Adani Net Worth in the lens | Weekly Market Wrap-up 18 Sep

No time to catch up with news of the weekly market? We’ve got you. Catch up with all the latest in the stock markets in 6 minutes. Lets get started and see what caught our eye last week:

In this article

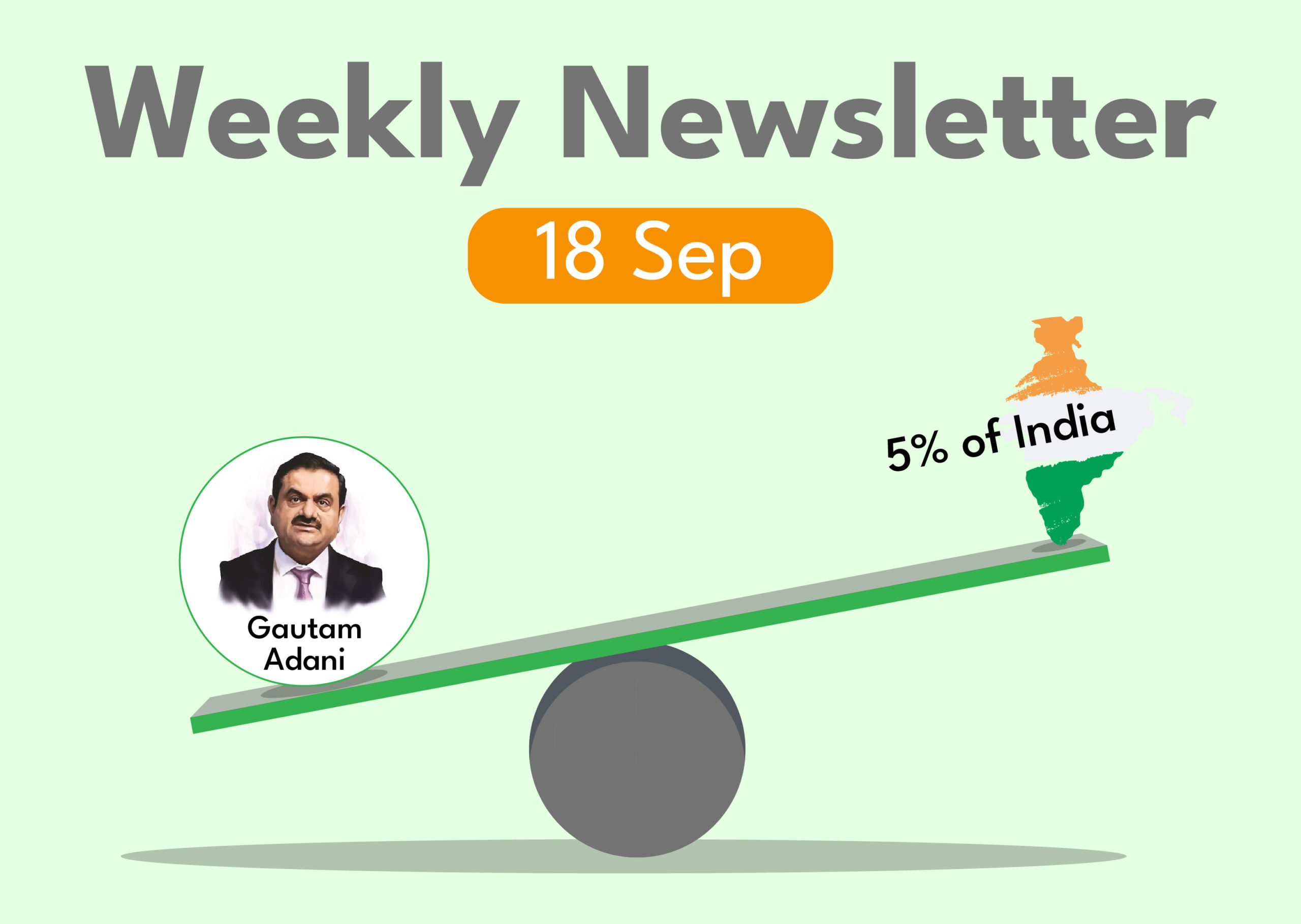

In the stock markets, victory can be fleeting, and no one felt it more than Gautam Adani. Gautam Adani’s acquisition of Ambuja and ACC Cements was marked by another big milestone: he surpassed Amazon’s Jeff Bezos to become the world’s second richest man. But, it seems his luck was fleeting, as panic struck D-street and caused a selloff in the markets (and of course, Adani shares). This paved the way for LVMH’s founders Bernard Arnault and family to take the second spot.

Time for a pride walk? Not so soon. At $155 billion, Adani’s net worth is 4.9% of India’s GDP of $3.2 trillion. Think about this for a second. 5% of India’s wealth is in the hands of this one person. To put this in perspective, if we add the net worth of the biggies: Elon Musk, Jeff Bezos, Bill Gates and Mark Zuckerberg it is still less than 3% of the US GDP. Add to this the fact, that India’s population is larger than that of the US. This speaks volumes about the huge disparity and concentration of wealth in India.

But why was there a sell-off in D-Street? The US inflation numbers came higher than expected, leading analysts to claim that there is no chance that Powell will pause on the rate hike. Global markets witnessed a correction with investors fearing that an aggressive hike to slow down growth and would lead to higher unemployment.

India’s stock market closed on a negative momentum led by losses in IT followed by Auto, Realty, Oil & Gas and Energy stocks. This is the worst week for the market in three months after it saw a sharp fall on Friday.

