Swiss Banking Heavyweight In Trouble? | Indian Stock Market Weekly Update 18 March

Grab your morning cuppa and let’s check out what happened during the week in the weekly stock market update.

Credit Suisse in Crisis?

Can you imagine a bank like Credit Suisse with a rich history of 167 years, who survived 2 world wars and thrived after, announcing that it found weaknesses in its reporting process?

Credit Suisse is one of the biggest financial institutions in the world and the second-largest bank in Switzerland. The bank has been plagued by a series of missteps and compliance failures in recent years that led to losses of $7.9 billion in 2022. This was the biggest annual loss experienced by the bank since the 2008 crisis.

Over the past couple of years, Credit Suisse has suffered losses due to events like the Greensill scandal, the collapse of Archegos, and the Mozambique ‘tuna bonds’ loan bribery scandal. Tuesday’s announcement ended up pushing the bank to the edge of the cliff, leading to a drop of over 25% in its share price this week.

The announcement could not have worse timing. Recently, we also saw Silicon Valley Bank collapse. Also, rising interest rates are reducing the value of bonds held by banks. So, confidence was already trading at a premium for banks.

Credit Suisse suffered another setback when Saudi National Bank, its biggest shareholder, ruled out further financial assistance to the Swiss bank. But, Switzerland’s central bank has agreed to lend $54 billion to Credit Suisse.

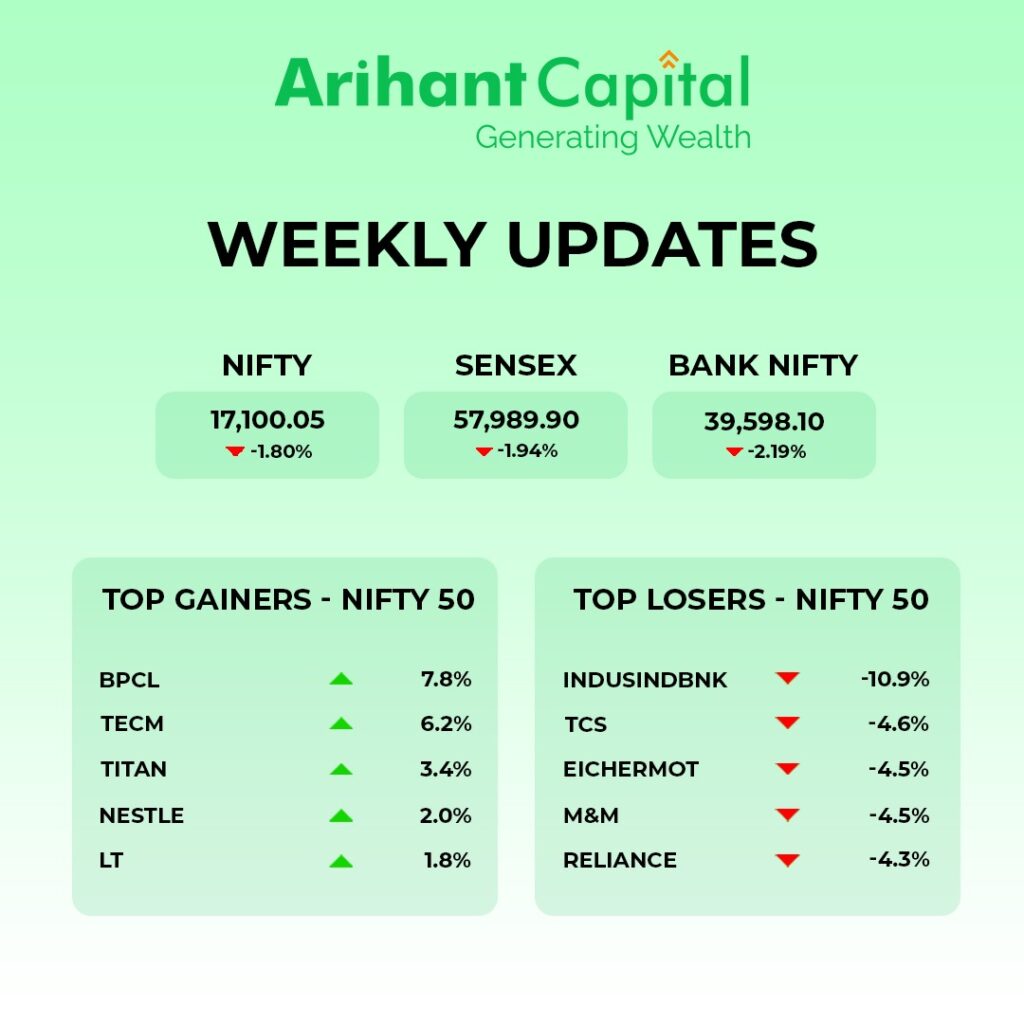

The Indian benchmarks ended higher on Friday after swinging amid volatility, some of which might be caused by the Credit Suisse crisis. On a weekly basis, the headline indices declined the most in three weeks. This week, Nifty slipped below the 17,000 level for the first time in over five months.

