R R Kabel Limited’s IPO is live. Should you Invest?

In this article

📃About R R Kabel Limited

Incorporated in 1995, R R Kabel Limited provides consumer electrical products for residential, commercial, industrial, and infrastructure purposes.

R RKabel has two broad segments:

- Wires and cables, including house wires, industrial wires, power cables, and special cables; and

- FMEG, including fans, lighting, switches, and appliances.

The company undertakes the manufacturing, marketing, and selling of wires and cable products under ‘The RR Kabel brand and fans and lights under the ‘Luminous Fans and Lights brand.

In 2020, R R. Kabel acquired Arraystorm Lighting Private Limited and obtained light emitting diode (LED) lights and related hardware business (LED Lights Business) along with its trademarks and design certificates, to expand their portfolio to cover office, industrial, and warehouse spaces. In 2022, the company acquired the home electrical business (HEB) of Luminous Power Technologies Private Limited and obtained a limited and exclusive license to use the Luminous Fans and Lights brand for fan and light products for a maximum period of four years with a one-time option to renew the permit for three months further and, that includes a right to use 61 registered trademarks, and a portfolio of lights and premium fans, to strengthen our FMEG portfolio.

The company has two manufacturing units located at Waghodia, Gujarat, Silvassa, Dadra and Nagar Haveli, and Daman and Diu, which primarily manufacture wire cables and switches. Apart from that, it owns and operates three integrated manufacturing facilities located at Roorkee, Uttarakhand; Bengaluru, Karnataka; and Gagret, Himachal Pradesh, which carry out manufacturing operations in respect of FMEG products.

R RKabel’s clientele comes from both the domestic market and international markets. In the last three months ending June 30, 2023, 71% of its revenue from operations came from the wires and cables segment, and 97% of the income from operations went from the FMEG segment, from the B2C channel.

💰Issue Details of R R Kabel Limited

- IPO open from 13th Sep 2023 – 15th Sep 2023

- Face value: ₹5 per equity share

- Price band: ₹983 to ₹1035 per share

- Market lot: 14 shares

- Minimum Investment: ₹14,490

- Listing on: BSE and NSE

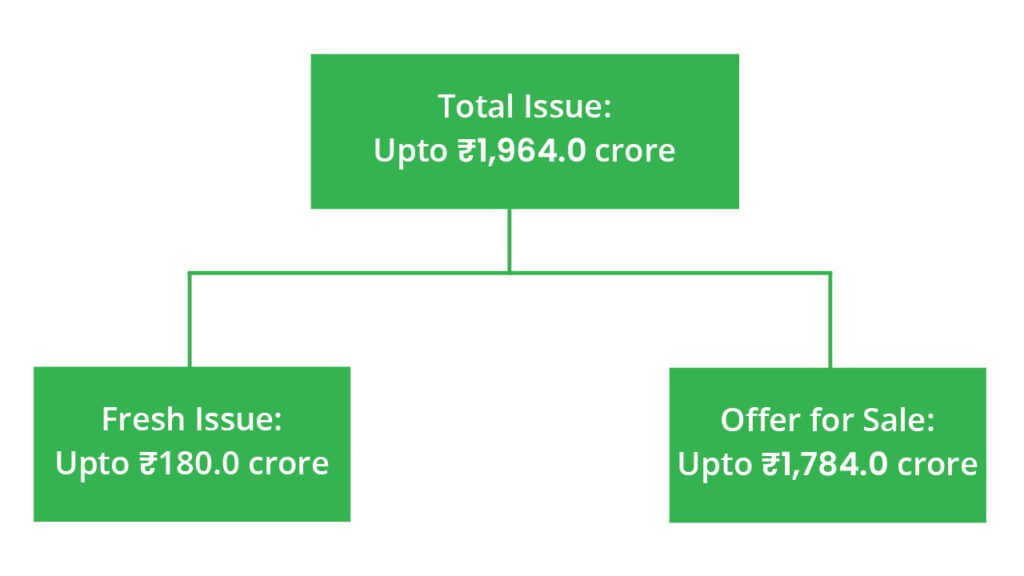

- Offer for sale: Approx ₹1964 Cr (Fresh Issue: ₹180 Cr + OFS ₹1784 Cr)

