Adani wins over Holcim, LIC fails to impress investors, Jet all set | Weekly market wrap-up 22 May

In this article

- What to expect from the markets

- Market Outlook

- Stock Pick

- Option-Hub

- Key Results

- Quick Bites

- IPO Corner

- Sustainability Corner

Hey investors,

What a lovely week! The bulls were back on the last day of the week. The much-hyped LIC IPO failed to attract D-street and got listed at a discount. The cat is out of the (cement) bag as Adani emerges as the winner of the cement tussle for Holcim’s India assets. Jet gets new wings as it gets DGCA nod to resume operations.

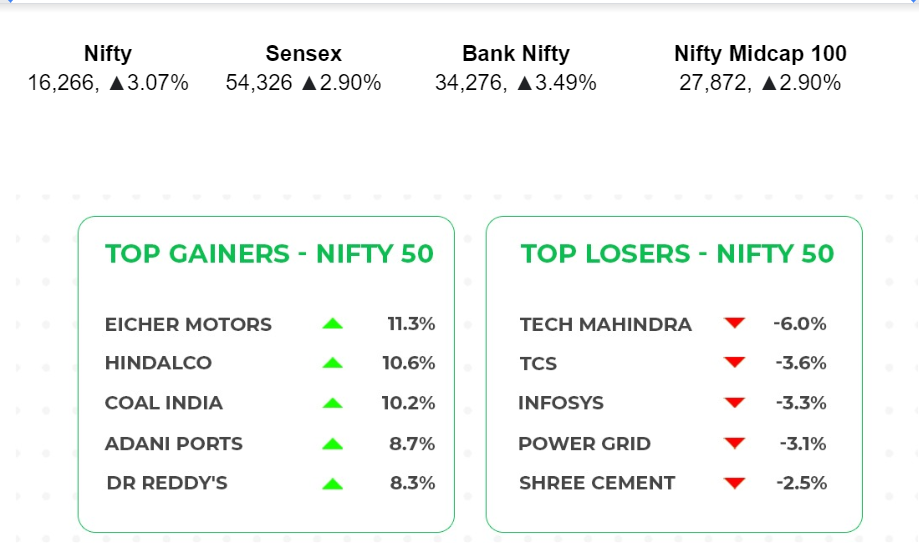

After a long losing streak, the benchmark indices finally saw some green. Nifty ended the week at 16,266, up 3.07%, and Sensex rose 1,532 points to end the week at 54,326. Bank Nifty and Nifty Midcap 100 ended the week showing gains of 3.5% and 2.9%, respectively.

Most sectors were in the green, with Nifty Metal leading the pack, followed by Nifty Auto (4.82%) and Nifty FMCG at 4.50%. Only Nifty IT index couldn’t be tempted to fall on the investor’s good side (-2.82%).

📊What to Expect from the Markets

-Mr. Abhishek Jain, Research Head, Arihant Capital

We expect the markets to open flat this week. However, the government has announced various reforms to calm down inflation like cut in excise duty for petrol & diesel which should augur well for OMCs like BPCL , IOC and HPCL. Even Reliance should get some benefits out of this news. The government has also waived customs duty on some raw materials like coking coal and ferro nickel in a move to calm down higher steel prices .

The export duty on iron ore has been hiked by up to 50% and a few steel intermediates to 15%. This move should impact iron ore exporters negatively. Even on pellets, a duty of 45% has been imposed which is negative for companies like GPIL. But overall this is positive for industries where steel has been used.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital

Nifty

In the daily chart, Nifty has filled the downward gap area and has formed a bullish candle and on the weekly front. Nifty is trading below the lower trendline area. We believe the market may consolidate and we may see stock specific activity. If Nifty crosses the 16,350 level, it may bounce towards 16,550 and 16,700 level. On the downside support- if it crosses below 16,100, then it can test the 15,900 and 15,750 levels.

Bank Nifty

Bank Nifty has filled the downward gap area on its daily chart, and on the weekly chart, the index is holding its 200-day SMA. We may see short covering in the coming sessions. This week Bank Nifty futures closed at 34,305 levels. In the coming trading sessions, if Bank Nifty holds below 34,020, then weakness could take it to 33,750 and 33,500. Minor resistance on the upside is around 34,650-34,900 levels.

