RBI increases repo, again. Weekly Market Wrap-up 02 October

Weekly Market Wrap-up. Catch up on all that’s trending in the last week and get ready for the Monday markets with insights from our expert research team.

🎧Tune in to this song: Unstoppable by Sia as you read our weekend newsletter wrapping up the key events of the week.

In this article

As in the song, inflation seems “unstoppable” although RBI is putting its armour on to show how strong the economy is in the latest monetary policy meeting. The RBI kept its inflation projection at 6.7% and said it may meet the target of 4% in around 2 years. Phew! That’s a long time for us to feel the pinch of high food prices.

RBI raised the repo rate by 50 bps to 5.9% to tame inflation. This is the fourth rate hike in 5 months, indicating the persistence of inflation and weakening growth impetus in the economy. Thus, the RBI also revised the FY23 GDP growth downwards to 7%. The stock markets had anticipated this move and the indices ended in green on the last day of the week. Looking for some more good news? GST collections in September showed an increase of over 26% at ₹1.47 lakh crore. Read what Mrs Anita Gandhi, Head of Institutional Business at Arihant Capital had to say about the forward outlook of GST collections in this Financial Express article.

On a week-on-week basis, Nifty closed on a negative note of 1.34% at 17,094 with 233 pts loss while BSE Sensex ended the week at 57,427 losing by 1.16%. Bank Nifty lost by 2.31% during the week, ending at 38,632.

In our last week’s newsletter, we saw how the global economies are grappling with inflation. This amazing insight by #McKinsey should help you understand the global effects of inflation.

What to Expect from the Markets

What to Expect from the Markets

–Mr Abhishek Jain, Head of Research, Arihant Capital

The broader indices advanced on Friday, gaining the most in a month after the Reserve Bank of India announced the repo rate hike., despite extended losses over the week. This is the third consecutive weekly decline for the Sensex and Nifty, as they logged their worst month since June. Sectorally, the Nifty Pharma and Nifty IT index were gainers while metal, auto, and realty indices declined the most.

The broader indices underperformed their larger peers, with the Midcap and Smallcap measures gaining 1.4%. Barring the oil and gas gauge, the other 18 sectoral indices compiled by BSE Ltd. advanced with the Telecom Index gaining 3.5%.

Given the global sentiments, it’s better to maintain stock specific approach at current levels. Avoid leverage for time being.

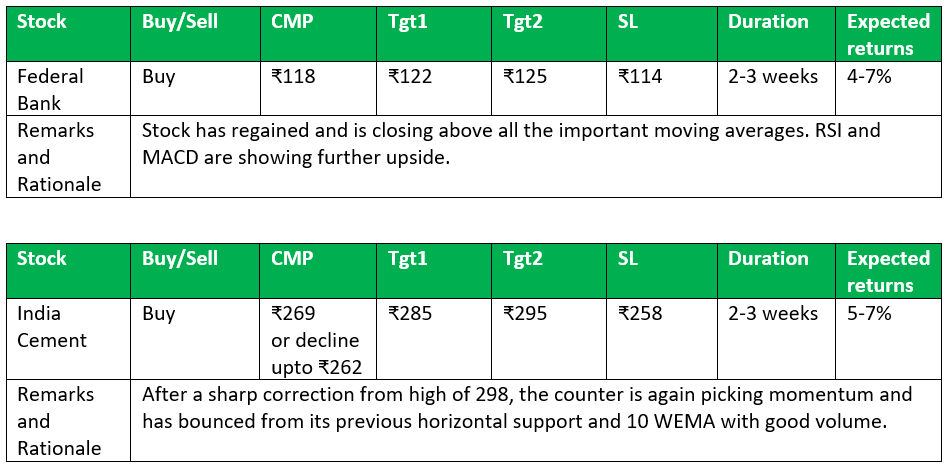

💰Stock Picks

From the Technical Desk

-Ms Kavita Jain, Sr Research Analyst and Learning Head, Arihant Capital

🔎Quick Bites

Global

- The US sanctions Indian company Tibalaji Petrochem Pvt Ltd and seven others for Iran energy dealings.

- Putin annexes four Ukraine regions. Kyiv vows to fight back.

- Taiwan electronics manufacturer Pegatron Opens Chennai Facility to Make iPhones.

- World Bank cuts 2022 East Asia growth outlook, cites China slowdown.

Economy

- Core sector growth slows to 3.3% in August, its lowest in nine months.

- India’s April-August fiscal deficit at $66.56 billion.

- Windfall profit tax cut on domestic crude oil, and diesel; scrapped for ATF.

- Govt to borrow ₹5.92 lakh cr in H2 of FY23; plans to raise ₹16,000 cr via sovereign green bonds.

Automobile

- Tata Motors to keep investing ~₹2,000 crores per annum in the CV business.

- September Automobile sales are out: Maruti Suzuki reports over a 2X increase in sales. Tata Motors’ domestic sales were up 44% while Nissan Motor’s sales decline by 16.64%. Hyundai sales rise 38% whereas Toyota Kirloskar sales were up 66%.

- Increased repo rate by RBI big dampener for auto industry according to FADA.

