Global Gloom: Weekly Market Wrap-up 25 Sep

6 days in 6 minutes Weekly Market Wrap-up. Catch up on all that’s trending in the last week and get ready for the Monday markets with insights from our expert research team.

In this article

This was an extremely eventful week, but let’s be honest, it wasn’t great. Before we get on with the doom and gloom here is a song to help you remain in cheerful spirits this Monday.

🎧Listen to Rangisari Gulabi

Alright, let’s get started- the markets last week were not coloured gulabi but red. Why you ask? With so many global events bearing heavily on them, we are hard-pressed to choose one.

Recession and Tightening liquidity

Bank of England announced that the UK economy is already in a recession, and the residents who are already burdened with the cruellest inflation in 40 years(9.9%) will now also bear the burden of 2.25% interest rates (the highest in 14 years).

Powell announced a hawkish 75 bps hike and forecasted further tightening before the year-end. He is clearly signalling that recession may be the price they are willing to pay for crushing inflation.

Central banks of Switzerland, Sweden, South Africa, Indonesia, and Norway all announced significant rate hikes this week.

Despite the turmoil in the US, the Rupee sank to an all-time low of 81 against the greenback (US dollar). RBI who has already spent a mammoth 80 Billion from its forex kitty, will be announcing its monetary policy soon. Analysts have already begun to predict up to a 50bps hike.

Tensions heat up

Putin decides to escalate war efforts on Ukraine. The death of a woman in Iran sparked a nationwide protest over the Hijab ban.

Xi in a soup? Or is it a coup? Rumours abound: Chinese Prime Minister Xi Jinpeng seems to be under house arrest amid a military coup. Let us see if this week will tell us what’s really happening in China.

