Nifty slips below 18,000 amid weak global cues | Weekly Market Wrap-up 25-29 Oct

From a steep market fall and 29% fall of IRCTC on Thursday to big bang IPOs and corporate results, it was an action-packed volatile week for the Indian stock markets.

Diwali mood has set in and everyone is gearing up for the upcoming festive season.

Market Wrap-Up

The week started on a strong note, with Nifty and Sensex closing in green on strong global cues. However, they went on a slippery route thereafter amid weak global cues. A fresh outbreak of COVID-19 cases in Europe, Russia, and China dented investors’ sentiments. China’s lockdown announcement went the world markets on a tizzy. Lanzhou, a city of four million people, was put under a strict lockdown amid the latest surge in Covid-19 cases in China.

Investors also squared off positions ahead of the monthly F&O expiry. Sensex slipped below the psychological 60,000 mark on Thursday and continued the downfall through Friday.

The Nifty slipped below 18,000-level and ended the week at 17671.65, down 2.43% while BSE Sensex closed the week at 59306.93, down 440.05 points or 2.49%. The Mid-Cap index lost 1,514.69 points and was down 4.24% and closed the week at 25,566.64 level. Among the top gainers were Ultratech Cement (6.8%), ICICI Bank (5.63%), UPL (5.09%), Asian Paints (3.95%) and Shree Cement (3.23%) while Axis Bank (-9.15%), Adani Ports (-9.03%), NTPC (-8.45%), BPCL (-6.61%) and Coal India (-6.51%) turned out to be biggest losers.

| NIFTY | SENSEX | BANKNIFTY | |

| LAST WEEK | 18,111.70 | 60,821.62 | 40,314.85 |

| CURRENT WEEK | 17,671.65 | 59,306.93 | 39,115.60 |

| CHANGE | -440.05 | -1,514.69 | -1,199.25 |

| % CHANGE | -2.43% | -2.49% | -2.97% |

Top and Worst Performers of the week

| Sector | Current Week | Last Week | Change | % Change |

| NIFTY BANK | 39,115.60 | 40,323.65 | -1,208.05 | -3.00% |

| NIFTY AUTO | 11,297.45 | 11,433.95 | -136.50 | -1.19% |

| NIFTY FINANCIAL SERVICES | 18,792.85 | 19,302.95 | -510.10 | -2.64% |

| NIFTY FMCG | 38,222.10 | 38,874.80 | -652.70 | -1.68% |

| NIFTY IT | 34,408.75 | 35,394.65 | -985.90 | -2.79% |

| NIFTY MEDIA | 2,246.00 | 2,281.55 | -35.55 | -1.56% |

| NIFTY METAL | 5,563.40 | 5,690.10 | -126.70 | -2.23% |

| NIFTY PHARMA | 13,879.35 | 13,949.65 | -70.30 | -0.50% |

| NIFTY PSU BANK | 2,825.15 | 2,823.25 | 1.90 | 0.07% |

| NIFTY PRIVATE BANK | 20,192.20 | 20,951.80 | -759.60 | -3.63% |

| NIFTY REALTY | 498.7 | 510.6 | -11.90 | -2.33% |

| NIFTY HEALTHCARE INDEX | 8,612.75 | 8,594.30 | 18.45 | 0.21% |

| NIFTY CONSUMER DURABLES | 28,242.30 | 28,335.20 | -92.90 | -0.33% |

| NIFTY OIL & GAS | 7,704.30 | 7,928.10 | -223.80 | -2.82% |

Market Outlook for the week

Nifty View: If we look at the daily chart of Nifty, the “Bearish” candle formation is visible and it is also trading below short-term moving averages. On the weekly front, Nifty has given a trendline breakout. If we combine both the data sets, it looks like the Nifty index may consolidate with some pressure. Nifty has to cross the 17,750 level to see a bounce towards 17,825 and 17,900 levels, while on the downside support if it crosses below 17,650 then it can taste the level of 17,500 and 17,380 levels.

Bank Nifty View: Consolidation is on the cards for Bank Nifty as it is trading at short-term moving averages on the daily chart and on the weekly chart it has given a trendline breakout. Last week Bank Nifty closed at 39,448 levels. In the coming trading session, if it holds below 39,250 then the weakness may drag it to 39,050 and 38,800 levels. Although, minor resistance on the upside is capped around 39,820-40,040 levels.

📺 Quick bites

- Morgan Stanley downgrades India equities on high valuation, follows Nomura, UBS.

- Bharti Airtel has informed the government that it will opt for the four-year moratorium on payment of AGR and spectrum dues

- JSW Steel announced its plans to invest around USD 20 million to set up a steel plant in Jammu and Kashmir.

- Reliance Jio and Google announced that the JioPhone Next will be available for buying from Diwali. It has been priced at Rs 6,499.

- Dabur India announced that it will enter the diapers segment in India, as part of its strategy to expand its baby care portfolio.

- Tata Motors unveiled 21 new commercial vehicles, including trucks and buses.

- Sun Pharmaceutical launched its medicine ILUMYA in Canada. It is used in the treatment of adults with moderate-to-severe plaque psoriasis.

- Fiscal deficit stood at ₹5.26 lakh crore at the end of September, 2021.

- The finance ministry has reportedly approved 8.5% interest rate on provident fund (PF) deposits for 2020-21.

Key Results this week

- ICICI Bank’s net profit for the September quarter rose 29.6% to ₹5,510.95 crore as compared to ₹4,251.33 crore in the same period last year.