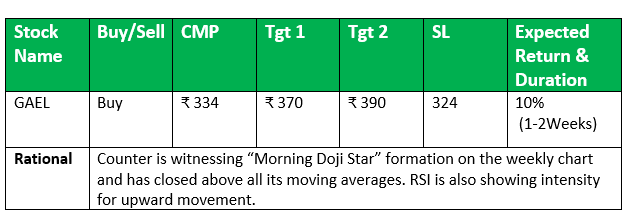

💰Stock Picks

From the Technical Desk

-Ms. Kavita Jain, Head Learning and Senior Research Analyst, Arihant Capital

Did you know? Our last week’s stock pick of Godrej CP achieved its first target. To get more such strategies, subscribe to our newsletter below and join our Telegram channel.

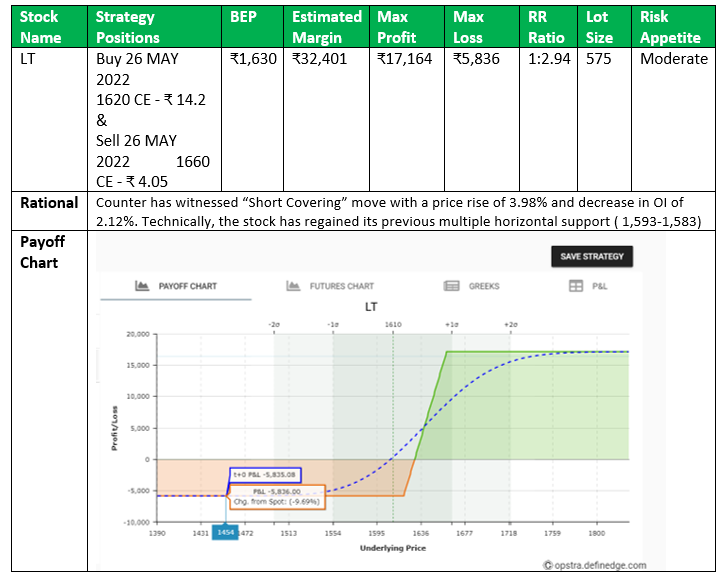

🏷️Option Hub

-Ms. Kavita Jain, Head Learning and Senior Research Analyst, Arihant Capital

Did you know? Our last week’s strategies of IGL gave traders a profit of ₹10,900 per lot and M&M gave a profit of ₹7,800 per lot. Want more such strategies delivered right to your phone? Join our telegram channel.

📝Key Results

- NTPC consolidated profit was up 14% YoY to ₹5,167 crores; revenue grew 23% to Rs 37,085 crores. The board has recommended a final dividend of ₹3 per share.

- Eicher Motors declared a 16% jump in its net profit to ₹610.14 crores.

- Airtel’s consolidated net profit rose 164.46% YoY to ₹2,007.8 cr for Q4’22. The mobile average revenue per user increased to ₹178 vs ₹145 in Q4’21.

- ITC‘s revenue rose 14.54% to ₹17,100 crores over Q4’22 when compared to last year. Its net profit rose 11.81% to ₹4,190.96 cr. A dividend of ₹6.25 per share was declared.

- Dr Reddy’s profit for Q4’22 fell 76% YoY to ₹87.5 crores. Revenue rose by 15% to ₹5,436 crores from ₹4,728 crores last year.

- Raymond’s Q4FY22 Revenue from operations grew by 44.36% YoY to ₹2,032 crores. EBITDA grew by 82.05% YoY to ₹358 crores. Q4’22 PAT grew 354.03% YoY to ₹265 crores.

🔎Quick Bites

Global

- Dollar falls for the first week in seven amid the US yield retreat. Fed to plow ahead on half-point hikes, undeterred by a stock slump.

- Asian shares jump as China cuts key lending benchmark

- Inflation in the UK stood at 9% in April – its highest in 40 years.

- India breathes a sign of relief as Indonesia plans to lift the palm oil export ban from May 23.

- Finland and Sweden have submitted applications for joining NATO.

Economy

- Nirmala Sitharaman signals speedy recovery and projects 8.9% GDP growth for FY22-23. According to UN, India’s projected GDP growth is at 6.4%, yet it is the fastest-growing major economy.

- India recorded the highest ever annual FDI inflows of $83.57 billion in 2021-22.

- The government has completed transactions worth ₹1 lakh crores under the National Monetisation Pipeline (NMP) in 2021-22.

- RBI board approves transfer of ₹30,307 crores as dividend to the government for FY22.

- WPI stood at 15.1% in April as compared to 14.5% in March.

Automobile

- Maruti Suzuki announced plans to invest ₹18,000 crores in its new plant in Sonipat.

