Should you Invest in eMudhra IPO?

In this article

Shopping, banking, Income Tax Returns filing- everything can now be done in a matter of a few clicks! But have you ever thought about how around 84 crore Indians suddenly started to trust the internet for their confidential documents and financial transactions?

This trust transformation has been brought about by authentication agencies like eMudhra. eMudhra is a subsidiary of 3i Infotech and is India’s largest certification agency. Its market share in the digital signature certifying space is 37.9%.

About the Company

eMudhra Limited is the largest licensed Certifying Authority (“CA”) in India operating in 3 segments:

- Digital Trust Services

- Digital Security Solutions

- Paperless Transformation Solutions

eMudhra Limited provides a range of services, including individual and organizational certificates, digital signature certificates, SSL/TLS certificates, and device certificates, as well as multi-factor authentication, mobile application security, website security testing, and IT policy assessment.

It has issued more than 5 crore digital certificates since its inception by catering to all kinds of subscribers who use digital signature certificates. Commonly customers need such certificates in income tax return filing, filings with the Ministry of Corporate Affairs (Registrar of Companies), tenders, foreign trade, banking, railways and many other needs. eMudhra works closely with large government and banking customers. 20+ Public and private sector banks and state governments trust eMudhra’s ecosystem.

As of September 30, 2021, eMudhra’s enterprise solutions are used by ten of the top banks in India, six of the top automobile companies, and 19 of the top 500 ranked companies in India by Economic Times.

Till Dec’21 the company had served 1,43,406 retail customers and 626 enterprises through its 91,259 channel partners and 539 system integrator partners to provide its services. Around 50% of its integrator partners are located in India and the rest of them are in the Americas, Europe, the Middle East and Africa and the Asia Pacific.

💰Issue Details

- IPO open from May20th – May24th 2022

- Face value: ₹5

- Price band: ₹243-256

- Market lot: 58 shares

- Minimum investment: ₹14,848

- Listing on: BSE and NSE

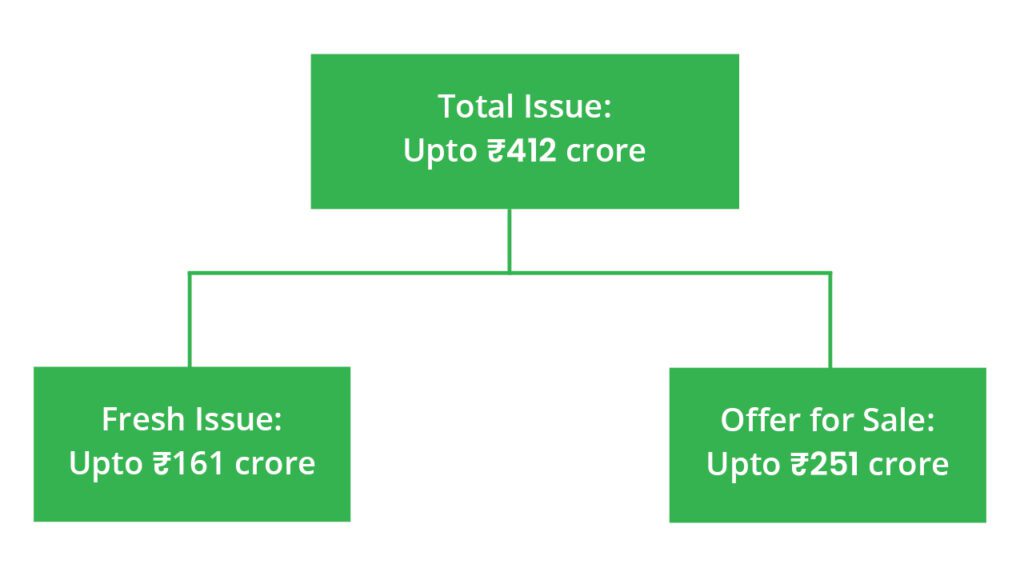

- Total issue size: up to ₹412 crores

- Fresh equity issue: up to ₹161 crores

- Offer for sale: up to ₹251 crores

- Promoters: Venkatraman Srinivasan and Taarav Pte. Limited is the company promoters.

- Book running lead managers: IIFL Securities Ltd, Yes Securities, and Indorient Financial Services Ltd

What is an IPO and should you invest in them?

