💡 A Strategic Move: RIL’s Demerger to Focus on Core Businesses 🔍|Stock Market Weekly Update July 15

RIL’s Demerger to Focus on Core Businesses | Indian Stock Market Weekly Update

Hello Readers!

🚀 Reliance Industries (RIL) has recently announced a significant move that has caught the attention of investors and market enthusiasts alike – the demerger of its financial services business. The new entity, Jio Financial Services (JFS), will be listed separately on the stock exchanges, and existing RIL shareholders are entitled to receive one share of JFS for each share of RIL they hold.

This 1:1 demerger ratio has created a buzz of excitement among investors, as it presents a unique opportunity to be part of a new and potentially promising business segment. 🎉

The rationale behind this strategic move can be viewed from different angles. One perspective suggests that RIL’s stock price has witnessed a lacklustre performance in recent years, leading to a desire to create fresh demand for the company’s shares.

However, a more plausible theory revolves around the issue of leverage. Typically, financial services companies rely on borrowing money before lending it out, which adds to their overall debt burden. By demerging JFS and listing it as a separate entity, RIL can present a clearer financial picture to investors, focusing on its core businesses while mitigating concerns related to debt levels. 💡

JFS has the potential to attract a diverse set of investors, especially institutional players looking to capitalize on India’s booming fintech wave without necessarily investing in RIL’s other business verticals. This move allows for targeted investment in the financial services segment, where JFS can tap into a vast customer base. The company will have immediate access to a captive audience, including the 400 million users of Jio telecom, the massive footfall of nearly 800 million people in Reliance Retail stores, and the 2 million merchants onboarded on the JioMart grocery platform. 💹

The financial services market in India is highly competitive, and JFS will have to navigate challenges and seize opportunities to establish itself as a formidable player. However, there are several factors in its favour.

Firstly, JFS has assembled a strong team, including experienced professionals from the banking industry, under the guidance of legendary banker KV Kamath. This ensures that the company has the required expertise to run its operations effectively. 👨💼

Secondly, JFS enjoys a significant advantage when it comes to distribution. The access to valuable consumer behaviour data available through various Reliance businesses can provide valuable insights for underwriting and risk management. Moreover, Jio’s backing ensures a top-notch credit rating from the outset, enhancing the company’s credibility in the financial market. 📊

Despite the promising prospects, potential investors should approach this opportunity with caution. 🚧🤔 While JFS offers exciting possibilities, it remains a speculative bet until the roadmap and execution strategy for the financial services entity is clearly defined.

