Should you invest in Aether Industries Limited’s IPO?

In this article

About the Company

Established in 2013, Aether Industries Limited manufactures specialty chemicals. Globally, the company produces more 4MEP, T2E, NODG, and HEEP products than anyone else. Two manufacturing sites of Aether Industries are located in Surat, Gujarat. 3,500 square meters are occupied by manufacturing facility 1 and approximately 10,500 square meters are occupied by manufacturing facility 2. The company has three business models:

- Large scale manufacturing of intermediates and specialty chemicals

- CRAMS (contract research and manufacturing services)

- Contract manufacturing.

💰Issue Details

- IPO open from May24th – May26th 2022

- Face value: ₹10

- Price band: ₹610-642

- Market lot: 23 shares

- Minimum investment: ₹14,766

- Listing on: BSE and NSE

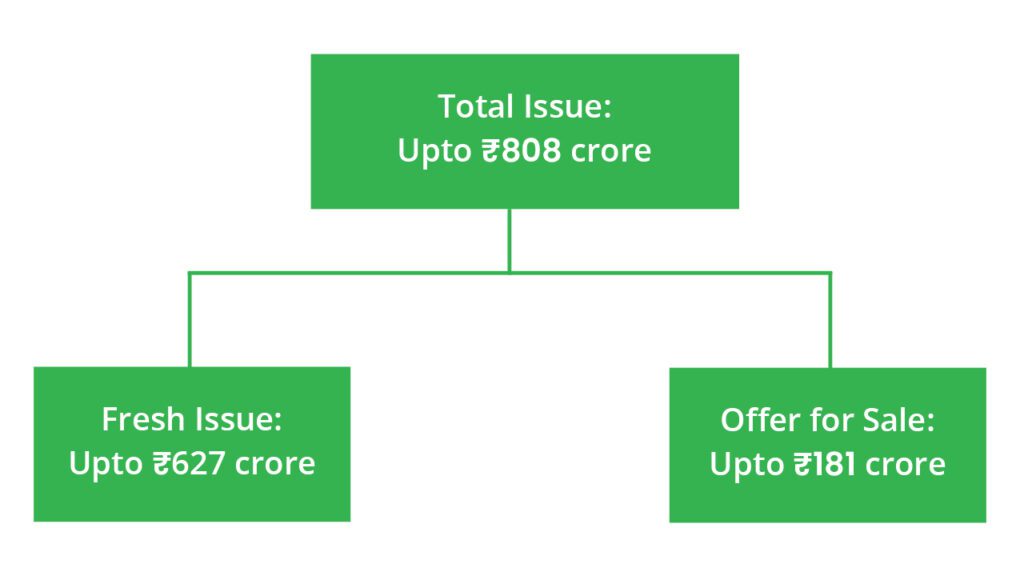

- Total issue size: up to ₹808 crores

- Fresh equity issue: up to ₹627 crores

- Offer for sale: up to ₹181 crores

- Promoters: Ashwin Jayantilal Desai, Purnima Ashwin Desai, Rohan Ashwin Desai, Dr. Aman Ashvin Desai, AJD Family Trust, PAD Family Trust, RAD Family Trust, AAD Family Trust, and AAD Business Trust are the company promoters.

- Book running lead managers: HDFC Bank Limited, Kotak Mahindra Capital Company Limited.

What is an IPO and should you invest in them?

