SEBI to Introduce ASBA-like Regulations for Secondary Markets | Indian Stock Market Weekly Update 1 April

Grab your morning cuppa and let’s check out what happened during the week in the weekly stock market update.

ASBA in Secondary Markets

On Wednesday, SEBI announced that it will be introducing a facility in the secondary market that is similar to an application supported by the amount (ASBA) in IPOs.

The ASBA-like regulation in secondary markets will be optional initially and implemented in a phased manner. The expected effective date is 1st July 2023.

When you apply for an IPO through ASBA, the money is debited from your application only if you are allotted shares. Until then, an amount in your account stays blocked.

When ASBA is applicable in the secondary market, i.e. trading of shares after listing, an amount from the funds you have earmarked will be blocked and released only when the clearing corporation demands it for clearing the trade.

Some of the benefits of this facility would be:

- Investors can earn interest on the blocked amount in their savings accounts

- Elimination of the risk of default with no adverse impact on the client

- Higher efficiency as a result of usage of the same blocked amount towards margin and settlement

- Lower margin requirements

- Elimination of risk of accidental fraudulent or erroneous reporting by intermediaries

Another important move by SEBI was that it extended the deadline to fill nominee details for mutual fund investors to 30th September from 31st March.

– Mr. Abhishek Jain, Head of Research at Arihant Capital

On Friday, the Indian stock market indices experienced an increase led by gains in banking and IT. The Asian and European markets rose and the US equity futures were steady, as a gauge of global shares headed for a second straight quarterly gain, underscoring investor optimism in the face of banking turmoil and elevated interest rates.

Tata Motors, Nestle India, Hindustan Unilever, State Bank of India, Housing Development Finance Corp, Axis Bank, Tata Consultancy Services, HDFC Bank, Infosys, ICICI Bank, and Reliance Industries positively added to the change.

Whereas Sun Pharmaceutical Industries, Apollo Hospitals Enterprise, Asian Paints, Adani Ports, and Special Economic Zone had a negative impact.

The broader market indices ended higher. The S&P BSE MidCap was up 0.96%, whereas the S&P BSE SmallCap was higher by 1.35%.

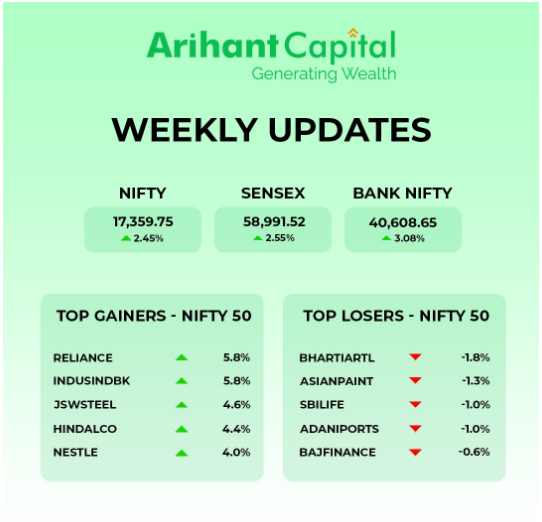

Nifty ended 260 points up at the 17,360 level. Sensex was up by 1.78% and stood at 58,991.

The market has witnessed a bounce back as per our expectations. We continue to remain positive for the market.

🧾In this Article

- Stock Market Outlook

- Stock Picks

- Quick Bites

- IPO Corner

- Sustainability Corner

- Updates on Silicon Valley Bank

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

If we look at the daily chart of Nifty, we see an “Upward Gap” area. On the weekly chart, we see a “Bullish Candlestick” formation. If we analyze both charts, it indicates that now we can see some consolidation in the market and stock-specific action.

If Nifty starts trading above the 17,450 level, then it can touch the 17,600-17,800 level. On the downside, support is 17,200, and if it starts to trade below then it can test the level of 17,050 and 16,950 levels.

Bank Nifty

If we look at the daily chart of Bank Nifty, we are observing an “Upward Gap” area and now it has closed above its 200-day SMA level. On the weekly chart, we see a “Bullish Candlestick” formation. If we analyze both charts, it indicates that Bank Nifty can outperform Nifty.

If it trades above 40,825 then it can touch 41,200 and 41,500 levels. However, downside support comes at 40,500, and below that, we can see 40,200 and 39,900 levels.

💰Stock Picks

– Ms. Kavita Jain, Sr Research Analyst, and Learning Head, Arihant Capital

🔎Quick Bites

Economy

- The Indian government plans to borrow ₹8.8 lakh crore in the first half of FY 2023-24.

- Global Trade Research Initiative (GTRI) expects that India’s merchandise imports will rise 15% to $710 billion.

Banking and Finance

- Life Insurance Corporation of India (LIC) plans to invest ₹2.4 lakh crore across markets in the fiscal year starting from 1st April.

- Shriram Housing Finance and Axis Bank have announced a partnership for co-lending MSME loans and home loans to lower and middle-class segment borrowers in rural and semi-urban regions.

- HDFC will be issuing non-convertible debentures worth ₹57,000 crore.

- RBI has given L&T Finance Holdings approval to merge its subsidiaries, L&T Finance, L&T Infra Credit, and L&T Mutual Fund Trustee, with itself.

- PNB Housing Finance plans to raise ₹2,500 crore through a rights issue offering 29 shares for every 54 shares with a record date of 5th April.