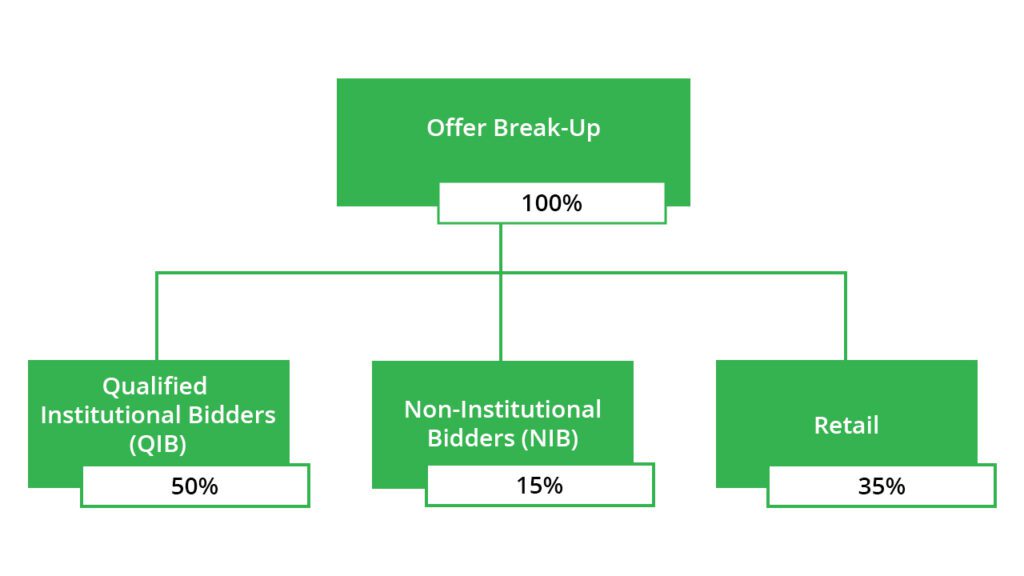

✂️Offer breakup

The offer is broken up into the following investor classes:

🏷️IPO Object

eMudhra is launching an IPO of ₹ 412 crore, which is open for subscription from 20th to 24th May 2022, with a face value of ₹ 5 shares in the price band of ₹ 243-256.

This IPO will reduce the promoters’ share in eMudhra from 79.19% to 61.03%.

1) Offer for Sale (OFS) ₹161 crores: Under this OFS, shareholders would sell their shares and the company would not receive any part of the IPO proceeds.

2) Fresh issue of ₹251 crores: Fresh issue would be done for the following purposes:

- Repayment/prepayment of certain borrowings

- Funding working capital requirements

- Purchase of equipment and funding costs for data centers

- Investment in eMudhra INC for augmenting its business development, sales, and marketing

- other corporate purposes.

📊IPO Timeline

| IPO open date | May 20th 22 | Initiation of refunds | May 30th 22 |

| IPO close date | May 24th 22 | The credit of shares to the Demat Account | May 31th 22 |

| Basis of allotment date | May 27th 22 | IPO listing date | June 01th 22 |

🔭IPO Strengths

- eMudhra holds a 37.9% market share in the digital signature market. Additionally, it has a share of 17.8% in the digital trust market, and 19% in the digital transformation market. It is a market leader in the secure digital transformation space.

- It is a one-stop-shop for all digital security solutions. It is well-positioned in the digital signature certificates market space and is growing at a fast pace with huge potential to grow.

- It has long-standing customer relationships with its diversified clientele across the banking, automotive, IT and insurance sectors. Some of its prominent customers include Hindalco Industries Ltd, Infosys Ltd, Baud Telecom Company, JSW Steel, Larsen and Toubro Infotech Ltd.

- It is a customer-driven business and its experienced promoters and qualified senior management keep high standards of customer service. This enables a high customer retention ratio of 96% in digital trust services and 88% in enterprise solutions.

- Enterprise solutions and digital trust segments are backed by efficient technological infrastructure, including data centers in India and abroad.

🔎Great, so what’s the catch?

To succeed in the business, the company should have the ability to analyze the need of the market and its customers. It should be able to research and develop resources so that the current and new solutions can be enhanced and made timely.

eMudhra is in a technology-intensive industry with a high dependency on technology infrastructure. A system failure or a cyber security concern may adversely impact the business.

🚀Financial data

| Particulars | For the year/period ended (₹ in Cr) | ||

| 30th Mar 22 (9M) | 31th Mar 21 | 31th Mar 20 | |

| Total Revenue | 138 | 132 | 117 |

| Total Expenses | 102 | 101 | 94 |

| Profit After Tax | 30.34 | 25.36 | 18.42 |

eMudhra has shown decent financials in the past few years. Its revenue increased from ₹101.6 cr in FY19 to ₹137.2 crores as of 9MFY22. Also, PAT increased from ₹17.4 crores to ₹30.3 crores as of 9MFY22. The upper price band of the issue is 44 times the FY22 estimated EPS.

eMudhra has a unique business model and none of its peers are listed on the exchange. Investors with a high-risk appetite can ‘Subscribe’ to the IPO. Will you be investing in the eMudhra IPO? Let us know in the comments below.