Avalon Technologies Limited IPO is live. Should you Invest?

Avalon Technologies Limited IPO is live. Should you Invest? Find out here.

In this article

📃About Avalon Technologies Limited IPO

Incorporated in 1999, Avalon Technologies Limited is a leading fully integrated Electronic Manufacturing Services (“EMS”) company. They have end-to-end capabilities in delivering box-build solutions in India, focusing on high-value precision engineered products. The company is one of the leaders in the segment in India in terms of revenue in Fiscal 2022.

Through a unique global delivery model, Avalon offers a full stack product and solution suite, right from printed circuit board (PCB) design and assembly to the manufacture of complete electronic systems (Box Build), to certain global original equipment manufacturers (OEMs), including OEMs located in countries like China, Netherlands, United States, and Japan.

The offerings of Avalon Technologies Limited include PCB design and assembly, cable assembly and wire harnesses, sheet metal fabrication and machining, magnetics, injection moulded plastics, and end-to-end box build of electronic systems.

💰Issue Details of Avalon Technologies IPO

- IPO open from 03 April 2023 – 06 April 2023

- Face value: ₹2 per equity share

- Price band: ₹415 to ₹436 per share

- Market lot: 34 shares

- Minimum Investment: ₹14,824

- Listing on: BSE and NSE

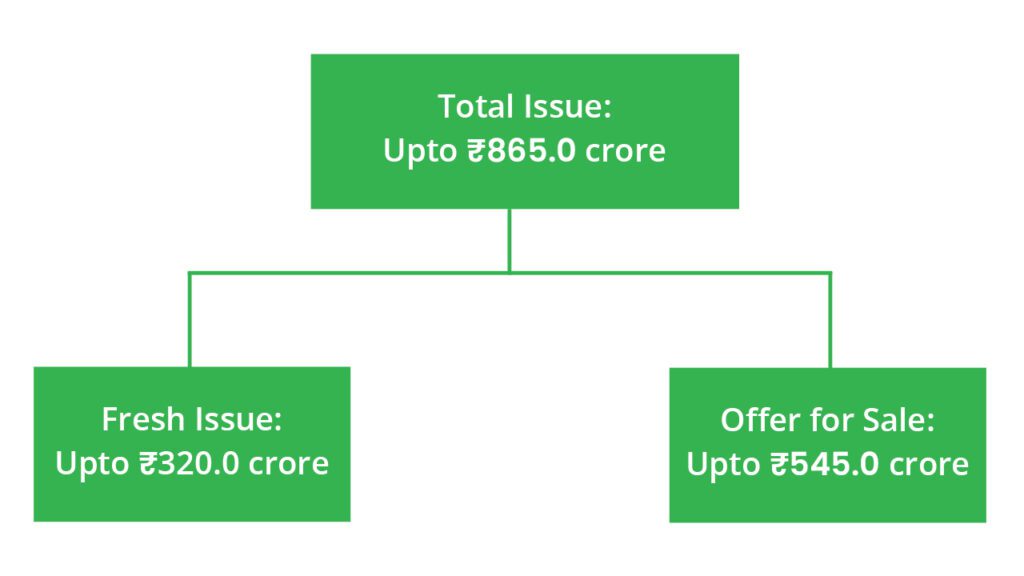

- Offer for sale: Fresh Issue of ₹320 Cr + OFS of ₹545 Cr

- Registrar: Link Intime India Private Ltd

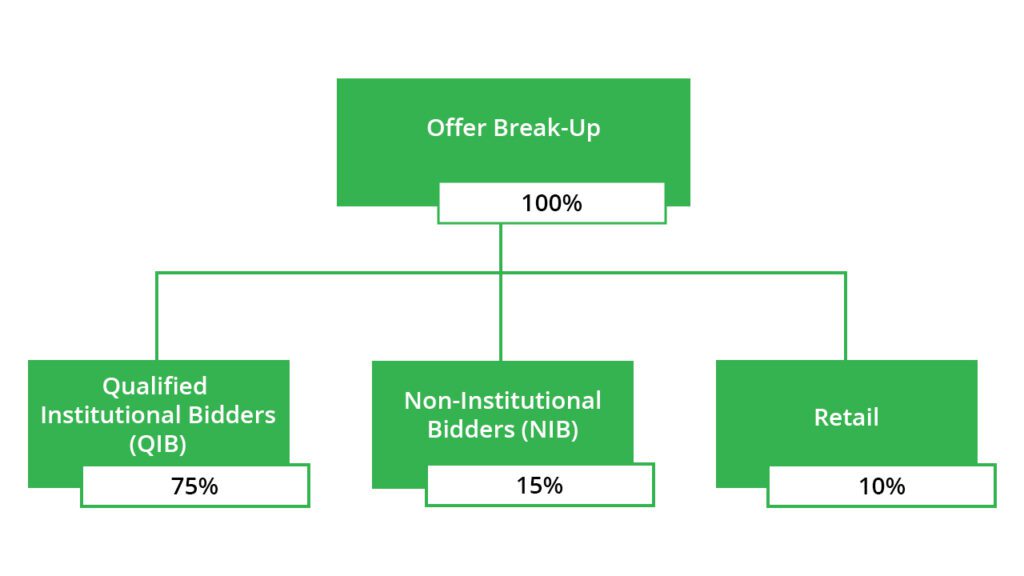

🪚Offer Breakup

🔭IPO Object

The Company proposes to utilize the net proceeds from the fresh issue towards the following objects:

- Prepayment or repayment of all or a portion of certain outstanding borrowings availed by the Company and one of the Material Subsidiaries, i.e. Avalon Technology and Services Private Limited (ATSPL).

- General corporate purpose.

- Funding the working capital requirements of the Company.

⛓️IPO Strength

Some of the qualitative factors and strengths which form the basis for computing the offer price are:

- End-to-end integrated solutions, providing a “One Stop Shop” for electronics and electro-mechanical design and manufacturing services.

- Experienced board, management and operating team.

- Well-diversified business leading to strong growth avenues.

- Global delivery footprint with high-quality standards and advanced manufacturing and assembly capabilities.

🧨IPO Risk

- They are dependent on certain customers for a portion of their revenues.

- They source their raw material from suppliers, primarily on a purchase order basis, who may not perform their contractual obligations in a timely manner, or at all. Any increase in the cost of raw materials or components, delay, shortage, interruption or reduction in the supply of raw materials may adversely affect their business, results of operations, cash flows and financial condition.

- Their business prospects and continued growth depends on their ability to access financing at competitive rates and competitive terms, which amongst other factors is dependent on their credit rating. Any downgrade of credit ratings may restrict their access to capital and thereby adversely affect business and the results of operations.

- Foreign exchange fluctuations may adversely affect their earnings and profitability.

⚖️Peer Companies

- DIXON TECHNOLOGIES LTD.

- AMBER ENTERPRISES LTD.

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-20 | ₹449.65 | ₹653.15 | ₹12.33 |

| 31-Mar-21 | ₹512.48 | ₹695.90 | ₹23.08 |

| 31-Mar-22 | ₹587.96 | ₹851.65 | ₹68.16 |

📬Also Read: Sustainable Investing in India: ESG Investments