Electricity

- Power distribution companies plan on raising tariffs in the range of single digits to as high as 40% across states.

- Larsen & Toubro (L&T) disclosed that its power transmission and distribution business has secured multiple in India and overseas in the range of ₹2,500 crore to ₹5,000 crore.

Automobiles

- Hero MotoCorp elevated Niranjan Gupta from the position of chief financial officer (CFO) to chief executive officer (CEO) effective from 1st May 2023.

- TVS Motor launched 7 new products in Ghana.

Defence

- Bharat Electronics Ltd (BEL) secured 10 contracts worth ₹5,498 crore with the Ministry of Defence.

Mining

- The government might sell its remaining stake in Bharat Aluminium Company in the next fiscal year.

- Jindal Stainless has entered into a joint venture with a unit of Eternal Tsingshan for a nickel pig iron plant and will be investing ₹1,290 crores.

Infrastructure

- HFCL received a contract to construct the Surat metro rail project worth ₹282 crores.

- Dilip Buildcon secured an order worth ₹780 crores to build the new Hybrid Annuity Project ‘ Bengaluru – Vijayawada under Bharatmala Pariyojana Phase-I’ in Andhra Pradesh.

Pharma

- The Indian government canceled the licenses of 18 pharmaceutical companies over allegedly manufacturing spurious drugs.

- Alembic Pharmaceuticals gets approval from USFDA for a glaucoma drug.

🚀IPO Corner

- Avalon Technologies’ ₹865 crore IPO will open for subscription on 3rd April and the issue will close on the 6th of April. The IPO will have a 10% allocation to retail investors. The minimum investment is 34 shares and the price band is ₹415 to ₹436 per share.

- JG Chemicals, a zinc oxide producer, received approval for its ₹203 crore IPO.

- Mamaearth, the skincare startup, has put IPO plans on hold.

- Oyo plans to cut the size of its IPO to a third of the original size.

🏗️Corporate Actions

Splits

| Company | Ratio | Ex-Date |

| Shree Securities | 1:10 | 6-Apr-2023 |

Rights issues

| Company | Ratio | Ex-Date |

| MKVentures Capital | 1:8 | 3-Apr-2023 |

| PNB Housing Finance | 29:54 | 5-Apr-2023 |

Buyback

| Company | Offer price | Ex-Date |

| TeamLease Services | ₹3500 | 3-Apr-2023 |

Dividend next week

| Company | Type of dividend | Dividend per share | Ex-Date |

| Rail Vikas Nigam | Interim | ₹1.77 | 6-Apr-2023 |

| Vedanta | Interim | ₹20.50 | 6-Apr-2023 |

🪜Others

- National Payments Corporation of India (NPCI) has decided that any UPI merchant payments that go through 2 different wallets will be chargeable at 1.1% above ₹2,000.

- Crompton Greaves has proposed a merger with Butterfly Gandhimathi.

- Adani Transmission and Adani Ports were said to pose contagion risks by Fitch Ratings. The rating agency raised concerns about governance weaknesses at the conglomerate’s sponsor level and other entities.

- A subsidiary of Adani Enterprises acquired a 49% stake in Quintillion Business Media.

- Reliance Industries has completed the acquisition of Sintex Industries.

- Lenders of Reliance Capital, a financial services company. have decided to proceed with the second round of auctions on 4th April.

- Allcargo Logistics plans on buying a 30% stake in Gati-Kintetsu Express for ₹407 crores.

- Nestle India will decide on whether to pay an interim dividend on 12th April.

- IndusInd Bank has withdrawn its objection to the Sony-ZEE merger.

- First Citizens Bank is buying Silicon Valley Bank’s assets worth $72 billion at a discounted value of $16.5 billion and will be handling $56 billion of the failed bank’s deposits.

🔌Sustainability Corner

- Reliance Industries, ReNew, and Tata Power Solar were among the 11 companies chosen to receive ₹14,007 crore worth of solar power production-linked incentives (PLI).

- India and Sri Lanka will be working together on a 135-megawatt solar power plant in Sri Lanka.

- EVs drive new car sales growth in Europe in February, which saw total registrations of just over 9,00,000 units, up 12% YoY. BEV market grows by 33%. BEVs gain market share in 25 out of 28 markets. Tesla Model Y emerges as the best-selling model.

- FY2023 comes to a close today. EV sales in India have already charged past a record 1.16 million units, clocking 154% YoY growth as demand accelerates for eco-friendly vehicles. Over 7,16,000 e2Ws and nearly 4,00,000 e3Ws have been sold.

- Tiago EV bats for TATAIPL2023 as its official partner. Tata Motors to leverage platform of the mega cricket tournament, which begins on 31st March 2023, to increase awareness of EVs and also accelerate demand for the all-electric hatchback displayed at all 12 venues.

- Altigreen supplies 200 fast-charging electric three-wheelers, its largest single-day delivery, to B2B and B2C customers in Bengaluru. An expansion in the dealership network is underway.

- Honda Motorcycle and Scooter India to commission a 6,00,000-unit dedicated EV assembly line at the Karnataka plant in March 2024 and will target a million units by 2030. Honda to locally source the battery pack, power control unit, motor, charger, and contactor.

📬Also Read: Sustainable Investing in India: ESG Investments