Market is likely to continue the profit booking mode in absence of any fresh positive trigger

Weekly Wrap

The Indian market closed the week ended December 06, 2019, on a negative note, halting its 5-week long winning streak. The BSE Sensex fell 0.85% to end the week at 40,445.15 while the NSE Nifty 50 was down 1.1% for the week to close at 11,921.50. The highlight of the week was the much anticipated RBI policy meet on December 5, however RBI spoiled the market mood by surprisingly hitting the pause button on rate cut. Market participants were widely expecting a further rate cut from RBI to spur up the economic activity which has hit the nadir, as reflected in last week’s 6-year low GDP growth number of 4.5%. Not getting the much anticipated rate cut breather from RBI market went into profit booking mode and continued its downward move to end the week on a negative note.

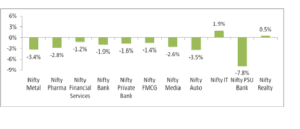

Sectoral Performance for the Week

Among sectoral indices, 9 out of the 11 sectoral indices ended in red for the week, led by Nifty PSU Bank Index’s 7.8% loss. Other prominent losers for the week were Nifty Auto (-3.5%), Nifty Metal (-3.4%), Nifty Pharma (-2.8%), Nifty Media (-2.6%), Nifty Bank (-1.9%), Nifty Private Bank (-1.6%), Nifty FMCG (-1.4%) and Nifty Financial Services (-1.2%), while Nifty Realty (+0.5%) and Nifty IT (+1.9%) closed the week on a positive note.

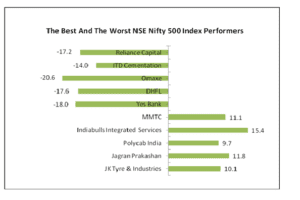

Best & Worst Performers for the Week

The broader markets also closed the week on a negative note, as the Nifty 500 Index closed 0.9% lower for the week, led by loss in companies like Yes Bank, Reliance Capital, Omaxe, ITD Cementation and DHFL. Despite overall market weakness, some of the stocks outperformed. The best performers for the week were Indiabulls Integrated Services (+15.4%), Jagran Prakashan (+11.8%), MMTC (+11.1%), JK Tyre & Industries (+10.1%), and Polycab India (+9.7%). On the other hand, the worst performers for the week were Omaxe (-20.6%), Yes Bank (-18%), DHFL (-17.6%), Reliance Capital (-17.2%) and ITD Cementation (-14%).

Market Outlook Going Forward – Market is likely to continue the profit booking mode in the absence of any fresh positive trigger

With GDP growth touching 26-quarter low, there was hope from the investor community that RBI in its December policy meeting will cut the benchmark repo rate to kick start the economy. However, RBI has hit the pause button citing increasing inflationary risk, though maintaining accommodative stance. The MPC significantly increased its CPI inflation forecast for H2FY20 to 5.1-4.7% from the earlier 3.5-3.7%. The MPC also considerably reduced its GDP forecast for FY20 to 5% from the previous 6.1%. This latest disappointment from RBI has triggered a market sell-off. Also the rally of last two months had inflated the valuation of Indian market, hence some profit booking was anyways overdue. In the global arena also, global economy since October 2019 did not show any improvement and factors that have constrained its growth has more or less remained intact. Also the uncertainty over signing of the Phase-I trade deal between China and US has potential to turn investors into the risk-off mode. As a result we remain cautious on the Indian market from near term perspective and believe in the coming week market is likely to continue its profit booking mode in absence of any fresh positive trigger.

Know more Weekly Report Click Here: Arihant Research Report