Bulls Tired after Winning Streak | Merc vs SIP | Weekly Stock Market Updates 04 Dec

Weekly Stock Market Updates. Catch up on all that’s trending in the last week and get ready for the Monday markets with insights from our expert research team.

In this article

Last week we witnessed a record-breaking inning of Ruturaj Gaikwad who hit 7 sixes in 6 consecutive balls. Even the stock markets were on a record-breaking spree reaching all-time highs and Sensex even crossed the 63K mark during the week.

High FPI inflows may be a reason behind this rally. Read what Mrs. Anita Gandhi, whole-time director, and Head of Institutional business at Arihant Capital say about FPI inflows. But it seems the bulls got tired by the time the week ended and bears took over on Friday, giving the week an anticlimactic end.

The benchmark indices closed flat with the Nifty up by 0.99% at 18,696 and the Sensex up by 0.92% at 62,869. Bank Nifty showed a mere 0.28% growth during the week, ending at 43,104.

Modi on a 🤝 spree, RBI launches e₹

India is not only showing promising economy and markets, but also strong diplomacy as it takes on two coveted international leadership positions -G20 and UNSC presidency.

The RBI has launched the e-Rupee or e₹ as an alternative to physical cash. Currently, rolled out as 2 crore e₹ with banks, only a select few can access it by installing the CBDC app. What remains to be seen is how it can become popular against UPI and if it can bring some privacy back to our small financial transactions.

Mercedes is facing strong competition in India, and it’s not from BMW.

Surprisingly, it’s from SIP. In the past few weeks, SIP investments have also been hitting new highs. With such cheery market performance, wouldn’t you want to invest in the stock markets too? The easiest way is to start a SIP and invest in small denominations. What can we say, we Indians love saving and SIPs make it super easy.

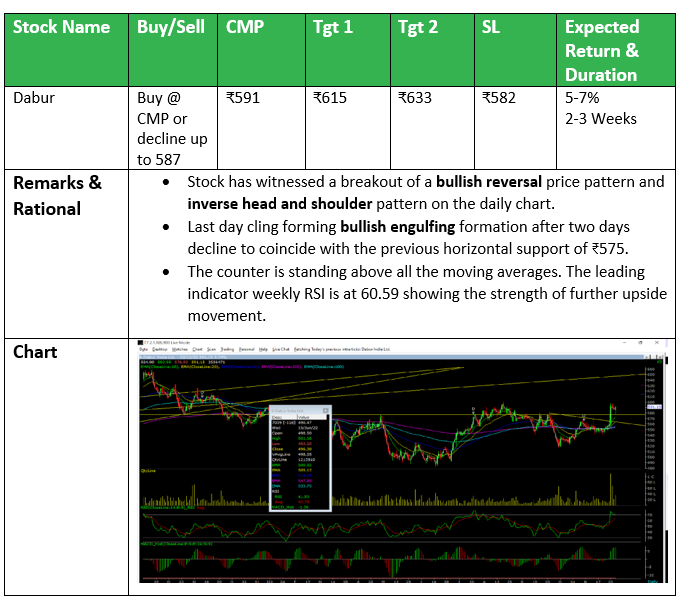

💰Stock Picks

From the Technical Desk

-Ms. Kavita Jain, Sr Research Analyst and Learning Head, Arihant Capital

📈Market Outlook

–Mr. Ratnesh Goyal, Senior Research Analyst, Arihant Capital

Nifty

We observe a “Doji” candlestick formation on the daily as well as the weekly chart of Nifty. It indicates that after a continuous rally, some consolidation may be seen and we maintain buy on dips strategy. Nifty can face resistance at the 18,750 level, if it breaks then it can touch 18,900-19,100 levels, while support is 18,550 and if that breaks then it can test 18,300 and 18,100 levels.

Bank Nifty

We observe a “Doji” candlestick pattern on the daily and weekly chart of Bank Nifty. Analyzing both charts, it seems that Bank Nifty may remain in consolidation and we maintain buy on dips strategy. In the coming trading session if it trades above 43,400 then it can touch 43,800 and 44,200 levels. However, the downside support comes at 42,800 below that we can see it touching 42,500-42,200 levels.

🔎Quick Bites

Global

- Asia’s factory activity shrinks in Nov as China lockdown impact widens.

- Citi sees global growth slow below 2% in 2023.

Economy

- India halves windfall tax on local oil and reduces levy on diesel.

- India’s gross GST revenue for November jumps 11% YOY to ₹1.46 L crores.

