Credit Suisse | Domino is Falling | Weekly Stock Market Updates 09 Oct

Get the latest stock market updates. Catch up on all that’s trending in the last week and get ready for the Monday markets with insights and stock recommendations from our expert research team.

🎧Tune in to this song: Skyfall as you read our weekend newsletter wrapping up the key events of the week.

In this article

CDS are in the news again – and suddenly back at the forefront of the global financial markets. This time it’s not Lehman but Credit Suisse who is bringing CDS to the front pages. Credit Suisse is in considerable financial distress: its share price is dropping to record lows, and CDS rates are skyrocketing. The question now is whether Credit Suisse will create a domino effect leading to a collapse of the entire global banking system?

Now if you aren’t a pro in the 2008 financial crisis, let’s tell you what CDS are and why they matter. Credit Default Swaps are financial instruments, which transfer risk from one party to another in exchange for a premium, just like insurance. The higher the risk associated with the CDS, the higher the premium. So, the people who lend money to any institution, always face a risk that the institution may fail to repay them. These lenders often enter a contract with another investor who will pay them in case of a default. These investors charge a premium for taking up this risk. In the case of Credit Suisse, the investors now think that the possibility of Credit Suisse paying up on their debt, is pretty low so the CDS premium is rising up substantially. Even the markets are losing confidence in it, so the stock prices hit an all-time low last week. Even though the company offered to buy back billions of its debt to show the strength of its books, the markets still wonder if the bank can sustain itself? Or will it lead to a collapse of the entire banking system and yet another financial crisis?

Heading East, OPEC+ announces the biggest cut in oil production since the Covid-19 pandemic. This move will reduce about 2% of global oil demand, and lead to an increase in crude oil prices. This is further bad news for India, whose Rupee has already touched an all-time low of 82, and has spent over $100 billion to save the Rupee’s freefall.

Read on for more news on EVs and stocks in the news of the week.

Coming to D-Street, the markets remained choppy, this week Nifty, Sensex and Bank Nifty were all closed in the green despite volatilities during the week. A good strategy to make money in such markets is to stay invested for the long term and keep topping and nibbling away every time there is a correction.

What to Expect from the Markets

What to Expect from the Markets

–Mr Abhishek Jain, Head of Research, Arihant Capital

The stock markets closed with a positive momentum aided by information technology, metal, realty, media, and pharma stocks. This happened amid a surge in oil prices following the OPEC+ bloc’s decision to cut supply in a bid to arrest the slide in oil prices.