S&P 500 advanced after the index rallied 1.8% yesterday as larger banks threw a lifeline to First Republic Bank. Banks including JPMorgan Chase & Co. and Citigroup Inc. banded together in a show of support for the First Republic on Thursday. Nifty ended 313 points down at the 17,100 level. Sensex was down by 1.94% and stood at 57,990.

Going forward, we continue to believe the market to remain range bound. The market would be looking for advanced tax numbers from various corporations.

Channel checks suggest a pick up in gold loan disbursement companies in the last few weeks. Muthoot Finance and Manappuram Finance are worth keeping on the radar. We have price objectives of ₹1,250 and ₹160 respectively. Biocon looks interesting at current levels.

This week, we learned that Adani Group prepaid share-backed loans worth $2.1 billion as well as $500 million borrowed to acquire Ambuja Cements. The group also informed its lenders that it will pause some proposed investments and focus on the ones where work has already started.

This Friday, Adani Enterprises, Adani Wilmar, and Adani Power moved out of the short-term additional surveillance measures (ASM) framework. However, on Monday, Adani Green Energy and NDTV will be moved to the long-term ASM framework.

In this Article

- Stock Market Outlook

- Stock Picks

- Quick Bites

- IPO Corner

- Sustainability Corner

- Updates on Silicon Valley Bank

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

If we look at the daily chart of Nifty, we see that it is trading below the 200-day SMA level and forming a “DOJI” candle. On the weekly chart, we are observing that it is still trading below the lower trend line. If we analyze both charts, it indicates that now the market can be in a consolidation zone and high volatility can be seen in the market. If Nifty starts trading above the 17,250 level, then it can touch the 17,350-17,500 levels. While on the downside, support is 16,850, and if it starts to trade below that, Nifty can test levels of 16,600-16,450.

Bank Nifty

If we look at the daily chart of Bank Nifty, we see that it is trading above its 200-day SMA level and forming a “HAMMER” candlestick. On the weekly chart, we see that it is taking support from the lower trend line. If we analyze both charts, it indicates that Bank Nifty can outperform Nifty. In the coming trading session, if it trades above 39,800, it can touch 40,200-40,500 levels. However, downside support comes at 39,400. Below this, we can see the Bank Nifty test 39,100-38,800 levels.

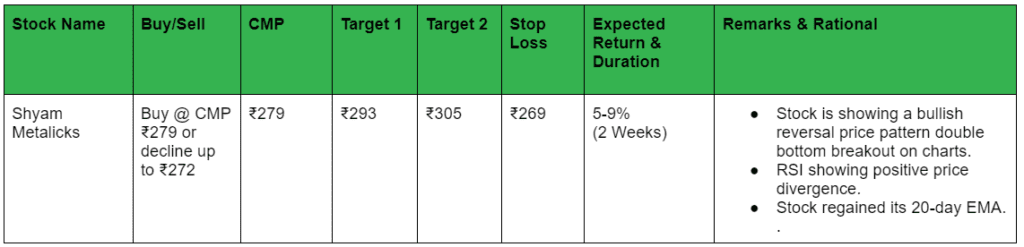

💰Stock Picks

– Ms Kavita Jain, Sr Research Analyst, and Learning Head, Arihant Capital

Quick Bites

Global

- US inflation drops to 6% in February from 6.4% in January.

- The Chinese economy shows signs of post-COVID recovery as industrial output and retail sales increase 2.4% and 3.5% in January-February on a YoY basis.

Economy

- Retail inflation dips to 6.44% in February from 6.52% in January but stays above RBI’s target range.

- Crude oil prices fall to a 15-month low due to rising supply and banking system turmoil.

- 101 projects worth ₹60,872 cr were identified under PM Gati Shakti’s plan for ports and shipping.

- So far in March, FPIs have invested more than ₹8,000 cr in Indian financial markets as per NSDL data.

Banking and Finance

- IDBI Bank‘s privatization plan worth $4 billion might be postponed over concerns that market volatility might discourage investors.

- PNB Housing Finance receives approval from SEBI to raise up to ₹2,500 cr through a rights issue of shares.

- Paytm disbursed loans worth ₹8,086 cr in January and February, up 286% on a YoY basis.

- The merger between HDFC and HDFC Bank receives approval from National Company Law Tribunal (NCLT).

- Tablesh Pandey gets appointed as LIC’s managing director with effect from April 1.

IT and Telecommunications

- TCS CEO, Rajesh Gopinathan, resigned to pursue other interests, and K Krithivasan was named as CEO designate.

