Tracxn Technologies Limited IPO is live now. Should you invest?

Tracxn Technologies Limited IPO is live now. Should you apply? Find out here.

In this article

About Tracxn Technologies Limited IPO

Founded in 2013, Bengaluru-headquartered company Tracxn Technologies operates on a software as a service (SaaS) model and provides market intelligence data for private companies. As of June this year, the company had 3,271 users across 1,139 customer accounts in over 58 countries.

It is a comprehensive B2B information platform that identifies, tracks and analyses private market companies and startups on deal sourcing, and deal diligence. Tracxn ranks among the top five players globally in terms of companies profiled offering data on private market companies across sectors and geographies. It works on an asset-light model and has the largest global coverage in emerging technology sectors such as IoT artificial intelligence, virtual reality, robotics, and blockchain.

Issue Details of Tracxn Technologies Limited IPO

- IPO open from Oct 10- Oct 12

- Face value: ₹1

- Price band: ₹75 to 80

- Market lot: 185 shares

- Minimum investment: ₹14,800

- Listing on: BSE and NSE

- Offer for sale: up to ₹309.38 crores

- Registrar: Link Intime India Private Ltd

- Promoters: Neha Singh and Abhishek Goyal

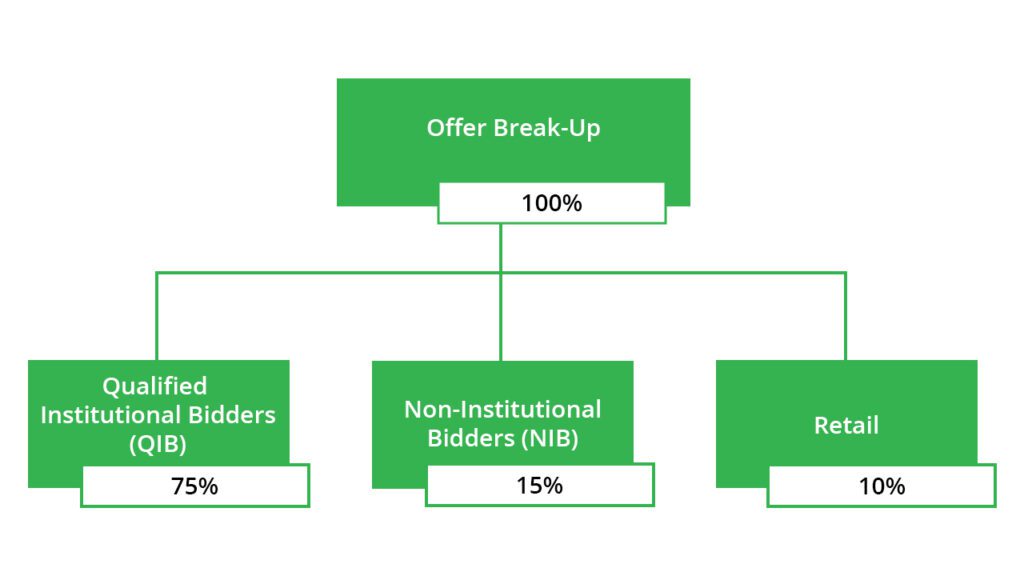

Offer Breakup

IPO Object

- The main objective of the issue is to carry out the sale of up to 38,672,208 Equity Shares and to achieve the benefits of listing the equity shares on the Stock Exchanges.

- Further, the listing of Equity Shares will enhance our Company’s brand name and provide liquidity to the existing Shareholders

IPO Strength

- High tech leading global platform developed with continuous research: Tracxn is a leading global platform private market intelligence SaaS Platform with 1.80 mn entities profiled, a presence in 55 countries, 50,012 Investor profiles and a customer base of 1,139 as on June 2022. The platform includes personalization for enhanced tracking and data-driven insights, sourcing dashboards both locally and globally, portfolio tracking, data intelligence and data analytics.

- Comprehensive data coverage: The platform is a combination of technology and human analysts, and is capable of processing vast amounts of data. The platform has been designed and built by primarily using new-age technologies, for hosting on cloud infrastructure. Tracxn is a data and market intelligence platform with over a million curated entity profiles mapped to over 49,000 different business models, searchable in near real-time through a set of search tools built in-house using an open search engine and analytics solutions

- Diversified global customer base: Tracxn has a diversified customer base across geographies and no single country contributes to more than 31.6% of the revenue in the last three FYs and as of June 2022. This geographically diversified customer account base comprises

- Private market investors and investment banks viz., venture capital and private equity investors, investment banks,

- Corporates across industries, and

- Others include government agencies, universities, accelerators and incubators.

- Growing base of long-standing customers: The company has had a 23.44% repeat customer rate for the last 3 years and a 74% repeat customer base for the last 2 years. The number of users as on June 2022 stood at 3,271 and the number of customer accounts stood at 1,139. The customer accounts have grown at a 3-year CAGR of 30.42%- all due to increased visibility, trust and comprehensive data available across sectors and geographies.

- In-house developed, scalable, and secure technology platform

- Significant cost advantages from India-based operations: The company operates in India which gives them significant cost advantages over their competitors as remuneration in India is almost 10x lower than in the United States and around 6x lower than in the UK. The revenue has grown at 3yr CAGR of 30% as against 3yr cost CAGR of 3-4%, which shows that the company can scale up at a low operating cost.

- Experienced promoters, board of directors, and senior management team backed by marquee investors

IPO Risk

- Failure to attract new clients, maintain existing clients or expand users within existing customer accounts

- Revenue from operations is gained from subscriptions to the platform by customers, hence, if the customers do not renew the subscriptions, it will hurt the revenues

- Interruptions or performance problems associated with the platform and business

- Unable to obtain and maintain accurate, comprehensive, or reliable data, could experience reduced demand for the platform and services

- Use of open-source software could subject the company to face claims challenging the ownership of open-source software and compliance with open-source license terms

Peer Companies

There are no listed entities in India, in the business portfolio which is comparable with this business.

Valuation and View

The company is a leading global player, ranking amongst the top 5 in its segment. With cost arbitrage advantages, high operating leverage, a strong technology platform, and comprehensive data coverage strengthening Tracxns position. It has achieved breakeven and reported gains in Q1FY23. The stock is currently valued at a P/S of 12.7x to its FY22 sales of ₹63.43 cr, the issue is fairly priced and we recommend that investors subscribe for the long term.

Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-20 | ₹52.38 | ₹6.31 | – ₹54.82 |

| 31-Mar-21 | ₹48.46 | ₹55.74 | – ₹4.15 |

| 31-Mar-22 | ₹54.01 | ₹65.16 | – ₹4.85 |

| 30-Jun-22 | ₹56.78 | ₹19.08 | ₹0.92 |

Also Read: Sustainable Investing in India: ESG Investments

Credit Suisse | Domino is Falling | Weekly Stock Market Updates 09 Oct