Should you Invest in Electronics Mart India Limited IPO?

Electronics Mart India Limited IPO is live now. Should you apply? Find out here.

In this article

- IPO details

- Issue details

- Offer Breakup

- IPO Strengths

- Key Risks

- Electronics Mart India Limited Financials

About Electronics Mart India Limited IPO

Incorporated in 1980, Electronics Mart India Limited is the 4th largest consumer durables and electronics retailer in India. The company offers a diversified range of products with a focus on large appliances (air conditioners, televisions, washing machines and refrigerators), mobiles and small appliances, IT and others. The company’s offering includes more than 6,000 SKUs (stock keeping units) across product categories from more than 70 consumer durable and electronic brands.

Electronics Mart India Limited business models:

Ownership Model: The company owns the underlying property including the land and building.

Lease Rental Model: The company has entered into a long-term lease arrangement with the property owner(s).

As of August 15, 2021, out of the total 99 stores the company operates, eight stores are owned and 85 stores are under the long-term lease rental model and six stores are partly owned and partly leased.

The company operates its business activities across three channels retail, wholesale and e-commerce.

Retail: As of August 15, 2021, out of 99 stores, 88 stores are Multi Brand Outlets (“MBOs”) and 11 stores are Exclusive Brand Outlets (“EBOs”). The revenue from the retail channel was ₹2,931.2.8 crores, ₹2,899.1 crores and ₹2,580.17 crores for the Financial years 2021, 2020 and 2019, respectively.

Wholesale: The company is also engaged in the wholesale business of consumer durables, where the company supplies products to single-shop retailers in Andhra Pradesh and Telangana regions. The revenue from the wholesale channel was ₹53.0 crores, ₹50.5 crores and ₹46.58 crores for Financial Year 2021, 2020 and 2019, respectively.

E-Commerce: The e-commerce website currently functions as a catalogue for the products that the company retail at stores. The revenue from the e-commerce channel was ₹44.4 crores, ₹28 crores and ₹21.27 crores for Financial Year 2021, 2020 and 2019, respectively.

💰Issue Details of Electronics Mart India Limited IPO

- IPO Open from: 04 Oct to 07 Oct 2022

- IPO Size: Fresh Issue aggregating up to ₹500.00 Cr

- Face Value: ₹10 Per Equity Share

- Price Band: ₹56 to ₹59 per share

- Min Investment: ₹14,986 (254 Shares)

- Registrar: KFin Technologies Limited

- IPO Listing date: 17th Oct 2022

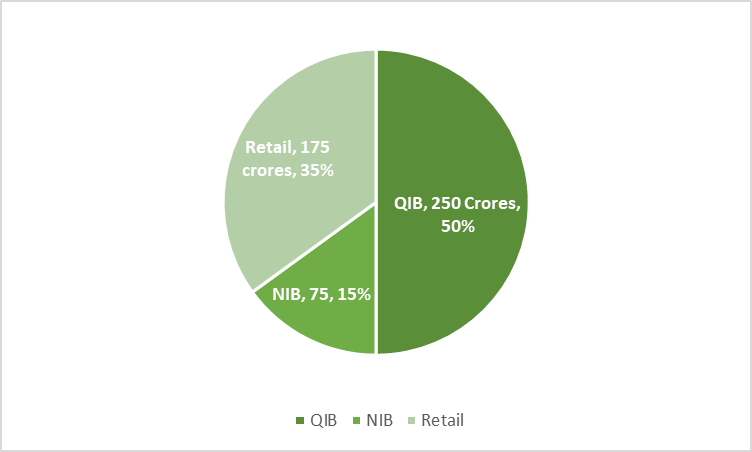

✂️Offer Breakup

The offer is broken up into the following investor classes:

🏷️IPO Object

The company proposes to utilize the net proceeds of the fresh issue for the funding of the following objects:

- Funding capital expenditure for expansion and opening of stores and warehouses.

- Funding incremental working capital requirements.

- Repayment/prepayment, in full or part, of all or certain borrowings availed by the Company.

- General corporate purposes.

🔭IPO Strengths

- Electronics Mart is the 4th largest consumer durable and electronics retailer in India with a leadership position in South India.

- It is one of the fastest-growing consumer durable and electronics retailers with a consistent track record of growth and industry-leading profitability.

- Increasing market presence and geographic reach with cluster-based expansion.

- Diversified product offering & optimal product assortment leveraging our deep knowledge and understanding of regional markets.

- Strategically located logistics and warehousing facilities backed by stringent inventory management using IT systems.

- Robust customer service support, timely delivery & installation support.

- Experienced management team with a proven track record.

🔎IPO Risks

- The majority of stores are presently concentrated in Andhra Pradesh and Telangana. It is planning to expand into new geographies. This may expose it to significant liability.

- Competition from online retailers who are able to offer products at competitive prices and are also able to offer a wide range of products.

- The company presently do not own certain trademark or logo (i.e., “BAJAJ ELECTRONICS”, “Electronics Mart”, “EMI ELECTRONICS MART INDIA LIMITED”, “EMIL”, and “Electronics Mart India Limited”) under which it currently operates.

- A large part of companies’ revenues is dependent on their top five brands.

- The company is dependent on external suppliers for its product requirements.

- Subsidiaries have incurred losses in some prior periods and may do so in the future.

⚡PEER COMPANIES

As on date, there is only one comparable listed company in India engaged in the same line of business.

- Aditya Vision Limited

🚀Financial Data

The below data is in Rs Crore

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-19 | 1109.15 | 2826.1 | 77.1 |

| 31-Mar-20 | 1347.6 | 3179.02 | 81.61 |

| 31-Mar-21 | 1523.53 | 3207.37 | 58.62 |

| 31-Mar-22 | 1824.74 | 4353.07 | 103.89 |

| 30-Jun-22 | 1755.58 | 1410.25 | 40.66 |

RBI increases repo, again. Weekly Market Wrap-up 02 October