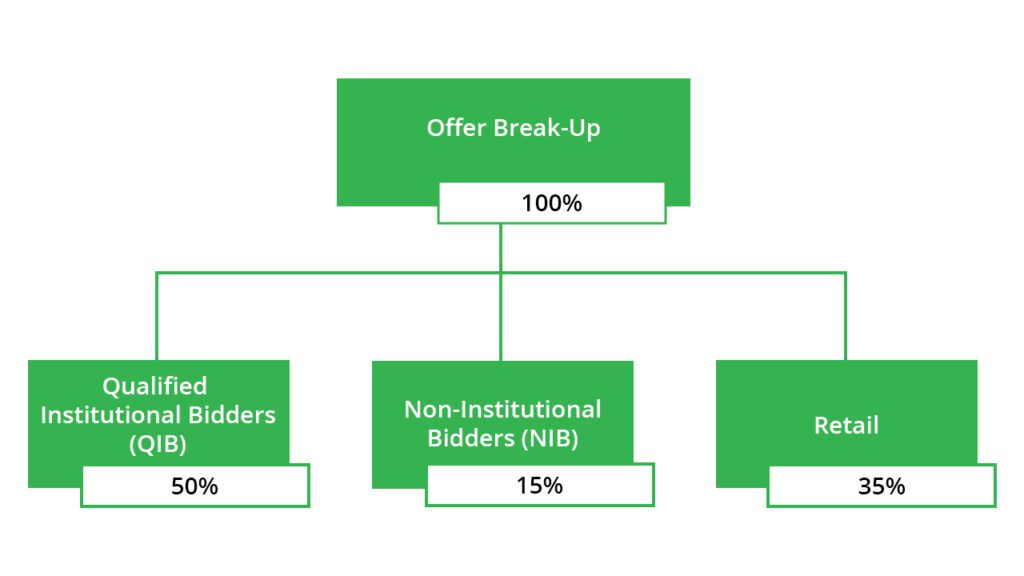

✂️Offer Breakup

The offer is broken up into the following investor classes:

🏷️IPO Object

Aether Industries Limited IPO size is ₹808 crores and below are the objects of the IPO:

1) Offer for Sale (OFS) ₹181 crores: The company would not receive any part of the IPO proceeds.

2) Fresh issue of ₹627 crores: Fresh issue would be done for the following purposes:

- ₹136 crores will be kept aside for funding the capital expenditure requirements for the greenfield project.

- ₹211.4 crores will be used to repay or prepay debt.

- ₹165 crores will be used to fund the working capital expenditure requirements of the company.

- Other corporate purposes.

📊IPO Timeline

| IPO open date | May 24th 22 | Initiation of refunds | June 01st 22 |

| IPO close date | May 26th 22 | The credit of shares to the demat account | June 02nd 22 |

| Basis of allotment date | May 31th 22 | IPO listing date | June 03rd 22 |

🔭IPO Strengths

Portfolio of market-leading products: Aether’s products are used across a wide spectrum of industries, including pharmaceuticals, agrochemicals, materials science, coatings, high-performance photography, additives, and oil & gas.

Focus on R&D: The company spends 5.40% of its total income on R&D. Aether Limited’s R&D team has 164 scientists and engineers devoted to developing next-generation products.

Diversified customer base: More than 160 multinational, global, regional, and local companies are among its customers. Aether’s product portfolio was sold to 34 international customers in 18 countries and 154 domestic customers.

Strong financial performance: As of fiscal 2021, the company has achieved revenue of over ₹450 crores in its 9 years of incorporation and 5 years of commercial manufacturing. All of these businesses were built organically and have demonstrated consistent growth in terms of revenue and profitability.

🔎IPO Risks

Use of hazardous substances: Various hazardous substances are manufactured, used, and stored by the company, which poses certain risks.

Dependency on major customers: Aether gets a significant part of its revenue from certain major customers. However, these customers do not have long-term contracts with all of them. If some of these major customers choose not to source from Aether or terminate their long-term agreements, the business will suffer.

Currency fluctuation: Since the company’s exports and a portion of its expenditures are denominated in foreign currencies, exchange rate fluctuations may adversely affect the company’s operations.

🚀Financial Data

| Particulars | For the year/period ended (₹ in Cr) | ||

| 30th Mar 22 (6M) | 31th Mar 21 | 31th Mar 20 | |

| Total Revenue | 296 | 454 | 304 |

| Total Expenses | 216 | 356 | 247 |

| Profit After Tax | 57.51 | 71.12 | 39.96 |