🧾In this Article

📊 Weekly Update

– Mr Abhishek Jain, Head of Research, Arihant Capital

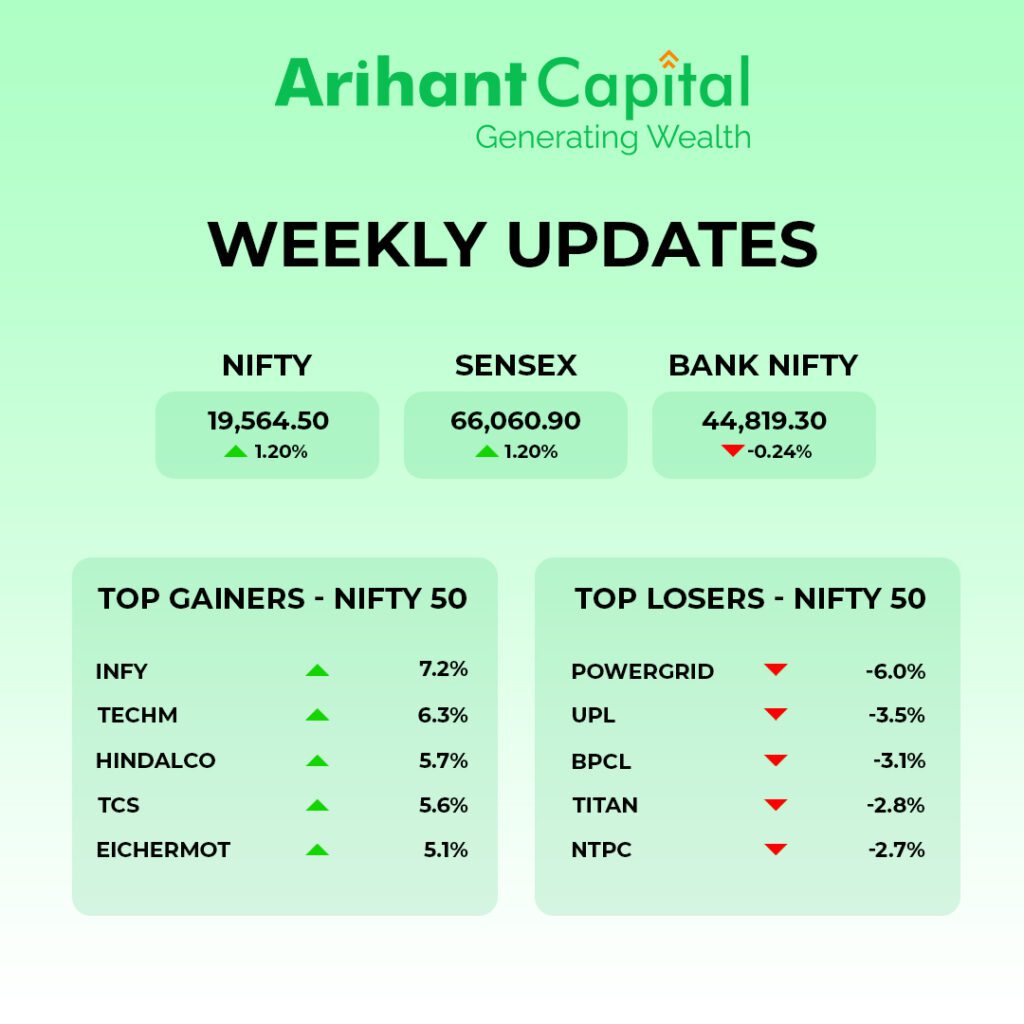

Last Friday, the Indian stock market indices reached new record highs, driven by strong performances in information technology, media, metals, and realty stocks. This positive momentum was also reflected in global stocks, which experienced their most significant weekly gains since November. Investors speculated that the United States monetary policy tightening might soon come to an end. The Japanese yen, on the other hand, strengthened for the seventh consecutive day.

Contributing to the Nifty index’s gains were companies like Infosys Ltd., Tata Consultancy Services Ltd., HCL Technologies Ltd., LTIMindtree Ltd., and Tech Mahindra Ltd. However, some heavyweights like Reliance Industries Ltd., HDFC Bank Ltd., Axis Bank Ltd., Mahindra & Mahindra Ltd., and ITC Ltd. exerted downward pressure on the index.

The Nifty closed on a positive note, rising by 0.78% to reach the 19,565 level. The Sensex also saw an increase of 0.74%, reaching 66,661 points, while Nifty Bank was up 0.35% at 44,819.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital.

Nifty

If we look at the daily and weekly charts of the Nifty, we are observing a breakout of consolidation, which suggests positive momentum may continue. If Nifty starts trading above the 19,600 level, then it can touch the 19,750–19,900 level, while on the downside, support is 19,450, and if it starts to trade below, then it can test the levels of 19,350 and 19,200.

Bank Nifty

If we look at the daily and weekly charts of the Bank Nifty, we are observing a series of narrow-range body formations that suggest some consolidation may continue. In the coming week, if it trades above 45,100, it can touch 45,350 and 45,600 levels. However, downside support comes at 44,750, and below that, we can see 44,600 and 44,450 levels.

💰Stock Picks

– Ms. Kavita Jain, Sr Research Analyst, and Learning Head, Arihant Capital.

🔎Stocks in News

🔔 Indraprastha Gas: announced the launch of IGL Genesis Technologies, a joint venture between IGL and Genesis with an equity split of 51:49.

💳 Paytm: signed an agreement with the Goa govt to facilitate digital payments.

📉 Nykaa: institutional investor Government Pension Fund Global has reduced its stake in the company to 1.13% during the June quarter from 1.15% in the prior quarter.

💼 Tata Communications: will consider a proposal to issue non-convertible debentures on a private placement basis on 19 July.

👨💼 Orient Electric: has announced the resignation of Rajan Gupta from the position of MD and CEO.

💰 HDFC Bank: on-boarded over 1 lakh customers and more than 1.7 lakh merchants on the CBDC (Digital Rupee) pilot program.

🔄 LTIMindtree: replaced HDFC in Nifty 50.

🌿 Adani Green: reported a 70% year-on-year rise in its June quarter energy sales to 6,023 million units.

💻 HCL Tech: will acquire Germany-based ASAP Group.

🚀 L&T: mentioned that it has supplied various components for India’s moon mission Chandrayaan-3.

✈️ SpiceJet: promoter Ajay Singh will invest ₹500 cr in the company.

🏢 ITC: reappointed Sanjiv Puri as the chairman and managing director.

⚙️ Suzlon: got a new order for the development of a 47.6 MW wind power project for The KP Group.