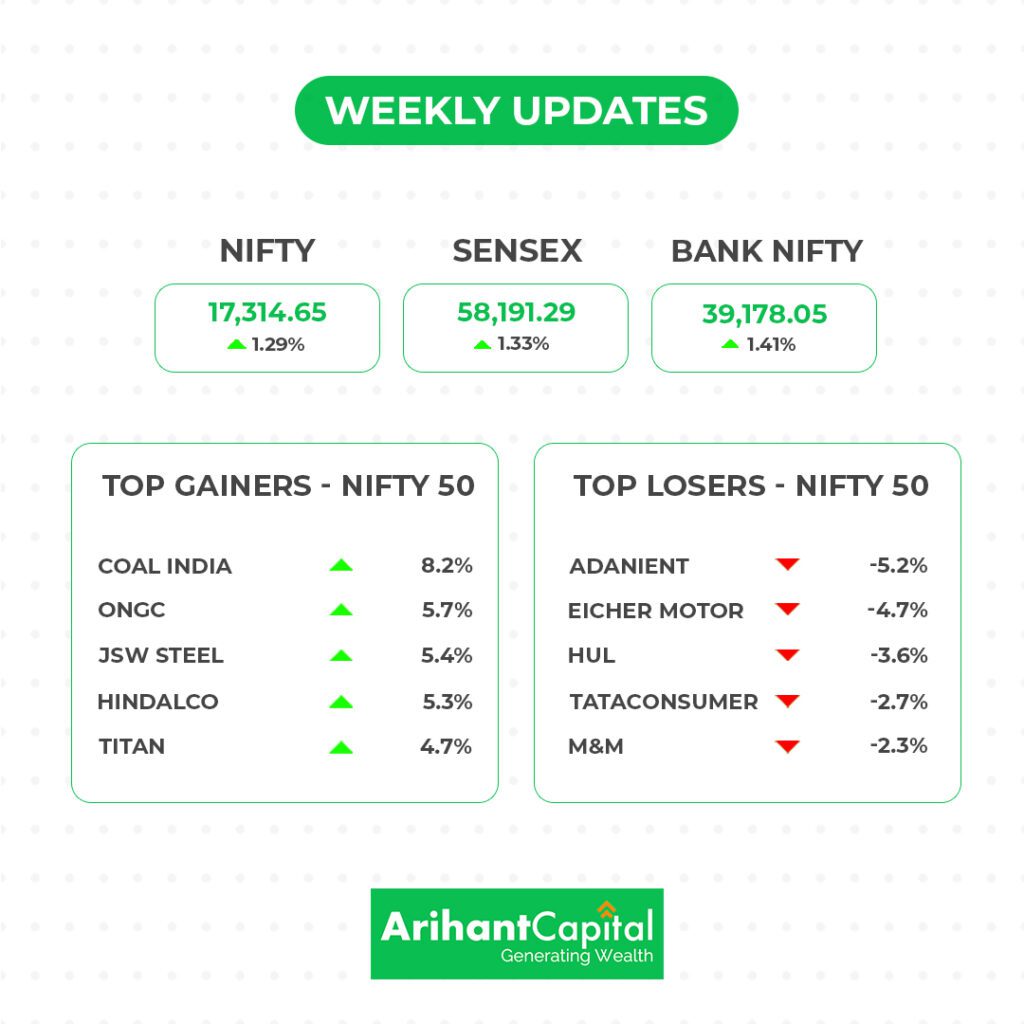

Nifty closed the week on a positive note of 1.29% at 17,315 with 220 pts gain and BSE Sensex ended the week at 58,191. On a week-on-week basis, Sensex gain of 1.33%. Bank Nifty gained by 1.41% during the week, ending at 39,178.

💰Market Outlook

-Mr Ratnesh Goyal, Sr. Technical Analyst at Arihant Capital

Nifty

We observe Doji candlestick formation on the daily chart of Nifty. On the weekly chart, we observe the prices have tested the downward gap area. It seems that the market may face some resistance at higher levels, and we may see some consolidation. Nifty can face resistance around the 17,350 level if it starts to trade above then it can touch 17,480-17,600 levels, while on the downside, support is 17,200 if it starts to trade below then it can test 17,050 and 16,800 levels.

Bank Nifty

On the daily & weekly chart of Bank Nifty, we observe the Doji Candlestick pattern formation. It seems that Bank Nifty may also face some resistance at higher levels. In the coming trading session if it trades above 39,500 then it can touch 39,800 and 40,100 levels, however, downside support comes at 39,100 below that we can see 38,500-38,200 levels.

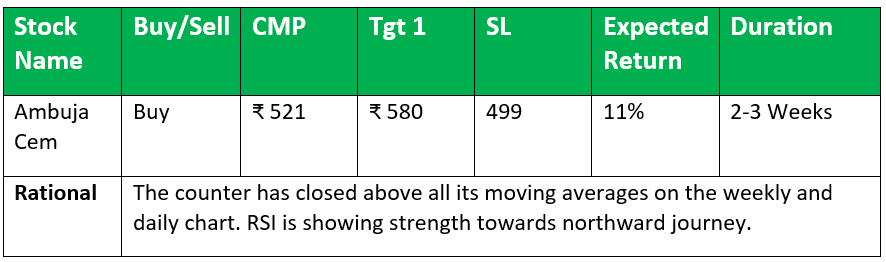

💰Stock Picks

From the Technical Desk

From the Fundamental Desk

-Mr Abhishek Jain, Head of Research, Arihant Capital

Thomas cook looks interesting at current levels. We have recommended this stock earlier as well. So, we maintain a buy on this stock with a price objective of ₹100.