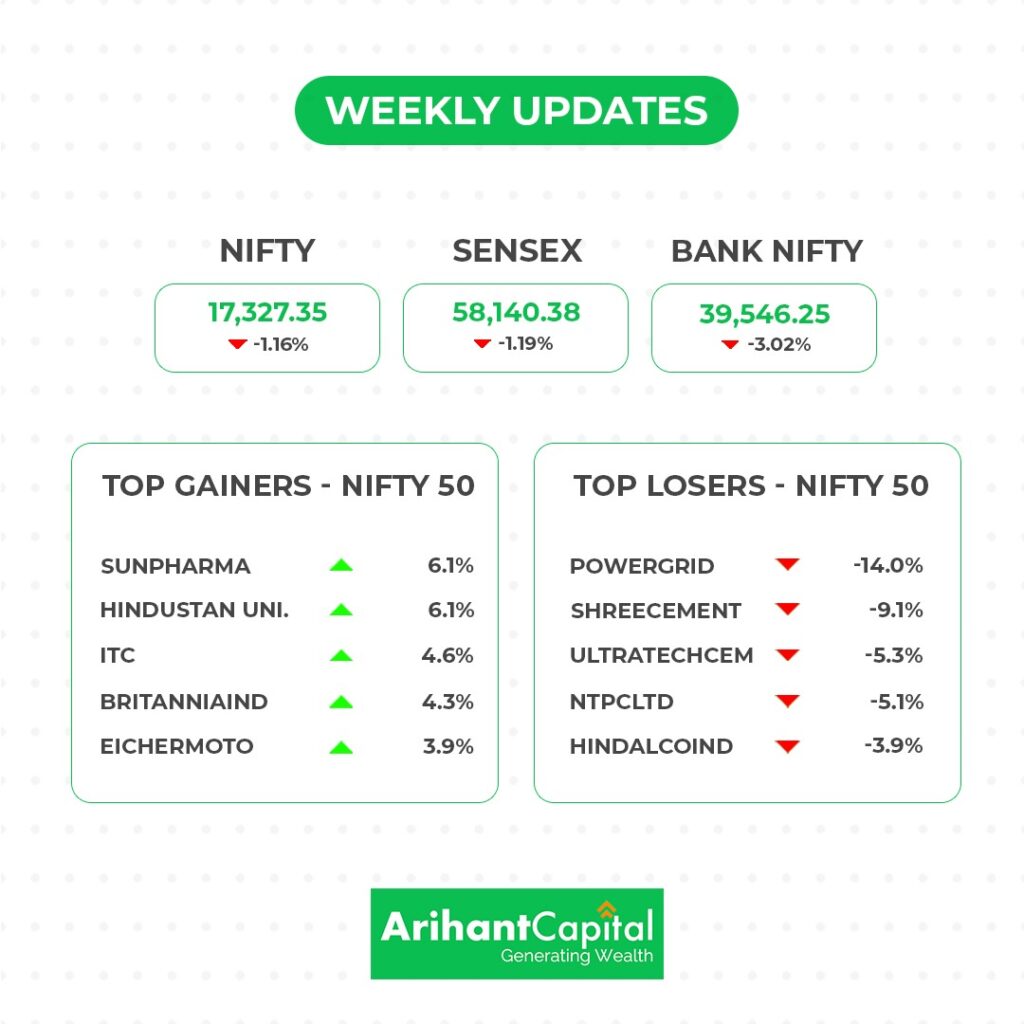

With all this, both benchmark indices left the investors poorer. Sensex and Nifty were both down 1.2% and 1.1% respectively ending the week at 17,327 and 58,140. But Bank Nifty fell to the tune of 3% to end this week at 39,546.

What to Expect from the Markets

–Mr Abhishek Jain, Head of Research, Arihant Capital

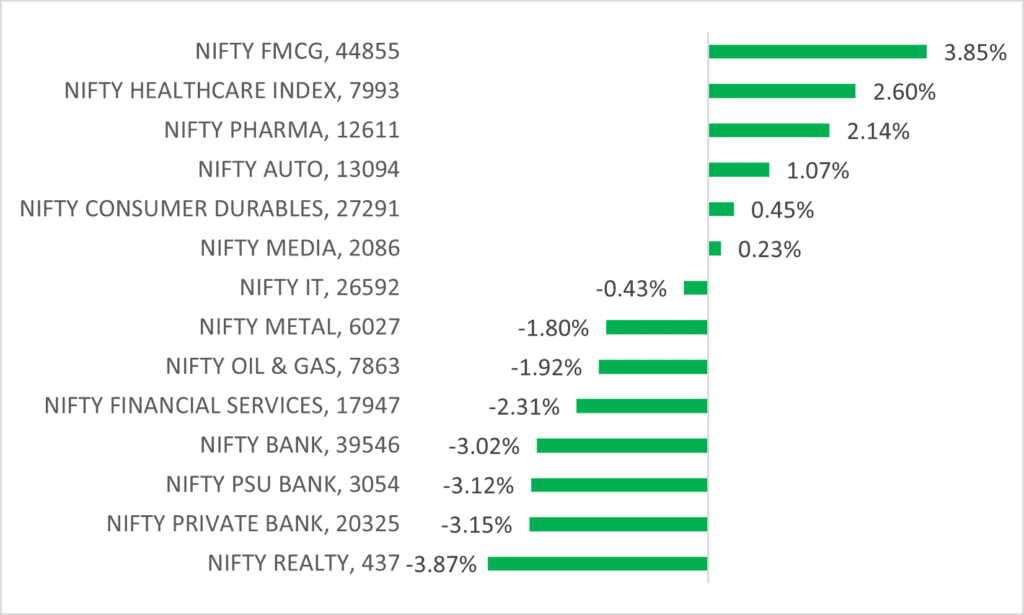

India’s stock market closed in a negative momentum after Federal Reserve announced a 75bps rate hike and provided hawkish commentary. Realty, PSU Banks, Banking, and Metal stocks decline while FMCG, Healthcare and Pharma indices rose in a volatile week. Liquidity tightening and recession conversations abound, and layoffs have started in the US- especially in the financial sector.

We believe that out of the FII inflows in India, only 15-20% are India-specific. The Indian economy decoupling from the global markets will not remain in focus after a certain time in the backdrop of global losses. India’s premium is still 4% higher than that of the global economy and its valuation is substantially higher than its peers. We would advise investors to be cautious while investing as popularism would be back on the backdrop of elections in 2024. While investing, investors should look for a mix of value and growth. We continue to maintain higher cash allocation to portfolios currently.

Indian rural sales are expected to pick up and their growth would determine India’s outperformance. We are recommending safeguarding your stocks and avoiding long-term stories at a premium.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital

Nifty

On the daily chart of Nifty, we observe a negative divergence on the RSI indicator as well as the formation of a Bearish candlestick pattern. On the weekly chart, the Shooting Star candlestick formation is visible, and the market may face some resistance at higher levels. Nifty can face resistance around 17,500 levels if beyond which it can touch 17,650-17,800 levels. On the downside, support is 17,200, upon breaching this, it can test 17,050 and 16,800 levels.

