Inflation’s Beat, RBI’s Seat: Will the Rhythm Stay Neat? | Stock Market Weekly Update Oct 07

Hello Readers!

We hope you had a great week!

Amidst the hustle and bustle of India’s economic stage, the RBI held a pivotal meeting, shaping the financial rhythm of the nation.

Here’s a peek into the financial symphony that played out

The Reserve Bank of India (RBI) recently had a meeting where they discussed how they manage money in the country. They decided to keep the main lending rate at 6.5%, which is the rate at which banks borrow money from the RBI. This rate has stayed the same for a few times now, showing they want to keep things stable.

They also talked about controlling the amount of money available in the country. If too much money is around, prices tend to go up. So, they want to control this in a way that prices don’t increase too quickly.

The RBI mentioned their predictions for the country’s economy. They think India’s economy will grow by 6.5% in the future. Additionally, they expect the prices of things we buy (like food, clothes, etc.) to go up by about 5.4%. This information helps them plan how they handle money in the country.

The person in charge of the RBI, called Governor Shaktikanta Das, said that right now, it’s essential to be cautious with money to manage these prices. He also mentioned that India has the potential to become a significant player in the world’s growth.

Governor Das shared that they are happy to see people and businesses borrowing money at a good rate from the banks. This is a sign that the economy is doing reasonably well. Also, businesses providing services (like education, healthcare, etc.) are growing, which is a good thing for India. It means more opportunities and jobs for people.

