Netweb Technologies India Limited IPO is live. Should you Invest?

Netweb Technologies India Limited IPO is live. Should you Invest? Find out here.

In this article

- IPO details

- Issue details

- Offer Breakup

- IPO Strengths

- Key Risks

- Netweb Technologies India Limited Financials

📃About Netweb Technologies India Limited

Incorporated in 1999, Netweb Technologies India Limited provides high-end computing solutions (HCS).

Netweb Technologies’ HCS offerings Comprise: High-performance computing (Supercomputing / HPC) systems, Private cloud and hyper-converged infrastructure (HCI), AI systems and enterprise workstations, High-performance storage (HPS / Enterprise Storage System) solutions, Data center servers, and Software and services for our HCS offerings.

Netweb Technologies designs manufactures and deploys HCS comprising proprietary middleware solutions, end-user utilities, and precompiled application stack. It develops homegrown compute and storage technologies and deploys supercomputing infrastructure to meet the rising computational demands of businesses, academia, and research organizations under India’s National Supercomputing Mission. Two of the company’s supercomputers have been listed 10 times in the world’s top 500 supercomputers.

As of February 28, 2023, the company has undertaken installations of over 300 Supercomputing systems, over 50 private cloud and HCI installations, over 4,000 accelerator / GPU-based AI systems and enterprise workstations, and HPS solutions with throughput storage of up to 450 GB/ sec.

Netweb Technologies caters to marquee customers across various end-user industries such as information technology, information technology-enabled services, entertainment and media, banking, financial services and insurance (BFSI), national data centres, and government entities including in the defence sector, education and research development institutions (Application Industries) such as Indian Institute of Technology (IIT) Jammu, IIT Kanpur, NMDC Data Centre Private Limited (NMDC Data Centre), Airamatrix Private Limited (Airamatrix), Graviton Research Capital LLP (Graviton), Institute of Nano Science and Technology (INST), HL Mando Softtech India Private Limited (HL Mando), Dr. Shyam Prasad Mukherjee International Institute of Information Technology, Naya Raipur (IIIT Naya Raipur), Jawaharlal Nehru University (JNU), Hemvati Nandan Bahuguna Garhwal University (Hemvati University), Akamai India Networks Private Limited (Akamai), A.P.T. Portfolio Private Limited (A.P.T.), and Yotta Data Services Private Limited (Yotta).

The company also caters to an Indian Government space research organization and an R&D organization of the Ministry of Electronics and Information Technology, Government of India which is involved in carrying out R&D in information technology and electronics and associated areas including Supercomputing.

💰Issue Details of Netweb Tech India Ltd IPO

- IPO open from 17th July 2023 – 19th July 2023

- Face value: ₹2 per equity share

- Price band: ₹475 to ₹500 per share

- Market lot: 30 shares

- Minimum Investment: ₹15,000

- Listing on: BSE and NSE

- Offer for sale: ₹500 Cr (Fresh Issue: ₹500Cr)

