support comes at 42,300 below that we can see 41,800-41,500 levels.

💰Stock Picks

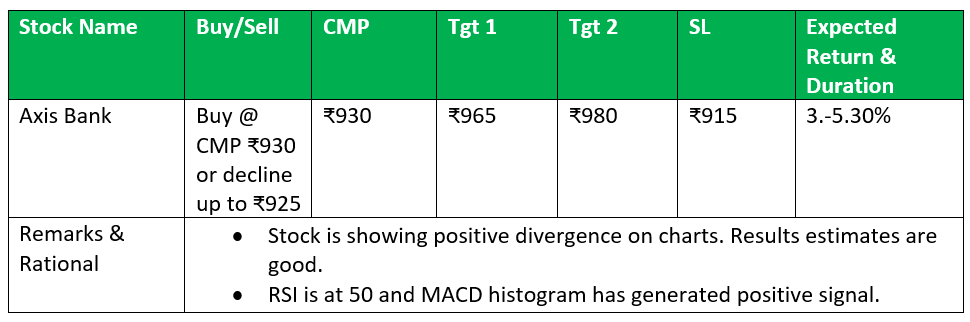

From the Technical Desk

-Ms. Kavita Jain, Sr Research Analyst and Learning Head, Arihant Capital

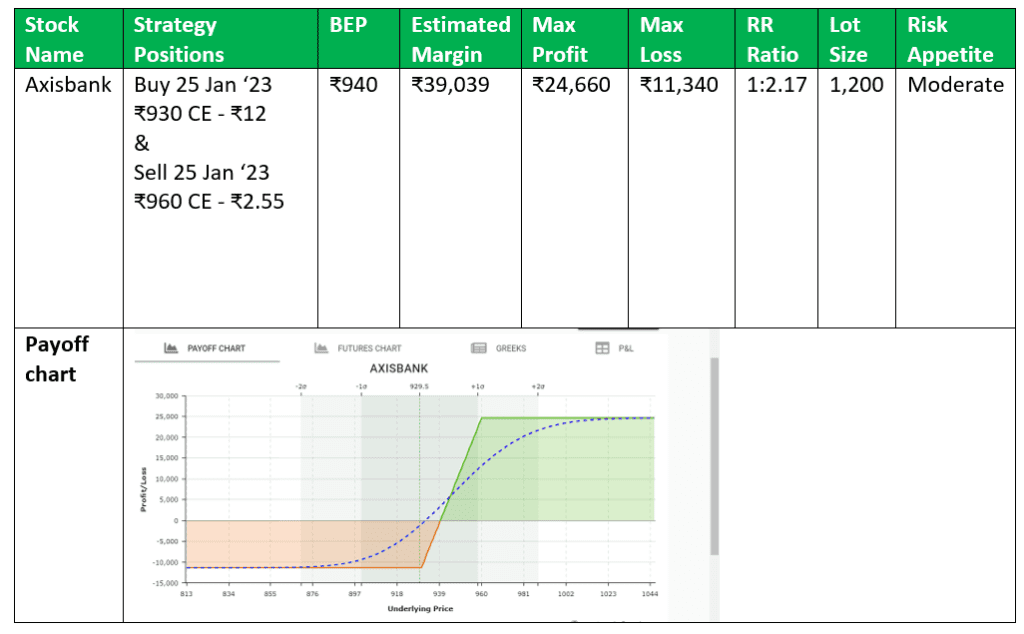

Options Hub

-Ms. Kavita Jain, Sr Research Analyst and Learning Head, Arihant Capital

📊Key Results: 3QFY23

- HUL Q3 profit jumps 12% YoY to ₹2,505 crores

- JSW Steel Ltd reported an 89% fall in net profit at ₹490 crores for Q3 FY22. The company had posted a profit of ₹4,357 crore in the last year period.

- Reliance reported a 13% drop in consolidated profit, at ₹17,806cr.

- Persistent Systems revenue rose by 45%YoY to ₹2,169 crore in Q3, while net profit was at ₹238 crores, a rise of 34% YoY.

Upcoming results

- Axis Bank 23-Jan-23

- HFCL 23-Jan-23

- Tata Communications 23-Jan-23

- IDBI 23-Jan-23

- Maruti 24-Jan-23

- TVS Motor 24-Jan-23

- Bajaj Auto 25-Jan-23

- Tata Motors 25-Jan-23

⏩Quick Bites

Economy

- WPI inflation dips to a 22-month low of 4.95%

- Forex reserves zoom by $10.417 bn to $572 bn as of Jan 13: RBI data

- Foreign portfolio investors (FPIs) sold Indian stocks worth $1.85 billion in the first half of Jan.