Automobiles

- Exports of 2-wheelers, 3-wheelers, and passenger vehicles declined 35% in February on a YoY basis.

Real Estate

- DLF generates sales of over ₹8,000 cr in just 3 days by selling luxury flats in Gurugram.

- HUDCO announces interim dividend of ₹0.75 per share.

Mining

- Hindustan Zinc Ltd‘s plan to acquire Vedanta’s zinc assets might be blocked by the government; it owns 29.5% of HZL.

- Coal India is scaling up production in anticipation of an extended summer and is optimistic about supplying 25% of its target for FY2024 in Q1.

- Vedanta’s pledged shares were freed as the majority owner repays $250 million to Standard Chartered Bank and Barclays Bank.

Energy and Infrastructure

- NTPC’s subsidiary was named as the nodal agency for 4 GW gas-based power supply.

- NTPC was offered $460 million by Petronas for a 20% stake in its green energy arm.

Oil

- PSUs including Indian Oil Corporation and Oil India Ltd are facing issues in accessing dividend payments worth $400 million stuck in Russia.

- GAIL receives approval to acquire JBF Petrochemical for ₹2,079 cr.

Defence

- Stocks of Bharat Forge, Bharat Electronics, and Hindustan Aeronautics rise on Friday as Defence Acquisition Council approves ₹70,500 cr worth of proposals.

Pharma

- Eris Lifesciences buys 9 dermatology brands from Dr Reddy’s Laboratories for ₹275 cr.

Manufacturing

- A consortium of Ramkrishna Forgings and Titagarh Wagons wins a bid to supply 80,000 forged wheels per annum over 20 years.

- Blackstone to sell remaining stake in Sona BLW Precision Forgings for $630 million through block deals that are expected to close on Monday.

Other

- Patanjali Foods fails to meet the public shareholding norm, so, exchanges freeze promoter shares.

- Reliance Industries Ltd receives approval from CCI to acquire Metro AG’s cash and carry business in India for ₹2,800 cr.

- Zee Entertainment Enterprises agrees to repay ₹83.7 cr to IndusInd Bank to wrap the Sony deal

🚀IPO Corner

- Global Surfaces IPO subscribed 12.21 times with retail investors subscribing 5.12 times.

- Divgi TorqTransfer Systems lists at ₹600, a 1.69% premium to the issue price, and closed at ₹605.50.

🔌Sustainability Corner

- NTPC commissions a first-of-its-kind commercial green coal project in Varanasi.

- NLC India plans to invest ₹1,000 cr for a 51% stake in a green energy joint venture with APDCL.

- In February, TVS Motor Company’s iQube recorded monthly wholesale sales at 15,522 units, the highest since its launch in January 2020. The iQube has surpassed the 10,000 units sales mark for the fourth consecutive month.

- Honda Motorcycle and Scooter India will start a new manufacturing line in Gujarat. The company will announce EV plans by the end of March and its factory in Karnataka is likely to be the base for EVs.

- Honda plans a new assembly line at the Gujarat plant and targets sales of 300,000 Shine 100s a year. It will announce an EV strategy with Karnataka as the likely base.

- TVS Group company and Tier 1 supplier, Brakes India, eyes demand from the growing EV industry and launches brake pads with advanced friction technology for electric vehicles.

- Cummins launches Accelera brand to advance the transition to a zero-emissions future. The range of solutions includes hydrogen fuel cells, batteries, e-axles, traction systems, and electrolyzers to sustainably power a variety of industries.

- Okinawa Autotech clocks sales of 250,000 electric scooters in India six years after starting production. It plans a network expansion from 542 touchpoints to over 1,000 by 2025 and is set to launch a new electric motorcycle co-developed with Tacita of Italy.

- Ola Electric recalls its S1 scooters to fix the front fork suspension issue and offers a free upgrade to the new front fork.

- ZF displays a new brake-by-wire solution for off-highway vehicles at CONEXPO 2023 in Las Vegas. Electro-Hydraulic braking solution supports the rapid transition to electric and autonomous vehicle applications.

🪜 Updates On Silicon Valley Bank

Tech companies, especially start-ups, suffered a blow when Silicon Valley Bank (SVB) and Silvergate Bank collapsed. On Thursday, the minister of state for electronics and IT stated that start-up deposits worth $200 million have been moved to GIFT City from SVB.

Typically, when US regulators seize a bank, like what happened with SVB, the bank will close on a Friday and a buyer will be secured by Sunday night. This ensures that when markets reopen, the panic doesn’t spread.

But, even a week later, no buyers have emerged for SVB. Things do not look rosy as SVB’s parent group filed for bankruptcy protection on Friday.

📬Also Read: Sustainable Investing in India: ESG Investments