- Six airbags in passenger vehicles should be mandatory: International Road Federation.

- Sales of CNG-powered vehicles take a hit as global natural gas prices soar Six airbags rule for passenger cars deferred by a year to October 2023.

Banking and Finance

- BSE to introduce electronic gold receipts on its platform.

- UCO Bank to open a special rupee account with Russia’s Gazprom Bank to facilitate growing trade between the two countries.

- ICICI Prudential, 14 insurance firms evaded ₹824 crore input tax credit.

- Torrent group to make ₹2,900-cr bid for Reliance Nippon Life Insurance.

Industry

- Shapoorji Pallonji Group firm, Forbes & Company Ltd to demerge its precision tools business.

- Tata Group to halve the number of listed companies to boost its competitive strength.

- HAL sets up a ₹208 crores rocket engine manufacturing facility.

- Amara Raja Batteries is planning to integrate the plastic components business of Mangal Industries with itself.

Energy and Infrastructure

- Blackstone Inc. sold ₹2,650 crore worth of units of Embassy REIT.

- The high price of coal adversely impacts the profitability of domestic non-ferrous metal cos: ICRA.

- CCI approves Adani’s acquisition of a 100% stake in DB Power.

- BHEL bags 2×660 MW thermal power project from NTPC.

- Power Ministry rejected REC’s proposal of selling PFC’s stake to PGCIL.

- Flood water inundates the powerhouse of NHPC’s mega project along the Assam-Arunachal border.

- IOC to set up a unit in GIFT City to help raise capital.

- BPCL to incur gross marketing losses in current fiscal: Fitch.

- Iran offers ONGC a 30% stake in the gas field.

- Adani Enterprises secures funds to build Ganga Expressway at ₹23,000 crores.

IT and Telecom

- KPIT Tech acquires Munich-based Technica Engg for €80 million.

- The much-awaited 5G is here.PM Modi launched 5G services on Oct 1.

- Vodafone Idea, EESL to install 50 lakh IoT-based smart meters in UP, Haryana.

- HCL acquires majority stake in vernacular ed-tech platform GUVI.

Other

- Reliance Retail is set to acquire Kerala’s Bismi.

- Mahindra Logistics to acquire Rivigo’s B2B express business.

- Jubilant FoodWorks acquires a 29.24% stake in RoadCast Tech Solutions.

- PVR to invest ₹350 crores for 100 new screens in FY23; expects the Inox merger to close by February next year.

- Torrent Pharmaceuticals to acquire Sequoia-backed Curatio Health for $245 million & 100% of Curatio Healthcare for ₹2,000 crores.

🚀IPO Corner

- Harsha Engineers International Limited Shares made a strong debut amid a falling market. Shares of Harsha Engineers opened at ₹444 per share and closed at ₹486.50. This is a premium of 47% or ₹156.5 against the issue price of ₹330. The IPO was subscribed 74.70 times on the final day.

- SEBI tightens IPO disclosure rules, gives nod to pre-filing of offer documents.

🔌Sustainability Corner

Before you head to our Sustainability corner, why dont you check out this article on why should you add flavours of ESG investing into your portfolio by Ms Shruti Jain, Chief Strategy Officer at Arihant Capital

- Indian solar brand Goldi Solar pledges ₹5,000 cr investments in renewable space

- Gas leaks from ONGC well in Mehsana.

- Cabinet okays ₹19,500 crores more for solar module PLI

- Amp Energy India and Ohmium collaborate on 400MW of green hydrogen

- Vedanta increases sourcing of green energy to 1 GW; seeks supplier for an additional 500 MW.

- Adani Group to invest over $100 billion of capital in the next decade. 70% of this investment is to be demarked for the energy transition space.

- Adani Green commissions a 600 MW wind-solar plant in Jaisalmer

- Electric 2-wheeler sales show a massive 238% year-on-year increase on the pandemic-impacted August 2021’s sales or a more realistic 13% month-on-month growth over July 2022 sales.

- Radical Citroen Oli concept, which weighs just 1,000kg, previews exciting, sustainable, affordable EVs; 400km range from a relatively small 40kWh battery & a single electric motor; heralds an array of new technologies earmarked for upcoming cars.

- Hero MotoCorp partners with US-based Zero Motorcycles to jointly manufacture electric motorcycles.

- Ather Energy records its highest-ever monthly wholesales in September at 7,435 units; looks at ramping up production and aggressive network expansion in March 2023.

- Hero Electric signs MoU with the Rajasthan government to set up its mega EV manufacturing hub with an annual production capacity of two million units.

- Tata Motors recently launched the Tiago EV hatchback: the most affordable 4W EV in India.

- Gulf Oil India to supply EV fluids to Piaggio Vehicles and Switch Mobility.

- India and California agree to collaborate on zero-emission vehicles

- Inox Wind successfully commissioned India’s first 3.3 MW Wind Turbine in Gujarat.

Also read: ESG Investing & Its Emergence in India

What to Expect from the Markets

What to Expect from the Markets

Global Gloom: Weekly Market Wrap-up 25 Sep