Industry

- Vedanta will acquire Meenakshi Energy for ₹1,440 cr.

- The Odisha government approved nine investment projects worth ₹1.53 lakh crore including a ₹38,000 crore proposal of ArcelorMittal Nippon Steel (AMNS)

- BHEL bagged an order worth ₹300 crores to renovate and modernise steam turbines at a thermal plant in Gujarat.

- Vedanta will sell Zinc International assets to Hindustan Zinc for $2,981 million.

IT and Telecommunications

- Vi paid only 10-30% of the licence fee, SUC for the December quarter.

- TCS wins the deal to be the strategic partner of Canadian jet maker Bombardier.

- Wipro opens the Wipro-AWS launch pad in Toronto.

- Jio expands its 5G presence to 16 more cities.

Energy and Infrastructure

- RIL suspended the auction for the sale of natural gas from its eastern offshore KG-D6 block.

- RIL to raise ₹20,000 crores through non-convertible debentures.

- Adani Transmission to acquire 100% stake in WRSR Power Transmission

- Mahindra Lifespace Developers bagged its first society redevelopment project in Mumbai. The project offers a revenue potential of around ₹500 crores.

- The Indian government has set a coal production target of more than one billion tonnes (BT) for the next financial year.

Automobile

- Ashok Leyland will supply 500 buses to Sri Lanka Transport Board.

- Chinese firms turn the heat on Tata Motors, aim for its market share with

- Maruti Suzuki recalled 17,362 vehicles due to faulty airbags.

- NCLT has approved Mahindra Electric’s merger with M&M.

Other

- ITC will acquire the healthy food brand, Yoga Bar.

- Eris Lifesciences acquired nine dermatology brands from Glenmark Pharma for ₹340 crores.

- Viacom18 bagged media rights for women’s IPL for ₹951 crores for 5 years.

- Lupin received the USFDA nod to market its generic medicines that are used to treat HIV.

- HUL to pay higher royalty fees to parent Unilever Plc from about 2.65% in FY22 to 3.45% in phases over three years.

- Cipla has launched a testing device for non-communicable and infectious diseases.

- Cantabil Retail opened 10 new retail outlets. It now has 439 stores in India.

- PNB Housing Finance to consider raising Rs 2,000 cr by issuing debentures.

Global

- UK inflation stood at 10.5% in Dec, down from 10.7% in the previous month.

- China’s GDP growth touches a new low. The economy grew by 3% in 2022 – lower than its target of 5.5%.

- Japan and India have started their first joint fighter jet drill.

- India has formally given an assurance to the International Monetary Fund to help Sri Lanka secure a $2.9 billion bailout.

- Global employment will grow by 1% in 2023: International Labour Organization.

🔌Sustainability Corner

- Tata Motors has dropped the entry price of its Nexon EV which can now also do extra miles per charge.

- Greaves Cotton aims to become a full-service electric mobility player. The company is already present in the e-mobility

- Tata Motors is discussing with global investors to raise $500-$600 million for the electric vehicle (EV) business.

- JSW Energy received orders for battery energy storage systems from Solar Energy Corporation of India.

- Sundram Fastener, an auto ancillary firm has secured a $250 million contract (its biggest in 60 years) to supply sub-assemblies for an electric vehicle (EV) platform. The company will invest ₹200 crore to fulfil the new order.

- BYD aims to be amongst India’s top three EV sellers by 2024; will explore local manufacturing in the second phase, as it eyes 40% market share by 2030.

- Adani Green will acquire 50% stake in Essel Saurya Urja Company.

- Tata AutoComp to invest ₹500 crore in setting up new dual-clutch transmission plant in Chakan, Maharashtra; initial production capacity of 100,000 units.

- Bajaj Chetak to ride into European markets in 2024; KTM and Bajaj Auto jointly working on a 48-volt electric motorcycle.

- Gogoro and Belrise will build a smart energy infrastructure in Maharashtra for developing open and accessible battery swapping infrastructure and smart battery stations as a leading source for mobility and energy storage.

Don’t have an Arihant Capital account yet?