Nifty closed the week on a negative note of 1.70% at 17,531 with a 303 pts loss while BSE Sensex ended the week at 58,766 On a week-on-week basis, Sensex lost 1.72% pts. Bank Nifty was flat by 0.89% during the week, ending at 40,777.

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital

Nifty

If we look at the daily chart of Nifty there is a negative divergence on the RSI indicator as well as the candlestick chart shows “Downward Gap Area”. On the weekly chart, Nifty traded above its upper trendline support levels. It seems that market may face some resistance at higher levels but buy on dip strategy will perform well in such market. Nifty can face resistance around 17,650 level, on breaching this, it can touch 17,880-18,050 levels, while on the downside support is 17,450 if it starts to fall further then it can test 17,300 and 17,150 levels.

Bank Nifty

If we look at the daily chart of Bank Nifty we observe a “Doji” candlestick pattern formation. On the weekly chart we observe a “Spinning Top” candlestick formation If we analyze and combine both the data then it seems that market may face some resistance at higher levels but Bank Nifty may outperform Nifty. In the coming trading session if it breaches 41,150 then it can touch 41,500 and 42,000 levels, however downside support comes at 40,650 below that we can see 40,200-39,500 levels.

💰Stock Picks

From the Technical Desk

-Ms Kavita Jain, Sr Research Analyst and Learning Head, Arihant Capital

From the Fundamental Desk

–Mr Abhishek Jain, Head of Research, Arihant Capital

Indian markets are expected to be stock specific . We continue to remain positive on travel, hotels, auto-ancillaries space. Indigo can be a good bet for portfolio.

🔎Quick Bites

Global

- Indo-Russian trade up 120% this year so far.

- No end near for Fed rate hikes: US consumer inflation for August stood at 8.3%.All eyes on next week’s policy meeting.

- Goldman cuts US growth forecast for 2023: US gross domestic product will increase 1.1% in 2023.

- India faces heat at WTO over rice export curbs.

Economy

- Inflationary pressures expected to ease in H2, according to RBI economists.

- New National Logistics Policy aims to cut costs. reducing logistics cost as a percentage of gross domestic product (GDP).

- Aug WPI eases to 11-month low of 12.4% as commodity prices decline.

Banking and Finance

- SBI Cards has raised ₹500 crore by issuing bonds on a private placement basis.

- RBI ready to bring card tokenisation norms into effect from Oct 1

- SBI has crossed the ₹5-lakh-crore market capitalisation mark, making it the third lender after HDFC Bank and ICICI Bank to do so.

- Yes Bank moves NCLT against Tulip Star over ₹1,000 crore default.

Energy and Infrastructure

- Adani Ports signs agreement with SPMK to enhance Haldia Dock’s capacity.

- Tata Power assures quality power to industries, to invest ₹5,000 crore in capex in Odisha.

- BPCL divestment not on the cards.

- GMR Infra changes name to GMR Airports Infra.

- NHAI to approach the capital market to raise funds for building roads,.

- Other bidders get chance to match GAIL’s offer for JBF Petro.

Industry

- Tata Metaliks inaugurated Phase-I of expansion project of Ductile Iron Pipe plant at Kharagpur.

- Fairfax India Holdings Corp. to sell its majority stake in speciality chemicals manufacturer Fairchem Organics Ltd.

- Tata Sons set to raise $500m offshore loan.

- Tata Steel to raise ₹2,000 crores through issuance of NCDs.

IT and Telecom

- Jio added 2.94 million subscribers, Airtel added 0.5 million subscribers, while Vodafone Idea lost 1.54 million subscribers in July.

- Stalin announces new Rs 600-crore IT park in south Tamil Nadu.

- Vedanta to make iPhones.

- Vedanta and Foxconn to set up Fab & Chip facility in Gujarat.

- Moonlighting debate: Infosys says termination on the cards for those who work on the side.

- Jio gets nod for satellite communication services.

🔌IPO Corner

- Sachin Bansal’s Navi Technologies has received Sebi’s approval for a ₹3,550 crore IPO

- Government drafts rules for IPOs of regional rural banks.

- Mankind Pharma files DRHP for ₹5,500 crore IPO.

- Tamilnad Mercantile Bank shares list at ₹495 a 3% discount to IPO price of ₹510

🔌Sustainability Corner

- Tata Power Solar Systems to Set Up Project for SJVN in Gujarat.

- Ather Energy Operationalises Second Plant, Targets 500k Units in FY24

- Hero MotoCorp to enter EV segment next month, to launch 1st model under Vida brand.

- Honda Motorcycle is working on new EV line under Activa.

- UPL has acquired a 26% stake in Clean Max Kratos, a solar/wind power generation company

- Honda to start battery sharing service for e-rickshaws in India this year

- Honda will also launch flex-fuel bike models in India by 2023 as part of strategy to meet the company’s aim to meet carbon neutrality for all its products and corporate activities by 2050, under which, it will introduce 10 or more electric motorcycle models globally by 2025.

- Auto sector should target 100% electrification in 2-3-wheeler segments in next four years: Amitabh K.

- Karnataka aims to convert 35,000 buses into electric by 2030.

- Shell to set up 10000 EV charging points, expand retail outlets.

- Tata Motors expects 20% of domestic passenger vehicle sales to come from EVs in three years.

- JSW Steel to ivnest $1.26 billion to cut the carbon emissions at plants in India.

Also read: ESG Investing & Its Emergence in India

Global Gloom: Weekly Market Wrap-up 25 Sep