- Govt launch 4th tranche of Bharat Bond ETF to mature in April.

- India’s jobless rate rises to a three-month high of 8% in Nov: CMIE data.

- India’s GDP grows 6.3% in the second quarter, in line with RBI’s projection.

- India’s Apr-Oct fiscal deficit at ₹7.58 trillion, 45.6% of the FY23 target.

- November manufacturing PMI at 55.7 vs 55.3 MOM.

Banking and Finance

- Kotak Mahindra Bank raises ₹1,500 crores through bonds.

- LIC is ready to enter into general insurance and indemnity health insurance.

- BoB’s GIFT City branch launches foreign currency loan against INR deposits.

- Bank of India has issued and allotted ₹1,500 crores in Basel III compliant Tier I bonds.

- HDFC Bank raises Tier 2 capital of ₹15,000 crores.

- Carlyle and Advent get a conditional nod from RBI to buy a YesBank stake.

- RBI launched a retail digital rupee pilot on 1 December.

- SBI board approves infrastructure bonds worth ₹10,000 crores.

Industry

- Government invites bids to sell a 50.79% stake in NMDC‘s Nagarnar Steel Plant.

- Tata Steel aims to double steel output from 9 million tonnes currently, from its factories in Odisha.

- Tata Group in talks to buy Wistron’s Apple facility in Karnataka: Report.

Energy and Infrastructure

- Ion Exchange bags contract worth ₹343 crores from IOCL for setting up a zero liquid discharge plant.

- Ashoka Buildcon receives LoA for an EPC project worth ₹1,669 crores.

- Essar to invest ₹52,000 crores ($6.4B) in Odisha.

- Adani Properties has bagged the rights to redevelop the Dharavi slum for ₹5,069 crores.

- Adani Ports has won the bid for Karaikal Port for ₹1,200 crores.

- Godrej Properties acquire an 18-acre land parcel in Kandivali, Mumbai with an estimated revenue potential of approximately 7,000 crores.

- BHEL is among the top 5 bidders for the deal to manufacture 200 Vande Bharat trains.

- Coal India’s production rises 17% to 412.6 MT in the April-Nov period.

Other

- Britannia Industries enters a JV with French cheese maker Bel SA. Bel to acquire a 49% stake in Britannia Dairy for ₹262 crores.

- Zydus Lifesciences gets USFDA nod to market Estradiol Transdermal System USP.

- Aurobindo Pharma gets USFDA nod for Ursodiol Capsule & Carbidopa, Levodopa.

- Alibaba to sell Zomato shares worth $200 million via block deal.

- Orchid Pharma gets a board nod to raise ₹500 crores via QIP.

- Tata Group announces Air India merger with Vistara; SIA to get 25% stake.

🚀IPO Corner

- Dharmaj Crop Guard Limited IPO subscribed 35.49 times till the last day.

- Uniparts India Limited IPO subscribed 25.32 times till the last day.

🔌Sustainability Corner

- Indian Hotels starts EV charging stations in Guwahati.

- L&T raises $107 Mn sustainability-linked loan from SMBC.

- IndusInd Bank becomes an exclusive partner of Tata Motors EV to finance EV vehicles.

- GE Power, NGSL upgrade steam turbine project for NTPC’s Ramagundam power plant.

- Infosys collaborates with UNLEASH, a non-profit organization to get the youth to create innovative and scalable solutions to help reach the Sustainable Development Goals (SDGs).

- SJVN, GRIDCO to form JV to develop 2,000 MW solar and 1,000 MW hydro projects in Odisha.

- MRF enters into power purchase agreements with Green Infra Solar Generation and First Energy 3 for solar and wind power.

- NLC India and GRIDCO signed MoU for setting up ground-mounted/floating solar power and other renewable projects.

- Centre steps up audit of EV firms taking subsidies after complaints.

- Hindustan Unilever constitutes the ESG committee to assist the board on sustainability matters.

- Electrification of India’s 2, 3-wheeler fleet requires $285-bn financing according to WEF.

- Ola Electric captures 92% market share in the premium scooter segment.

- Phase out diesel autos in NCR by 2026: air quality panel.

- Tata Power to set up 1,000 EV charging points and 1 lakh solar pumps in Odisha.

- Nexon EV & Tigor EV draw almost 25% of the bookings for these models for Tata Motors.

- Hero Electric E-bikes to run on motors developed with NIDEC Japan.

Also read: ESG Investing & Its Emergence in India