Should you be Investing in Campus Activewear Limited IPO?

In this article

About The Company

As India’s largest sports and athleisure footwear brand, Campus Activewear Limited was founded in 2005. It manufactures and distributes footwear like running shoes, walking shoes, casual shoes, floaters, slippers, flip flops, and sandals in a variety of colors and styles. Online platforms and offline stores are used by Campus Activewear to sell its products.

The company has a pan-India trade distribution network of over 400 distributors spanning 28 states and 625 cities. The company also has 18,200 retailers across India.

As of September 30, 2021, Campus activewear owns and operates five manufacturing facilities in India with a capacity for assembling 25.60 million pairs annually.

💰Issue Details

| IPO open from | Apr 26th– Apr 28th, 2022 | Listing on | BSE and NSE |

| Face value | ₹5 | Total issue size | up to ₹1400 crores |

| Price Band | ₹278-292 | Fresh Equity Issue | up to ₹0 crores |

| Market Lot | 51 shares | Promoters | Hari Krishan Agarwal and Nikhil Aggarwal are the company promoters. |

| Minimum Investment | ₹14,892 | Book running lead managers | JM Financial Consultants Private Limited, BofA Securities India Limited, CLSA India Private Limited & Kotak Mahindra Capital Company Limited. |

What is an IPO and should you invest in them?

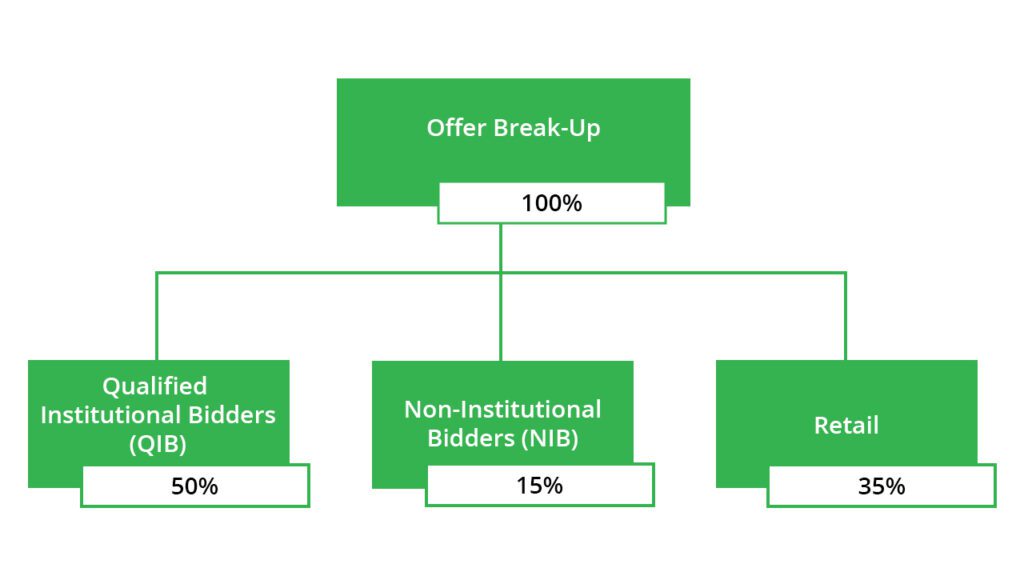

✂️Offer Breakup

The offer is broken up into the following investor classes:

🏷️IPO Object

- Offer for Sale (OFS) ₹1,400 crores: The existing shareholders would sell their shares and the company would not receive any part of it from the IPO proceeds.

- To achieve the benefits of listing the Equity Shares on the Stock Exchanges.

📊IPO Timeline

| IPO open date | 26-Apr -2022 | Initiation of refunds | 05-May-2022 |

| IPO close date | 28-Apr-2022 | The credit of shares to the Demat Account | 06-May-2022 |

| Basis of allotment date | 04-May- 2022 | IPO listing date | 09-May-2022 |

🔭IPO Strengths

Largest Footwear brand – The largest and fastest-growing scaled sports and athleisure footwear brand in India with a comprehensive product portfolio to meet diverse customer needs

Pan India presence- In addition to expanding its presence in tier 2 and tier 3 cities, the company has also increased its revenue contribution from metro areas and tier 1 cities to 26.89% by the year 2021.

Focus on design and innovation – Through the fashion-forward approach, The Company is committed to innovation and design in order to bring the latest global trends and styles to the customers.

Strong brand recognition– The campus has built a strong brand that consumers trust, as demonstrated by its leadership in the sports and athleisure footwear market in India.

🔎IPO Risks

Competitive Business – In the highly competitive sports and athleisure footwear industry, business and operations could be adversely affected if The Company does not compete effectively.

Product trends- Revenues and profits are at risk if The Company is not able to anticipate product trends and consumer preferences and develop successful new products.

Pricing Pressure- As a result of pricing pressure from customers, The Company may experience a reduction in gross margin, profitability, and ability to increase prices, which may adversely affect the business.

🚀Financial Data

| Particulars | For the year/period ended (₹ in Cr) | ||

| 30-Mar-21 | 31-Mar-20 | 31-Mar-19 | |

| Total Revenue | 715 | 734 | 597 |

| Total Expenses | 645 | 635 | 530 |

| Profit After Tax | 26.9 | 62.4 | 38.6 |