- Relief in fuel prices as FM announces a substantial cut in excise duty.

Banking and Finance

- IDBI Bank has sold its 19.1% stake in Asset Reconstruction Company India (ARCIL) to Avenue India Resurgence Pte.

- Mahindra Finance raises ₹255 crores by issuing bonds. GIC Housing Finance has approved raising funds by issue of non-convertible debentures up to ₹2,500 crores.

- IDFC First Bank has allotted 2.38 lakh equity shares under ESOS.

- HDFC Bank’s total foreign shareholding in the bank is 66.55% of its total issued and paid-up capital.

- IDBI Bank has agreed to sell its whole stake in the JV Ageas Federal Life Insurance Company to Ageas Insurance International NV for around ₹580 crores.

Energy and Infrastructure

- Cabinet advances 20% ethanol blending target to 2025-26.

- India to let power plants blend up to 30% imported coal to avoid a grid collapse. Power generation doubles in May on imported coal blending.

- Tata Power seeks higher tariff for Mundra project.

- The government may look to divest a quarter of BPCL instead of its complete stake.

- IRB infrastructure developers to commence road projects in Himachal Pradesh.

- IGL to invest ₹8,000 crores in five years for expansion.

Industry

- Odisha govt approves ₹429 crores ores for mega aluminium park.

- India exported a record 13.5 MT steel in 2022.

- Abu Dhabi’s International Holding Company PJSC (IHC) has invested ₹15,400 crores in Adani Green, Adani Transmission, and Adani Enterprises.

Other

- Adani Group is on a buying spree: It will acquire Holcim Group’s stakes in Ambuja Cements and ACC for $10 bn. The bid includes all of Holcim’s Indian operating entities. The deal is expected to be closed by the second of the calendar year 2022 (January to December).

- Adani Group will also buy a 49% stake in Quintillion Business Media. QBM runs the news platform Bloomberg Quint.

- Adani Enterprises has incorporated a wholly-owned subsidiary for healthcare services – ‘Adani Health Ventures Ltd.’

- Tata Consumer Products is in acquisition talks with 5 brands.

- UltraTech Cement announced the commissioning of its 2nd clinker line of 2.7 mtpa at its integrated cement manufacturing unit in Chhattisgarh.

- Metropolis Healthcare is planning to raise more than $300 million and bring onboard a strategic partner. Flipkart and Apollo Hospitals are among potential strategic investors that have signed NDAs.

- Jet Airways has been granted the license to resume commercial flights by DGCA.

- Welspun Corp Limited bags US order for the supply of 325,000 MT of large diameter coated pipes worth over ₹5,000 crores.

🚀IPO Corner

Current IPOs

- Paradeep Phosphates IPO gets 1.75 times subscription on last day.

- Ethos Limited IPO gets 1.07 times subscription on last day.

- eMudhra Limited IPO gets 0.50 times subscription on day 1.

IPOs listed this week

- Lackluster debut for LIC, India’s biggest IPO, shares close 7.75% lower at ₹875.25

- Prudent Corporate Advisory Services shares list at nearly 4.8% premium, slip minutes later and closed 10.8% lower.

Upcoming IPOs

- Aether Industries Limited (a specialty chemicals manufacturer) IPO is open from 24th-26th May, at a price band of ₹610-642, the issue size is ₹808 crores.

🔌Sustainability Corner

- NTPC to raise ₹5,000 cr via term-loan to fund capex. It also began commercial operations in its 56MW Kawas solar PV project in Gujarat.

- NHPC awards contracts for 1,000-MW solar project to Adani Infra, Tata Power Solar Systems and SSEL-ASR JV.

- SJVN to develop a hydro-power project worth ₹4,900 crores in Nepal.

- Tata Power has received a 300 MW solar project worth ₹1,731 crores from NHPC.

- Tata Power and Hyundai Motor India partner to build an EV charging network.

- M&M to study feasibility of using VW’s components in it’s electric cars.

- Indian auto parts supplier Sona BLW bets on global EV push. It will invest about $130 million over the next 3 years towards its electrification push.

- Ashok Leyland in talks with investors to raise funds for EV subsidiary Switch Mobility.

- Toyota chases the hydrogen dream to create completely carbon free engines.

- EV sales top 50,000 units in Delhi, a 12.5% share of new vehicle sales in March.

- Hero Electric ties up with RevFin to jointly finance and lease 2,50,000 e2Ws.

- Ather partners with Magenta to set up fast EV charging grids across country.

That’s all for now folks! See you next week!