Uniparts India Limited IPO is being live. Should you invest?

Uniparts India Limited IPO is Being live. Should you apply? Find out here.

In this article

📃About Uniparts India Limited IPO

Incorporated in 1994, Uniparts India Limited is a manufacturer of engineered systems and solutions. The company is one of the leading suppliers of systems and components for the off-highway market in the agriculture and construction, forestry and mining (“CFM”) and aftermarket sectors with a presence across over 25 countries.

The company’s product portfolio includes core product verticals of 3-point linkage systems (“3PL”) and precision machined parts (“PMP”) as well as adjacent product verticals of power take-off (“PTO”), fabrications and hydraulic cylinders or components. Uniparts is a concept-to-supply player for precision products for off-highway vehicles (“OHVs”) with a presence across the value chain

In India, the company have five manufacturing facilities, two at Ludhiana, Punjab, one at Visakhapatnam, Andhra Pradesh, and two at Noida, Uttar Pradesh.

Uniparts also have a manufacturing, warehousing and distribution facility at Eldridge, Iowa, acquired under the acquisition in 2005 of Olsen Engineering LLC, now known as Uniparts Olsen Inc. (“UOI”) and a warehousing and distribution facility at Augusta, Georgia.

Uniparts India Ltd.’s global business model is based on :

- The sales in regions outside India (“International Sales“).

- The sales from our dual shore manufacturing facilities in India and the United States, in their respective domestic markets (“Local Deliveries“).

- Export sales from Indian locations directly to overseas customers (“Direct Exports“).

- Sales from the warehousing facilities in their respective domestic markets (“Warehouse Sales”).

💰Issue Details of Uniparts India Limited IPO

- IPO open from 30 Nov – 02 Dec 2022

- Face value: ₹10 per equity share

- Price band: ₹548 to ₹577 Per Share

- Market lot: 25 shares

- Minimum investment: ₹14,425

- Listing on: BSE and NSE

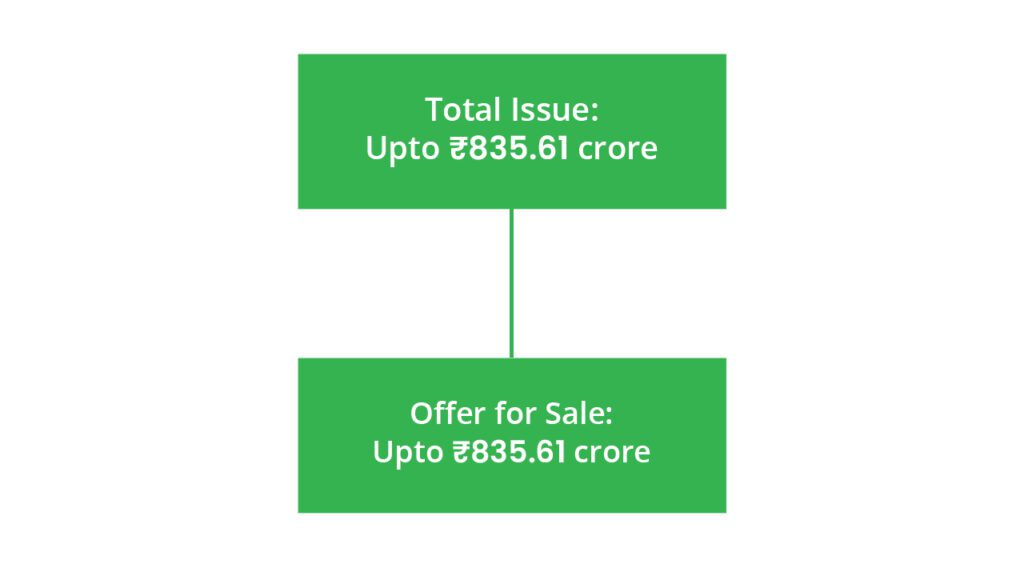

- Offer for sale: ₹835.61 Cr

- Registrar: Link Intime India Private Ltd

- Promoters:

- Gurdeep Soni

- Paramjit Singh Soni

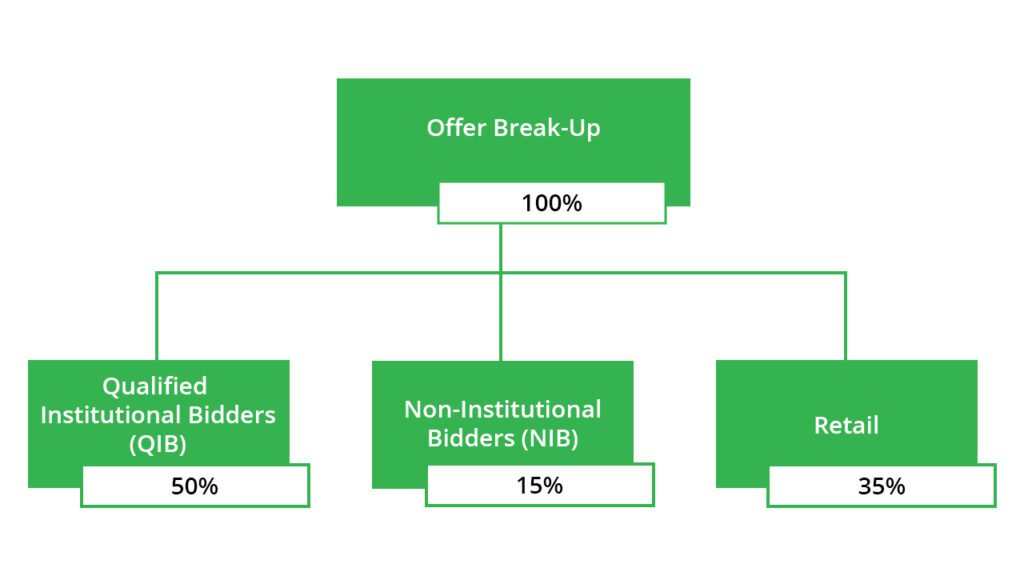

🪚Offer Breakup

🔭IPO Object

The net proceeds of the fresh issue, are proposed to be utilized in the following manner:

- The company will not receive any proceeds from the Offer and all such proceeds will go to the Selling Shareholders.

⛓️IPO Strength

Some of the qualitative factors and strengths that form the basis for computing the offer price are:

- Leading market presence in the global off-highway vehicle systems and components segment

- Engineering-driven, vertically integrated precision solutions provider

- Global business model optimizing cost-competitiveness and customer supply chain risks

- Long-term relationships with key global customers, including major OEMs, resulting in a well-diversified revenue base

- Strategically located manufacturing and warehousing facilities that offer scale and flexibility.

- Strong financial position with robust financial performance metrics

🧨IPO Risk

- Inability to accurately forecast demand for its products

- Availability and cost of raw materials and labour.

- Cyclical effects in the global and domestic economy, specifically in the agriculture and CFM sectors.

- Dependence on its subsidiaries, Uniparts India USA Limited and Uniparts India Olsen Inc.

- Certain open bills in the Export Data Processing and Monitoring System of the RBI

⚖️Peer Companies

- There are no listed entities in India, in the business portfolio which is comparable with this business.

💸Financial Data

| Period Ended | Total Assets | Total Revenue | Profit After Tax |

| 31-Mar-20 | ₹898.75 | ₹938.84 | ₹62.64 |

| 31-Mar-21 | ₹893.27 | ₹947.69 | ₹93.15 |

| 31-Mar-22 | ₹1031.18 | ₹1231.04 | ₹166.89 |

📬Also Read: Sustainable Investing in India: ESG Investments