Udayshivakumar Infra Limited IPO is live. Should you Invest?

Udayshivakumar Infra Limited IPO is live. Should you Invest? Find out here.

In this article

📃About Udayshivakumar Infra Limited IPO

Incorporated in 2019, Udayshivakumar Infra Limited is engaged in the business of the construction of roads.

Udayshivakumar Infra Limited is an ISO 9001:2015, ISO 14001:2015, and ISO 45001:2018 company. They construct roads including State Highways, District Roads, Smart Roads under Municipal Corporations, Smart Roads under PM’s Smart City Mission projects, National Highways, Bruhat Bengaluru Mahanagara Palike (BBMP), and Local Area Roads in various Taluka Places, etc.

The company primarily operates in the State of Karnataka. They bid for Roads, Bridges, Irrigation & Canals Industrial Area construction in Karnataka, this includes National Highways (MORTH), State Highway Development Corporations Ltd., (SHDP), Government Departments such as Karnataka Public Works Ports & Inland Water Transport Department (KPWP & IWTD), Davanagere Harihara Urban Development Authority (DHUDA), and many more.

As of August 31, 2022, the Company had executed over 30 projects in and around the State of Karnataka and the erstwhile partnership firm, M/s. Udayshivakumar. The entity is working on twenty-five ongoing projects.

To gear up its operations and scale larger, the company is also looking to undertake projects in the joint venture with other infrastructure companies in the industry.

💰Issue Details of Udayshivakumar Infra IPO

- IPO open from 20 March 2023 – 23 March 2023

- Face value: ₹10 per equity share

- Price band: ₹33 to ₹35 per share

- Market lot: 428 shares

- Minimum Investment: ₹14,980

- Listing on: BSE and NSE

- Offer for sale: fresh Issue ₹66 Cr

- Registrar: MAS Services Limited

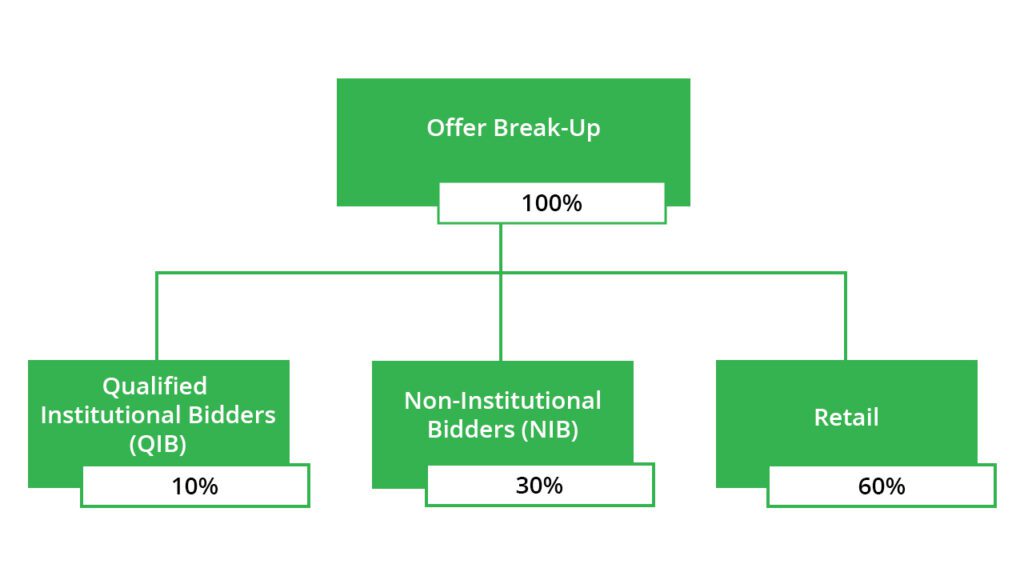

🪚Offer Breakup

🔭IPO Object

The Company proposes to utilize the net proceeds from the fresh issue towards the following objects:

- Funding incremental working capital requirements of our Company.

- General corporate purpose.

⛓️IPO Strength

Some of the qualitative factors and strengths which form the basis for computing the offer price are:

- Experienced management team

- Strong Order Book of roads, bridges, flyovers and irrigation projects from the state government

- Strong execution capabilities with industry experience

🧨IPO Risk

- The majority of their revenue is from civil construction, their financial condition would be materially and adversely affected if they e fail to obtain new contracts or their current contracts are terminated.

- A significant portion of their revenues from a limited number of clients. The loss of any significant clients may have an adverse effect on their business, financial condition, results of operations, and prospects.

- The business currently is primarily dependent on projects in India undertaken or awarded by governmental authorities. Any adverse changes in the central or state government policies may lead to our contracts being foreclosed, terminated, restructured or renegotiated, which may have a material effect on our business and the results of operations.

- The business has been relatively concentrated in the state of Karnataka, consequently, they are exposed to risks emanating from economic, regulatory and other changes in these locations which we may not be able to successfully manage and may adversely affect their business.

⚖️Peer Companies

- KNR Constructions Limited

- PNC Infratech Limited

- HG Infra Engineering Limited

- IRB Infrastructure

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-20 | ₹158.26 | ₹194.41 | ₹10.49 |

| 31-Mar-21 | ₹146.82 | ₹211.11 | ₹9.32 |

| 31-Mar-22 | ₹162.61 | ₹186.39 | ₹12.15 |

📬Also Read: Sustainable Investing in India: ESG Investments