🧾In this Article

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

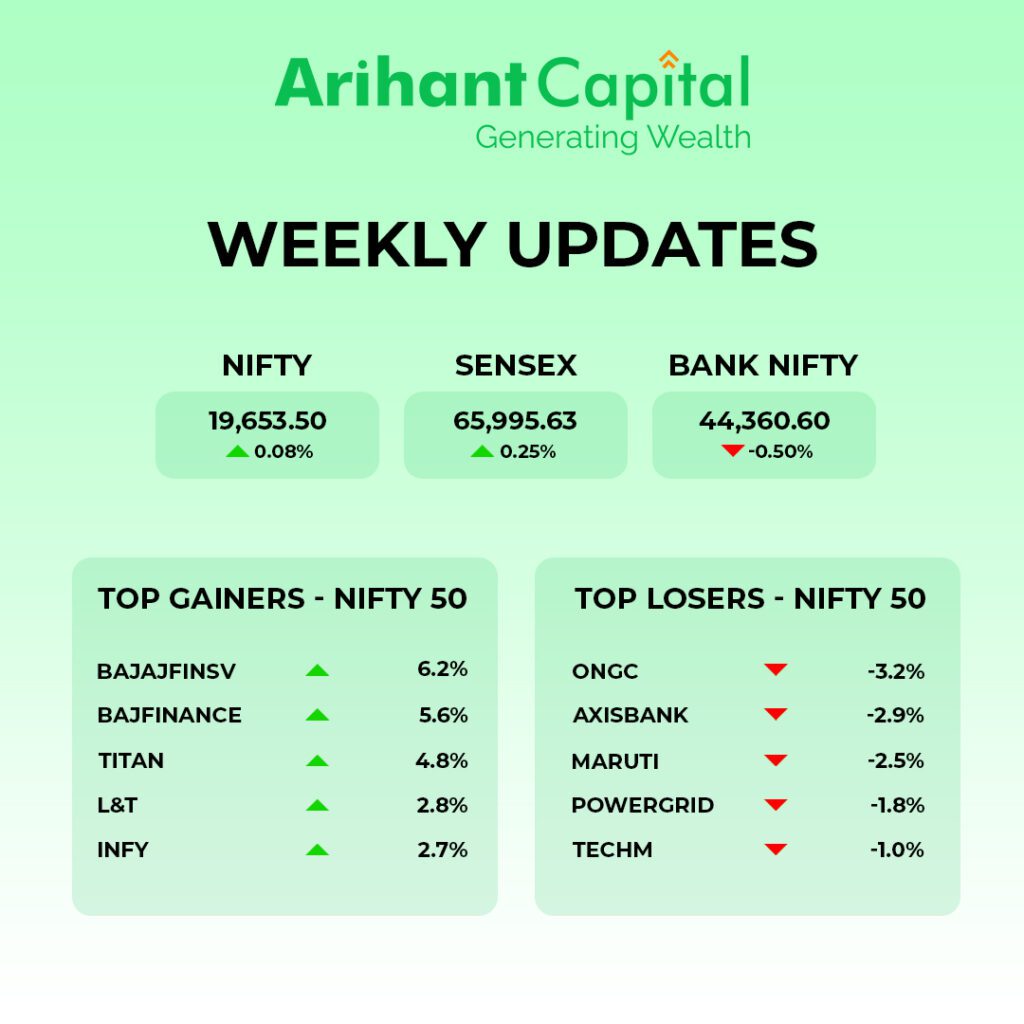

Nifty

If we look at the daily chart of Nifty, we are observing an “Island Reversal” pattern formation & with prices close above 50Day SMA & on the weekly chart, we are observing a “Doji” candlestick formation. Analyzing both chart patterns indicates that we can now see stock-specific action in the market. If Nifty starts trading above the 19,750 level, then it can touch the 19,850-20,050 level, while on the downside, support is 19,500, and if it starts to trade below, then it can test the level 19,350 and 19,200 levels.

Bank Nifty

If we look at the daily chart of Bank-Nifty, we observe a series of “Narrow” range body formations & on the weekly chart “, Doji” candlestick formation. If we analyze both chart patterns, it indicates that bank-nifty can see some more range-bound trade. Bank-nifty starts trading above 44,500, then can touch 44,700 and 44,950 levels. However, downside support comes at 44,200; below that, we can see 44,050 and 43,900 levels.

🔎Stocks in News

📅 TCS: Board will consider a share buyback proposal on 11 Oct.

📋 Sun Pharma: Submitted a New Drug Application in the US for alopecia treatment.

⛽ InterGlobe (IndiGo): Introduced a fuel surcharge, up to ₹1,000, to counter the Aviation Turbine Fuel (ATF) costs.

🏭 Apollo Micro Systems: Planning to establish a new facility with a ₹150 cr investment.

📊 BCL Industries: Board has granted approval for a 1:10 share split proposal.

⚠ NHPC: Temporarily shut down its operational Teesta-V hydropower station in Sikkim due to a flash flood.

💸 Bajaj Finance: Plans to raise ₹8,800 cr through a Qualified Institutional Placement (QIP).

📝 TCS: Secured a contract from the Georgia State government (USA) to modernize the unemployment insurance system.

💰 BHEL: Distributed a final dividend of ₹88 cr to the Government of India for the fiscal year 2022-23.

💰 ICICI Bank: Raised ₹4,000 cr by issuing long-term bonds.

📅 Nestle India: Board of directors will consider the split of its equity shares on 19 Oct.

🏢 Bajaj Finserv: Subsidiary Bajaj Allianz General Insurance Company received a show cause notice of ₹1,010 cr on 3 Oct.

⚒ NMDC: Reported a 10% increase in iron ore production in September.

🔄 IDFC First Bank: Planning to raise ₹3,000 cr through QIP.

📈 RVNL: Secured an order worth ₹1,098 cr from the Himachal Pradesh State Electricity Board.

🏢 Kalpataru Projects: Won an order worth ₹1,016 cr for power transmission, distribution, and factory business segment.

📈 Adani Enterprises: Abu Dhabi’s IHC Capital Holding LLC raised its stake in the company to over 5%.

📰 Quick Bites

📱 Over 3 cr Indians are expected to switch to 5G Phones in 2023: According to Ericsson.

🏭 India’s coal production rose 15.81% YoY to 67.21 million tonnes in Sept.

🏭 India’s manufacturing sector activity (PMI) stood at 57.5 in Sept vs 58.6 in Aug.

💵 RBI has extended the last date to deposit ₹2,000 notes till Oct 7.

📊 India’s unemployment rate stood at 7.09% in Sept vs 8.10% in August: According to the Centre for Monitoring Indian Economy.

📶 India’s mobile download speed jumped 72 ranks with the launch of 5G services: It now ranks 47th in Speedtest Global Index, says Ookla.

📅 SEBI has extended the deadline for market rumour verification by 4 months to 1 Feb, 2024: After this rule, listed companies will have to publish their statements on rumours about them that are circulating in media reports.

🚗 Auto sales stood at a record high in September: Car sales rose 2.4% YoY to 3.61 lakh units.

🏠 Housing sales across 8 big Indian cities rose by 12% YoY in July-Sept to 82,612 units, a 6-year high quarterly sales value: Knight Frank.

💸 The Indian government has hiked the subsidy for Ujjwala Scheme beneficiaries to ₹300 per cylinder from ₹200.

🌐 NPCI will sign an agreement with Al Etihad Payments in Abu Dhabi to enable cross-border transactions.

🚗 Audi reported an 88% YoY increase in sales in India — 5,530 units in the Jan-Sept period.

Also Read: How to Trade Above Freeze Quantity in Options on Arihant Plus?