📺 ZEE: NCLT has reserved its order on the merger of Zee Entertainment Enterprises and Sony Pictures Networks India.

🔌 Minda Corp: got a ₹750 cr order to produce battery chargers for electric vehicles.

💳 SBI Cards: CEO Rao Amara has resigned. Deputy MD Abhijit Chakravorty will be the next CEO.

⚡ Coal India: subsidiary South Eastern Coalfields Ltd is planning to develop solar power projects with 600 MW capacity.

🚗 CarTrade Tech: will acquire Sobek Auto India Private Limited (OLX Autos).

🍟 Quick Bites

🚀 Chandrayaan-3 was launched from the Satish Dhawan Space Centre in Sriharikota at 2.35 pm today.

💼 Credo Banks Marketing Ltd has filed draft IPO papers with SEBI.

🛢️ India’s edible oil imports grew by 39.31% year-on-year in June to 13.11 lakh tonnes.

💰 Utkarsh Small Finance Bank (SFB) IPO has been subscribed 101.91 times. Retail investors subscribed to the issue 72.11 times.

💰 Senco Gold opened at a premium of nearly 36% compared to the issue price.

✈️ Akasa Air is planning to add up to 800 new workers this financial year: CEO Vinay Dube. 🍔 Swiggy will acquire LYNK Logistics.

💼 Netweb Technologies IPO will open on 17 July. The price band is Rs 475-500 per share. 💰 The International Monetary Fund (IMF) has approved a $3 billion loan agreement for Pakistan.

📈 Retail inflation in India rose to 4.81% in June after a 25-month low of 4.25% in May.

🏭 India’s industrial production rose to 5.2% in May from 4.5% in April 2023.

💰 The GST Council has decided to impose a 28% tax on casinos, online gaming, and horse racing. Other decisions – restaurants in theatres will be charged 5% GST vs 18% earlier, rise in cess on SUVs by 2%, cancer drug Dinutuximab and satellite launching services exempted from GST.

💸 Union Finance Ministry has released ₹7,532 crore to 22 state governments for their State Disaster Response Funds (SDRF).

🌱 Sustainability Corner

🚗 Mahindra & Mahindra and NXP Semiconductors have joined hands to develop smart electric mobility and connectivity solutions for utility vehicles, commercial vehicles, farm equipment, and tractors.

💼 HCL Technologies is set to acquire ASAP, an engineering services company specializing in autonomous driving and e-mobility, to expand its presence in Germany and other regions.

🚙 Maruti Suzuki is considering integrating Advanced Driver Assistance Systems (ADAS) in its vehicles, evaluating the feasibility of the safety technology on Indian roads.

📈 In Q1 FY 2024, SUV and MPV sales in India grew by 18%, with Maruti Suzuki and Mahindra leading the pack, while Tata Motors and Kia faced tough competition.

💡 The government’s GST council clarified the definition of Utility Vehicles (UVs) to prevent misclassification and tax evasion of Sports Utility Vehicles (SUVs).

⚡ Fortum’s EV charging business in India is now ‘Glida’, aiming to serve one-third of EVs on Indian roads by 2030.

🚗 Indian automotive industry’s Q1 FY 2024 trends: Passenger vehicle sales hit a record high, commercial vehicles declined, two-wheelers grew by 11%, and electric three-wheelers surged by 102%.

📊 SIAM India’s wholesale numbers for June 2023: Car and SUV sales growth declined to 2%, electric three-wheeler sales surged by 81%, scooter sales declined by 8%, and motorcycle sales grew by 7%.

💰 Minda Corporation secured a contract worth ₹750 crore for manufacturing EV battery chargers at Spark Minda Green Mobility Systems in Pune.

💡Knowledge Candy🍬: Change in Expiry Days for Bank Nifty F&O Contracts on NSE! 🔄

Here’s some interesting news from the National Stock Exchange (NSE) – they’re shaking things up a bit with the expiry days for futures and options contracts! Starting September 4, 2023, Bank Nifty’s weekly F&O contracts will now expire on Wednesdays instead of Thursdays. So, mark your calendars for the first Wednesday’s weekly expiry on September 6, 2023!

💥 According to NSE, all weekly contracts will expire on Wednesday of every week, except for the expiry week of the monthly contract. And hey, if Wednesday happens to be a trading holiday, then the expiry day will be the previous trading day.

But don’t worry, the monthly and quarterly contracts of Bank Nifty are not changing. They’ll still expire on the last Thursday of every month/quarter. So, no major disruptions there!

📅 Keep an eye out for these updates.

Happy trading!

Also Read: Understanding ESG Investing & Its Emergence in India