- Kotak Mahindra Bank’s net profit rises 7% to ₹2,032 crores. Net interest income, difference between interest earned on loans and interest given on deposits, rose 3% to ₹4,020 crores. Bank’s net NPA rose to 1.06% from 0.64%.

- Axis Bank reported a net profit of ₹3,133 crores, an all-time high for the bank and an 86% increase yoy. Net interest income rose 8% to ₹7,901 crores. Asset quality improved qoq but worsened yoy. Net NPA was at 1.08% in the July to September quarter, 1.2% during the June quarter and 0.98 during the September quarter last year.

- Bajaj Finance net profit jumps 53% to ₹1,481 crores. Net interest income rose 28% to ₹5,335 crores.

- Titan Company net profit zooms 270% to ₹641 crore while the jewellery company’s sales jumped 75% to ₹7,243, yoy.

- Maruti Suzuki reported a net profit of ₹475 crores, down 65.35% yoy. Net sales for the quarter declined 9.09% to ₹19,297.80 crore yoy.

- Tech Mahindra reported net profit of ₹1,338 crores, up 26% yoy but down 1.1% qoq. Revenues were up 16% to ₹10,881 crores from last year. The company declared a special dividend of ₹15 per share.

- Dr Reddy’s Laboratories reported a 30% yoy rise in consolidated net profit at ₹992 crore. The drugmaker also reported an 18% yoy rise in consolidated revenues to ₹5,763 crore

- Cipla reported net profit of ₹711 crores, 7% rise yoy but down 0.47% sequentially. Revenue inched up 0.28% qoq to ₹5,519.8 crore, up 10% yoy.

🚀 IPO Corner

Our detailed IPO analysis report with recommendations of ongoing IPOs.

- Nykaa IPO Review: क्या मिलेगा मोटा मुनाफा?

- Policybazaar IPO – Everything you need to know about PB Fintech Limited IPO

Ongoing IPOs:

- Nykaa IPO was subscribed 3.47 times at 4pm of Day 2

- Fino Payments Bank Limited 0.39 times at 4 pm of Day 1

Upcoming IPOs: This festive season will see many IPOs hitting the market starting Monday, including ₹5,625 crores Policybazaar IPO

- Policybazaar: 01 Nov to 03 Nov

- Sigachi Industries: 01 Nov to 03 Nov

- SJS Enterprises: 01 Nov to 03 No

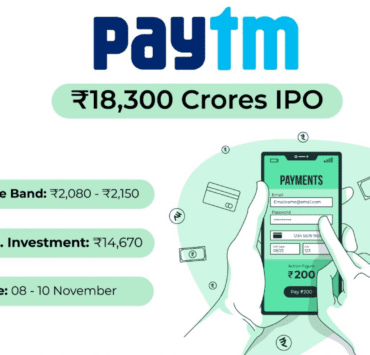

- Paytm: 08 Nov to 10 Nov; price band of ₹2,080-2,150

- Sapphire Foods India: 09 Nov to 11 Nov

🔌EV and Sustainability Corner

Key sustainability news from India Inc includes renewable energy, net-zero commitments, electric vehicles.

- Greaves Cotton’s e-mobility arm, Greaves E-mobility recorded 111% revenue growth, yoy. The company now has over 1 lac electric vehicle consumers, making it one of the fast-growing EV brands in the country. Moreover, October witnessed highest sales numbers for Greaves Electric Mobility standing at 5,000 units as on 25th Oct’21 & exceeded 500 retails in one day. The demand for its electric two-wheelers (Ampere electric scooters) and electric three-wheelers (Ele electric rickshaws & MLR e-autos) has been increasing month-on-month, making it a preferred choice in EV segment.

- Odisha state government has announced a full exemption of motor vehicles taxes and registration fees on purchase of electric vehicles (EVs).

- Tata Power and Tata Steel will together develop grid-connected solar plants in Jharkhand and Odisha. The two companies have signed a Power Purchase Agreement (PPA) for a duration of 25 years to set up 41MW solar project, which will be a combination of rooftop, floating and ground mounted solar panels (Free Press).

- Tata Motors bags order for 3,500 XPRES-T EV units from BluSmart Mobility (ET).

- Bajaj Auto managing director Rajiv Bajaj, during the launch of the new Bajaj Pulsar, took a dig at EV startups and coined new terms such as ‘BET’ and ‘OATS’ (short for Ola, Ather, Tork and SmartE). Talking about the future of electric vehicles, Bajaj said that he puts his trust in ‘BET’ (Bajaj, Enfield and TVS).

- Maruti Suzuki will launch EVs only after 2025, said company’s chairman RC Bhargava, as demand for such vehicles at the moment is less. They want to launch EVs once the market becomes slightly matured.

- Reliance BP Mobility Ltd (RBML), the fuel and mobility joint venture of Reliance Industries Ltd (RIL) and British multinational oil and gas company BP, launched its first Jio-bp branded mobility station at Navde, Navi Mumbai. The company has brought a range of services for consumers on the move, including additivised fuels, electric vehicle charging, refreshments and food, and plans to offer more low-carbon solutions over time, the company said in a statement.

- Tata Power now has a network of more than 1,000 electric vehicle (EV) charging stations across the country.

- An expert panel found that ONGC was to blame for the mass mortality of coconut trees in the Konaseema region of East Godavari district.

- Infosys and BP are planning to co-develop a digital platform that can optimise the energy supply and demand for power, heat, cooling and electric vehicle charging.

- The CO26 kickstarted on October 31st in Glasgow. Prime Minister Narendra Modi will be participating in a World Leaders Summit to be held next week as part of the COP.