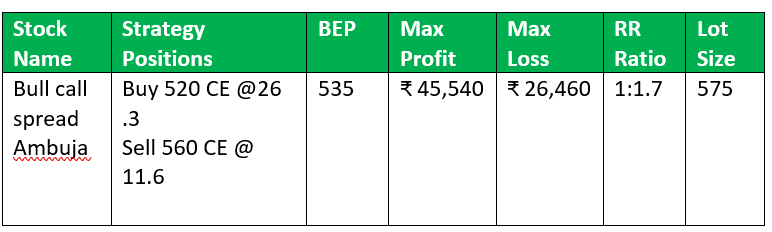

Option Hub

🔎Quick Bites

Economy

- India’s service sector PMI stood at 54.3 (at a 6-month low)

- India’s unemployment rate fell to 6.43% in September, the lowest in 4 years

Banking and Finance

- Carlyle-backed Yes Bank is now on a stressed assets hunt.

- Union government, LIC to divest over 60 per cent stake in IDBI Bank.

- IDBI Bank to seek bids via Swiss auction for Jaypee Infratech Debt.

- BOB plans to raise a $500m overseas loan to expand its offshore investments and credit.

Industry

- US-based Global Infrastructure Partners, GIP looks to buy $175m Adani Airports bonds.

- Tata Steel sold a 19% stake in Oman – Based company Al-Rimal mining company.

Energy and Infrastructure

- Actis, M&M arm ink JV to set up a joint platform for developing industrial and logistics real estate facilities.

- RSBVL, a wholly owned subsidiary of Reliance Industries (RIL), and US-based Sanmina Corporation announced the completion of electronics manufacturing JV to produce 4G and 5G telecom equipment for local and overseas markets.

- DB Realty acquires the remaining stake in the subsidiary DB Man Realty.

- National Highways Infrastructure Trust to raise ₹1,500 cr. via NCDs

IT and Telecom

- Jio just did it again! It announced a laptop (JioBook) for just under ₹15,000 disrupting another field. Jio will also launch its 5G services, with a free welcome offer.

- Airtel to work with lending cos to help more people purchase smartphones.

- Airtel announced the rollout of 5G services in 8 cities.

- BSNL is to roll out 4G services in November.

Other

- Nykaa has entered a partnership with Dubai-based Apparel Group to establish a “multi-brand beauty retail business” across the Gulf countries.

- The Competition Commission of India has given the nod to the Zee-Sony merger, on condition that the two parties don’t misuse their dominance in the market.

🚀IPO Corner

- Electronics Mart India Limited IPO which was open from 04-Oct to 07-Oct witnessed 71.93 times subscription. Why it had such a great response from investors: let’s find out what Mr Arpit Jain, Joint MD, Arihant Capital says about this.

- Tracxn Technologies Limited IPO is opening between 10 Oct till 12-oct,2022. It is one of the leading providers of market intelligence data for private companies globally.

🔌Sustainability Corner

- Tata Power mulls 10,000 MW clean energy capacity in the next five years in Rajasthan.

- India and the US announce the launch of a new energy storage task force to support the clean energy transition.

- NMC to install solar power panels on public toilets.

- Tata Motors looking to introduce four-wheel drive capability in electric SUVs.

- Govt halts sops for Okinawa, Hero Electric on manufacturing norms.

- Electric two-wheeler maker Ather Energy to ramp up production.

- Hero Moto will bring in more affordable e-bikes in future says Pawan Munjal.

- Adani announced a Rs 65,000 crore investment in Rajasthan to set up a mega 10,000 MW solar power capacity, expand the cement plant and upgrade Jaipur airport.

- RattanIndia to buy electric motorcycles maker Revolt Motors.

- NTPC ropes in GE Gas Power to reduce CO2 emissions at plants.

- Hero MotoCorp launches its first e-scooter Vida, price starts at INR 1.45 lakh.

- Bajaj aims to double Chetak electric scooter sales to around 6,000 units a month by March 2023.

- Electric 2W sales charge past 275,000 units (up 404%) in H1 FY2023; Ola bounces back to regain the No 2 spot; Okinawa reigns supreme.

- Revolt Motors expands retail network to Trichy and Faridabad

- Vitesco Technologies simplifies EV battery design and opens up new potential for improved range. Vitesco has recently won orders worth more than 2 billion euros (Rs 15,866 crore) for its innovative Battery Management Systems.

- Sona BLW Precision Forgings (Sona Comstar), one of India’s leading automotive technology companies, has achieved the 100,000 EV traction motor production milestone.

- TVS-backed Ultraviolette gears up to launch electric F77 motorcycle.

Also read: ESG Investing & Its Emergence in India

What to Expect from the Markets

What to Expect from the Markets