Weekly Market Outlook for the Week ended September 20, 2019

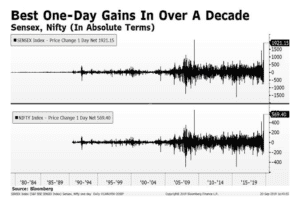

The Indian Equity market ended the week on a stronger note, with the Nifty climbing by 1.8% for the week to 11,274 while the Sensex rose 1.7% to end the week at 38,015. The highlight of the week was the surprise corporate tax cut move announced by the Finance Minister on Friday. On Friday itself the S&P BSE Sensex and Nifty both closed the day 5.3% higher. This was the best one day gain for the benchmark indices over a decade. Investors turned US$ 96 bn richer in a single day.

The benchmark indices wiped out the losses logged so far during the year on today’s gain. The 31-share index surged 5.4 percent and the 50-stock gauge rallied 3.79 percent year-to-date. The government’s tax relief proposal is among its measures to revive the economy. The nation’s gross domestic product growth fell to a six-year low owing to a fall in investments and consumption.

Domestic investors funnelled in Rs 3001 cr on Friday into the markets, NSE data showed. The provisional data for foreign portfolio investors’ showed that the overseas investors infused Rs 35.78 cr. The NSE recorded equity turnover of Rs 82,322 crore on Friday, compared with nearly Rs 30,000-crore average till Thursday.

Overall, the tax cut move of the FM can catapult Nifty earnings going forward by about 6% in FY20 as the effective tax rate for several companies was already lower at 26%. But the main take-away from the above fiscal stimulus by the FM is that the move will lift the sagging sentiment of the stock market and investor community in general. The sentiment booster angle and the way this move will be taken positively by FIIs and local investors will be the key monitorable going forward. Till this positive sentiment lasts, we can expect the Nifty to rally by another 4-5% from here till the time the second-quarter earnings start to pour in from the second week of October.

For further details Click Here– Weekly Market Outlook Report