Dodla Dairy IPO – Should you invest?

Listing gains likely for Dodla Dairy given the IPO frenzy in the market, however, for long-term investors, we recommend to buy on dips post-listing after watching the company’s earnings growth and focus on expanding its value-added product offerings.

In this article

- IPO offer details

- How will the company use funds?

- Offer break-up

- Understand Dodla Dairy’s business

- Key risks of the company

- Should you invest in Dodla Dairy IPO?

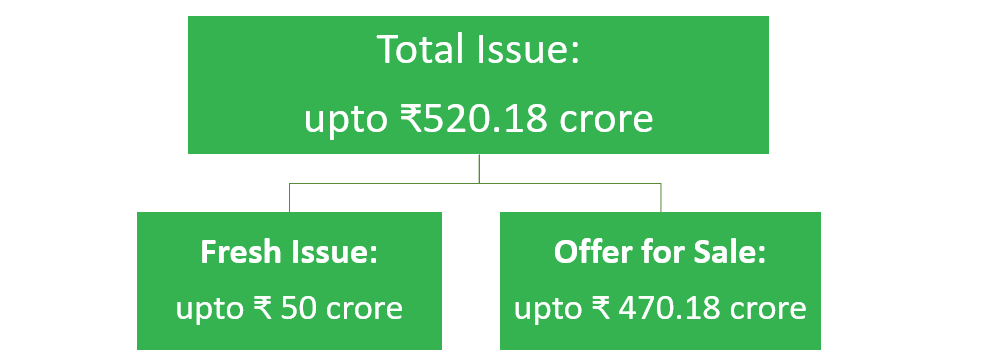

Dodla Dairy, a leading dairy company in southern India, is all set to raise ₹520.18 cr through its initial public offering (IPO), as the dairy company seeks to repay its debt and the promoters look to raise cash through selling their holdings. The IPO opens today and closes for subscription on 18th June 2021.

The maiden offer comprises of a fresh issue of upto ₹50 cr and an offer-for-sale of upto ₹470.18 cr (~1.09 cr equity shares) by promoters and private equity investors.

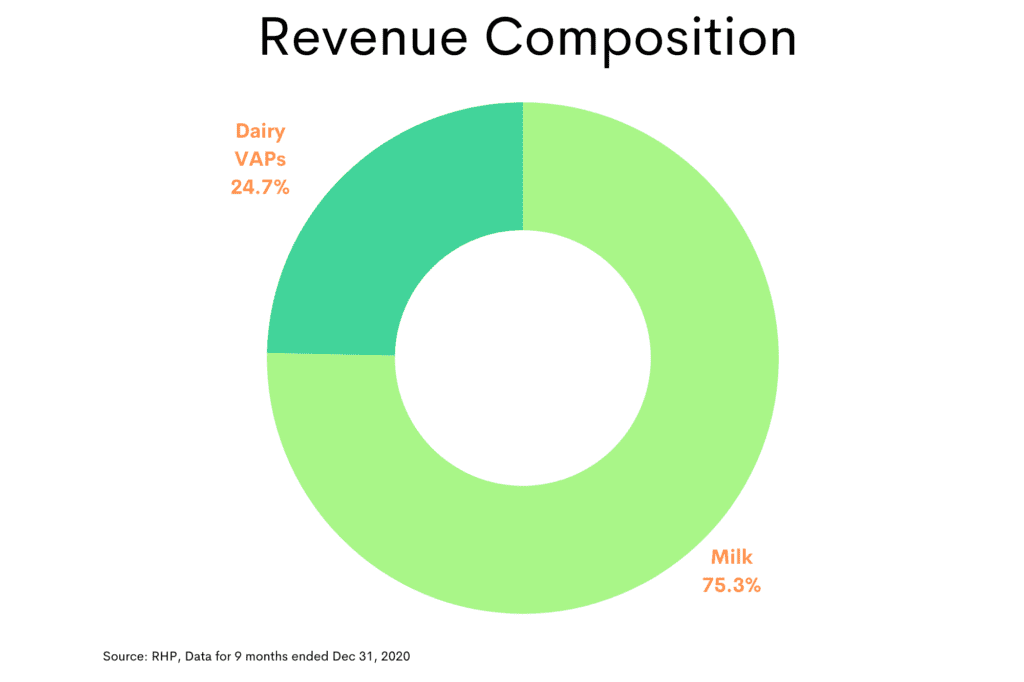

While the company has a range of dairy-based value-added products (VAPs), over seventy-five percent of its revenue comes from the sale of processed milk, according to its red herring prospectus (RHP). It has a stronghold in the southern India market in the branded consumer market.

