Should you be Investing in Ethos Limited IPO?

In this article

About The Company

Ethos Limited is the largest retailer of luxury and premium watches in India. Luxury watches are offered through the company’s websites, social media platforms, and physical stores. With its watch portfolio spanning 50 premium brands, the company offers watches from Omega, IWC Schaffhausen, Jaeger LeCoultre, Panerai, Bvlgari, H. Moser &Cie, Rado, Longines, Baume & Mercier, Oris SA, Corum, Carl F. Bucherer, Tissot, Raymond Weil, Louis Moinet, and Balmain. The company has 50 physical retail stores in 17 Indian cities. There are more than 7,000 different premium watches available at Ethos Limited, and over 30,000 are available in stock at all times.

💰Issue Details

- IPO open from May18th – May20th 2022

- Face value: ₹10

- Price Band: ₹836-878

- Market Lot: 17 shares

- Minimum Investment: ₹14,926

- Listing on: BSE and NSE

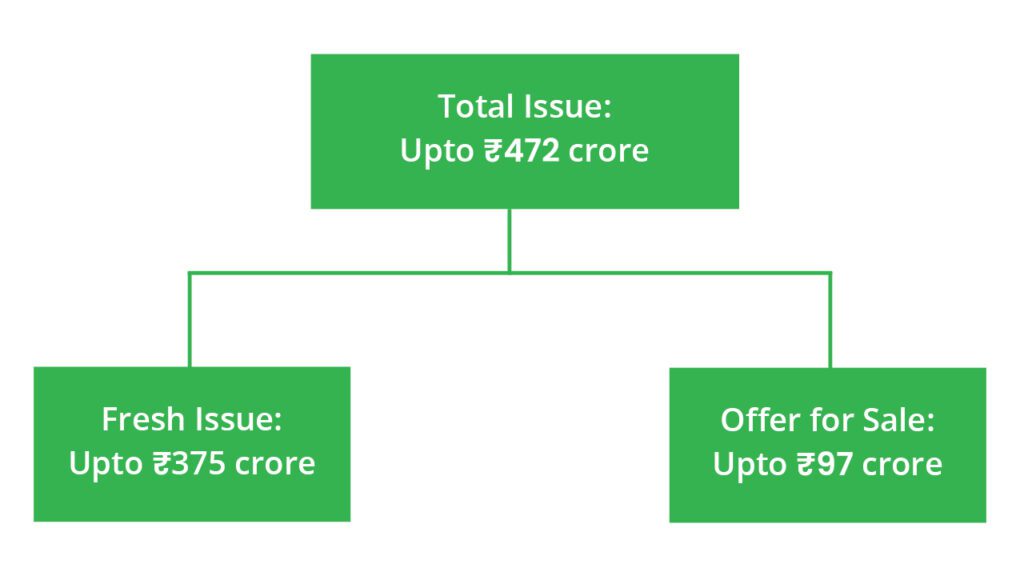

- Total issue size: up to ₹472 crores

- Fresh Equity Issue: up to ₹375 crores

- Offer for sale: up to ₹97 crores

- Promoters: YashovardhanSaboo, KDDL Limited, and Mahen Distribution Limited are the company promoters.

- Book running lead managers: Emkay Global Financial Services Ltd, InCred Capital Financial Services Pvt Ltd.

What is an IPO and should you invest in them?

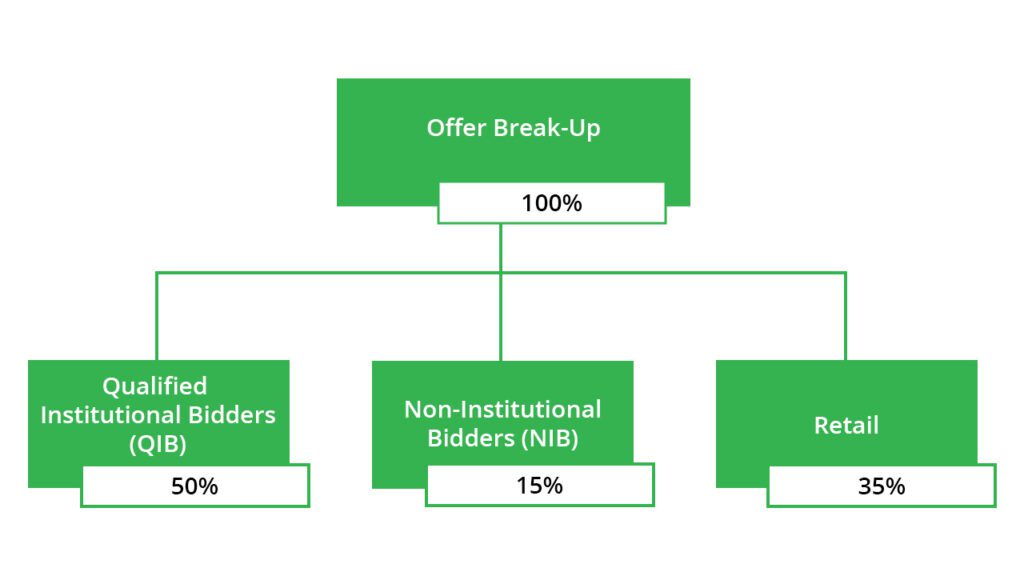

✂️Offer Breakup

The offer is broken up into the following investor classes:

🏷️IPO Object

Ethos Limited IPOSize is ₹472 crores and below are the objects of the IPO:

1) Offer for Sale (OFS) ₹97crores: Under this OFS, shareholders would sell their shares and the company would not receive any part of the IPO proceeds.

2) Fresh issue of ₹375crores: Fresh issue would be done for the following purposes:

- Repayment/prepayment of certain borrowings

- Funding working capital requirements of the Company.

- Financing the capital expenditure for establishing new stores.

- Financing the renovation of certain existing stores

- Other corporate purposes.

📊IPO Timeline

| IPO open date | May 18th 22 | Initiation of refunds | May 26th 22 |

| IPO close date | May 20th 22 | The credit of shares to the Demat Account | May 27th 22 |

| Basis of allotment date | May 25th 22 | IPO listing date | May 30th 22 |

🔭IPO Strengths

Leading luxury watch with omnichannel presence: Ethos Limited leads the luxury watch sector in India and is a leader in the luxury multichannel market, with a broad presence and focus on multiple channels.

Strong store network: More than 7,000 varieties of luxury and premium watches are available at the company’s 50 retail stores, which are strategically located in shopping malls, airport terminals, and other premium areas.

Strong ties with luxury watch Brands: In order to build brand loyalty, the Company has a team of brand managers who work closely with brands to devise and implement growth strategies.

🔎IPO Risks

Lack of supply agreements: The Company does not have definitive agreements for the supply of products or fixed terms of trade with most of its suppliers, hence disruption in the supply of products can affect the profitability of the business.

Dependency on other brands: The business partly depends on the success and reputation of the third-party brands globally, and any negative impact on these brands may adversely affect the business.

Customer demand: Inability to identify customer demand accurately and maintain an optimal level of inventory in the stores may adversely affect the business

🚀Financial Data

| Particulars | For the year/period ended (₹ in Cr) | ||

| 30th Mar 22 (9M) | 31th Mar 21 | 31th Mar 20 | |

| Total Revenue | 231 | 403 | 461 |

| Total Expenses | 226 | 395 | 459 |

| Profit After Tax | 3.75 | 5.79 | -1.33 |