- Registrar: Kfin Technologies Limited

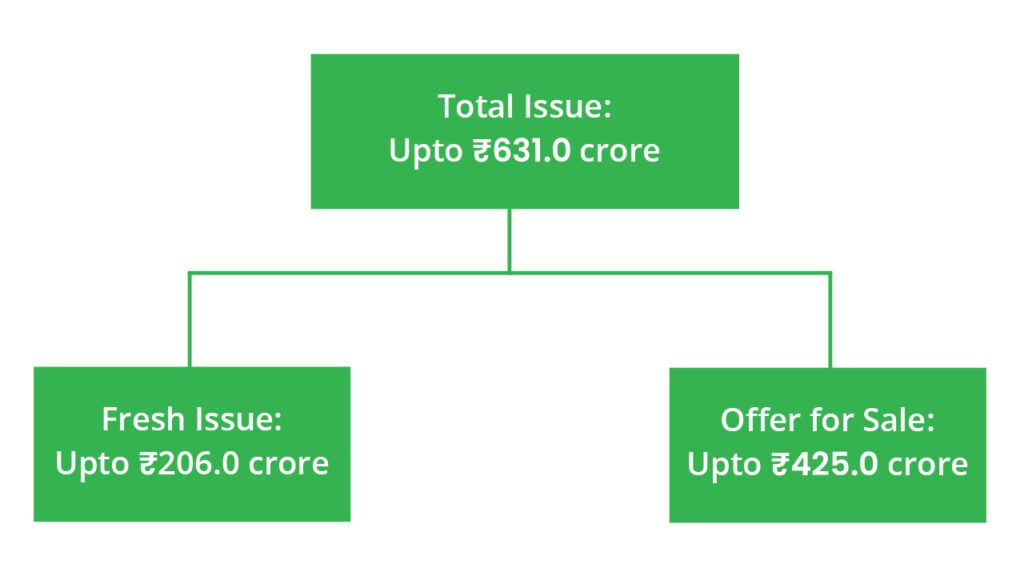

🪙Total Issue Price

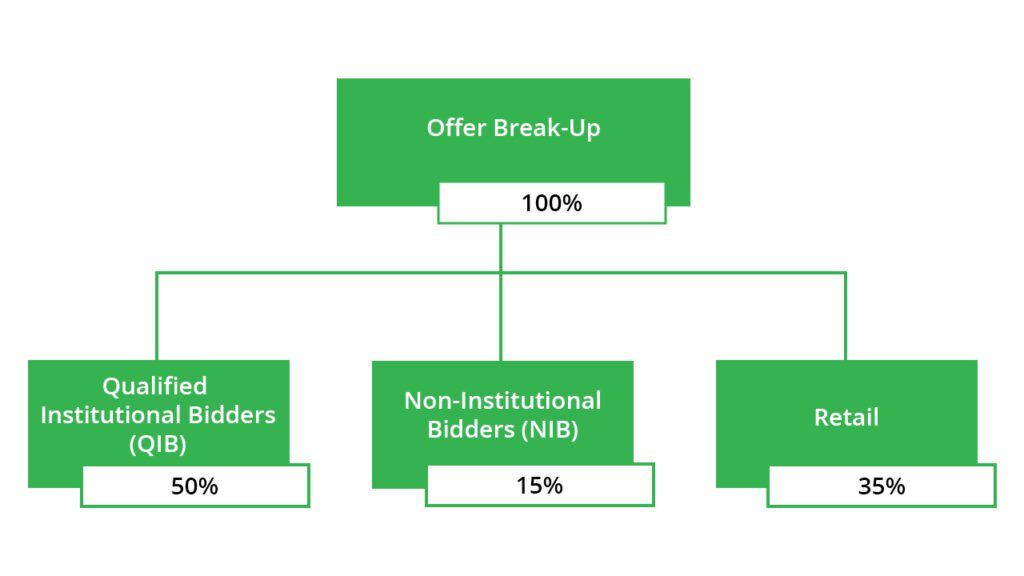

🪚Offer Breakup

🔭IPO Object

The company intends to utilize the net proceeds from the issue towards the funding of the following objects:

- Funding capital expenditure requirements for civil construction of the building for the surface mount technology (SMT) line and interior development, and purchase of equipment/machinery for the new SMT production line (SMT Line),

- Funding of long-term working capital requirements,

- Repayment or pre-payment, in full or in part, of certain outstanding borrowings, and

- General corporate purposes.

⛓️IPO Strength

Some of the qualitative factors and strengths which form the basis for computing the Offer Price are:

- One of India’s leading Indian-origin owned and controlled OEM for HCS with integrated design and manufacturing capabilities

- Long-standing relationship with a marquee and diverse customer base;

- Significant product development and innovation through R&D;

- Experienced Board and Senior Management

- They are one of India’s leading HCS provider and they operate in a rapidly evolving and technologically advanced industry with high entry barriers;

🧨IPO Risk

- Their success is dependent on their long-term relationship with their Customers. In particular, they are heavily reliant on their top 10 Customers.

- They derive a majority portion of their revenues from operations from a select few of their HCS offerings. Loss or decline in the demand for such offerings may result in an adverse effect on their business, revenue from manufacturing operations, and financial condition.

- They are heavily reliant on their Promoters, Key Managerial Personnel, Senior Management and persons with technical expertise. Failure to retain or replace them will adversely affect their business.

- A significant proportion of their orders are from government-related entities which award the contract through a tender process. Their performance could be adversely affected if they cannot successfully bid for these contracts or are required to lower their bid value.

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-21 | ₹110.20 | ₹144.29 | ₹8.23 |

| 31-Mar-22 | ₹148.61 | ₹247.94 | ₹22.45 |

| 31-Mar-23 | ₹265.95 | ₹445.65 | ₹46.94 |

PEER COMPANIES

- Syrma SGS Technology Limited

- Kaynes Technology India Limited

- Dixon Technologies (India) Limited

📬Also Read: Sustainable Investing in India: ESG Investments