The company, on Tuesday said it has raised a little over ₹156 cr from anchor investors ahead of its initial share-sale. Those participated in the anchor bidding included SBI Mutual Fund (MF), Aditya Birla Sun Life MF, Edelweiss MF, Kuber India Fund, Saint Capital Fund and Integrated Core Strategies Asia Pte Ltd.

IPO offer details

- IPO open from: June 16th – June 18th 2021

- Face value: ₹10

- Price Band: ₹421-428

- No. of shares: 12,173,092 – 12,153,668

- Market Lot: 35 shares

- Listing on: BSE and NSE

- Fresh Equity Issue: up to ₹50 cr

- Offer for sale: up to ₹470.18 cr

- Total issue: up to ₹520.18 cr

- Promoters: Dodla Sunil Reddy, Dodla Sesha Reddy, and Dodla Family trust

- Book running lead managers: ICICI Securities Ltd, Axis Capital Ltd

- Registrar: KFin Technologies Pvt Ltd.

After the successful completion of the IPO, the promoters’ shareholding will drop from 68.52% to 64.17% and the rest will be held by the public.

What is an IPO and should you invest in them?

How will the company use funds?

According to the promoter Mr. Sunil Reddy Dodla, the object of the issue is to retire the company from its debt and make it debt-free. The freed-up leverage capacity will improve its ability to raise further resources in the future and allow utilisation of internal accruals for business growth and expansion

The company will use the proceeds from the fresh issue to repay its borrowings to the tune of ₹32.26 that it availed from bankers including ICICI Bank, HDFC Bank and HSBC Bank. The remaining funds will be used as per following:

- ₹7.151 cr for capital expenditure requirements including investments in existing manufacturing technologies and automation of the Kurnool processing plant.

- Upto 25% of the fresh issue for general corporate purposes, such as capital expenditure, funding growth opportunities, and brand building

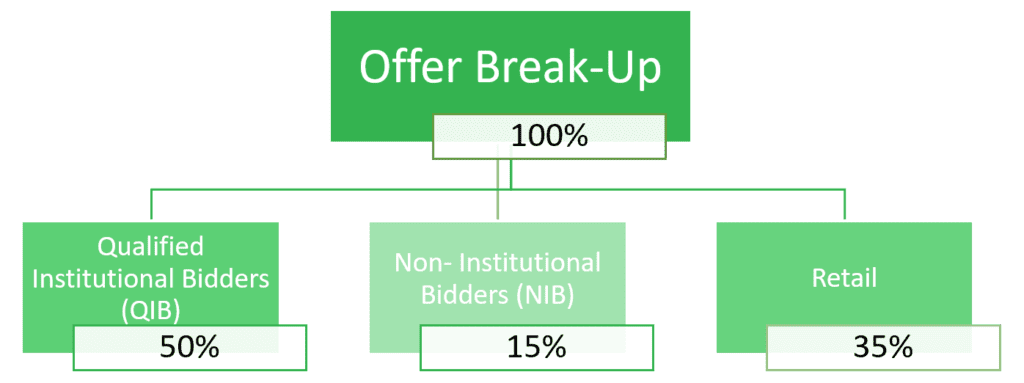

Offer Break-up

The offer is broken up into the following investor classes:

Understanding Dodla Dairy’s Business

Promoted by Dodla Sunil Reddy, Dodla Sesha Reddy, and Dodla Family Trust, and incorporated in 1995, Dodla Dairy Limited is the third largest dairy company in terms of milk procurement per day with an average procurement of 1.03 million litres of raw milk per day (MLPD) as on March 31st, 2021, according to its RHP. It is also the second-largest in terms of market presence amongst all Indian private dairy players with a significant presence in southern India.

The company’s operations in India are primarily across the four states — Andhra Pradesh, Telangana, Karnataka and Tamil Nadu. Its international operations are based in Uganda and Kenya. The company engages in procurement, processing, distribution and marketing operations of milk as well as dairy based VAPs such as curd, ghee, butter, flavoured milk and ice cream amongst others.

In FY19, DDL acquired a cattle feed and mixing plant with a capacity of 80 MTPD in Andhra Pradesh for the purpose of manufacturing and selling cattle feed to farmers through its procurement network. It has successfully integrated its cattle feed operations with its existing procurement network through its subsidiary OPL.

Its Indian operations are mainly undertaken under the brand name of “Dodla”, “Dodla Dairy”, and “KC+” whereas it serves overseas market under the brand name of “Dodla Dairy”, “Dairy Top”, and “Dodla+”.

Its processing operations consist of processing of the collected raw milk into packaged milk and manufacturing of other dairy based VAPs by 13 processing plants with an aggregate installed capacity of 1.70 MLPD. The company has a strong distribution network of 40 sales offices, 3336 distribution agents, 863 milk distributors, and 449 product distributors across 11 states in India.

The company also commenced overseas operations in FY 2015 through the acquisition of Hillside Dairy and Agriculture Limited through their Subsidiary Lakeside Dairy Limited in Africa.