Bank Nifty

The daily chart of Bank Nifty shows a Bearish Candlestick pattern formation. On the weekly chart, we observe a negative RSI divergence. It seems that the market may face some resistance at higher levels. In the coming trading session if it trades above 39,800 then it can touch 40,100 and 40,500 levels, however, the downside support comes at 39,450 below that we can see 39,200-38,800 levels.

💰Stock Picks

From the Technical Desk

-Ms Kavita Jain, Sr Research Analyst and Learning Head, Arihant Capital

🔎Quick Bites

Automobile

- M&M to acquire Swaraj Engines’ 17.41% stake from Kirloskar Industries.

Banking and Finance

- RBI removes Central Bank of India from the PCA framework after more than 5 yrs.

- Ashoka Buildcon receives LoA for the construction of the new BG Line. The bid project cost is ₹258.12 crores. The completion period is 24 months.

- KEC International bags orders worth ₹1,123 cr.

- HDFC Life Insurance Company has received approval from the NCLT for the merger of Exide Life Insurance Company itself.

Industry

- Tata Steel to merge 7 group cos with self.

- Tata Steel has raised ₹2,000 crores through the NCDs issue.

Energy and Infrastructure

- IRCON International secures order worth ₹256 crores.

- Resurgent Power Ventures Pte Ltd completed the acquisition of South East UP Power Transmission Company (SEUPPTCL).

IT and Telecom

- KPIT acquires Technica Engineering to accelerate the drive toward software-defined vehicles.

- Wipro and the UK-based Finastra announced a partnership in India to power digital transformation for corporate banks in India.

- Moonlighters face the axe: Wipro fired 300 employees for moonlighting.

Other

- Adani Group pledges a stake worth $13 billion in ACC, Ambuja Cements.

- Govt starts the process to sell two subsidiaries of erstwhile national carrier Air India.

- Hatsun Agro Product has received approval from the board for its rights issue of up to ₹400 crores.

🔌Sustainability Corner

- Mahindra Group and British International Investment commit $500 million for electric SUV space.

- CABT Logistics to buy 500 Mahindra EVs; the first- & last-mile delivery platform will deploy the eco-friendly three-wheelers across 20 states in India.

- Incentives for semiconductor manufacturing in India increased; government offers to cover 50% of project cost for semiconductor fabs

- BYD India to launch its second EV, the all-electric Atto 3 SUV in New Delhi on October 11; pricing likely around ₹30 lakh-35 lakh.

- Kinetic Green Energy ties up with Tata Capital Financial Services to enable speedy digital disbursement of finance for its electric two-wheeler customers.

- HeroMotoCorp partners with HPCL, to set up charging infrastructure for electric two-wheelers. Hero MotoCorp mobile app to drive cashless transactions.

- EV start-up Ather Energy, now producing 10,000 e-scooters a month at its plant in Hosur, Tamil Nadu, has aggressive plans to double its retail network from 52 outlets in 46 cities to 120 showrooms in 95 cities across India by March 2023.

- Indian Oil has partnered with India electric vehicle charging Infrastructure startup eVolt to install over 75 EV charging stations in the states of Punjab, Haryana and Uttar Pradesh in India.

- India, World Bank looking to spur lending for electric vehicles.

- Adani Green Energy has commissioned a 325-megawatt wind energy plant in Madhya Pradesh. The plant has two 25-year Power Purchase Agreements (PPAs) with Solar Energy Corporation of India at a tariff of ₹2.83 per kWh (kilowatt hour).

- The launch of M&M’s first electric SUV – SUV-XUV400 saw great enthusiasm. With the launch, M&M has entered the competition in the new e-SUV segment,

- UPL to set up a hybrid solar-wind energy power plant in Gujarat with CleanMax.

- Mahindra group to sell 30% stake in renewable energy arm Mahindra Susten for ₹2,317 cr to Ontario Teachers.

- Reliance New Energy (RNEL) to acquire a 20% stake in California-based Caelux Corporation, an industry leader in research and development of perovskite-based solar technology, for ₹97.31 crores ($12 million).

Also read: ESG Investing & Its Emergence in India

RBI increases repo, again. Weekly Market Wrap-up 02 October