- Registrar: Link Intime India Private Ltd

🪙Total Issue Price

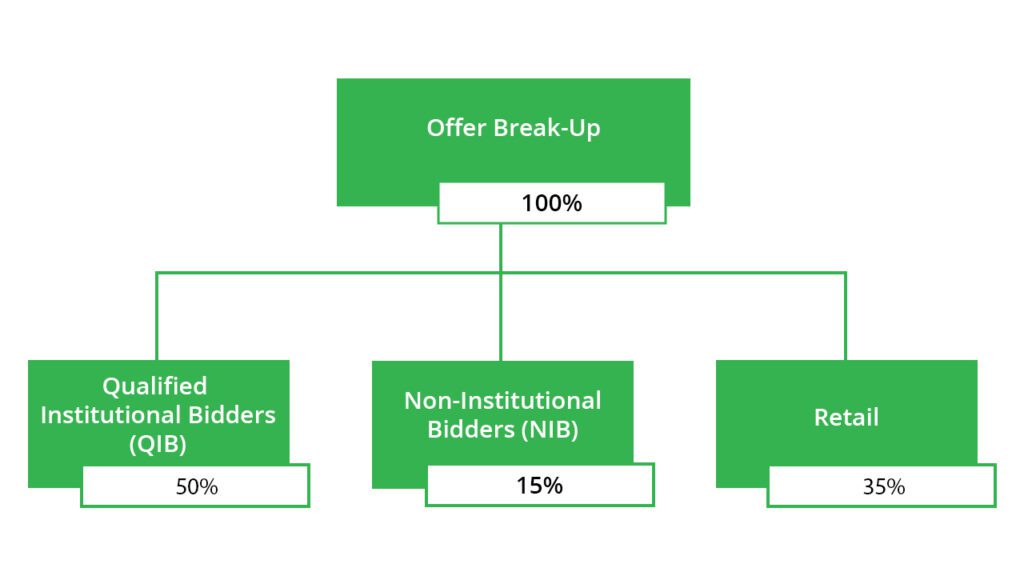

🪚Offer Breakup

🔭IPO Object

The company intends to utilise the net proceeds from the issue towards the funding of the following objects:

- Repayment or prepayment, in whole or in part, of borrowings availed by the company from banks and financial institutions.

- General corporate purposes.

⛓️IPO Strength

Some of the qualitative factors and strengths that form the basis for computing the Offer Price are:

- Scaled B2C business in the large and growing wires and cables industry.

- Extensive domestic and global distribution network

- A diverse suite of products driven by their focused research and development efforts with global certifications and accreditations.

- Technologically advanced and integrated precision manufacturing facilities.

- Well-recognized consumer brands.

🧨IPO Risk

- The costs of the raw materials they use in manufacturing are volatile due to factors beyond their control. Increases or fluctuations in raw material prices may adversely affect their business, financial condition, results of operations and cash flows.

- Any shortages, delays or disruption in the supply of the raw materials they use in their manufacturing process due to factors beyond their control may adversely affect their business, financial condition, results of operations and cash flows.

- Their inability to maintain the stability of their distribution network across their distribution channels and attract additional distributors, dealers and retailers may adversely affect their results of operations and financial condition.

- Their inability to handle risks associated with their export sales could negatively affect their sales to customers in foreign countries and their operations and assets in such countries.

- They depend highly on their Key Managerial Personnel and Senior Management Personnel for their business. The loss of or their inability to attract or retain such persons could adversely affect their business performance.

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-21 | ₹1715.11 | ₹2745.94 | ₹135.40 |

| 31-Mar-22 | ₹2050.64 | ₹4432.22 | ₹213.94 |

| 31-Mar-23 | ₹2633.62 | ₹5633.64 | ₹189.87 |

PEER COMPANIES

- Havells India Limited

- Polycab India Limited

- KEI Industries Limited

- Finolex Cables Limited

- V-Guard Industries Limited

- Crompton Greaves Consumer Electricals Limited

- Bajaj Electricals Limited

📬Also Read: Ensuring Financial Safety: Embracing the Raksha of Returns