It has a long-term relationship with dairy farmers and has very stringent quality control processes in place, giving it a strong ground in the market.

Company Product Portfolio

- Consumer Products (India): Pasteurized pouch milk, UHT milk, Sterilized flavored milk, Curd (Dahi), Butter, Clarified butter (ghee), Butter milk, Lassi, Ice creams, Paneer, Kulfi, Milk based sweets

- Consumer Products (Africa): UHT milk, yogurt with different flavours, ghee, paneer, cheese and UHT milk

| Dodla Dairy | Hatsun Agro | Heritage Foods | Creamline Dairy | Tirumala Milk | |

| Milk | ✓ | ✓ | ✓ | ✓ | ✓ |

| Curd | ✓ | ✓ | ✓ | ✓ | ✓ |

| Buttermilk | ✓ | ✓ | ✓ | ✓ | ✓ |

| Lassi | ✓ | ✓ | ✓ | ✓ | ✓ |

| Flavored Milk | ✓ | ✓ | ✓ | ✓ | ✓ |

| Ghee | ✓ | ✓ | ✓ | ✓ | ✓ |

| Butter | ✓ | ✓ | ✓ | ✓ | ✓ |

| Paneer | ✓ | ✓ | ✓ | ✓ | ✓ |

| Ice-cream | ✓ | ✓ | ✓ | ✓ | ✓ |

| Dairy-whitener | X | ✓ | ✓ | X | X |

| Milk powder | X | ✓ | X | X | X |

| Cream | X | ✓ | X | X | X |

| SMP | ✓ | ✓ | X | ✓ | X |

| Other product | Milk-cake, basundi, dood peda | Santosa cattle feed | NA | Milk-cake, mishit dahi, dood peda | Condensed milk snacks |

Key Risks

- High dependence on supply of raw milk – inability to procure adequate amounts of raw milk from farmers and third-party suppliers, at competitive prices, may have an adverse effect on business, results of operations and financial condition.

- Contingent liabilities – the company has certain contingent liabilities totalling ₹165 cr that has not been provided for in its financial statements. If these materialise, it could adversely affect its financials.

- Concentration in south India – Dodla Dairy is a regional player with a very high concentration of processing plants, procurement in southern India. Any adverse developments affecting this region could have an adverse effect on the business, results of operations and financial condition.

- Competition: The dairy industry is a very competitive industry. Its inability to compete with dairy cooperatives may adversely affect results of operations and financial condition.

- Impact of Covid-19 on business: The COVID-19 pandemic has affected and may continue to affect company’s business, results of operations and financial condition in a number of ways, including a decrease in their sales volume by 20% and in their revenues by 12% from the period December 31, 2019 to December 31, 2020.

While COVID-19 has directly affected the business and operations, there is significant uncertainty regarding the duration and impact of the COVID-19 pandemic, as well as possible future responses, which makes it impossible for the company to predict with certainty the impact that COVID-19 will have on them and their customers at this time. Any intensification of the COVID-19 pandemic or any future outbreak of another highly infectious or contagious disease may adversely affect their business, results of operations, and financial condition.

Valuations

On the upper price band of ₹428 and EPS of ₹14.57 for FY20, the P/E ratio works out to be 47.8x. On annualizing the 9MFY21 EPS, the P/E ratio is 15.4x. which is low compared to Parag Milk Foods (trading at 32.7x) and Hatsun (79.1x). However, it is high when compared with Heritage that is trading at 12.1x PE.

The company margins were on declining mode between FY18 to FY20, however it posted high margins for 9MFY21. We feel that the 9MFY21 margins were abnormal and will normalize going forward which in turn will also lower the RoE of 23.7% in FY21.

We believe the key determinants of revenue growth as well as profitability for DDL in the coming 3-5 years will be:

- strengthening direct milk procurement,

- right product mix,

- rising acceptance of value-added milk, and

- distribution expansion.

Should you invest in Dodla Dairy IPO?

The company’s major revenues come from processed milk while the composition of its VAPs is at ~24 percent only. The margins in the processed milk industry is tightening, while the VAPs offer lucrative profits. We believe DDL would perform better on the back of an increase in value-added product mix.

Given the decent valuations compared to peers, we believe the company could offer listing gains, especially considering the frenzy in the IPO market. High-risk investors wanting to cash out on listing gains can consider investing in the IPO.

As for the long-term prospect, once the company demonstrates increased business in its VAPs and earnings growth going forward, one could consider buying even post listing on dips.

P.S. – For vegans and animal lovers, this is not the right stock to invest in as dairy is one of the cruelest industries in the world. Cows and buffalos are tortured and once they stop producing milk are sold to the leather industry. There are better companies you can seek for investment that are free from cruelty.